Summary:

- The housing market remains on shaky ground. But in times like this, Opendoor shines.

- Opendoor returned to positive contribution profit in Q3.

- Opendoor is back to being a net buyer of homes.

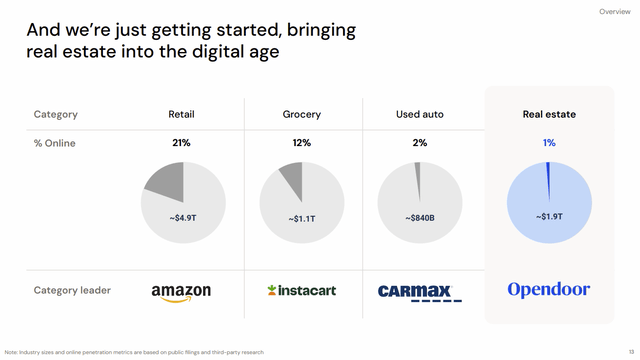

- ~99% of residential real estate transactions are left undigitized.

Jarmo Piironen

Introduction

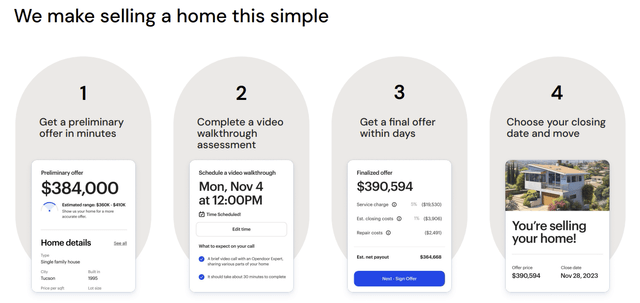

Opendoor (NASDAQ:OPEN) is the leading iBuying company that provides an ecommerce-like experience for buying and selling homes. The company aims to simplify and streamline what could be the most stressful, time-consuming, and expensive stage in most people’s lives: moving from one home to another.

Opendoor FY2023 November Investor Presentation

The past year or so has been a particularly tough time for Opendoor as rising interest rates, spiking mortgage rates, and the housing market reset put tremendous pressure on Opendoor’s home inventory and profitability.

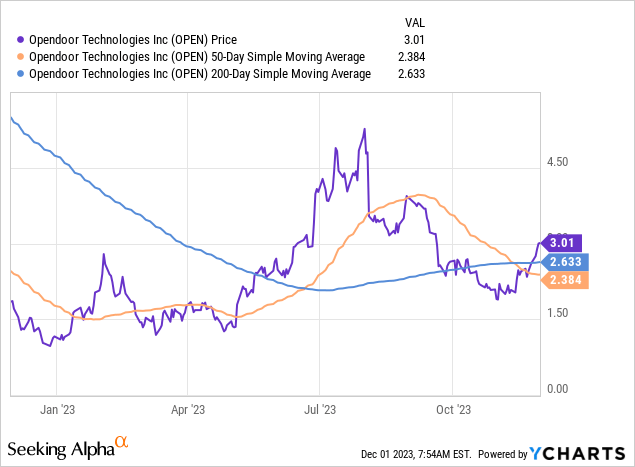

It’s no surprise why the stock has been incredibly volatile this year, swinging from as low as $1 to as high as $5. Today, the stock is caught smack in the middle at $3 a share.

Where does it go from here?

Tough to say.

But one thing’s for sure: Opendoor is well-positioned to rescale its business in 2024.

Growth

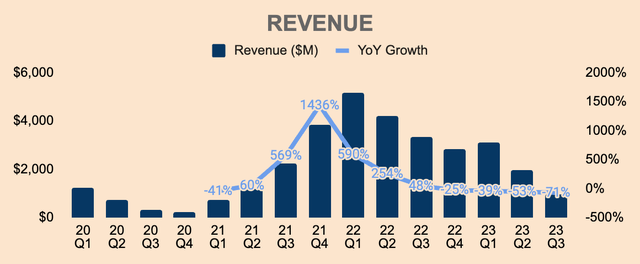

Opendoor’s topline was in line with management’s guidance of $950M to $1B but fell short of analyst expectations by $30M. In Q3, Revenue was $980M, down 71% YoY and 50% QoQ, due to lower sales volumes and lower home prices, which was down 8% YoY.

Author’s Analysis

As you can see, Opendoor completely erased all the growth it enjoyed during the early days of the pandemic, back when the housing market was firing on all cylinders due to ultra-low interest rates.

But as you all know, the Fed hiked interest rates at a record pace, causing mortgage rates to spike as well. Consequently, transaction volume dried up as home buyers stayed on the sidelines.

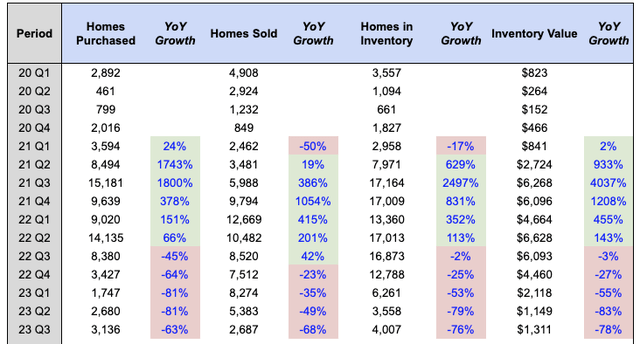

Clogged with high inventory, Opendoor slowed down its pace of home acquisition by embedding higher spreads into its offers. As such, Homes Purchased declined gradually in 2022 as the company focused on unloading the homes it acquired at peak prices — aka the old book.

However, Opendoor has begun to ramp up acquisitions over the last few quarters as the housing market stabilizes. Q3 Homes Purchased — although down 63% YoY — increased 17% sequentially to 3,136, despite average new listings being down 8%. This is due to increased savings from improved cost structure and pricing accuracy, which Opendoor passes to customers in the form of lower spreads, driving higher conversions in the process.

In our business, there is an inverse relationship between spread and seller conversion, meaning the more we reduce spread, the higher our seller conversion is. Higher conversion results in more home acquisitions and, in turn, more home sales.

Author’s Analysis

Moving forward, Homes Purchased should increase over the next few quarters as Opendoor continues to increase distribution through its channel partners. According to management, acquisitions from these low-cost distribution channels increased by 33% compared to Q2 this year and 76% compared to Q1 this year.

These partnerships boost brand awareness as well as market reach, which should increase conversion at minimal cost, and ultimately drive growth for Opendoor.

- Its exclusive partnership with Zillow (Z) — the largest online real estate company — is now live in 45 markets.

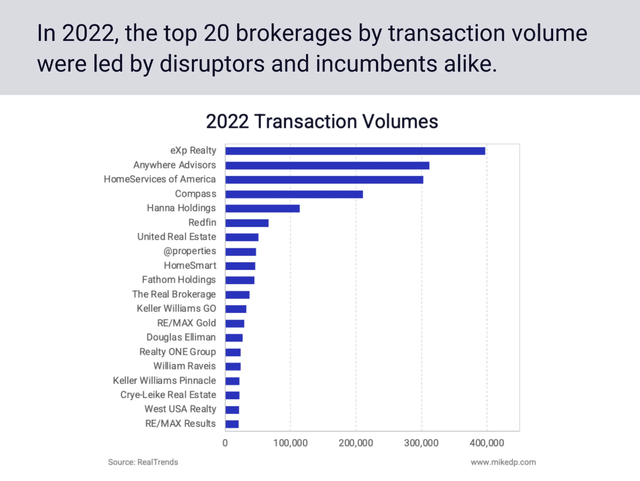

- In October, Opendoor also landed a new partnership with eXp Realty — the largest independent real estate company in the world. As you can see below, eXp Realty is the largest broker by transaction volume.

MikeDP

On the other hand, Homes Sold continued to drop sequentially as Q2 marked a 2-year low in terms of Homes in Inventory. As such, Opendoor only sold 2,687 homes in Q3, down 68% YoY. Moreover, Q3 (and Q4) is a seasonally slow quarter in the housing market.

However, as Opendoor rebuilds its inventory in the next few quarters, we can expect more Homes Sold in the coming quarters, especially during the hotter seasons (Q1 and Q2).

Yes, uncertainty looms over the housing market. It continues to be volatile.

But in times like this, Opendoor shines.

In turbulent times, customers search for speed, transparency, and certainty — features that are nonexistent in traditional ways of buying and selling homes.

That’s why Opendoor continues to gain market share.

We have been showing throughout the course of the year that we’re gaining share. And we’re gaining share against a declining market. And I think that’s evidence of the value prop and what we’re putting into the market for customers and our focus is continuing to do so.

(CEO Carrie Wheeler — Opendoor FY2023 Q3 Earnings Call)

Profitability

While growth has been muted (for now), profitability is looking better with each passing quarter.

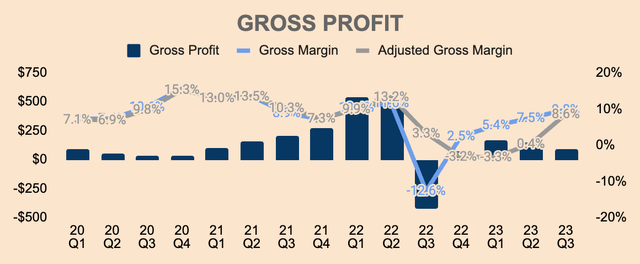

GAAP Gross Profit improved from $(425)M last year to $96M this most recent quarter. On the other hand, GAAP Gross Margin improved from (12.6)% last year to 9.8% in Q3.

This looks great but ignore GAAP metrics for now, since Opendoor made a large Inventory Valuation Adjustment in Q3 last year, due to the housing correction.

Instead, it’s better to look at Adjusted Gross Profit, which aligns the timing of Inventory Valuation Adjustments recorded under GAAP to the period in which the home is sold.

Encouragingly, Adjusted Gross Margin improved YoY and QoQ to 8.6%, due to home price stabilization and higher spreads embedded in Opendoor’s offers.

Author’s Analysis

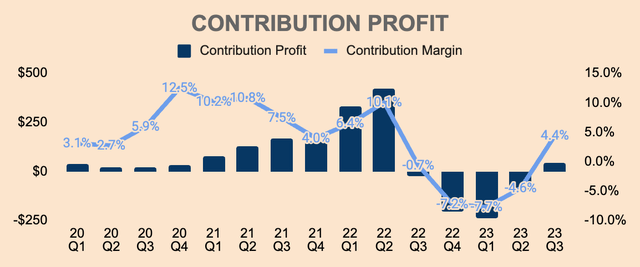

We see a similar trend with Contribution Profit.

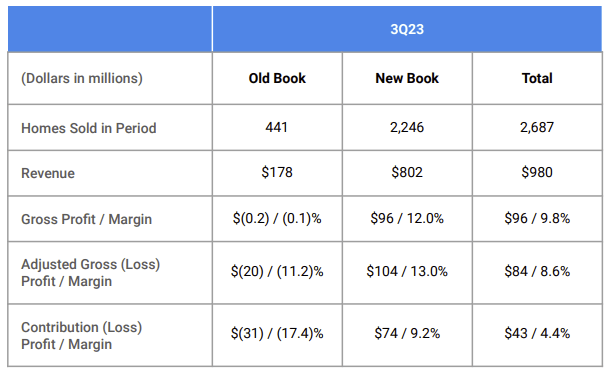

Q3 Contribution Profit, which accounts for direct selling costs and holding costs, was $43M, representing a Contribution Margin of 4.4%. This also exceeded management’s guidance of 3.2% to 4%, due to the strong performance of their new book of homes and lower-than-expected sales from the old book.

Author’s Analysis

As you can see, the higher mix of new book to old book explained the outperformance in Opendoor’s Contribution Margin.

- Old book: sold 441 homes at a Contribution Margin of (17.4)%

- New book: sold 2,246 homes at a Contribution Margin of 9.2%

As of the end of Q3, Opendoor has less than 150 old book homes not in resale contract, which means minimal margin pressure from the old book moving forward. In other words, expect Contribution Margin to improve from here as the higher-margin new book of inventory makes up the majority of Revenue.

Opendoor FY2023 Q3 Shareholder Letter

Regardless, Contribution Margin finally turned positive after being negative for a full year — great news for investors.

It’s not back to where management would have liked — their annual Contribution Margin target range is 5% to 7% — but it’s getting there.

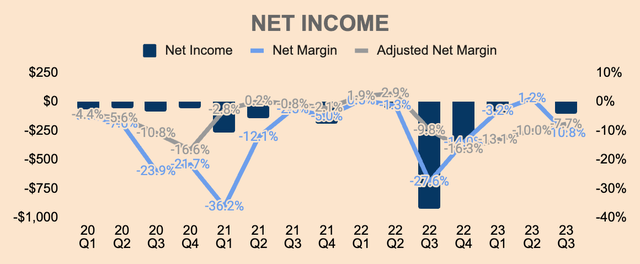

In terms of the bottom line, Q3 GAAP Net Income was $(106)M, which is a (10.8)% GAAP Net Margin. Again GAAP metrics are not very useful since they include one-time items such as Gain on Extinguishment of Debt, and it does not align the timing of Inventory Valuation Adjustments to the period in which the homes are sold.

As such, it is better to look at Adjusted Net Income, which was $(75)M, representing a (7.7)% Adjusted Net Margin. As you can see, it is getting better by the quarter.

Author’s Analysis

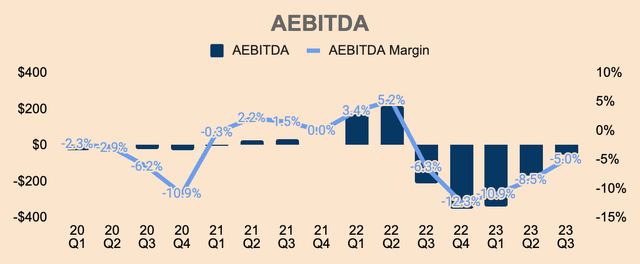

The same goes for Adjusted EBITDA, which was $(49)M in Q3, ahead of management’s guidance of $(70)M to $(60)M, due to stronger-than-expected Contribution Margin as well as operating leverage.

Author’s Analysis

As you can tell, profitability metrics across the board are improving as Opendoor continues to offload its lower-margin old book of inventory and sell more of its higher-margin fresh inventory.

By Q4, almost all of the old book should be sold, which clears the way for Opendoor to return to Adjusted Net Income profitability. In addition, the housing market is stabilizing and the company is proceeding cautiously with ongoing cost discipline, so things should only get better from here.

That said, Opendoor is still severely unprofitable — and the only way to achieve profitability is to rescale its business to cover its large fixed costs.

Health

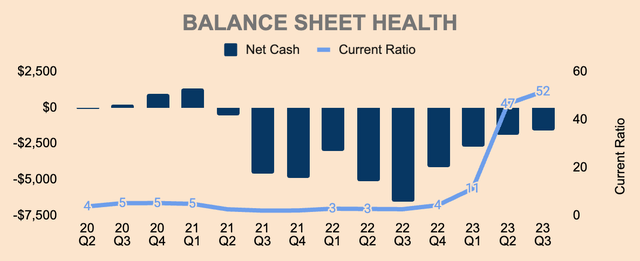

Turning to the balance sheet, Opendoor has $1.2B of Cash and Short-term Investments with $2.9B of Total Debt, placing its Net Cash position at about $(1.7)B.

As shown below, Net Cash has been improving over the last few quarters as the company delevers its balance sheet and slows down the pace of home acquisitions. However, as the company scales, I expect Net Cash to drop as Opendoor taps into the capital markets to fund home purchases.

Author’s Analysis

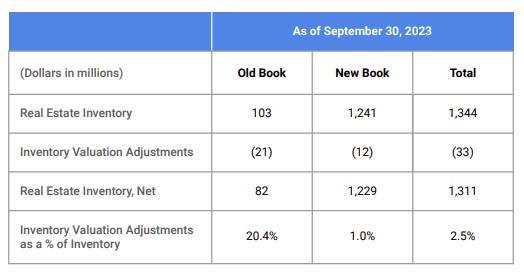

Opendoor’s inventory situation is looking better as well. As of Q3, Opendoor holds 4,007 Homes in Inventory worth $1.3B, of which less than 150 homes came from the old book, worth about $82M. The old book now represents about 6% of the net inventory balance, down from 22% in Q2.

Opendoor FY2023 Q3 Shareholder Letter

It’s also worth noting that as of Q3, 12% of Opendoor’s homes had been listed on the market for more than 120 days — if not for the old book, that figure would have been 8%. Regardless, Opendoor’s turnover rate is much better than the broader market’s 15%, which is a testament to Opendoor’s value proposition and speed of execution.

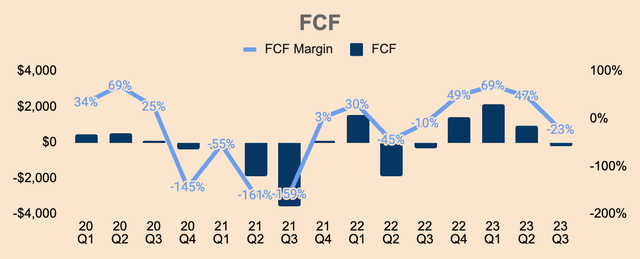

In terms of cash flow, Opendoor had Free Cash Flow of $(227)M, which is a (23)% FCF Margin. This negative cash flow is expected since Opendoor was a net buyer of homes in Q3 — in the last three quarters, Opendoor was a net seller of homes, thus the positive FCF in those quarters. Moving forward, I expect Opendoor to be a net buyer of homes in the next few quarters as the company rescales.

Author’s Analysis

Outlook

Here’s what investors can expect in Q4. I’ve included management’s midpoint guidance here:

- Revenue of ~$825M, which is down 71% YoY and 16% QoQ. The drop in Revenue sequentially is due to 1) lower market clearance rates in the winter months, 2) high mortgage rates of 8%, and 3) lower expected home-level list prices, probably to clear the old book of inventory.

- Contribution Profit of ~$20M, implying a 2.4% Contribution Margin, which is slightly down from Q3’s 4.4%, but still an improvement from last year’s (7.2)%. The decrease in Contribution Margin QoQ is due to 1) lower home prices and 2) pressure from the lower-margin old book.

- Adjusted EBITDA of ~$(100)M, implying a (12.1)% Adjusted EBITDA Margin, which is lower than Q3’s 5.0%, likely due to lower Revenue and Contribution Profit.

In addition, management expects home purchases of about 3,000 in Q4, which is flat QoQ. On the other hand, management expects to accelerate home acquisition in 2024 as the company reduces spreads, grows partnership channels, and increases marketing spend.

More importantly, the complete disposal of its old book and the gradual rescaling of its business should put Opendoor in a good position to reach Adjusted Net Income profitability.

We expect to return to positive Adjusted Net Income at steady state annual revenue of $10 billion, or approximately 2,200 acquisitions and resales per month, at the higher end of our annual contribution margin target range of 5% to 7%.

(Opendoor FY2023 Q3 Shareholder Letter)

Scaling the business is necessary to achieve profitability — and I believe Opendoor has what it takes to get there. Here’s why:

- Opendoor did it in 2022, generating more than $15B of Revenue.

- Opendoor’s growing partnership with distribution partners should increase brand awareness and accelerate growth.

- The residential real estate market is a $1.9T industry, which means that Opendoor only has less than 1% market share — the growth potential is monumental.

- More importantly, Opendoor has a proven track record of capturing over 4% market share in multiple markets.

- Since 2019, Opendoor has quadrupled its serviceable addressable market via market and buybox expansion, to $600B+. Assuming just a 3% market share within its buybox — which is more than reasonable — Opendoor should generate at least $18B of Revenue. At that point, Opendoor should be profitable.

Opendoor FY2023 November Investor Presentation

It won’t be easy by any means.

But given the fact that 99% of residential real estate transactions are still happening offline, given the fact that Opendoor has a far superior value proposition over traditional real estate agents, and given the fact that Opendoor runs a virtual monopoly in the iBuying space, I believe Opendoor is well positioned to gain significant market share in the largest industry in the world.

Valuation

Over the past few weeks, Opendoor stock blasted past three major resistance levels, namely:

- Horizontal resistance at $2.80

- The 50-day SMA

- The 200-day SMA

With that in mind, the primary trend is now up for Opendoor stock, which could point to more upside for the stock.

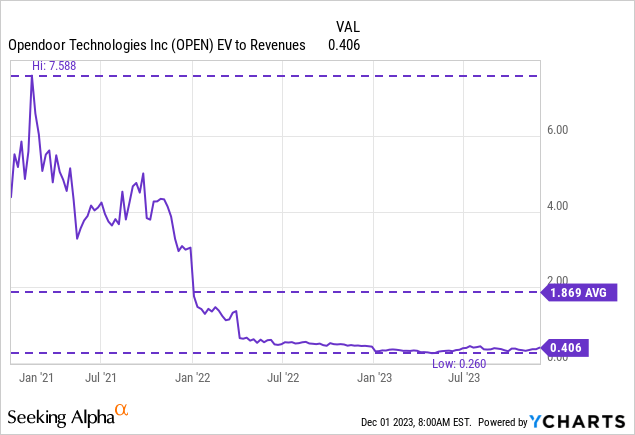

That said, Opendoor trades at depressed valuations, at only 0.4x EV to Revenue, significantly below its highs of 7.6x and its average of 1.9x.

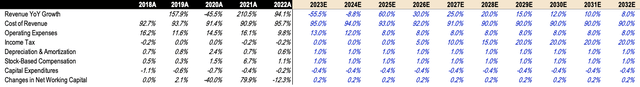

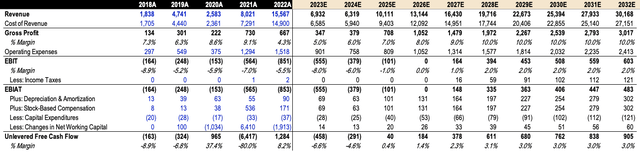

In my previous article, I was too aggressive with my growth assumptions. As such I am lowering my Revenue estimates for Opendoor. Here are the key assumptions driving my DCF model:

- Revenue: I followed analyst estimates for the first three years and gradually dropped growth rates to 8% by 2032. As a result, I expect FY2032 Revenue to be $30B, down from my previous estimate of $46B. The reason for this downward revision is my expectation that management will scale the company at a slower, more manageable, and more profitable pace.

- FCF Margin: Management said that Adjusted Net Income is the best proxy for Operating Cash Flow, and they mentioned that the company will be Adjusted Net Income profitable when they hit $10B of Revenue — I expect this to happen in 2025. In the long term, I expect a steady-state FCF Margin of 3%.

Author’s Analysis

Here are the projections:

Author’s Analysis

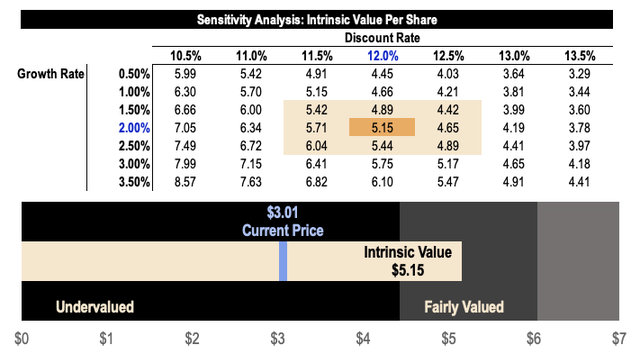

Based on a discount rate of 12.0% and a perpetual growth rate of 2.5%, I get an intrinsic value estimate of $5.15 for Opendoor, which is lowered from my previous estimate of $7.88, solely due to lower Revenue estimates.

That said, this is significantly higher than the average analyst price target of $2.29. My price target also represents an upside potential of 71%, based on the current price of $3.01.

Author’s Analysis

Risks

Higher for Longer

As mentioned by management, mortgage rates reached 8% in October, the highest level in over two decades. This could mean more homeowners on the sidelines as they wait for interest rates to come down.

Interest rates could remain elevated for longer — or worse, go higher — which not only reduces housing affordability but also increases Opendoor’s cost of capital.

Another Housing Crash

Another housing correction could delay Opendoor’s growth and profitability ambitions. Sentiment could turn negative once again as investors dump real estate-related stocks.

Thesis

In my previous article, I wrote my investment thesis on Opendoor:

Opendoor operates as a virtual monopoly in the iBuying business and with less than 1% market share in the massive residential real estate industry, Opendoor has a long growth runway ahead as the company builds an end-to-end platform for people to buy and sell homes with simplicity and certainty.

Nothing has changed with my thesis.

Furthermore, a lot of positives can be taken from Opendoor’s Q3 results. This includes:

- the return to positive Contribution Margin

- improving profitability

- shrinking old book of homes

- expanding fresh inventory

Opendoor is not out of the woods yet — the macro environment remains shaky.

However, Opendoor is leaner and meaner than ever before, and with a disciplined approach towards growth, Opendoor is well-positioned to rescale its business and eventually achieve sustained profitability.

And with less than 1% online penetration, Opendoor is now preying on the remaining 99% of residential real estate that is left undigitized.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of OPEN either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.