Summary:

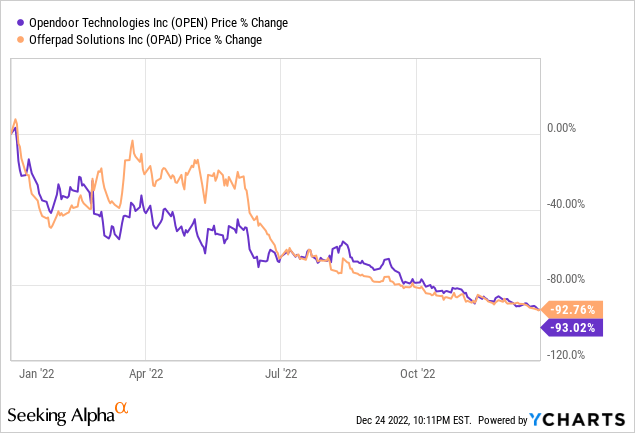

- Opendoor and Offerpad are both down by around 93% year-to-date.

- Their disruptive home-buying model looks set to get discombobulated by the falling real estate prices next year.

- High leverage ratios against rising interest rates have rendered a new position in both companies as too high risk.

adamkaz/iStock via Getty Images

iBuying was meant to be a straightforward, more convenient, and ultimately less frictional way for people to sell and buy homes. Both Opendoor (NASDAQ:OPEN) and Offerpad (NYSE:OPAD) use information supplied by homeowners and computer-generated analysis of local market data to make cash offers for homes within hours. The model’s usefulness to sellers really comes from how inherently frictionless it is and how it does away with the traditional model of high estate agent fees, numerous showings, stacks of paperwork coordinated across numerous entities, and months of uncertainty.

And it’s clear the model creates value with customers of both flagging how easy and smooth of an experience it is to sell through their respective platforms. Zero home prep by homeowners before selling, no seller concessions, and electronic signing of documents. iBuying can be aptly described as a welcome disruption of the complex, slow, and stressful traditional orthodoxy. San Francisco, California-based Opendoor was founded in 2014 by Eric Wu who up until a few weeks ago was also the CEO of the company. He has stepped down to be replaced by the previous CFO Carrie Wheeler. Offerpad is based in Chandler, Arizona and was founded a year later in 2015 by current CEO Brian Bair.

It’s important to note that iBuying differs from home flipping as the latter seeks to profit from buying relatively distressed assets, conducting extensive renovations and then selling the property at a material markup. iBuyers seek to replace real estate agents and to consume their excessive margins. They make money from their single service charge.

A Torrid Near-Existential Year For The Disruptive Model

There is very little difference between both companies with Opendoor obviously being the larger of the two and available in more locations. Offerpad also charges a higher 6% to 10% service fee versus Opendoor’s 5% flat service fee.

Replacing the middlemen with a simplified cost structure hasn’t worked out for Opendoor and Offerpad this year with both down around 93% year-to-date. Indeed, house prices could retract by 20% next year and the model is especially sensitive to this due to the high degree of leverage employed by both firms. Investor home purchases fell by 30% year-over-year nationwide in the third quarter of 2022, the most marked decline since the 2008 financial crisis. Blackstone-backed single-family landlord Home Partners of America is set to stop its home purchases in 38 US cities. This follows a pause by Invitation Homes and KKR’s My Community Homes. Single-family landlords pulling away from home buying is a terrible omen. It looks like the music is about to stop and iBuyers Opendoor and Offerpad are still dancing around the chairs.

Opendoor uses debt for its purchases at around an 80% to 90% LTV rate for any given house. The company held total debt of $8.07 billion on its balance sheet as of the end of its last reported fiscal 2022 third quarter. This placed its debt-to-capital ratio at around 84.4%, higher than its peer group’s median 48.85% debt-to-capital ratio. Offerpad held total debt of $1.15 billion as of the end of its last reported fiscal 2022 third quarter. This placed its debt-to-capital ratio at 82.7%, also far in excess of its peer group median.

Both companies are staring at an erosion of their book values in the year ahead as higher interest rates embed friction into their operations by increasing the cost of their leverage. With Fed fund rates only set to peak at 5% to 5.25% in the first half of next year, there is more pain ahead. Investment bank Keefe, Bruyette & Woods expects a 50% decline in the 2023-end book values of both firms.

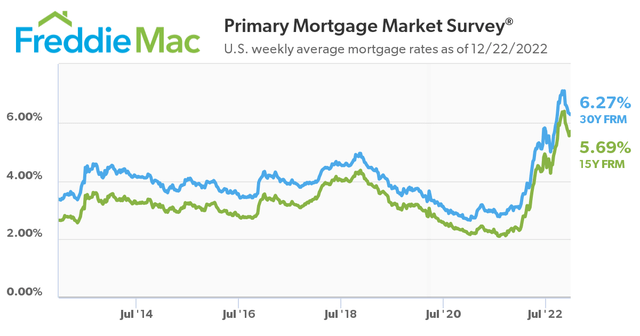

Bulls would be right to flag that the 30-year fixed-rate mortgage rate at 6.27% continues to trend down and that forecasts for the meltdown of single-family housing might be overdone. This is especially as there is increasing confidence from some investment banks including Goldman Sachs that the US economy might actually be able to stage a soft landing next year by avoiding a recession.

We Ain’t In Kansas Anymore

Offerpad’s earnings report for its fiscal 2022 third quarter saw revenue come in at $821.7 million, a 52% increase from the year-ago period and a beat by $126.9 million on consensus estimates. Gross profit collapsed year-over-year to $2.2 million versus $53.1 million with management blaming a $27.5 million inventory impairment charge for the fall. Excluding this and gross profit margin would have come in around 3.6%, up from 0.27%. Net loss for Offerpad was $80 million, up by 422% year-over-year from $15.3 million as adjusted EBITDA deteriorated significantly to a loss of $62.3 million from positive adjusted EBITDA of $6.1 million in the year-ago comp.

Opendoor’s fiscal 2022 third quarter saw revenue come in at $3.4 billion, an increase of nearly 50% from its year-ago quarter. The company’s gross profit margins were negative at -12.6% with a net loss for the period of $928 million, up from a loss of $57 million in the year-ago quarter.

Fundamentally, the tepid macro backdrop is set to continue to weigh down on the respective financial results of both for much of 2023. Opendoor and Offerpad hold housing inventory on their balance sheet until they are sold which will see impairment charges become common in the quarters ahead.

It’s hard to see what the near-term bull case is for both shares here. The iBuying operating model fast disintegrates when houses are consistently marked below cost. The worst-case scenario forecast for a 20% decline in house prices next year against their high leverage ratios would push both companies into negative shareholders’ equity. Success will very much depend on which economic forecast comes true.

Editor’s Note: This article covers one or more microcap stocks. Please be aware of the risks associated with these stocks.

Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.