Summary:

- Virtually every single metric in Opendoor’s Q2 earnings report beat management’s guidance and analyst expectations.

- However, the company issued soft guidance against a weakening housing market.

- Despite the uncertainty, Opendoor’s fundamentals continue to improve, signifying strong business momentum.

- While Q3 will look soft, Q4 and beyond could look much better as the Fed is set to cut interest rates.

- Opendoor stock trades at only 0.6x its Revenue — but investors need a strong stomach to hold this stock.

Vertigo3d

Introduction

Opendoor Technologies Inc. (NASDAQ:OPEN) – the leading ibuying and online residential real estate company – reported strong Q2 earnings that beat both Revenue and EPS estimates. In addition, virtually every single metric came in above the high end of management’s guidance, reflecting strong business momentum.

Despite the outperformance, Opendoor stock fell sharply the following day, largely due to soft guidance and the broader market selloff. That said, this could be a dip-buying opportunity for long-term investors.

Though Opendoor stock is one of the riskiest stocks in my portfolio, I believe the stock still offers tremendous upside potential, especially considering looming rate cuts as early as September this year.

Growth: All Eyes on Interest Rate Cuts

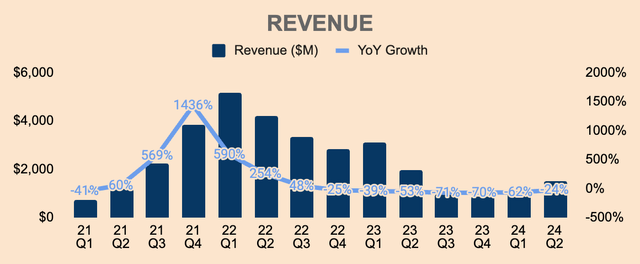

In Q2, Opendoor generated $1.5B of Revenue, down 24% YoY but up 28% QoQ. This was above the high end of management’s guidance and this also beat analyst estimates by $40M.

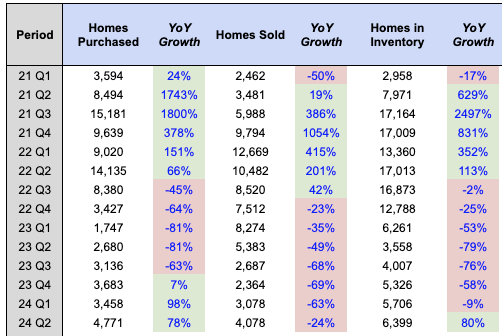

The sequential growth in revenue was mainly driven by an increase in the number of Homes Sold, which was 4,078 in Q2, exactly 1,000 more Homes Sold QoQ.

On the acquisition front, Opendoor acquired 4,771 homes in Q2, up 78% YoY and 38% QoQ. This growth was driven by lower spreads embedded in its offers, higher marketing spend, as well as increased traction from its partnership channels including Zillow Group, Inc. (Z) and eXp Realty.

Author’s Analysis

Without a doubt, Opendoor is stepping on the gas pedal in terms of home acquisitions and resales – it is gradually rescaling the business as it inches closer to Adjusted Net Income breakeven.

However, profitability may not happen as early as investors might have anticipated as elevated mortgage rates and interest rate volatility continue to negatively impact housing affordability for buyers and leave unattractive deals for sellers.

Furthermore, management mentioned that they’re seeing an abnormal slowdown in the housing market in the back half of Q2, risking a deterioration of the company’s fundamentals in the next few quarters.

During the second half of the second quarter, we observed signals in leading macro metrics that indicated a slowing in the housing market. Delistings began to rise and are currently at a higher level for this time of year than we’ve seen in our ten-year operating history. Second quarter market clearance rates, or the percent of listed homes that enter into a sales contract per day, have been declining more than seasonally typical. These dynamics resulted in softness in month-over-month home price appreciation (HPA), which entered negative territory in June, two months earlier than in a typical year.

As a result of the housing weakness observed by management, Opendoor began increasing its spreads, which negatively impacted acquisition volumes. At the same time, Opendoor also decreased listing prices in order to maintain its resale targets, which will be dilutive to Contribution Margin in the short term.

Considering all this, management expects Q3 Revenue to be slightly lower than Q2, at about $1.2B to $1.3B, which fell short of analyst expectations of $1.6B. This is probably why Opendoor stock sold off violently following its Q2 results.

While management’s remarks seemed all doom and gloom, they expect interest rate cuts of at least 50bps this year, which should boost housing market activity and therefore, provide tailwinds for Opendoor.

So Q3 looks like a soft quarter for Opendoor – but beyond that, when interest rates go down, we could see a decent ramp in Opendoor’s topline numbers.

On the positive side, Opendoor is still in its early stages with a $650B total addressable market within its current buy box. With its unique value proposition, net promoter score of 80+, and rapidly increasing brand awareness, Opendoor is well-positioned to capture this massive residential real estate market, which is still predominantly offline.

But for now, Opendoor needs to endure the pain – at least until the Fed cuts rates, which is expected to be in September.

Profitability: Rescaling is Necessary

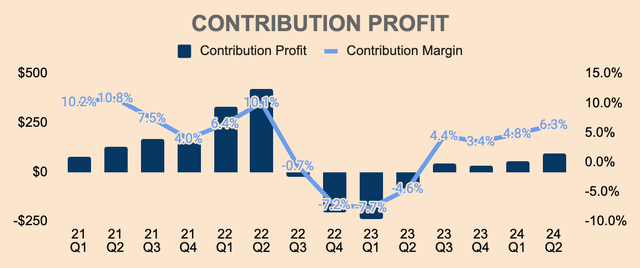

Opendoor generated a Contribution Profit of $95M, representing a Contribution Margin of 6.3%, which is up 1,090bps YoY and 150bps QoQ. Contribution Margin also beat the high end of management’s guidance of 5.7%.

Such strong progress in the unit economics department was due to the company selling more new inventory as opposed to the old book of inventory, which has grotesque margins due to the housing reset in 2022. At this point, the negative impact from the old book of inventory should be negligible.

While Contribution Margins have been trending nicely, management warned of lower margins in the near term due to the housing weakness as explained in the previous section – in Q3, management expects a Contribution Profit of $35M to $45M at a 2.9% to 3.5% Contribution Margin.

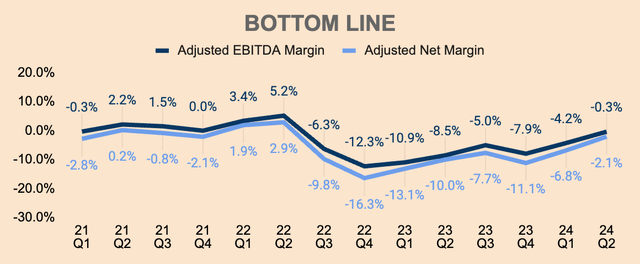

That said, Opendoor’s bottom line continues to be negative:

- Q2 Adjusted Net Income of $(31)M at a (2.1)% Margin.

- Q2 Adjusted EBITDA of $(5)M at a (0.3)% Margin. This came in above the high-end of management’s guidance of $(25)M, due to “margin outperformance and ongoing cost discipline”.

Again, while losses are getting smaller, expect a slight reversal in Q3. For instance, management expects Q3 Adjusted EBITDA of $(60)M to $(70)M, which already includes cost savings from the spin-off of its single-family rental market intelligence and transaction platform, Mainstay.

The good thing is that management is rescaling the business responsibly, adapting quickly to the changing housing environment by widening spreads and cutting marketing expenses – they don’t want to repeat the same mistake of acquiring too many homes at peak prices like they did in 2022.

Applying higher spreads means a higher margin of safety when Opendoor resells the homes it acquired – if home prices go down, Opendoor would likely still be Contribution Profit positive given higher spreads embedded in its offers, unlike a year or so ago when Opendoor was forced to resell at huge losses.

That being said, Opendoor expects lower volumes in Q3, relative to Q2, which means lower Revenue and Contribution Profit to cover its fixed cost base. Thus, Adjusted EBITDA is expected to worsen in Q3.

However, rate cuts should spur housing transaction activity in Q4 and beyond, which should help Opendoor rescale its business… enough for the company to reach Adjusted Net Income breakeven.

Whatever it is, Opendoor needs to rescale further – or else it will stay unprofitable indefinitely.

Health: Resilient Position

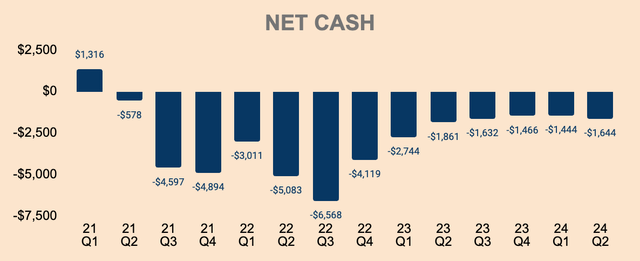

As it stands, Opendoor has $0.8B of Cash and Short-term Investments with $2.4B of Total Debt, placing its Net Cash position at about $(1.6)B. The company also has about $7.0B of borrowing capacity, of which $2.3B has been drawn.

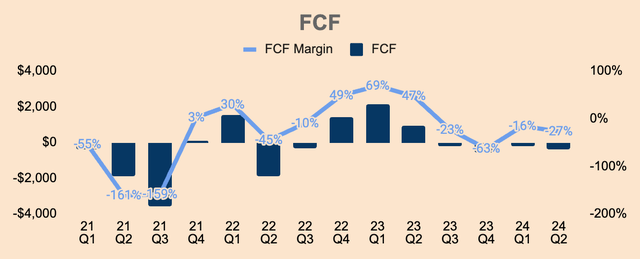

Net Cash position dropped slightly QoQ as the company was a net buyer of homes in Q2, as seen by its negative Free Cash Flow in the quarter, which was $(0.4)B. In Q3, given management’s conservative stance, we may see FCF turn positive. However, beyond that, I expect Opendoor to be a net buyer of homes once again.

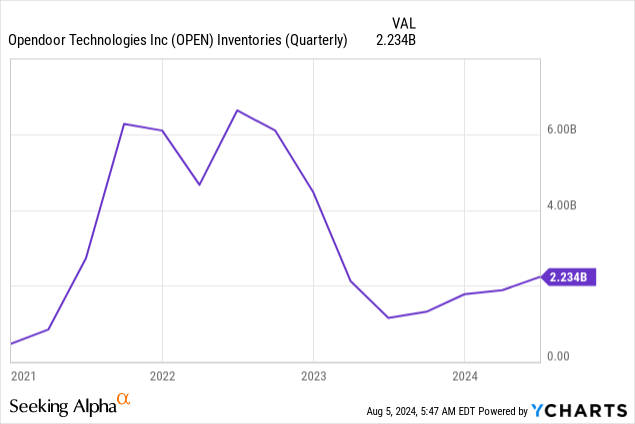

As of Q2, Opendoor has 6,399 Homes in Inventory, up 80% YoY, valued at $2.2B, up 94% YoY. As you can see, Opendoor is rescaling gradually, as seen by the gentle slope over the last few quarters, as compared to the extremely steep slope back in 2021 and 2022. Moreover, Inventory levels are nowhere near 2022 levels.

For these reasons, I believe Opendoor has a more resilient balance sheet and inventory position than ever before, which helps to minimize any downside or inventory writedowns if we do see another housing shock.

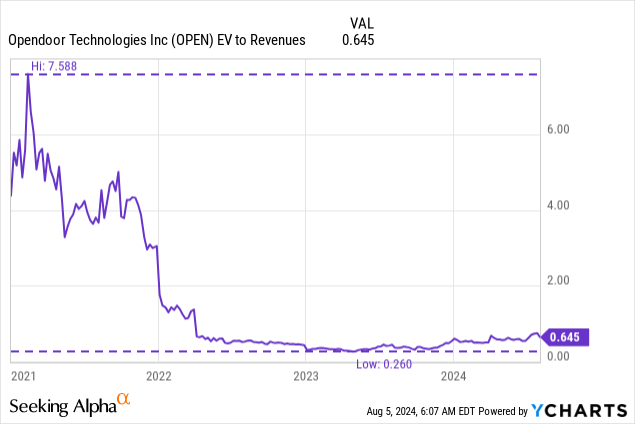

Valuation: Cheap But Volatile

As it stands, Opendoor trades at an EV to Revenue of 0.6x, which is dirt cheap considering its potential to scale revenue by 5x, 10x, or even 20x from here. It will take some time to reach this scale, but it’s very much possible given its strong value proposition, strong brand, and strong competitive position.

Granted, it is cheap for a reason: 1) shaky global economy and housing market, 2) low-margin business model, 3) unprofitability, 4) negative growth, and 5) high mortgage rates – to name a few.

However, there are major positive catalysts ahead for Opendoor, including interest rate cuts.

Yes, the stock will continue to be volatile. It has been swinging from $1 to $5, and as of this writing, it is down by 10% due to the global market selloff currently.

Investors need a strong stomach to hold this stock.

I do have that stomach – though it has been pretty upset lately.

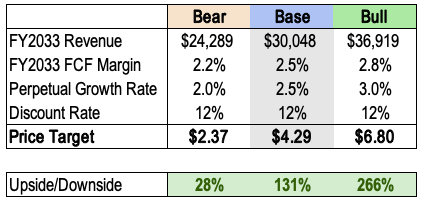

I am still bullish on the company. However, I’m lowering my price target – from $6 to $4 – due to slower-than-expected growth and increasing housing market uncertainty.

It represents an upside potential of 131%. However, I understand that it will be a volatile ride.

Author’s Analysis

Risks

- Housing Correction: as mentioned by management, they are seeing some weakness in the housing market in the back half of Q2, and are proceeding cautiously. If we see another housing correction, Opendoor’s operations will take a major hit.

- Busted Business Model: the million-dollar question remains: can Opendoor turn profitable once it rescales? Can Opendoor sustain profitable growth and reward shareholders with positive earnings over time? Only time will tell…

Thesis

Opendoor’s Q2 results were a home run – it beat guidance and estimates in virtually all metrics.

But outperformance is not enough – its stellar results were completely eclipsed by soft guidance and a worsening housing market.

Thus, the stock sold off.

But it seems that there’s light at the end of the tunnel.

The company is rescaling. Margins are improving. Interest rate cuts are just around the corner.

It has not been easy holding Opendoor stock – but be patient.

I believe this is just the beginning of Opendoor’s turnaround story.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of OPEN either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.