Summary:

- Opendoor Technologies Inc. introduced an at-the-market equity program to raise $200 million over the next three years, indicating a need for additional financing.

- Even with improved revenue projections, there is still significant uncertainty over when the business will achieve sustainable, positive free cash flow.

- Some lessons on perspective on why being down 70% from its highs, doesn’t mean it’s a bargain. Or perhaps it is.

shapecharge

Investment Thesis

Opendoor Technologies Inc. (NASDAQ:OPEN) is a highly contentious stock. It’s a business with a lot of promise. But beyond its promises, what we are left with is a business that is still struggling to deliver positive free cash flow.

I used to believe with all my might that Opendoor could be a promising investment. And I’m not a “once bitten twice shy” investor. If the facts change, I’m happy to change my mind.

And while I would not declare that its stock is a sell, I am hesitant to call it a buy either.

Rapid Recap

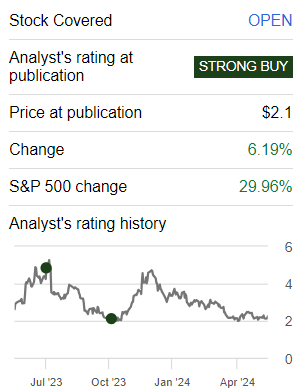

Back in 2023, October, I said:

Opendoor believes that by H1 2024 this business will be operating at free cash flow breakeven. If that transpires to be the case, Opendoor business will have been put through the most challenging housing environment in more than a decade and will be vindicated, demonstrating to naysayers that the business model can be operated in a sustainable fashion, irrespective of any market downturn, down or up.

Author’s work on OPEN

Fast-forward to H1 2024, and we are still inching closer to breakeven on its EBITDA. Is this truly as good as it’s going to get for Opendoor? Breakeven profitability? Or is there more to it? I believe it’s a tough call.

Why Opendoor? Why Now?

Opendoor is a digital platform that helps people buy and sell homes more easily and quickly. Instead of the traditional process of listing a home on the market, homeowners can sell their house directly to Opendoor for a cash offer, often avoiding the lengthy. It aims to make real estate transactions simpler and more convenient for consumers.

Meanwhile, Opendoor faces headwinds as it strives to rescale its business. Despite exceeding revenue expectations and achieving notable acquisition volumes, the company is grappling with the macroeconomic environment.

The fluctuating market conditions present an obstacle, impacting transaction volumes.

Nonetheless, Opendoor has managed to nearly double its y/y acquisition volumes.

That being said, importantly, Opendoor has introduced an at-the-market equity program to sell up to $200 million in shares over the next three years. This is not a business that is expecting to reach positive free cash flow any time soon.

Given this context, let’s now discuss its valuation.

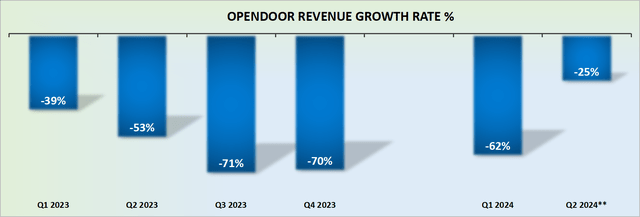

Growth Rates Should Improve, But How Sustainable Is It?

Opendoor’s revenue growth rates beginning Q2 2024 will start to become more favorable. Throw in some easing of macro conditions, and all of a sudden, Opendoor can post some topline growth rates. Perhaps.

Possibly, starting Q3 2024, Opendoor delivers some positive growth rates. Then, all of a sudden, Opendoor can declare that they’ve stabilized the business and put forth a narrative of how the business is now quite different.

Needless to say, this setup would be very bullish, particularly given that its valuation, at least at first glance, doesn’t look stretched. Something we discuss more thoroughly next.

OPEN Stock Valuation — It’s a Tough Call

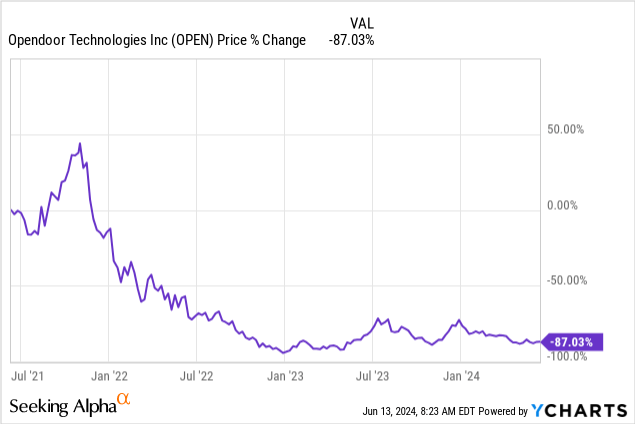

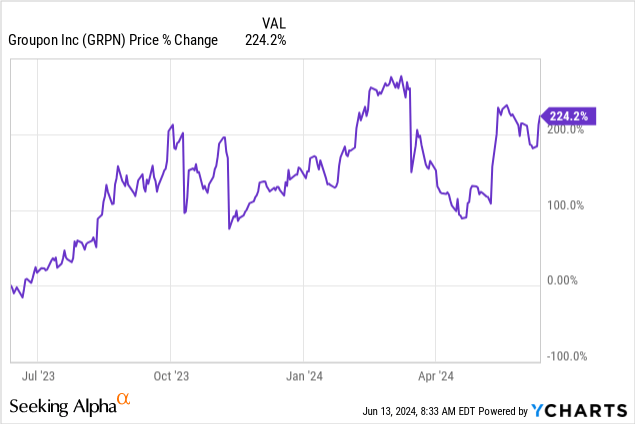

When I started out investing, if I saw a chart like the one above, I would be immediately compelled to buy this stock. This had to be a bargain, after all, the stock is down more than 70% from its highs.

Today, I am not as quick to make assumptions. Today, I know two things. Firstly, where a stock was yesterday or last month makes no insight into where the stock will be tomorrow or next month.

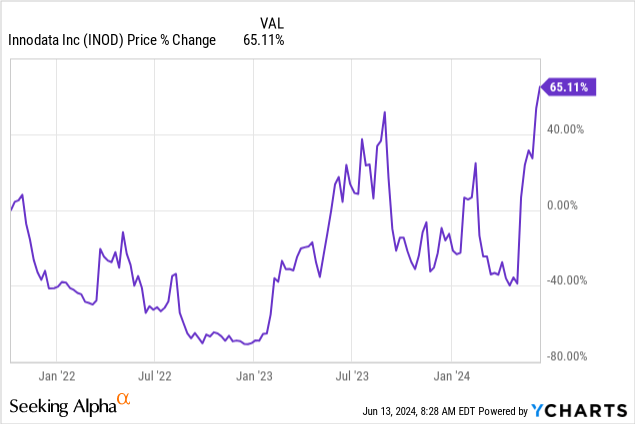

Secondly, dismissing a business just because it’s down 70% from its highs isn’t constructive, either. Here are two examples to justify my argument.

Innodata (INOD) is a consulting business that strives to help its customers harness AI, by creating data sets to train AI models. The stock was down 70% before turning around and is now at an all-time high.

Similarly, another business that many suspect to be washed away, Groupon (GRPN), is now up more than 200% in the past year.

Netflix back in 2011 is another example. Therefore, we should not be too quick to say that down is out.

But the problem with Opendoor remains. The business is struggling to reach breakeven on its EBITDA line. That being said, I do believe that at some point soon, there’s a possibility for Opendoor to reach breakeven.

On yet the other hand, Opendoor’s business model is highly seasonal, with Q2 being its strongest quarter of the year. And since Opendoor’s Q2 only guides for negative $25 million EBITDA at the high end, even if Opendoor does deliver a beat on the high end of its own guidance and delivers close to negative $15 million of EBITDA, the fact remains, this is as good as it’s going to get this year.

Altogether, I can’t recommend Opendoor Technologies Inc. stock. There’s still too much uncertainty over when exactly the business will start to report positive, sustainable, free cash flow. Meanwhile, investors also have to contend with its at the market equity offering.

The Bottom Line

Given the persistent Opendoor Technologies Inc. struggle to achieve positive free cash flow, combined with ongoing macroeconomic challenges and the introduction of an at-the-market equity program to raise $200 million over the next three years, it is prudent to be cautious about recommending Opendoor at present.

The company’s performance shows some promise, but its inability to reach consistent profitability and the uncertainty over sustainable growth make it too risky an investment.

Therefore, despite some potential for improvement, the current financial instability suggests it’s too tough a call to make.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

Strong Investment Potential

My Marketplace highlights a portfolio of undervalued investment opportunities – stocks with rapid growth potential, driven by top quality management, while these stocks are cheaply valued.

I follow countless companies and select for you the most attractive investments. I do all the work of picking the most attractive stocks.

Investing Made EASY

As an experienced professional, I highlight the best stocks to grow your savings: stocks that deliver strong gains.

-

- Deep Value Returns’ Marketplace continues to rapidly grow.

- Check out members’ reviews.

- High-quality, actionable insightful stock picks.

- The place where value is everything.