Summary:

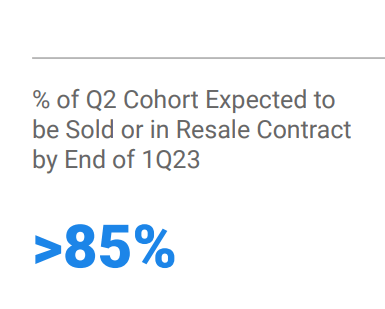

- Opendoor Technologies Inc. is about 85% of the way through shedding the inflated housing inventory it bought in Q2 2022. Opendoor calls this group of housing its reset quarter.

- Opendoor’s founder and old CEO has passed the reins to the CFO, Carrie Wheeler, making her the new CEO.

- Opendoor believes that in H2 2024 it will reach free cash flow breakeven.

SDI Productions

Investment Thesis

Opendoor Technologies Inc. (NASDAQ:OPEN) is a highly speculative investment. The business has enough capital on its balance sheet near term that it can get through this year.

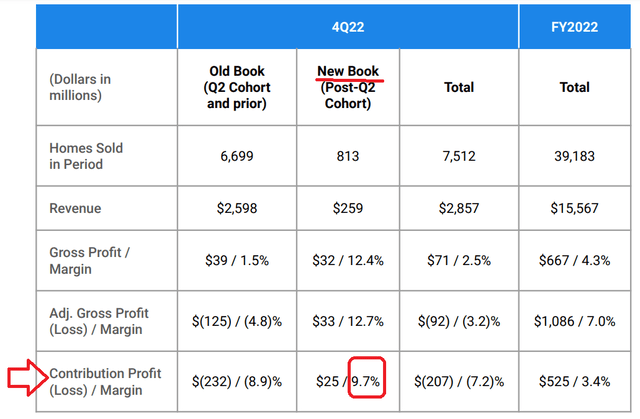

As you can see in its Q4 results, the business model has turned a corner on the new houses it bought after Q2 2022.

However, to be absolutely clear, the long-term target of reaching a breakeven free cash flow (“FCF”) level by mid-2024 is still uncertain.

So, investors should price Opendoor Technologies Inc. stock accordingly in their portfolio.

How to Think About Opendoor?

I know that housing is in massive turmoil right now, but what I’m trying to see is if housing is stabilizing. That’s really the key for me.

I recognize two considerations. Firstly, when I recommended this stock at $8, I was wrong to do so. And I also recognize that the verdict on Opendoor’s ultimate long-term viability is still in doubt.

Furthermore, when there’s a ”dash for trash,” meaning investors chasing high beta stocks, Opendoor does well; and when animal spirits retreat, Opendoor’s stock also gives way.

However, I declare that these actions are very short term over a course of 3 to 6 months or so. Over slightly longer time frames, Opendoor will start to trade on its own merit. In the short term, as Benjamin Graham said, the market is a voting machine. Longer term, it better reflects intrinsic value.

To be absolutely clear, it’s not all bad with Opendoor.

Opendoor’s Prospects

Opendoor Technologies Inc. shines strongly where it matters most. Sellers through Opendoor give Opendoor an NPS score of approximately 80. This makes it one of the highest-rated NPS-scoring companies.

The premise behind Opendoor is very attractive. There’s a massive market in the selling of homes. If you’ve sold your home at some point you’ll remember the hardship and stress that created.

So, the premise behind Opendoor makes a lot of sense. The problem is that the business went from a period where money was cheap and selling houses into an upcycle that allowed the company to go after massive growth.

And then, conditions tightened and the company was caught unprepared. The founder was removed as CEO of the company and the CFO was made CEO. Basically, the company recognizes that it’s playing for survival.

In the midst of all this turmoil, Opendoor had what it termed its ”reset” quarter. That has meant selling the housing inventory it bought at higher price points, back in Q2 2022, at a loss. This has been percolating through its income statement.

OPEN Q4 2022

As it stands right now in Q1 2023, 85% of the ”reset” group has percolated through. Meaning that Q2 2023 will have the last 15% of houses to be sold at a loss. After that, Opendoor states,

The homes we’ve acquired since the reset are outperforming our expectations and prior years.

Going on to declare,

We believe our new book is on track to generate contribution margins at or in excess of our annual target of 4% to 6% once fully sold through.

Contribution margins are Opendoor’s unit economics. That’s how much it makes on the spread between buying the houses and selling. Remember, Opendoor is not supposed to be a high-margin business. Instead, it’s a high-volume business.

That being said, there’s the argument that Opendoor doesn’t have any repeat custom. Once it makes a sale, that customer is unlikely to return at any point over the next several years, as they’ve already acquired a new home.

To that argument, I counter that the key for Opendoor is to gain a high NPS score. To gain the trust of consumers. To build a strong brand. For customers to know that Opendoor is the company that’s going to buy their house and remove the stress of one’s life from selling their home. Opendoor sells simplicity and convenience.

Focused on a Winner-Take-Most Strategy

I believe that Opendoor’s pilot partnership with Zillow Group, Inc. (Z) is a watershed moment. Zillow is in the same boat as Opendoor in that the housing market is in turmoil. Put another way, Zillow has problems too.

And Zillow’s willingness to partner with a company that it once saw as a bitter rival is not out of kindness or charity. It’s because both companies believe that they can prosper better together. By providing consumers with more digital options to transact their house.

As sellers start their searches on Zillow, the option to sell for cash with Opendoor presents itself. The strategy is not to gain every seller. But to develop Opendoor as ”the place” that sellers go for a cash offer on their homes.

Will Opendoor Survive Through this Period?

Opendoor holds $1.3 billion of cash. This is countered with $12 billion of debt. However, keep in mind that this debt is tied to the houses. It’s non-recourse. So, as the houses are sold, that debt will be taken care of.

However, the issue here is the interest rates. Presently, much of Opendoor’s interest rates are locked in at around 4%. But these rates will climb to at least 5.5% on a blended basis in 2023 (see page 87). This means that its debt payments will reach about $700 million in 2023.

Unit Economics Vs. Adjusted Net Income

Opendoor notes that its adjusted net income is a proxy for free cash flow. Opendoor’s business model is extremely working capital intensive. That means that there are quarters where they are buying houses. And there are quarters where they are selling houses.

When they are buying houses, the free cash flow looks very negative. When they are selling houses, their inventory, its free cash flow looks very positive. Opendoor’s adjusted net income normalizes for these periods. And it’s a helpful way to think about its free cash flow progress.

Opendoor believes that it can reach breakeven free cash flows in mid-2024.

The other metric is unit economics. That’s the spread Opendoor makes between buying and selling a house. This doesn’t include management costs, SG&A, interest expenses, or taxes. It’s simply the unit economics of the business.

On that consideration, Opendoor has always stated that the spread of its houses would be between a 4% and 6% contribution margin.

As you can see here, the old book, from Q2 2022, from houses made at the higher point of the cycle prior to the interest rate hikes, was negative 9%.

While the new book is running at 10% contribution margins. However, Opendoor’s business model is not on squeezing its sellers. That’s not what the business model is about. It’s about gaining trust in the knowledge that by selling their house on Opendoor, customers are not being taken advantage of.

Accordingly, throughout the earnings call, Opendoor contends that once the new houses are sold, Opendoor will normalize their unit contribution margins at 4% to 6% contribution margin.

The Bottom Line

We are in a wait-and-see period. There are a lot of questions outstanding still.

And this investment has turned out to be a lot more speculative than I had wished for.

The main difference is that I would have appropriately sized OPEN better as a long-term option. I would have only made it a 2% position in my portfolio rather than close to the 7% position it is now.

Because if I’m correct in my insight, and that by the summer of 2022, there’s going to be more clarity around this business and less pessimism in the overall real estate market, I will be more than adequately rewarded without the challenges and heartache that have come from seeing the massive price swings in Opendoor Technologies Inc. stock. In conclusion, I’m optimistic.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of OPEN either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

Strong Investment Potential

My Marketplace highlights a portfolio of undervalued investment opportunities – stocks with rapid growth potential, driven by top quality management, while these stocks are cheaply valued.

I follow countless companies and select for you the most attractive investments. I do all the work of picking the most attractive stocks.

Investing Made EASY

As an experienced professional, I highlight the best stocks to grow your savings: stocks that deliver strong gains.

-

- Deep Value Returns’ Marketplace continues to rapidly grow.

- Check out members’ reviews.

- High-quality, actionable insightful stock picks.

- The place where value is everything.