Summary:

- One key lesson I’ve learned from investing in Opendoor Technologies Inc. is to have a set of hard rules to prevent irrational actions.

- Holding a stock for at least one year after the initial purchase has saved me from making impulsive decisions during market fluctuations.

- Investing in the future of a business is an art, not a science. It involves understanding the odds and gaining insights to tilt the odds in my favor.

- Opendoor’s business model, focusing on trust and convenience for sellers, has the potential to succeed as the real estate market stabilizes in 2024.

metamorworks/iStock via Getty Images

Investment Thesis

Opendoor Technologies Inc. (NASDAQ:OPEN) is a stock that I’m bullish on. Here, I explain some key investment lessons I’ve taken from investing in Opendoor and how you too can pick up helpful nuggets.

And how investors should now think about Opendoor going forward. According to my estimates, Opendoor is priced at approximately 10x next year’s net income (after debt, but before taxes).

Lessons Learned From Opendoor, Top Rule

This is what I said in my previous analysis,

Now, to make something clear, I’m not 100% bullish on OPEN stock. I do absolutely own this stock. And have recently purchased more shares, luckily below $2. However, my overall average price is meaningfully underwater, at closer to $7.

So, I was wrong in my initial purchase price. Although I should note that since the stock fell so significantly since my original purchase, I’ve plenty of time to ask ”hard questions” about my investment.

And by asking those hard questions, I’ve been able to a large extent to pierce through the noise and share price volatility to better understand the risks and opportunities available.

And I concluded the analysis by saying,

In summary, although I’m bullish on Opendoor Technologies Inc., I’m also cautious before I can categorically ascertain whether the worst of the property downturn is in the rearview mirror. Although, as you know, by the time I know, you’ll know, and everyone else will know too. And that will be in the valuation.

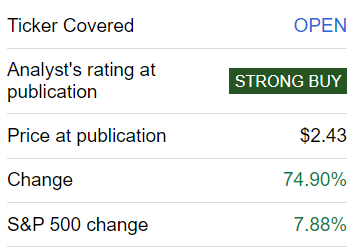

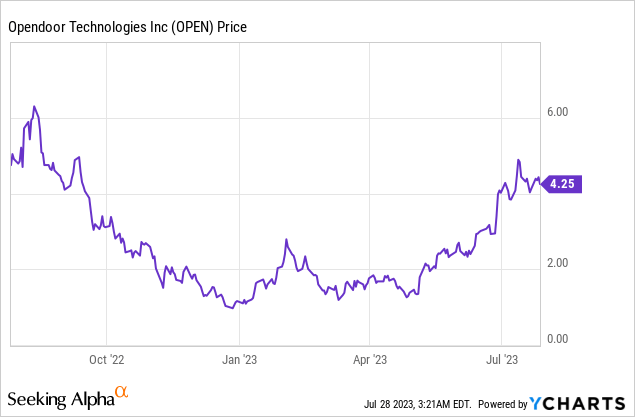

Since I wrote those words, this is how the stock has performed.

OPEN author’s work

When I invest, I have put in place hard rules to stop me from acting irrationally. These are rules that I have refined over time. With time and experience, I’ve seen many different types of markets. Both the ups and the down.

One of the rules that I believe has helped me tremendously is putting in place a rule that I will not sell out of my business for one year after the initial share purchase. Why?

Because after you’ve invested in the business, there’s no guarantee that the share price will immediately go up. Indeed, there’s nothing that says, Michael bought the stock, therefore it will now rise.

By putting in place this safeguard of not selling a stock 1 year after the initial share purchase, it helps me protect my invested capital from my own foolish mistakes. Allow me to add further context.

There were periods in the past 1 year when this stock dropped below $1 per share and become a penny stock. Can you imagine the pressure on me to act? Can you imagine the pressure on me to stop recommending this stock? It was through the roof.

But I kept going in my mind to safety rules that I’ve refined over time. I don’t believe in having too many rules when it comes to investing. I have 5 rules in place that I believe help me keep out of trouble. Having a long list of rules may be fun to write down, but have limited practical applicability.

And one of these rules is don’t sell a stock that you’ve held for less than a year. Why?

Firstly, because a lot can happen in the market in the short term. And secondly, you don’t know anything about a business until you are the owner of the business.

I often state you can be the biggest Apple (AAPL) fan. But until you’ve held a share of Apple, you don’t know much about its business. Once you’ve bought a share of Apple, you are an owner of Apple. And at that juncture, you’ve gone beyond a consumer to a business owner.

As Warren Buffett says,

I am a better investor because I am a businessman, and a better businessman because I am no investor.

The point I’m making is don’t turn yourself into your own investment enemy. Think and act like the owner of the business. And thinking as the owner of a business, you are becoming business minded. And you are looking beyond the share price. You are trying to formulate a view of what the next 12 months are going to look like for your business.

And this leads me to discuss Opendoor’s outlook.

2024 Will be Dramatically Different

As my members know, the market is always looking ahead 6 months. Not more than 6 months. Not less than 6 months. 6 months. So, you need to look forward by 12 months, so that in 6 months’ time, the market can be seeing what you see.

This doesn’t always work. You’ll make all kinds of judgment mistakes. But investing is an art. Not a science. You need to get comfortable with understanding that investing in the future of a business is a game of odds. And every little edge and insight helps tilt the odds more in your favor.

Further Thoughts on Opendoor

Opendoor’s business model is a very high-throughput business model, that strives to operate at around 4% contribution margin. That’s the core of the business model.

And more importantly, it’s about providing consumers with trust and convenience. The sellers reaching out to Opendoor want to know that they are not being taken advantage of. That they are being given a fair deal. And that they are being provided convenience.

They put their house for sale with Opendoor and in about a week’s time they can cash out and exit the property on a date that suits them. That the whole process is accomplished stress-free and quickly. And then these sellers spread the word of mouth about Opendoor. I’m not saying that Opendoor is like Tesla (TSLA). But I am saying that Tesla was able to gain substantial ground with no advertising. Word of mouth advertising is powerful.

Moving on, in 2023, interest rates were raising at a breakneck pace. Few households would be willing to sell in this market. But in 2024, interest rates will be more stable. And may, in actuality, get cut.

That’s a dramatically different setup for the real estate market to find itself in.

Think Through Opendoor’s Valuation

Opendoor is a few days from reporting its Q2 2023 results (expected Thursday, August 3, post-market). Assuming that Opendoor can reaffirm to investors that its contribution margins in 2024 can reach 6% at the midpoint, this could reassure investors that indeed Opendoor can be free cash flow positive by mid-2024.

The assumption here is that Opendoor’s revenues would be on a run-rate (or an annualized revenue basis) of $10 billion by mid-2024.

This would mean that Opendoor’s contribution income profit would be annualizing at close to $600 million by mid-2024.

On the back of that, could Opendoor see around 2% net income margin, after interest payments of around $400 million per year? Note, here I’ve subtracted interest payments of $400 million.

This would leave Opendoor’s net income (before taxes, given that Opendoor is unlikely to be paying taxes for a considerable time), at around $200 million.

In sum, Opendoor is priced at approximately 10x next year’s adjusted net income.

The Bottom Line

I am bullish on Opendoor Technologies and have learned some valuable investment lessons from my experience with the stock.

One key rule I follow is to hold a stock for at least one year after the initial purchase to avoid making rash decisions based on short-term fluctuations. This rule helped me stay calm and hold my Opendoor stock even when its share price dropped significantly.

Looking ahead, I believe Opendoor’s business model, focused on providing trust and convenience to sellers, has strong potential for success. As the real estate market stabilizes in 2024, Opendoor’s contribution margins may improve, and it could become free cash flow positive by mid-2024. At its current valuation, Opendoor is priced at around 10x next year’s adjusted net income, which I find makes Opendoor a strong buy at this valuation.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of OPEN either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

Strong Investment Potential

My Marketplace highlights a portfolio of undervalued investment opportunities – stocks with rapid growth potential, driven by top quality management, while these stocks are cheaply valued.

I follow countless companies and select for you the most attractive investments. I do all the work of picking the most attractive stocks.

Investing Made EASY

As an experienced professional, I highlight the best stocks to grow your savings: stocks that deliver strong gains.

-

- Deep Value Returns’ Marketplace continues to rapidly grow.

- Check out members’ reviews.

- High-quality, actionable insightful stock picks.

- The place where value is everything.