Summary:

- OPEN has executed brilliantly, attributed to the improving spreads and healthier inventory levels, triggering its expanded profit margins.

- We may expect the same cadence in FY2024, based on the management’s FQ1’24 guidance and the Fed’s potential pivot in H1’24.

- OPEN remains undervalued compared to its sector peer, with a top/ bottom line beat likely to boost its discounted valuations while triggering the expansion in its stock prices.

- Readers looking for the great upside may still add here, assuming that they are comfortable with the elevated short interest and moderate volatility.

cagkansayin

We previously covered Opendoor Technologies (NASDAQ:OPEN) in December 2023, discussing its improved prospects then, with most of its older inventories already sold and the newer book bringing forth relatively improved profit margins.

Combined with the cooling inflation, reversal in the mortgage rates, and the Fed’s dovish stance, we had believed that the worst might very well be behind us, with the resale market recovery likely to occur sooner than expected.

In this article, we shall discuss why we are maintaining our Buy rating for the OPEN stock, thanks to its improving profit margins, healthier inventory levels, promising FQ1’24 guidance, and lifting market sentiments as the inflation cools and the Fed’s (likely) pivot by H1’24.

While the iBuying company is likely to remain unprofitable in the intermediate term, the recovery in resale home market is likely to boost its inherently discounted valuations while triggering the expansion in its stock prices.

The OPEN Investment Thesis Remains Opportunistic For The Brave

For now, OPEN has reported top/ bottom line beats in the FQ4’23 earnings call, with revenues of $870M (-11.2% QoQ/ -69.5% YoY) and GAAP EPS of -$0.14 (+12.5% QoQ/ +77.8% YoY), with FY2023 numbers of $6.94B (-55.4% YoY) and -$0.42 (+80.6% YoY), respectively.

Much of the tailwinds are attributed to the stable average selling prices of $368.64K (+1% QoQ/ -4.5% YoY) in FQ4’23 and $368.98K in FY2023 (-7.3% YoY), nearing the average US existing home prices of $386.9K in Q4’23 (-3.4% MoM/ +3.8% YoY) and $387.95K in 2023 (+1% YoY).

Readers must also note that OPEN’s inventory health has been improving, with $333.64K in estimated value per homes (+1.9% QoQ/ -5.2% YoY), allowing the company to generate improved spreads.

We believe that the management has executed brilliantly despite the uncertain macroeconomic outlook, since its new book of homes have already generated an improved adj contribution margin of 8.3% in FY2023. This is compared to the overall contribution margin of -3.7%, attributed to the drag from older inventories.

As a result, it is unsurprising that OPEN has reported narrowing losses in the recent earnings call, as gross margins expand to 8.3% (-1.5 points QoQ/ +5.8 YoY) and operational expenses moderate to $183M (+4.5% QoQ/ -30.9% YoY).

The same prudence has also been observed in the iBuying company’s improving balance sheet with a net debt of $1.44B (-10% QoQ/ -46.4% YoY), as interest rates remain elevated and “market supply still at record low,” triggering its lower acquisition volumes thus far.

Most importantly, we believe that the worst may very well be behind us, with the 30Y Fixed Rate Mortgage already declining to 6.9% by February 22, 2024 (+0.3 points MoM/ +0.4 YoY/ +3.1 from 2019 averages of 3.8%), down from the recent high of 7.8% in October 25, 2023.

With the Fed “remaining resolute to returning inflation to 2 percent over time” and a pivot likely to happen by H1’24, the normalization process and recovery of resale market is a matter of when, not if.

For now, market analysts have already estimated the “magic mortgage rate of 5.5%,” with more homeowners likely to sell their properties then, consequently increasing the resale market supply.

In addition, the OPEN management has offered an optimistic FQ1’24 guidance, with revenues of $1.075B (+23.5% QoQ/ -65.5% YoY), contribution profit of $45M (+50% QoQ/ +118.6% YoY), and adj EBITDA of -$75M (-8.6% QoQ/ +78% YoY).

These numbers imply a projected improvement in its contribution margin to 4.1% (+0.7 points QoQ/ +11.8 YoY) and adj EBITDA margin to -6.9% (+1 points QoQ/ +4 YoY), implying that its reversal may already be here.

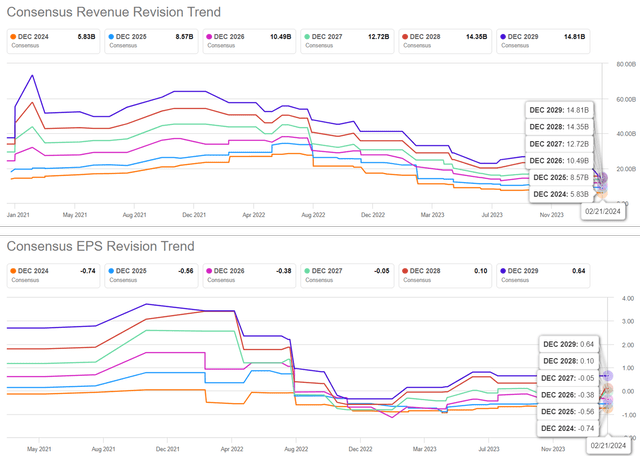

The Consensus Forward Estimates

As a result, we can understand why the consensus estimates have moderately upgraded OPEN’s bottom lines despite the lower top-line growth, with it now expected to generate a FY2024 revenues of $5.83B (-15.9% YoY) and adj EPS of -$0.74 (-76.1% YoY), compared to the original estimates of $15.97B (+130.1% YoY) and -$0.90 (-114.2% YoY), respectively.

However, readers should also temper their expectations, since the iBuying company is unlikely to generate positive GAAP earnings in the intermediate term, with the management already guiding “a meaningful increase in acquisitions” and “ramped up total marketing spend” in 2024.

At the same time, thanks to the inherent reliance on Stock-Based Compensations and multiple capital raises, OPEN may continue to dilute its long-term shareholders, with its share count already growing to 672.66M by the latest quarter (+10.51M QoQ/ +38.06M YoY/ +592.68M from FY2019 levels of 79.98M).

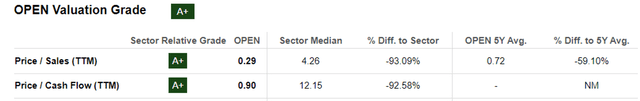

OPEN Valuations

And it is for this reason that the only metrics that we are able to use to measure OPEN’s valuations are the TTM Price/ Sales of 0.29x and TTM Price/ Cash Flow of 0.90x.

When compared to its same sector peer, Zillow (Z) at 5.66x/ 17.91x, it is apparent that OPEN is trading at discounted valuations, partly attributed to the uncertain recovery of resale home market and volatile macroeconomic outlook.

Even then, we maintain our belief that the iBuying platform has executed relatively well, in light of the multiple unprecedented global events thus far, especially since we are starting to see the much-needed reversal in its profit margins.

So, Is OPEN Stock A Buy, Sell, or Hold?

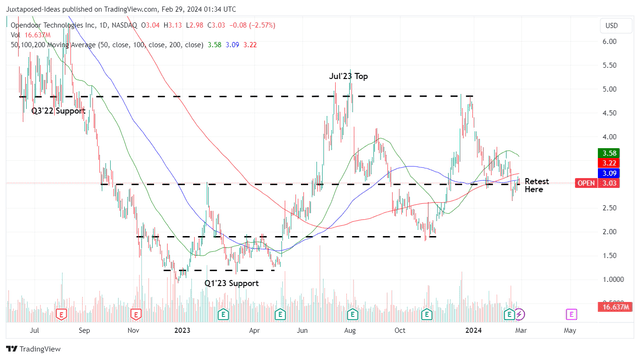

OPEN 1Y Stock Price

By now, it seems that the market has adopted a wait and see approach, with OPEN also likely to remain volatile, thanks to the elevated short-interest at 13.31% at the time of writing.

With the stock unable to hold on to its recent gains, as it retraces to the previous support levels of $3s, it is apparent that OPEN is only suitable for contrarian investors looking for value play tech stocks.

Even then, since the iBuying company is unlikely to breakeven in the intermediate term, we believe that anyone whom is adding here must be very patient indeed.

Despite so, we are maintaining our Buy rating for the OPEN stock, with the worst of the interest rate headwinds likely behind us, as the International Monetary Fund projects a soft landing ahead.

Combined with robust US labor market as of January 2024, we believe that there remains immense opportunities for investors/ traders looking for the great upside.

Naturally, due to the speculative nature of the stock, they should also size their portfolios according to their risk appetite, since volatility is more likely than not.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

The analysis is provided exclusively for informational purposes and should not be considered professional investment advice. Before investing, please conduct personal in-depth research and utmost due diligence, as there are many risks associated with the trade, including capital loss.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.