Summary:

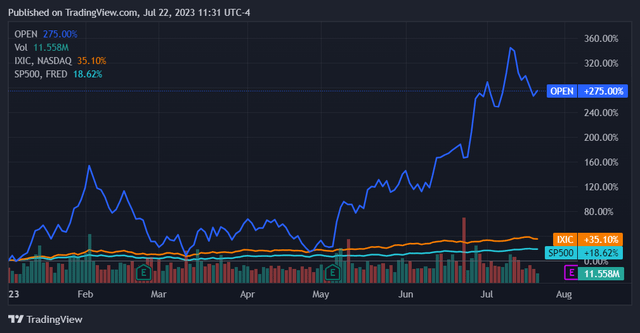

- Opendoor Technologies’ stock has outperformed the NASDAQ Composite and S&P 500 significantly this year, largely due to an impressive 73.5% beat against consensus EPS expectations in the company’s May earnings report.

- Despite higher interest rates pressuring the residential real estate market, Opendoor’s last earnings report showed improved return metrics on newer inventory amid earnings far beyond analyst expectations.

- The company’s Q2 2023 earnings report is expected to show a loss of $0.27 per share, but this estimate seems highly conservative and doesn’t account for the company’s improving margins.

- Calculating through what EPS will likely be for Q2 ’23, we see that Opendoor is set to outperform against consensus.

- The stock’s strong momentum profile should then see its shares rise further as a result.

OlegAlbinsky/iStock via Getty Images

Overview

Opendoor Technologies (NASDAQ:OPEN) stock has had an exceptional year, outperforming both the NASDAQ Composite and S&P500 by a significant multiple. Most of this appreciation came in the wake of the company’s May earnings report, which yielded an impressive 73.5% beat against consensus EPS expectations.

This robust appreciation in Opendoor’s stock has happened even as higher interest rates have put pressure on the residential real estate market. Nonetheless, the housing market has remained more robust than many observers expected. The Case Shiller Index had dropped roughly 5% from its peak by January of this year but has since resumed its upward climb, now holding at about 2.3% less than its top price point. New home construction has also been particularly robust, evidenced by excellent recent earnings reports from large homebuilders such as D.R. Horton (NYSE:DHI).

Of course, Opendoor’s platform is oriented around selling existing homes and does not directly benefit from new inventory entering the market for the first time. In contrast with new construction, existing home sales have slowed materially throughout this year. This is because Opendoor is what’s known as an ‘iBuyer’ as well as a marketplace for homes. What this means more specifically is that the company operates a market in which both buyers and sellers can participate, pocketing a commission fee from transactions that occur on its platform. As per the iBuyer designation, it also purchases homes itself and keeps them on the balance sheet, proceeding to sell them on its platform and pocketing the spread between the purchase price and selling price.

All of this makes for an interesting macroeconomic context heading into Opendoor’s next earnings report, set to be released on August 3rd. Upon first glance it would seem that the current situation is disadvantageous to the firm and should weigh on its earnings. On the other hand, Opendoor’s last earnings report demonstrated improving return metrics on newer inventory – as well as earnings far beyond analyst expectations.

The question is then around what the results are for this quarter, namely if Opendoor been able to maneuver itself and further improve its prospects in what is a challenging market. This is made all the more critical as the firm is not yet profitable. In this article I’ll review current expectations for its earnings and how likely the company is to meet them, as well as how this should play out for Opendoor’s share price in the near-term.

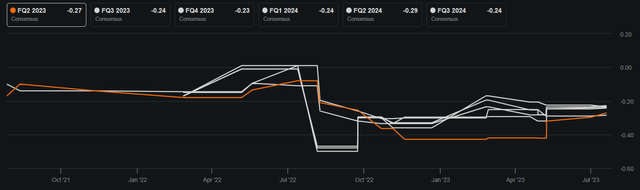

Earnings Expectations

Expectations for Opendoor’s earnings for Q2 2023 have fluctuated over the past year, declining significantly and then reclaiming some ground after its last earnings report. Current consensus now expects Opendoor to lose $0.27 per share on a GAAP basis.

The first thing to note is that consensus expects Opendoor to lose more money per share than it did last quarter, where the GAAP EPS figure came in at -$0.16. Analysts are not expecting last quarter’s significant beat on EPS to persist into this quarter.

While some of this is likely due to the cyclicality inherent in Opendoor’s business, EPS trends across recent quarters do not demonstrate a clear relationship between Q1 and Q2 for the firm. In 2021, Q2 saw Opendoor post an EPS loss half of that of Q1. In 2022, this relationship was reversed, with Opendoor losing twice as much per share as it did in Q1 2022. Earnings seasonality may be a factor but is evidently not determinative at this time.

As such, we must focus our earnings analysis on Opendoor’s progress on margins as well as its cost structure to gain insight into what will have happened from last quarter to this one.

Earnings Analysis

Opendoor’s last earnings call offers insight into how its margins and cost structure are developing. The first thing to note here is that the company let go of 22% of its employees in April, which is expected to yield $50M in annualized savings. We can extrapolate that into last quarter’s SG&A expense to approximate what the figure will be in this quarter. Opendoor’s Q1 SG&A expense was $252M. Dividing $50M by 4 to get a quarterly figure of $12.5M, we can thus expect SG&A expenses of $239.5M in this quarter. Assuming that R&D expenses stay the same at $40M, we get $279.5M in expected total operating expenses for Q2.

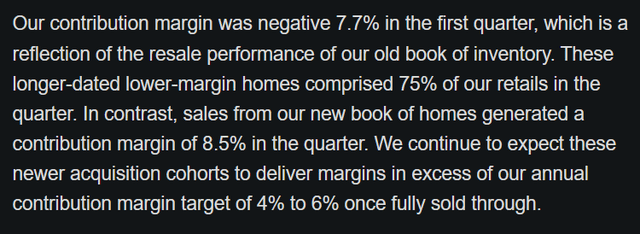

We can then compare this expected operating expense figure against projected gross margins for this quarter. This is where things get interesting. On Opendoor’s last earnings call, management outlined significant improvements in its contribution margins from selling its inventory of homes.

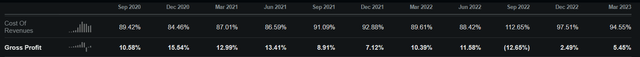

This indicates that gross margins are quite likely to have improved quarter/quarter. This has already been happening over the last two quarters, with cost of revenues decreasing and gross margin increasing from 2.5% in Q4 ’22 to 5.5% in Q1 ’23.

The challenge with extrapolating this further is that it is unclear what portion of Opendoor’s inventory was bought when and exactly how much an elevated contribution margin will contribute to this quarter’s results. Since we have a trendline of improvement, however, as well as management’s comments on the latest call, we can be relatively more sure that they are set to improve overall. I think a reasonably conservative estimate would then be gross margins in the realm of 6.5%, a number well within historical norms for the firm.

At current revenue expectations of $1.82B for Q2 ’23, a gross margin of 6.5% yields $118.3M in gross profit. Taking our previous number for expected operating expenses, $239.5M, we can then derive an expected operating income of -$121.2M for Q2 2023. This ends up being quite close to last quarter’s operating loss of $122M, something which I believe further indicates it to be a relatively conservative estimate.

At last quarter’s operating loss of $122M, Opendoor’s net loss was only $101M due to a small amount of non-operating income. Adjusting our projected operating loss for the quarter ahead, we can then infer a net loss of $100.2M for Q2. This then yields a projected EPS of -$0.158 per share, rounding to -$0.16. This is the same number as last quarter.

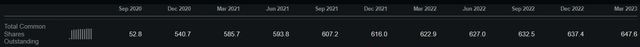

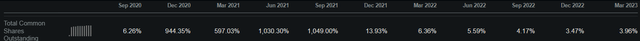

We can now adjust this for changes in total shares outstanding to get a final EPS estimate for Q2. Total shares outstanding grew 3.96% y/y in Q1. At this rate that would yield a total share count of 651.83M for Q2, which is 0.65% higher than last quarter’s.

We can now divide our earnings expectations into this new quantity of shares, which yields a projected EPS of -$0.15. This number is my estimate for where EPS will be in Q2, indicating significant outperformance against consensus EPS expectations of -$0.27.

Conclusion

Having walked through expectations for Opendoor’s earnings, I think that it will outperform in this quarter. The core risk here is that of margin deterioration. If Opendoor’s margin improvements have not persisted through into this quarter, this will not occur. Considering that the Case Shiller has appreciated over this time period, however, I don’t consider this to be particularly likely.

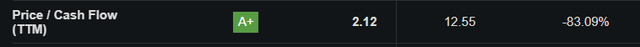

The question is then around what impact this will have on Opendoor’s share price. Valuation can’t be a primary reference point here because Opendoor is not yet profitable and as such does not allow us to compare its P/E ratio to that of its peers or the market at large. We must also note that this stock has almost tripled in value year-to-date. It appears that these shares are trading on momentum for the time being. A look at momentum metrics shows us that this force has continued to push the stock upwards, something made clear by the strong performance across the last 3 months in particular.

This implies a certain level of investor attention and the potential for further appreciation in the event of Opendoor outperforming against earnings expectations. The likelihood of this is further enhanced by the fact that the stock has appreciated so much in response to its most recent earnings outperformance. As mentioned above, I expect Opendoor to beat EPS consensus again this quarter. This should push the stock further upwards towards something closer to what we can consider to be its fair value.

Fair value for this security is again difficult to determine using a standard price/earnings valuation methodology. I will note, however, the significant discount that Opendoor trades at on a price/operating cash flow basis. Relative to the real estate sector at large it is discounted by more than 80%. A mean-reverted fair value would then be 83% higher than its current share price of $4.39, coming in at roughly $8.03. Uncertainty as to the company being able to maintain these cash flows accounts for the discount and will likely persist, but another quarter of results should see this spread diminish and subsequently for the instrument to reprice closer to its fair value.

Considering the full picture here, I think this upcoming earnings report will see Opendoor outperform on EPS and subsequently yield further appreciation that brings it closer to its fair value of $8.03. As such I am calling Opendoor stock a buy into and through its upcoming Q2 2023 earnings report.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, but may initiate a beneficial Long position through a purchase of the stock, or the purchase of call options or similar derivatives in OPEN over the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.