Summary:

- Opendoor Technologies Inc. stock took a double-digit tumble in yesterday’s after-hours session despite beating Q2 2023 estimates.

- While Opendoor’s guidance calls for -50% q/q decline in revenues, I think management’s conservative playbook is the right way to navigate this tricky housing market.

- Opendoor’s long-term risk/reward for investors remains asymmetric. Hence, I continue to rate it a “Strong Buy” at $4.2 per share.

ogichobanov

Introduction

Post reporting its Q2 2023 numbers, Opendoor Technologies Inc. (NASDAQ:OPEN) stock took a double-digit tumble in yesterday’s after-hours session despite beating consensus estimates on both top and bottom lines.

In my latest research report on Opendoor, I highlighted OPEN stock as a “generational buy” at $2 per share:

Opendoor has the right product, capabilities, capital, and team to not only weather the current market cycle but to emerge stronger on the other side of it. As real estate continues to move online, Opendoor’s 1P-3P platform is likely to be a big winner. While the near-term business outlook remains uncertain, Opendoor’s long-term risk/reward is truly asymmetric in favor of bullish investors. The company made material progress on its path to profitability during Q1, and I expect to see better financial performance in upcoming quarters.

Source: “Opendoor Q1 2023 Review: This Deal Won’t Last Long.”

Over the last three months, Opendoor stock has more than doubled, with the stock reaching $5.4 earlier this week. As of writing, OPEN stock has re-traced back down to $4.2 per share. While Opendoor’s Q3 revenue guidance of $0.95-1B (-50% q/q) could have irked short-term-minded traders/investors, I see this post-ER selloff as nothing but profit-booking. On the back of a 300%+ year-to-date run-up in OPEN stock, profit-booking is only natural. That said, the long-term risk/reward in Opendoor stock remains skewed to the upside, as we’ll see in this note.

My investment thesis and subsequent research updates for Opendoor are available on SA:

- Opendoor: A Generational Buy For Bold, Contrarian, Long-Term Investors [26th September 2022]

- Opendoor Q3 Review: Don’t Miss The Forest For The Trees [22nd November 2022]

- Opendoor Q1 2023 Review: This Deal Won’t Last Long.

If you haven’t read up on my work on Opendoor, I strongly suggest you read the notes linked above before you proceed with this article. In today’s note, we will analyze Opendoor’s Q2 2023 earnings report (“ER”) and re-assess its valuations, technicals, and quant factor grades to make an informed investment decision.

Demystifying Opendoor’s Q2 2023 Numbers

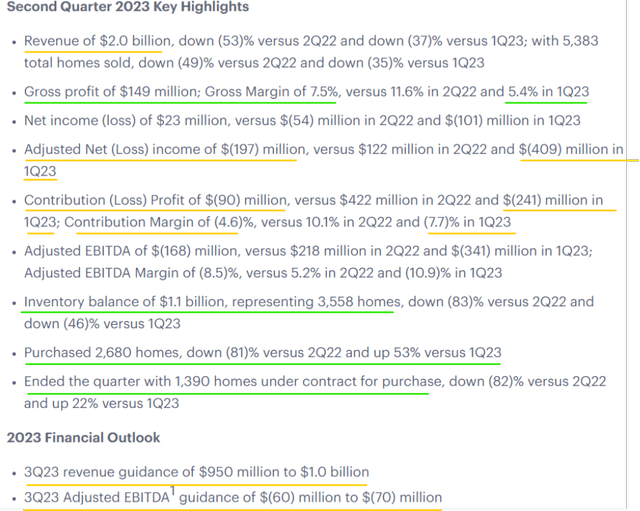

For Q2 2023, Opendoor’s revenue came in at $2.0B (consensus estimates: $1.84B, management guide: $1.75B to $1.85B) on the back of strong market clearance rates of ~2.5-3%. While housing demand has collapsed under the weight of higher mortgage rates, home prices have held up in recent months as the housing supply has gotten even more constrained due to sellers moving to the sidelines [hanging onto their low (2-3%) interest rate mortgages].

Opendoor Q2 2023 Earnings Press Release

During Q2 2023, Opendoor sold 5,383 homes and acquired 2,680 homes [up 53% q/q]. And as of the end of Q2, Opendoor held an inventory balance of just 3,558 homes [$1.1B], with nearly 1,390 homes under contract for purchase. According to Opendoor’s CEO, Carrie Wheeler (emphasis added):

We reduced spreads between 1Q23 and 2Q23 to reflect pricing model improvements related to home condition, reduced holding and selling costs due to shorter expected holding times, and an improvement in our view of home prices in the back half of 2023. Even though spreads are still elevated, the reduction translated through to a 53% increase in acquisition volumes between 1Q23 and 2Q23, despite a 43% reduction in paid marketing and overall lower market new listing volumes during the same period.

We plan to continue to operate with elevated spreads and for acquisition volumes to pace at roughly 3,000 homes per quarter through the end of the year. Our expanded partnership channels should mitigate typical seasonal market volume declines in the second half of the year. In the fourth quarter, we expect to be able to reduce spreads due to typical home price seasonality, which would accelerate acquisitions in the first quarter of 2024, coinciding with improving market volumes. This will allow us to increase cost-effective investments in paid marketing. These factors, combined with the accruing benefits of our partnership channels, will drive higher volumes and ultimately allow us to rescale the business.

Source: Opendoor Q2 2023 Shareholder Letter.

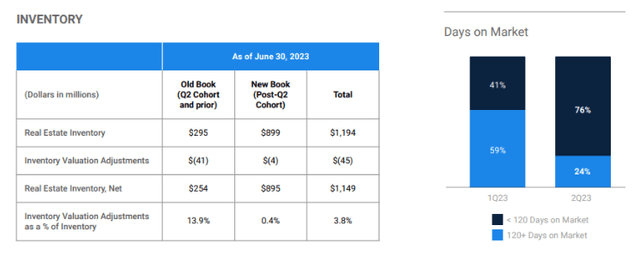

Opendoor’s inventory reset is nearly complete, with ~99% of the toxic “Q2 cohort” homes now sold or under contract:

Opendoor Q2 2023 Shareholder Letter

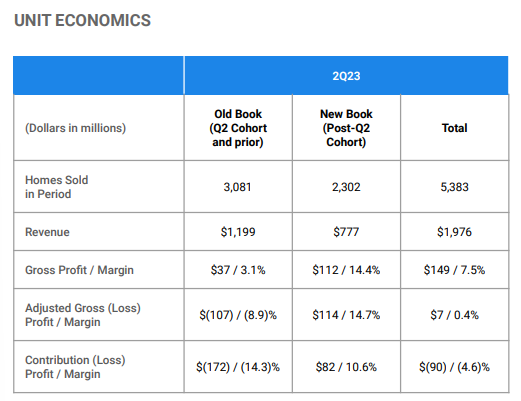

In 2Q23, the old book of inventory represented 57% of our resale mix, which resulted in negative contribution profit and margins. Contribution Profit (Loss), which accounts for the direct selling and holding costs incurred on the homes sold during the quarter, was $(90) million in the second quarter, versus $422 million in 2Q22 and $(241) million in 1Q23. Contribution Margin was (4.6)%, versus 10.1% in 2Q22 and (7.7)% in 1Q23. We have reached an inflection point and expect the resale mix to shift to be a majority new book in 3Q23 resulting in us returning to positive Contribution Margin.Our new book of homes continues to show strong margin performance, with homes sold generating gross margins of 14.4% and contribution margins of 10.6% in the second quarter. The outperformance was primarily driven by higher than expected home price appreciation in the first half of the year, which translated to higher realized margins on the new book. We regularly update our short-term home price forecasts with the latest market data, allowing us to reduce spreads on more recent acquisition cohorts while maintaining our revised annual contribution margin target.

Opendoor Q2 2023 Shareholder Letter

Home pricing was stronger than expected in H1 2023; however, I think there’s a very good chance home prices resolve lower when the supply-demand equation finds a new equilibrium in a “higher interest rates for longer” regime. With housing affordability at or near all-time lows, the outlook for home prices remains grim despite ongoing supply constraints. Now, any further home price declines are likely to be a slow burn lower, and in my view, Opendoor’s elevated spreads should enable the company to operate within management’s raised contribution margin guardrails of 5-7% starting Q4 2023 (emphasis added):

With a healthy inventory mix, more typical holding periods and early benefits from the investments we are making in our pricing and operating platforms, we expect to deliver positive contribution margin in 3Q23 and perform within our 5% to 7% contribution margin target by 4Q23.In the first half of the year, home prices performed better than expected on the back of historically low listing volumes that were approximately half the levels of 2014 to 2019. Against this backdrop of constrained supply, market clearance is at historically healthy levels, with approximately 3% of listed homes going into pending status per day in 2Q23 compared to typical second quarter clearance of 1% to 2%observed in 2016 to 2020. However, there continues to be uncertainty in how housing performs for the remainder of the year given persistently low supply, the prospect of additional Fed rate action and recession risk. We continue to expect modest month-over-month home price depreciation in the second half of the year. Looking forward, we will continue to actively monitor leading indicators and adjust spreads accordingly as the housing market stabilizes and we have greater certainty on home pricing and seller demand. We are managing our business to return to positive Adjusted Net Income, which is our best proxy for operating cash flow, at steady state annual revenue of $10 billion.

As a long-term investor, I am happy that Opendoor’s leadership team has learned from past mistakes, and are now running a conservative playbook that prioritizes positive contribution margins over sales volumes.

What’s In Store For Q3 And The Rest Of 2023?

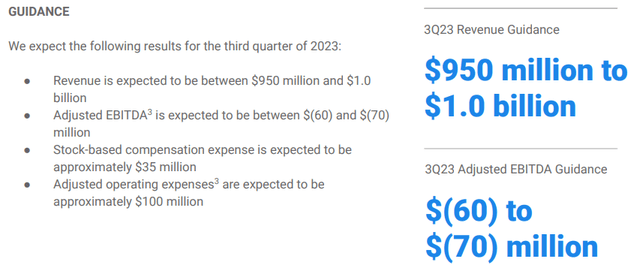

For Q3 2023, Opendoor guided for revenue and adj. EBITDA to be in the range of $0.95B to $1B and -$60M to -$70M, respectively. While Opendoor’s contribution margins (unit economics) are all set to turn positive in Q3 2023, a sheer lack of sales volumes is expected to keep Opendoor’s bottom line in the red for the time being.

Opendoor Q2 2023 Shareholder Letter

Despite a projected -50% q/q decline in revenue for Q3, I strongly believe that management’s decision to operate at lower volumes and higher spreads is the right way to operate in this uncertain macroeconomic environment. In my view, Opendoor getting back to positive contribution margins in such quick order during such a challenging macro environment is a testament to the strength of Opendoor’s product offering.

According to Opendoor’s management, the inventory reset will be now completed in Q3 2023; however, the business is still on track to return to positive adj. net income (a proxy for operating cash flow) by mid-2024 at ~$10B annualized revenue. Considering persistent uncertainty around the housing market (and the economy), Opendoor’s business outlook is robust.

Assessing Opendoor’s Liquidity Situation

After massive resale losses wiped out nearly $1.2B of Opendoor’s book value in the second half of 2023, the company’s liquidity situation has come under immense scrutiny in recent months, with Mr. Market pricing Opendoor for an imminent bankruptcy until very recently (May 2023).

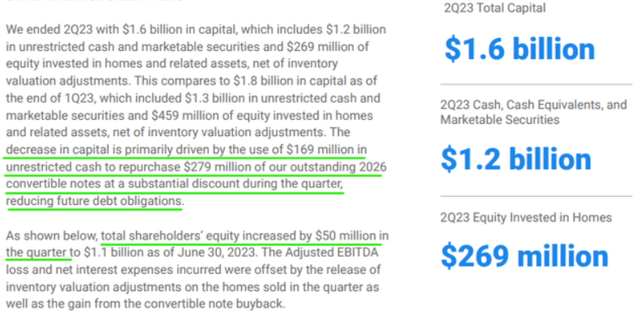

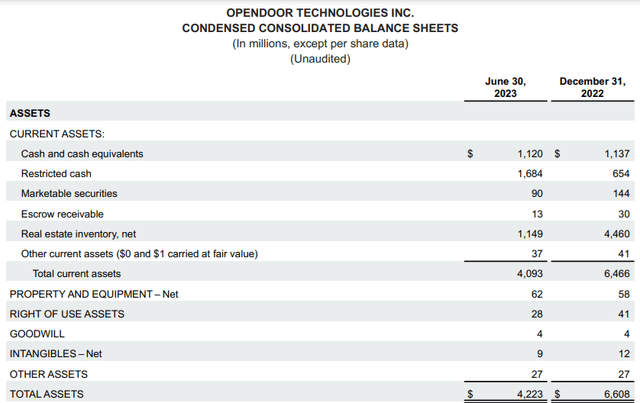

With a total capital (unrestricted cash + marketable securities + equity invested in homes) position of ~$1.6B, I continue to believe that Opendoor has ample liquidity to ride through this housing downturn. Leading economic indicators and a deeply inverted yield curve continue to point toward a recession; however, the worst of the cash burn for Opendoor is behind us. With reduced inventory levels, Opendoor is unlikely to suffer big losses as it did in H2 2022 (due to the most aggressive interest rate hike cycle in history) for the foreseeable future.

Opendoor Q2 2023 Shareholder Letter

Opendoor Q2 2023 Shareholder Letter Opendoor Q2 2023 Shareholder Letter

As I see it, Opendoor remains well-capitalized even after extinguishing half of its convertible debt (by buying it back at a deep discount). And Opendoor’s management has made concrete progress on stemming operational losses and resulting cash burn. Hence, I continue to believe that liquidity/bankruptcy fears about Opendoor are overblown.

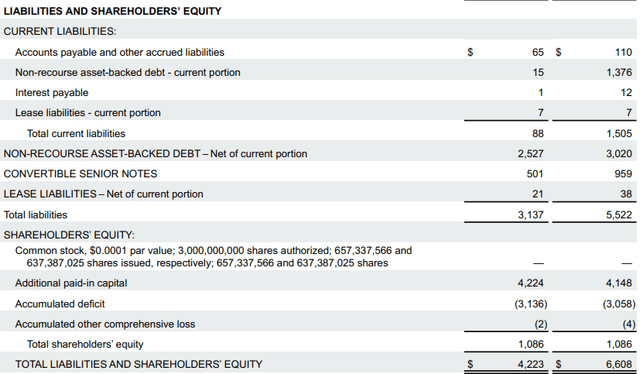

During Q2 2023, Opendoor’s shareholder equity increased by $50M in Q2 2023 due to a gain on debt extinguishment. Unfortunately, Opendoor’s management said on the earnings call that no such (convertible debt buyback) deals are expected going forward.

Opendoor Q2 2023 Shareholder Letter

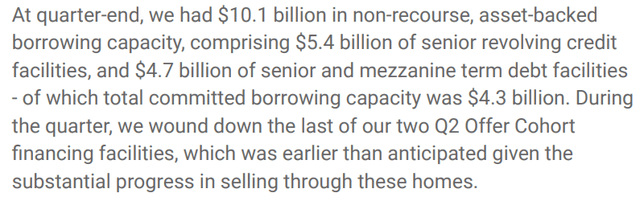

Opendoor’s balance sheet has shrunk considerably since the turn of the year; however, the company still has ~$10.1B in borrowing capacity as of the end of Q2 2023. The reduction in borrowing capacity from $10.7B in Q1 to $10.1B in Q2 is a result of Opendoor winding down the last of its Q2 Offer Cohort financing facilities earlier than anticipated.

Opendoor Q2 2023 Shareholder Letter

While I have a cautious near to medium-term outlook for the economy, I think any housing market downturn will be a slow burn lower on prices going forward due to demand-supply dynamics. When the housing market rebounds, Opendoor will be there to pounce on its humongous $1.9T total addressable market, or TAM [$650B SAM], opportunity, whereas most of its rivals won’t survive this downturn.

Considering everything, I continue to like Opendoor’s balance sheet power and borrowing capacity. With Opendoor’s leadership now operating a conservative playbook, overblown liquidity/bankruptcy fears are likely to subside further in the coming months.

A Brief Update on Opendoor Exclusives

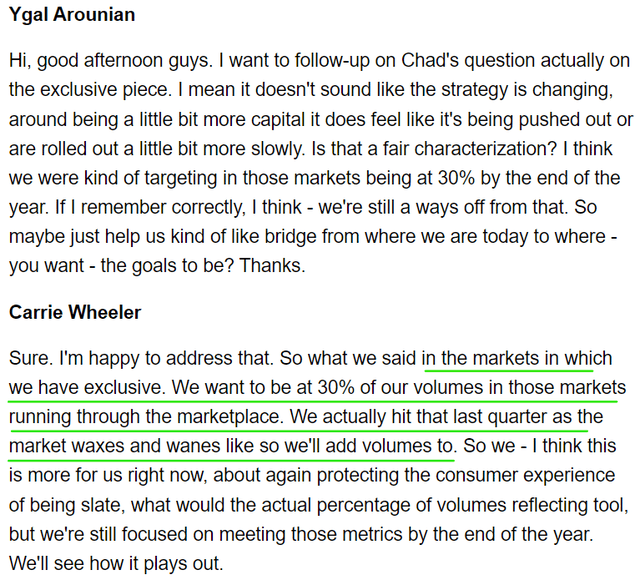

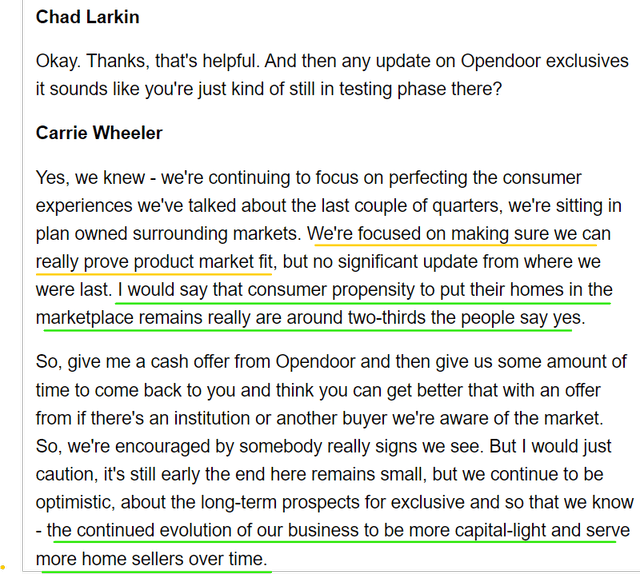

If you have been following my research work on Seeking Alpha, you already know that my investment thesis for Opendoor is based on the iBuying pioneer shifting from a low-margin, 1P marketplace model to a high-margin, 3P marketplace model in the long run. While there was no significant update on Opendoor Exclusives, I was happy to learn from the earnings call that >30% of volumes in Plano, TX went through Opendoor’s 3P marketplace during Q2 2023.

Opendoor Q2 2023 Earnings Call Transcript (SeekingAlpha)

Please note that going through the 3P marketplace (Opendoor) could still end up in a 1P transaction (Opendoor direct buy). Hence, I am not getting overly excited about this piece of information from the management. For now, Opendoor Exclusives are limited to one market (Plano, TX), and as per Carrie Wheeler, the company is still in the process of establishing a product market fit.

Opendoor Q2 2023 Earnings Call Transcript (SeekingAlpha)

While I am confident that Opendoor’s 3P marketplace is going to be an absolute game changer in the real estate market, investors need to remain patient for a while as Opendoor gets this product ready for broad rollout. In my view, Opendoor Exclusives will be additive on volumes and accretive to margins [5% seller fee, no selling or financing costs], whilst it would also reduce capital risk.

With ~$1.6B in total capital and ~$10.1B in borrowing capacity ($4.3B committed financing), I think Opendoor has adequate liquidity to get through this tumultuous period and emerge as a dominant 1P-3P real estate e-commerce platform on the other side of this housing market downturn.

Let us now evaluate Opendoor’s intrinsic value and projected returns.

Opendoor’s Fair Value And Expected Return

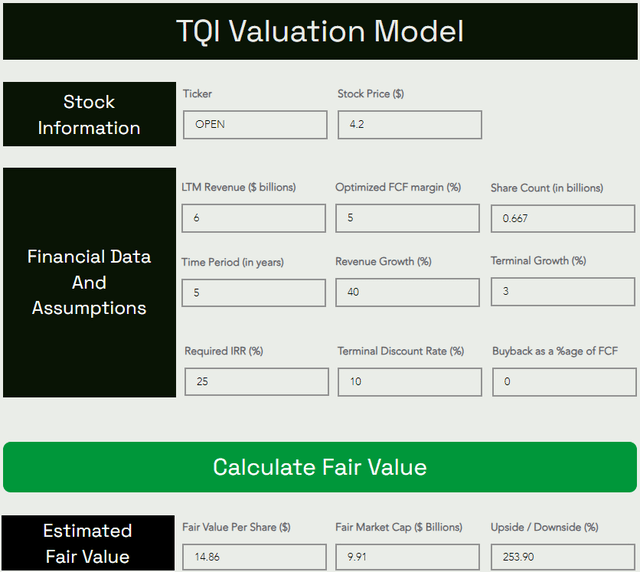

With housing demand and supply constraints staying persistent, Opendoor’s management is running a conservative playbook to navigate a potentially challenging “higher interest rates for longer” regime. While buyers and sellers will adjust to higher mortgage rates, we could be in for a slow burn lower in housing prices similar to what we saw during the Great Financial Crisis [25% decline in average U.S. home prices took 4 years]. In a bear market, Opendoor’s value proposition improves significantly for sellers, and Opendoor could realistically charge a higher spread in a buyer’s market (bear market). We have seen evidence of this business model feature in Opendoor’s recent quarterly reports, where real-seller conversion rates have come in at 10-15% (down from 30%+) despite Opendoor raising spreads very significantly. Given current data and management’s outlook for re-scaling the business, I am basing my model for Opendoor on a reduced revenue base of $6B [NTM expected revenue], with an elevated modeling period growth of 40% (up from 30%) for the next five years.

I have discussed my thoughts on Opendoor’s steady-state margins, but let’s go through them again:

Over the long run, I see Opendoor’s transaction spread (difference between buy and sell price) stabilizing in the ~3-5% range. As we know, Opendoor charges a service fee of 5% to sellers. Furthermore, I believe that Opendoor could generate another ~3-5% margins from the sale of ancillary services (financing, moving, insurance, warranty, renovations, etc.) to buyers. Overall, Opendoor can end up generating ~10-15% in gross margins at the unit level in its 1P business. At scale, Opendoor aims to get its Operating Expenses down to ~3% and Interest, D&A, and Tax expenses down to ~2%. I believe these targets are achievable. Hence, a 5% long-term margin assumption for Opendoor’s 1P business is not out of whack with reality.

The unit economics and volume outlook for Opendoor’s 3P marketplace (Exclusives) are not yet clear, but we do know that the service fee for sellers will still be ~5%. In my opinion, Opendoor can also generate additional fees of ~3-5% from buyers for various services in the long run. And if Opendoor can build an advertising & discovery business on top of its platform (like Zillow), then margins could go even higher. If Opendoor Exclusives succeeds, the sky is the limit for Opendoor in terms of scalability; after all, residential real estate in the US alone is a $1.9T addressable market opportunity.

In a nutshell, I continue to believe that Opendoor’s free cash flow margins could reach ~6-10% at maturity. To implement a margin of safety, I chose an optimized FCF margin of ~5% in my valuation model for the company. Despite a downturn in housing driving negative growth at Opendoor right now, I think Opendoor (and iBuying) is still at a nascent stage, and this means Opendoor could grow through and beyond this downturn after its inventory reset is complete. Therefore, I am maintaining my 5-yr CAGR revenue growth forecast at 30%. Please note that Opendoor Exclusives (3P marketplace) will likely create a significant impact on the bottom line, but little impact on the top line.

Source: Opendoor Q1 2023 Review: This Deal Won’t Last Long.

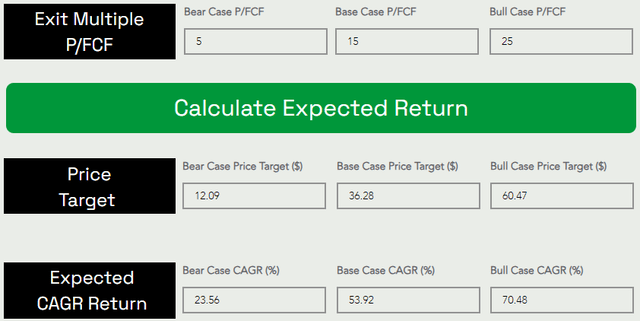

Here’s my updated valuation for Opendoor:

TQI Valuation Model (TQIG.org)

Under TQI’s required IRR [discount rate] of 25% (for moonshot growth investments), Opendoor’s latest fair value estimate came out to be ~$9.91B (i.e., $14.86 per share). With the stock currently trading at $4.2 per share, OPEN is still trading at a significant discount to its fair value.

In a base case scenario, I expect Opendoor to trade at ~15x P/FCF (optimized FCF) by 2027-28, which would be equivalent to ~0.75x 2027 P/S ratio based on my forward revenue projections shared above [most e-commerce platforms trade anywhere between ~1-3x P/S].

TQI Valuation Model (TQIG.org)

With these assumptions, I see Opendoor trading at ~$24B in market cap ($36 per share) by 2027-28 [~8-9x current valuation of OPEN]. And this outcome would reflect a CAGR return of ~54%+ over the next five years. Hence, I still view Opendoor’s long-term risk/reward as truly asymmetric.

OPEN’s Technicals And Quant Factor Grades

In my previous note, I highlighted the breakout potential for Opendoor:

We have seen a ~50% bounce in OPEN stock over the last couple of trading sessions, and the stock is now trading at the upper end of this base formation. With the iBuyer likely to return to positive unit economics in H2 2023, Opendoor’s stock looks primed to break out to the upside from this Stage-I base formation within the next quarter or two.

And since that call, we have seen Opendoor breakout of its Stage-I base and rally up to $5.4 per share. That said, after an incredible 300%+ year-to-date run-up, Opendoor stock was breaking a key trendline in yesterday’s after-hours session with a double-digit decline.

If this selloff intensifies today or next week, we could be looking at a clean break of the higher highs & higher lows pattern formed in OPEN stock over the last few weeks. In terms of support, I would look at the $3.75-3.85 range (50DMA, 38.6% Fib. retracement). If that level fails to hold, we could be looking at the $2.8-3.3 range (200DMA, 61.8% Fib. retracement, and the upper end of OPEN’s Stage-I base) for support.

Webull Desktop

After such a massive run-up this year, a pullback can happen purely due to positioning. Opendoor as a business made good progress during Q2, and I think the company is headed in the right direction. With Carrie Wheeler at the helm, Opendoor appears to be in safe hands! If OPEN retraces to the $2.8-$3.3 range, I would turn into an aggressive buyer!

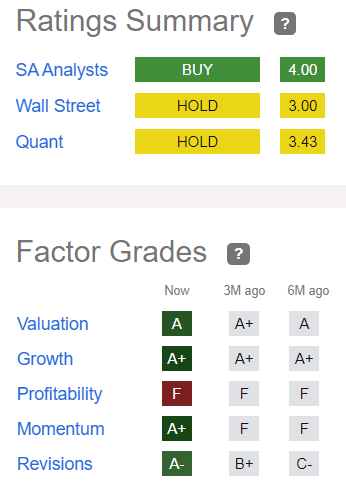

According to SA’s Quant Rating system, Opendoor gets an “A+” grade on “Momentum” and “Growth,” an “A” on “Valuation,” an “A-” on earnings “Revisions,” and an “F” on “Profitability.” While I expect the growth grade to deteriorate due to Opendoor’s conservative playbook (low volumes, positive contribution margins), I think Opendoor’s strategy is sound.

SeekingAlpha

From a quantitative data-based perspective, Opendoor stock is a “Hold” [with a total score of 3.43/5 on SA’s Quant Rating system]. And technically, Opendoor could potentially break a key trendline in today’s session. Hence, Opendoor stock isn’t necessarily a great near-term bet. However, I continue to like it as a long-term investment, and I am satisfied with its “neutral” technical and quantitative data.

Final Thoughts

As I see it, Opendoor has the right product, vision, capital, and team to weather the ongoing slump in housing activity and emerge stronger on the other side of it. With the real estate transaction process moving online being a matter of when not if, Opendoor’s 1P-3P platform is likely to be a big winner in the long run. While the near-term business outlook remains uncertain, Opendoor’s long-term risk/reward is truly asymmetric in favor of bullish investors. I am thrilled with how Opendoor is navigating through the current macroeconomic environment through a conservative playbook, and I remain convinced of Opendoor’s ability to digitally transform the archaic real estate transaction process:

Opendoor is building the way future generations will transact real estate 10, 20, and 50 years from now.

The company made material progress on its path to profitability during Q2, and I expect to see better financial performance in upcoming quarters.

Key Takeaway: I rate Opendoor a generational buy at $2 per share.

Thanks for reading, and happy investing. Please share your thoughts, questions, or concerns in the comments section below.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of OPEN either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

Are you looking to upgrade your investing operations?

Your investing journey is unique, and so are your investment goals and risk tolerance levels. This is precisely why we designed our marketplace service – “The Quantamental Investor” – to help you build a robust investing operation that can fulfill (and exceed) your long-term financial goals.