Summary:

- Opendoor’s tangible book value for its fiscal 2022 fourth quarter was cut in half versus its year-ago comp.

- The company is guiding for high fiscal 2023 adjusted EBITDA losses.

- Continued pressure on the balance sheet could force the commons below the minimum listing price required by Nasdaq.

Thomas Bullock/iStock via Getty Images

Opendoor (NASDAQ:OPEN) faces an existential crisis on the back of still-rising Fed funds rates which have led to its liquidity drying up and its tangible book value collapsing. The problem stems from the home flipping business which relies highly on leverage to fund the purchase of new properties. These are then directly held on the balance sheet until they are sold. The company is in essence a levered play on residential US real estate with a recovery of its tangible book value forming the near-term catalyst for a recovery of common shares that are down by 84% over the last 12 months.

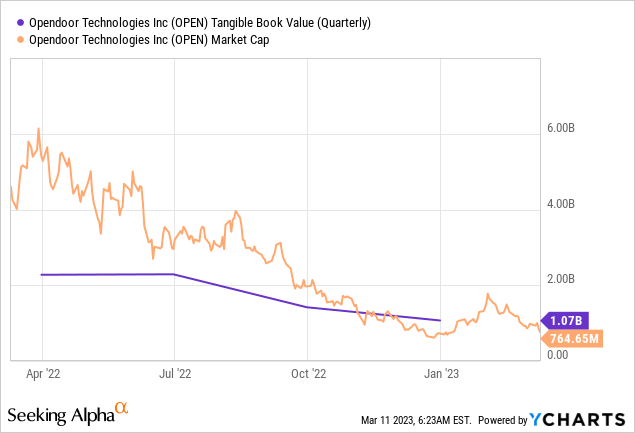

Bears, which form the 18.71% short interest, are betting that interest rate pressure and falling real estate prices will continue to weigh down on a tangible book value that fell by 50.8% year-over-year to $1.07 billion for the company’s fiscal 2022 fourth quarter. This was also a sequential decline from $1.42 billion in the third quarter with the short-to-medium-term bearish view being that this could move negatively.

The current tangible book value of $1.68 per share is around $0.49 per share higher than Opendoor’s stock price to imply that longs are buying an asset at a healthy discount to its intrinsic value. However, it’s on a downtrend that could render near-term tangible book value per share below $1 in a few quarters. This would imply a decline of at least 40.5% through to the fourth quarter of 2023 and would be against broader economic forecasts for a 20% decline in US home prices this year. Critically, such a move would mean the company trades below Nasdaq’s $1 minimum listing price with the commons currently $0.20 per share away from this.

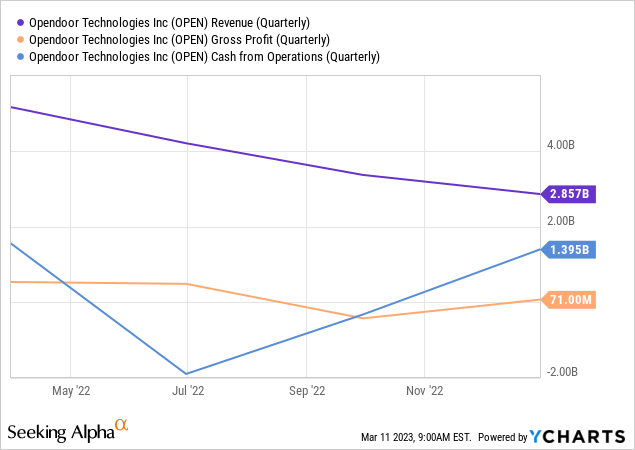

Dual Beats And The Direction Of Liquidity

Opendoor recently reported fiscal 2022 fourth quarter revenue of $2.86 billion, a 25.1% decline versus the year-ago comp but a beat by $350 million on consensus estimates. The company purchased 3,427 homes in the fourth quarter, a 64% decline versus the year-ago comp with Fed funds rate pressure leading to a $573 million write-down on the value of its real estate portfolio. Opendoor’s gross profit came in at 2.5% during the quarter with its contribution margin negative at 7.2%.

The company exited the fourth quarter with an inventory balance of 12,788 homes, around $4.5 billion in value and down sequentially from 16,873 homes representing $6.1 billion in value as of the end of the third quarter. The challenge for Opendoor is concentrated on the stabilization of its balance sheet and driving back up gross profitability.

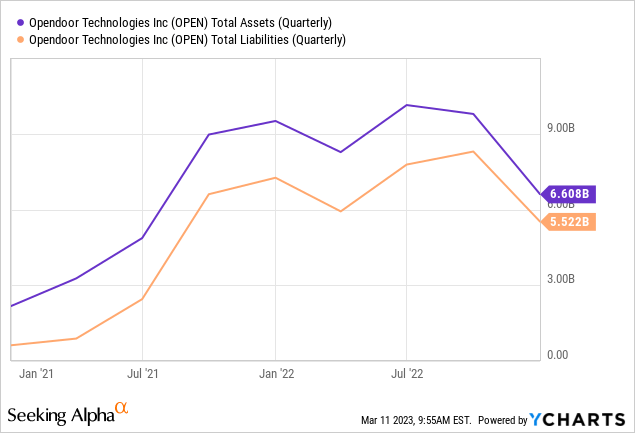

Total debt as of the end of the fourth quarter stood at $5.4 billion, down sequentially from $8.07 billion on the back of inventory sales and a reduction in home buying momentum. The company held cash and equivalents of $1.28 billion, down sequentially from $1.5 billion in the third quarter. Interest expense for the quarter came in at $113 million, up from $73 million in the year-ago comp but down marginally from $115 million in the third quarter. Hence, with the Fed funds rate set to keep moving higher, quarterly interest expense will remain elevated even against Opendoor’s divesting housing inventory below their respective purchase price to reduce total debt.

Opendoor And The 2023 Headwinds

To be clear here, Opendoor held total assets of $6.6 billion as of the end of its fourth quarter with $4.5 billion of this formed from a housing inventory now expected to realize weak demand and falling prices through to the end of 2023. This was directly offset by total liabilities of $5.52 billion.

Against a fourth quarter EPS loss of $0.63 per share, a beat by $0.11 on consensus estimates but up 2x from the year-ago comp, the underlying operations continue to experience intense losses. The company is guiding for fiscal 2023 first quarter revenue to come in at not less than $2.45 billion with adjusted EBITDA losses in the range of $350 million to $370 million. This would underperform consensus estimates for a $246 million loss to indicate that the balance sheet will remain under pressure this year. A move to the Nasdaq’s minimum listing requirements is in play.

Bulls are likely buying Opendoor stock because they think the current discount to tangible book value provides enough of a margin of safety. However, the balance sheet is likely set to remain under sustained pressure. Fundamentally, the current discount reflects market expectations for balance sheet weakness as inventory sales below their initial purchase price get aggregated with higher interest expense payments. Opendoor essentially went long residential housing and short interest rates with its balance sheet positioning. Its commons will likely continue to track tangible book value lower and investors should avoid the company until this stabilizes.

Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.