Summary:

- Opendoor Technologies faces significant macroeconomic headwinds, including a challenging housing market and high-interest rates, which will likely continue to deteriorate its performance.

- Despite recent revenue growth, OPEN’s business model remains capital-intensive with low margins, making it difficult to achieve profitability, especially in the current economic environment.

- OPEN’s liquidity is severely strained, with a limited runway and potential need for additional funding, which could further dilute shareholder value.

- Valuation analysis suggests that OPEN’s share price is still overvalued, with a potential downside of more than 30%, urging investors to remain cautious.

10’000 Hours

Introduction

Opendoor Technologies (NASDAQ:OPEN) is a digital platform that seeks to transform the home selling and buying process into a streamlined process. Since the company launched in 2014, OPEN operates in 50 markets across the United States. OPEN’s business model involves acquiring a home, and reselling these home at a higher price after repairing and refurnishing.

Since reaching its high in 2021, OPEN’s share price has plunged more than 90%. On the surface, it may look like OPEN is an attractive buy. However, upon further investigation, my analysis suggests that OPEN’s performance is likely to continue to deteriorate. Macroeconomic headwinds will continue to weigh on OPEN’s performance; furthermore, OPEN’s business model is starting to show weaknesses. In this report, I will demonstrate why investors should avoid OPEN and not fall prey to this value trap.

Latest Developments

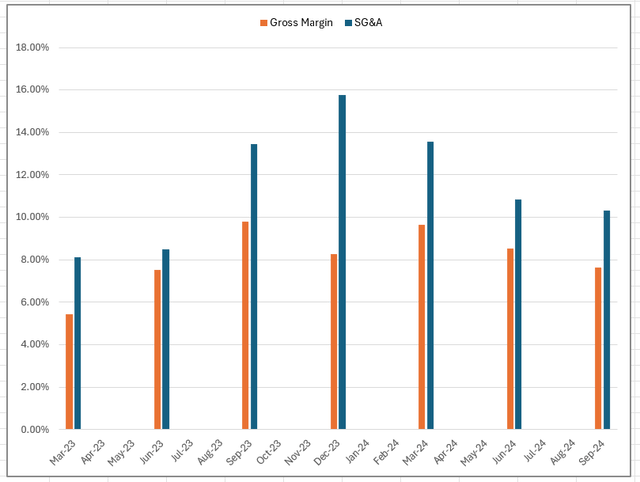

In 3Q24, OPEN generated 1.37 billion in revenues, representing a 40.51% year-on-year growth and -8.87% quarter-on-quarter decline. During this period, the company’s revenue beat estimates by $105.32 million. That being said, OPEN posted a gross margin of 7.63%; gross margin deteriorated by 217 bps as compared to the same period last year. SG&A improved substantially, from 13.47% in 3Q23 to 10.31% in 3Q24, improving by 316 bps.

Looking forward, OPEN expects to generate $925 million to $975 million in revenues. The company continues to expect negative EBITDA; OPEN expects Adjusted EBITDA to range between -70 million and -$60 million.

Housing and Macroeconomic Environment Will Serve As Challenging Headwinds

In 3Q24, OPEN had posted a strong performance, beating estimates substantially by 8.26% and successfully posted a positive year-on-year growth of 40.51%; this marks the first positive year-on-year growth after seven consecutive quarters of declining sales. Although it may seem like OPEN had finally turn around, systemic factors suggests that OPEN’s performance is likely to remain deteriorated. It is important to highlight that in 2022 and 2021, OPEN’s average revenue per quarter is approximately $2.9 billion with an average gross margin of 6.7%; today, while overall margins have improved, topline sales represent less than half of what it was previously making.

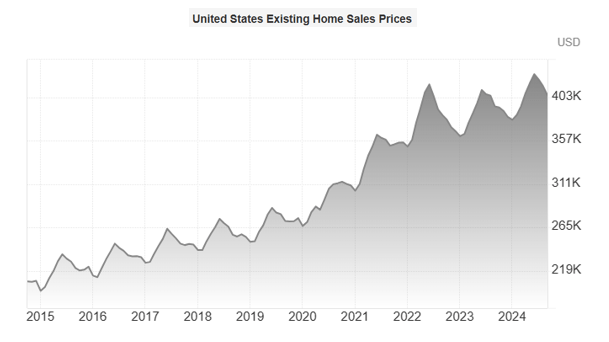

US Existing Home Sales Prices (National Association of Realtors)

In the United States, we continue to see an extremely challenging housing market. Existing home sales have plunged to record lows. The last time we saw monthly existing home sales near the 3.5 million mark was in 2010. Currently, there is a housing shortage and supply deficiency, causing home prices to inflate significantly. According to the US Existing Home Sales Prices Index, home prices have almost doubled in less than a decade; in some places, home prices have more than doubled. Unfortunately, these inflationary effects have weighed on demand considerably.

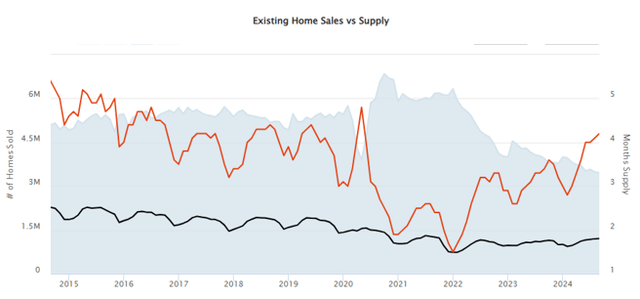

Existing Home Sales v Supply (National Association of Realtors)

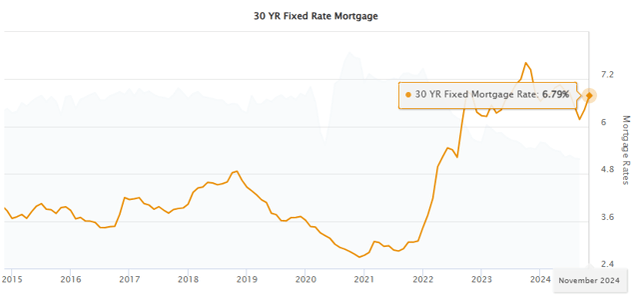

Despite contracting supplies, when the US Federal Reserve started raising interest rates in 2022, we saw a huge divergence between the demand and supply of the housing market. Mortgage rates have spiked from about 3% to 6.79%, making it increasingly unaffordable for Americans to own homes.

30 Year Fixed Rate Mortgage (FRED)

Unfortunately, it is likely that demand will remain depressed. Although the United States Federal Reserve have already started pivoting, it is likely that rates will remain relatively higher for longer. US Federal Reserve Chairman, Jerome Powell have recently stated that there is no rush to lower rates as the economy remains strong. Moreover, recent studies have estimated that if president-elect Trump imposes a tariff rate of 60% on Chinese imports and 10% on other imports, there will be a huge inflationary effect, affecting households across the United States and providing a compelling reason for interests rates to remain higher.

Overall, the macroeconomic situation is extremely negative and is likely to continue to weigh on OPEN’s topline and operating performance. In the latest earnings call, CEO Carrie Wheeler highlighted a deteriorating environment for OPEN, stating, “We saw further deterioration in key housing market indicators in the third quarter. The listing rates continued to decline and clearance rates declined more than seasonally typical. Overall, the housing market is on track to experience the lowest level of existing home sales since 1995 for a second consecutive year.”

OPEN’s Business Model Is Showing Weaknesses

OPEN was founded in 2014 by Keith Rabois, Eric Wu, JD Ross, and Ian Wong; after 10 years, the company continues struggling to achieve positive operating margin. Ultimately, this is because the company’s business model is extremely capital intensive and provides limited margins, making it not only hard to operate but also extremely hard to scale.

If we look at OPEN’s performance since June 2021, in a period of low-interest rates, OPEN’s gross profit margin was 12% at best; extremely low margins for a technology company that is highly reliant on sales and marketing spending; they are burning money on advertising like big technology companies but have margins akin discount retailers. Additionally, because this is ultimately a real-estate play, OPEN will not only require financing but also have to take substantial risk by holding these properties on its balance sheet.

Given that OPEN’s gross margin is typically limited, adding accounting for SG&A spending and interest spending, we can fairly assume that OPEN is an extremely low margin business. For the past 13 quarters, SG&A spending is approximately 10.41% on average, while net financing costs is about 3%. This is the reason why, despite years of operations, OPEN has not been able to generate a positive bottom line.

Gross Margin v SG&A (Company Filings)

OPEN must be able to reduce SG&A spending while maintaining its sales in order for its business model to work. Given that OPEN is not able to generate positive operating income in a favorable interest rate environment, it is highly unlikely that the company can even breakeven in the current interest rate environment. Unfortunately, based on the latest earnings call, CEO Carrie Wheeler stated that the company will continue to invest in marketing to drive conversion.

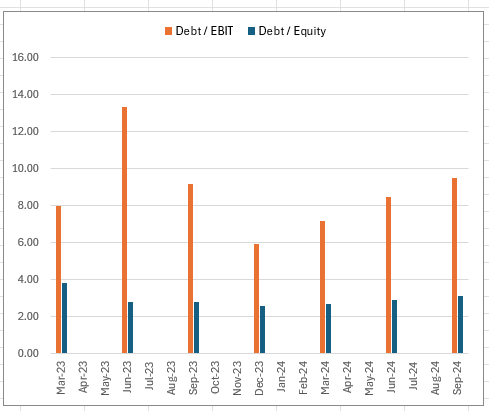

Debt Related Metrics (Company Filings)

It is also important to highlight that it is not easy for OPEN to offload its inventory. For reference, OPEN’s days inventory outstanding is 157 days, while its debt-to-EBIT and debt-to-equity is 9.51x and 3.13x. Currently, housing inventory takes up more than 65% of the company’s total asset base. If a huge macroeconomic event causes a huge re-valuation of housing prices (towards the downside), we can easily see OPEN’s total assets fall below its total liabilities.

OPEN Is Forced To Reconsider Its Cost Structure and Business Model

Given that OPEN has not been able to breakeven, the company is forced to reconsider its cost structure to ensure survivability. In the latest letter to shareholders, the company announced a layoff of approximately 300 roles, representing 17% of their total workforce. Previously, OPEN had cut about 22% and 18% of its workforce in 2023 and 2022. This is the third consecutive year that OPEN had reduced its workforce.

Apart from that, the company has introduced other less capital intensive products such as List with Opendoor and Opendoor Exclusives. Unfortunately, although OPEN’s CEO stated that these initiatives have outperformed internal expectations, they are still in its early stages and unlikely to offset any headwinds that the company is currently facing.

Finally, it is important to note that the company’s liquidity profile is severely deteriorating; this is also the reason why OPEN has been consecutively reducing its workforce. Based on trailing-twelve-months data, OPEN’s has a cumulative and average quarterly operating cashflow of -1.05 billion and -$264.25 million. Currently, the company has $837 million in cash and short-term investments, representing a runway of 3.16 quarters. If OPEN continues its current burn rate, the company may not have enough liquidity to cover its operations. In my opinion, OPEN will likely need to raise funds through equity sale or take on higher debt; in either case, it will not be beneficial to shareholders.

Despite Falling More Than 90%, Valuation Analysis Suggest Further Downside

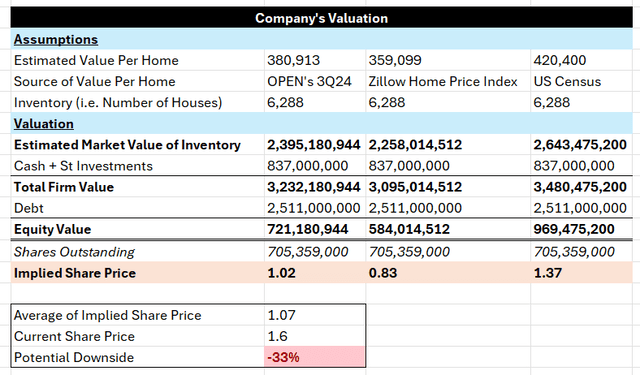

To derive the potential value of OPEN, I have multiplied OPEN’s current number of homes against the estimated value per home from multiple sources ranging from OPEN’s 3Q24 performance, Zillow Home Price Index, and US Census.

Valuation Analysis (Author’s Projections, Zillow, Open, US Census)

Based on OPEN’s latest balance sheet, the company has 6.29k homes in its inventory. According to the above-mentioned sources, the estimated value per home range between $359k to $420k. Utilizing these values, the total estimated firm value of OPEN range between $3.1 billion to $3.48 billion. After accounting for OPEN’s debt, cash, and short-term investments, the valuation model indicates that the implied share price of OPEN should range between $0.83 and $1.37. The mid-point of this range will suggest a potential downside of more than 30%, indicating that OPEN’s share price is still overvalued.

Closing Remarks

Overall, OPEN is operating in an extremely challenging environment. Unfortunately, the macroeconomic environment will not turnaround swiftly, and it is highly likely that we will continue to see dislocations in the housing market against the backdrop of relatively higher interest rates.

All of these factors will continue to weigh on OPEN. Moreover, OPEN’s business model is still questionable and has proved to be ill-suited in times of an economic slowdown and housing market instability. As such, I urge investors who are attracted by the ostensible value of OPEN to stay cautious. Perhaps, we can consider looking at OPEN again if the company is able to scale its capital-light services to offset the potential deterioration of its primary business model.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.