Summary:

- Opendoor just reported Q4 earnings – results were great, but guidance was soft.

- More specifically, Opendoor does not expect to achieve profitability in 2024.

- However, Opendoor’s fundamentals are improving – much better than it was a year ago.

- The question is: Are you bold enough to hold on to Opendoor stock for the long run?

OsakaWayne Studios/Moment via Getty Images

Introduction

It has not been easy holding Opendoor Technologies (NASDAQ:OPEN) stock.

If you have been an Opendoor investor for the past year or so, you might have experienced a roller coaster of emotions as the stock oscillates violently between $1 and $5.

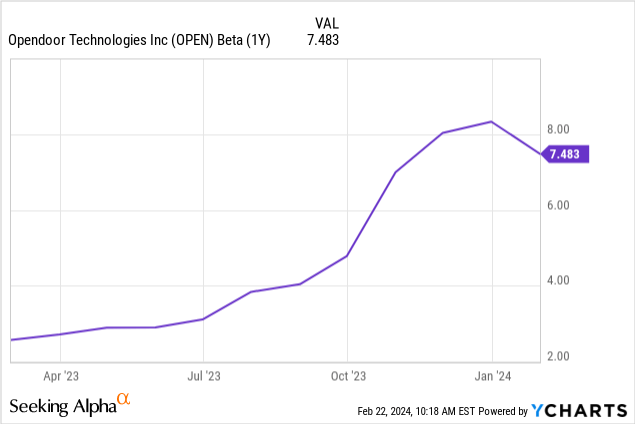

To illustrate, the stock has a 1-year Beta of 7.5, which screams extreme volatility.

Elevated interest rates and low housing affordability led to record low home sales, which put a strain on Opendoor’s operations — Opendoor is sensitive to interest rate changes, which explains the volatility.

Furthermore, Opendoor just reported Q4 earnings, sending the stock down 10% the next day and another 7% the following day. Results were actually great — but soft guidance disappointed the markets.

The question is: are you bold enough to hold on (or add) to your Opendoor position?

Growth

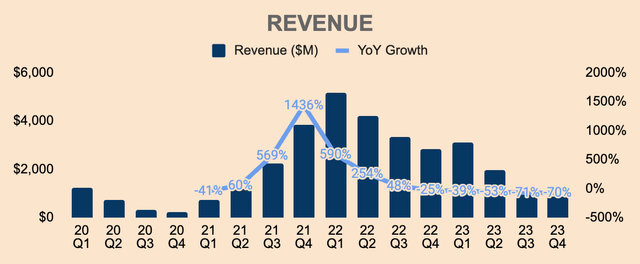

In Q4, Opendoor generated $870M of Revenue, which beat analyst estimates by $42M, or 5%, as well as the high end of management guidance of $850M.

While this outperformance is encouraging to see, Revenue was down 70% YoY and 11% QoQ, sending Revenue down to a 3-year low.

Author’s Analysis

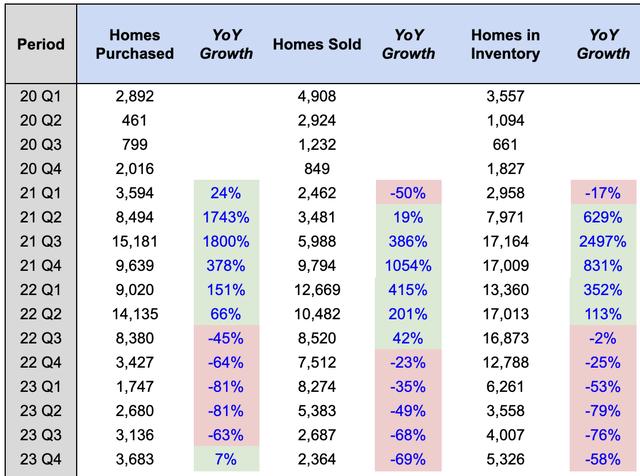

This was due to fewer Homes Sold at 2,364 for the quarter, down 69% YoY.

However, Q4 should be the short-term bottom in terms of Revenue and Homes Sold as Opendoor enters the hotter seasons. In addition, Opendoor has been ramping up acquisitions in the last few quarters with Homes Purchased up 7% YoY and 17% QoQ, to 3,683 in Q4.

Moreover, as of the end of Q4, Opendoor was in contract to purchase 2,114 homes, which was up 109% YoY and 27% QoQ.

More Homes Purchased leads to higher Homes in Inventory, which leads to more Homes Sold in subsequent quarters, which leads to higher Revenue.

Author’s Analysis

In addition, Opendoor was able to purchase more homes YoY despite average new listings being down 7% YoY within its buy box, due to lower spreads embedded in Opendoor’s offers.

This time last year, Opendoor operated with elevated spreads given the uncertainty and volatility in the housing market. However, as home prices stabilized, and as Opendoor cut costs and improved its pricing accuracy, Opendoor decided to pass on the savings to customers by gradually reducing its spreads.

Lower spreads led to higher seller conversions. More importantly, it enabled Opendoor to triple its market share throughout 2023.

Opendoor still has a long growth runway ahead as it builds the most complete e-commerce platform for residential real estate.

But it needs to achieve profitability in order to fulfill its goals and ambitions.

Profitability

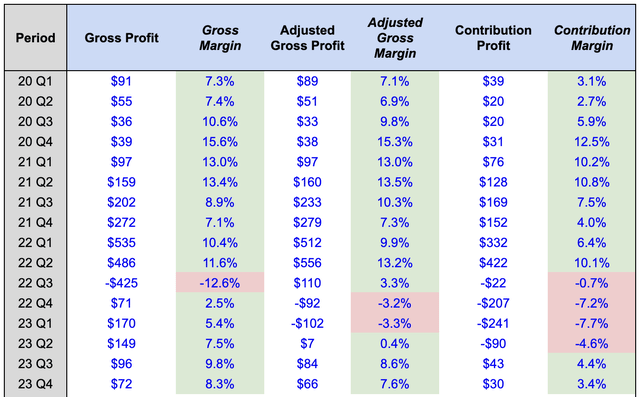

As it stands, here’s how Opendoor’s unit economics look like in Q4:

- GAAP Gross Profit was $72M, representing a Gross Margin of 8.3%.

- Adjusted Gross Profit — which aligns the timing of inventory valuation adjustments to the period in which the home is sold — was $66M, representing an Adjusted Gross Margin of 7.6%. This is a 1,080 basis point improvement YoY.

- Contribution Profit — which accounts for direct selling and holding costs — was $30M, representing a Contribution Margin of 3.4%. This is a 1,060 basis point improvement YoY and also higher than management’s guidance range of 1.9% to 2.9%

Author’s Analysis

As you can see above, unit economics declined QoQ, due to seasonality and continued margin pressure from the old book. However, they all improved significantly on a YoY basis, reflecting “the reversion to a healthier book of inventory and resale mix”.

Below, you can see Opendoor’s unit economics in more detail:

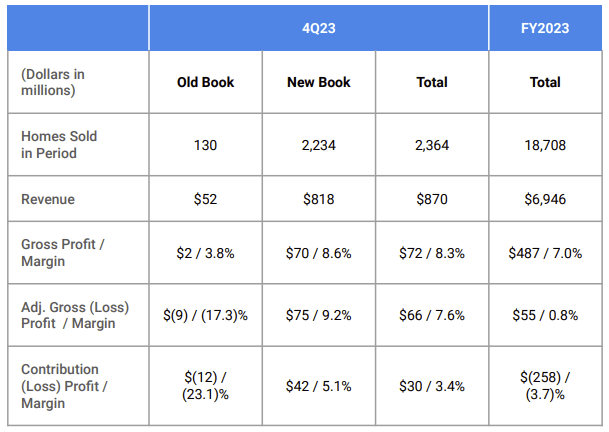

- The company sold 130 homes from the Old Book, at a Contribution Margin of (23.1)%.

- All eyes were on the New Book as Opendoor sold 2,234 new homes at a Contribution Margin of 5.1%. This was materially lower than Q3’s figure of 9.2% — I think seasonality and spread reduction have some sort of an impact here. Nevertheless, FY2023 New Book Contribution Margin was 8.3%, which is still within management’s 5% to 7% annual target.

Opendoor FY2023 Q4 Shareholder Letter

Moving forward, Opendoor’s overall Contribution Margin should improve as the company now has less than 75 old homes not in resale contract as of Q4, which should have minimal impact on the business. In addition, unit economics should see a slight bump as we enter the warmer seasons.

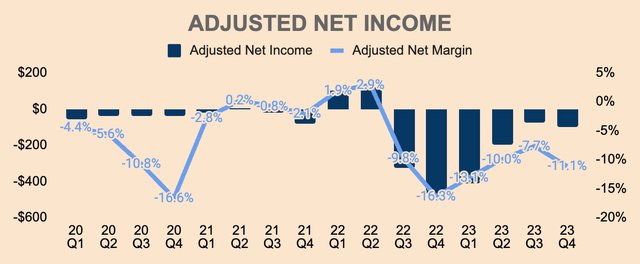

On the other hand, Opendoor remains severely unprofitable.

Despite cutting Adjusted Operating Expenses by 30% YoY, Adjusted Net Income was $(97)M in Q4, representing an Adjusted Net Margin of (11.1)% — still deeply negative.

Author’s Analysis

It just goes to show that Opendoor needs to scale operations in order to turn profitable. According to management, they are taking three steps to rescale in 2023:

- Increase Advertising: After reducing advertising spend from $200M in 2022 to $75M in 2023 and with the Old Book of inventory out of the picture, Opendoor is ready to ramp up advertising in 2024.

- Expand Partnership Channels: This includes its partnership with Zillow (Z), eXp Realty (EXPI), and Redfin (RDFN). Acquisitions from these channels are up 35% QoQ with a lot more room to bring in new business for Opendoor, at an attractive fixed cost.

- Lower Spreads: Opendoor intends to reduce spreads to drive higher conversions, thus increasing home volumes, and subsequently Revenue generation.

With positive Contribution Margins in place, Opendoor just needs to scale to cover its fixed costs. Otherwise, it will stay unprofitable indefinitely.

Fortunately, Opendoor is in a fundamentally stronger footing than it was a year ago: the Old Book is nearly gone, the New Book is selling at an attractive margin, the housing market is stabilizing, the business is leaner, and the company is ramping up acquisitions

As I see it, Opendoor is well-positioned to rescale its business and is on track to achieve sustained, profitable growth.

Health

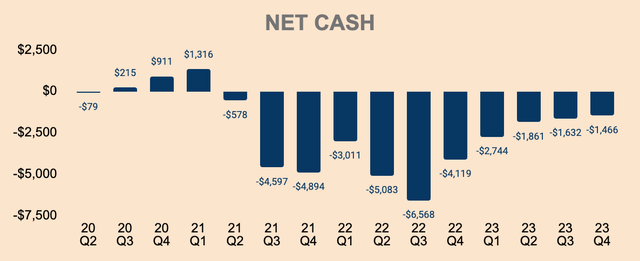

As I’ve said earlier, Opendoor is a much leaner business today.

As you can see, the company’s Net Cash balance continues to improve with each passing quarter, at $(1.5)B as of Q4.

Author’s Analysis

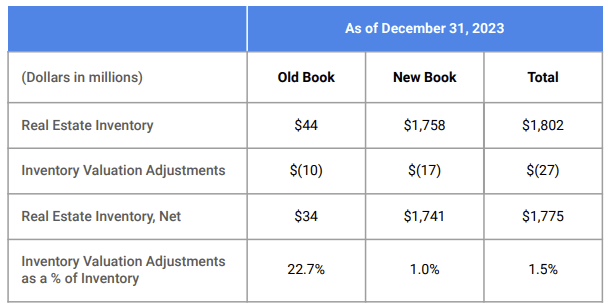

By the end of the quarter, Opendoor had 5,326 homes in inventory, valued at $1.8B net of inventory valuation adjustments. This is up 35% QoQ.

More notably, the Old Book now represents just 2% of its inventory balance, down from 6% in Q3 and 22% in Q2.

Additionally, inventory valuation adjustment as a % of inventory has dropped significantly from 9.3% last year, to just 1.5% as of Q4, and management expects the metric to remain stable going forward.

Opendoor FY2023 Q4 Shareholder Letter

Of important note, Opendoor’s inventory remains more liquid than the industry. As of Q4, 18% of Opendoor’s homes had been listed on the market for more than 120 days as compared to 21% for the broader market, showing Opendoor’s superior value proposition in terms of speed and certainty. This is also a big improvement from 55% last year, given its success in disposing of its Old Book of inventory.

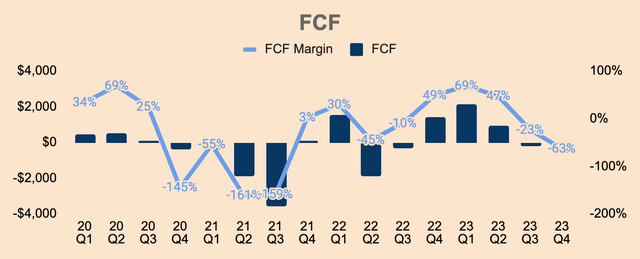

In terms of cash flow, Opendoor was a net buyer of homes once again, which is why Free Cash Flow was $(551)M in Q4. I expect FCF to stay negative for a while as the company rescales in 2024.

Author’s Analysis

Outlook

We remain focused on re-scaling the business in a sustainable fashion. Looking ahead, we expect to benefit from advertising, partnerships, and spread tailwinds, coupled with improved overall Contribution Margin, while navigating ongoing macro uncertainty.

As mentioned above, Opendoor is focused on rescaling volumes while improving unit economics.

That said, management provided the following Q1 guidance at the high end:

- Revenue of $1.1B, implying a 65% decline YoY, but a 26% growth QoQ. Somewhat good — but this missed analyst estimates of $1.17B.

- Contribution Profit of $50M, which implies a 4.5% Contribution Margin. This is a 1,220 and a 110 basis point improvement YoY and QoQ, respectively. Very good.

- Adjusted EBITDA of $(70)M as Opendoor is still expected to operate at a loss. Not good enough.

All in all, Q1 guidance was okay for me, though it would be nice to see higher growth and Contribution Margin.

But the dealbreaker came when management added the following:

We expect to significantly reduce Adjusted Net Losses this year as we meaningfully ramp acquisitions year-over-year within our target annual Contribution Margin range, while leveraging our fixed costs. However, as we sit here today, we don’t anticipate reaching the acquisition and resale volumes needed to reach positive Adjusted Net Income for a quarter in 2024.

(Opendoor FY2023 Q4 Shareholder Letter)

In other words, Opendoor is not going to achieve profitability in ANY quarter in 2024 — Opendoor needs a $10B Revenue on an annual run-rate basis to breakeven but it won’t achieve that in 2024.

While home acquisitions are expected to double YoY in Q1 and increase even further in Q2, Opendoor is not expected to reach 2,200 acquisitions and resales per month (or 6,600 per quarter) required to achieve Adjusted Net Income profitability.

Put simply… 2024 is going to be another year of losses…

That’s a bummer.

And that’s why the stock sold off following the news.

Having said that, I believe management is just being extra conservative with their guidance — they do have a history of sandbagging guidance — especially because they have just gone through one of the sharpest housing market resets in the past two decades.

Now that the worst has likely passed, Opendoor can focus on rebuilding its future.

iBuyer penetration is only 1% in the massive residential real estate market — being virtually the only game in town and with a Net Promoter Score of nearly 80 over the last three years, I believe that the long-term outlook for Opendoor remains as bright as ever.

Valuation

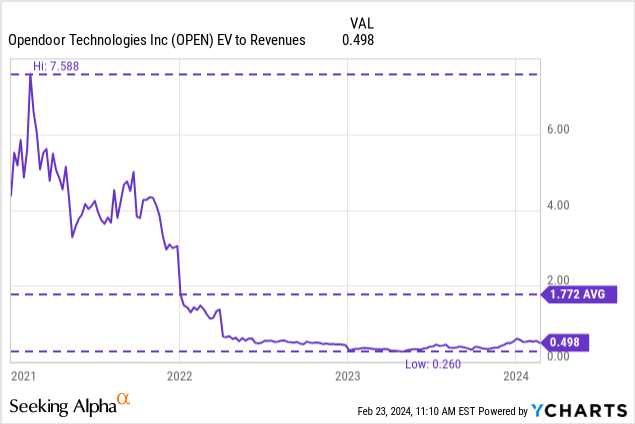

Opendoor still trades at the bottom range of its valuation multiple. The stock currently trades at an EV to Revenue multiple of 0.5x, which is a significant discount to its peak of 7.6x and average of 1.8x, so from a historical standpoint, Opendoor still looks attractive.

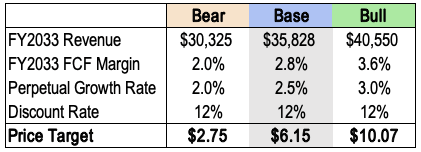

As for me, I have a price target of $6 a share for Opendoor, based on the following assumptions:

- FY2033 Revenue of $35B, which is quite conservative given the $1.9T industry that Opendoor operates in.

- FY2033 FCF Margin of 2.8%.

- Perpetual Growth Rate of 2.5%.

- Discount Rate of 12%.

I have my bear and bull price targets of $3 and $10, respectively, as shown below. For context, analysts have an average price target of $3, so clearly, I’m in the bullish camp.

Author’s Analysis

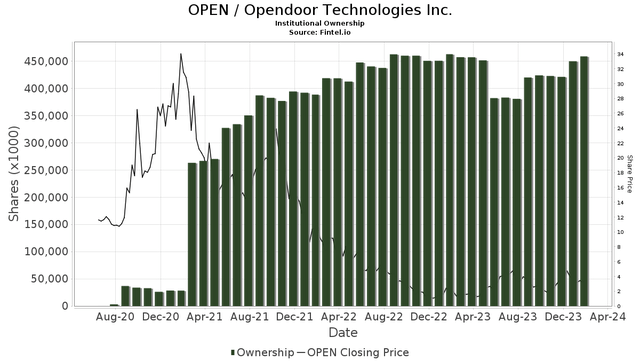

On a side note, institutions have been loading up on Opendoor over the last few months, which may support Opendoor’s bullish momentum.

In addition, rate cuts on the horizon may provide a meaningful catalyst for the stock.

Fintel

Risks

- Higher for Longer: interest rate volatility is Opendoor’s biggest enemy. It creates uncertainty in the real estate market and it keeps homeowners on the sidelines, which means lower volumes for Opendoor.

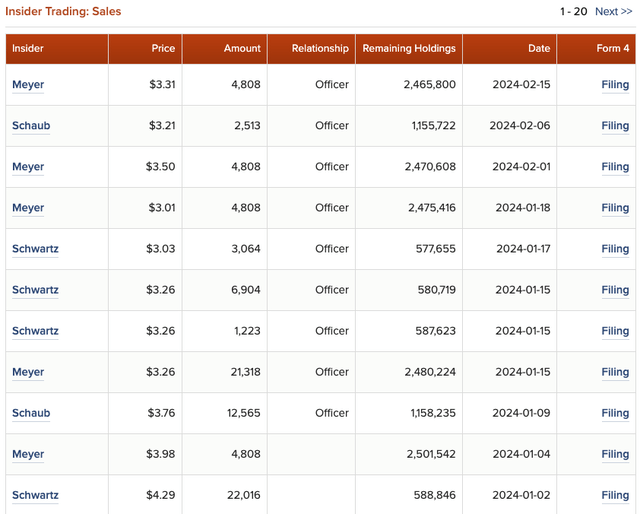

- Insider Selling: the constant barrage of insider selling is definitely a concern, especially when there is no insider buying to support the bull thesis.

Insider Monkey

Thesis

As I’ve said at the beginning of this article, it has not been easy holding Opendoor stock. Its volatile nature might have scared a lot of investors away.

For me, I’m probably numb by the frequent pops and drops.

But recently, the stock sold off following Q4 earnings results.

Actual results show that the company is on the right track to achieving sustained profitability. However, many investors didn’t like the fact that profitability had been delayed by another year.

In investing, there’s going to be a period of outperformance and underperformance. There’s going to be moments of victory and moments of pain. There’s going to be good times and hard times.

That’s just the way it is — it’s not a linear game.

Accepting this helps us to tune out the noise, to endure volatility. It helps us to build a long-term mindset. It helps us to hold on to our investments when the going gets tough.

In Opendoor’s case, things are tough.

But things are getting better as well.

As we’ve seen with Q4 results, Opendoor is rescaling volumes and improving unit economics.

It’s just that the path to profitability is going to take slightly longer than expected.

The sell-off is justified.

But Opendoor is fundamentally stronger than it was a year ago — they’re better positioned to achieve sustained, profitable growth.

History tells us that significant alpha can be generated when an investor holds on for the long game, despite the ups and downs of the business.

In other words, fortune favors the bold.

Are you bold enough to hold on or to add to your Opendoor position?

I know I am.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of OPEN either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.