Summary:

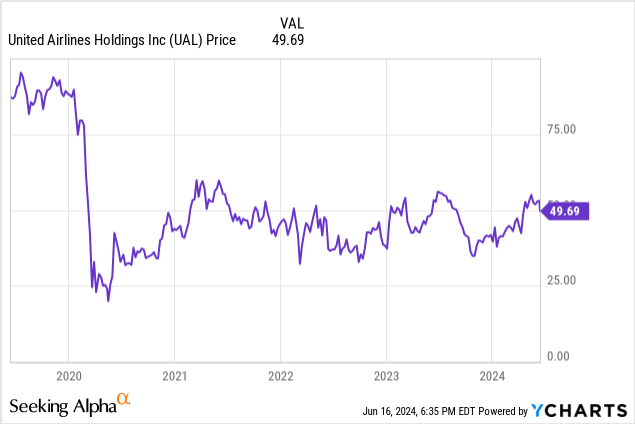

- United Airlines shares have risen over 20% this year after a 43% fall in the last 5 years.

- Despite challenges, UAL is focused on growing and boosting profits with a clear plan for the future.

- Q1 results showed solid revenue growth, effective cost management, and positive free cash flow generation, positioning the Company well for profitability.

- Given its higher margins, lower debt multiple, and positive outlook, I believe United Airlines shares do not warrant to trade at such a discount to its peers.

Laser1987

Introduction

United Airlines (NASDAQ:UAL) is one of the world’s largest airlines, with flights to over 350 destinations. Over the last 5 years, the shares have fallen 43% but have risen over 20% so far this year. Having faced multiple challenges, from the Covid-19 pandemic to problems at Boeing (BA), United Airlines has started to bounce back. With a clear plan for growing the airline and a positive set of financial results in the most recent quarter, United is on a solid future footing. Let me explain why United Airlines shares are a buy.

Company Overview

United Airlines is one of the world’s largest airlines, with a fleet of over 950 aircraft. Headquartered in Chicago, United can trace its routes back to 1926 and has grown both through organic growth and takeovers and mergers of competitors such as Continental Airlines.

United offers an extensive route network serving both domestic and international destinations. With seven major hubs including Chicago O’Hare and Newark Liberty, with almost 5,000 flights offered daily, United appeals to both leisure and business passengers. The sheer scale of United offers many competitive advantages connecting destinations across the continent, and slots at increasingly congested airports, giving it a preferential position in these markets. Despite high barriers to entry due to high capital requirements and stringent regulation, United still faces competition both from low-cost carriers and full-service airlines.

Growth But Not Without Its Challenges

It is true that United has been through a tough few years, with the Covid pandemic seriously hampering demand and problems at Boeing impacting United’s fleet. Despite this, United Airlines has bounced back and is currently focused not on just maintaining their current size, but actually growing the airline and boosting profits by focusing on launching more profitable routes. This was explained by CEO Scott Kirby in the first quarter earnings report:

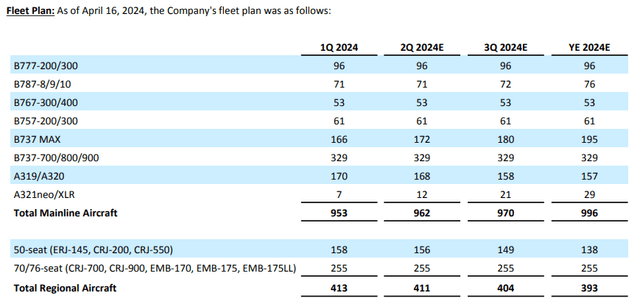

We’ve adjusted our fleet plan to better reflect the reality of what the manufacturers are able to deliver. And, we’ll use those planes to capitalize on an opportunity that only United has: profitably grow our mid-continent hubs and expand our highly profitable international network from our best in the industry coastal hubs.

This expansion continues to show United Airlines plans to grow further and double down on its most profitable long-haul routes. With covid behind us, the strong recovery in air travel is set to continue, exceeding pre-pandemic levels, benefiting United Airlines. United Airlines is currently poised for a record-breaking summer, with US air carriers set to see a 6.3% growth in passengers this year, with United predicting that travel on Memorial Day weekend was up 10% year-on-year.

All this is not without its challenges. United’s planned fleet strategy has been significantly impacted by Boeing’s production issues. The company now only expects five of the expected eight Boeing 787 and 36 of the expected 157 Boeing 737 MAX. With additional delays with the Boeing 737 MAX 10, this has resulted in a notable drop in expected capacity for United. This has led the company to convert some orders for the MAX 10 into the smaller MAX 8 and MAX 9 which are expected sooner and secure additional leases on Airbus A31neos to help ensure capacity. Although the Boeing MAX series has faced considerable problems, this move indicated United’s confidence in this model of plane that makes up a substantial chunk of the fleet.

United Airlines Investor Update 16th April

In addition to this, the FAA has imposed an operational freeze on United Airlines, preventing the addition of new aircraft into United’s fleet. This was triggered following a series of non-fatal incidents at United, from engine fires, cracked windshields, a plane skidding off a runway and an individual entering a cockpit during a flight. Whilst this is concerning, in their Q1 earnings call United stated they expect this to have minimal impact on the rest of 2024’s capacity plans. This issue should hopefully be resolved quickly, with United claiming they have proactive safety measures.

Despite the challenges facing United Airlines, it has a plan to profitably grow the company and continue to meet the demand for air travel for millions of passengers every year.

Q1 Results

On April 25th, United Airlines released its results for the first quarter of 2024. Revenue came in at $12.5 billion, surpassing expectations by $150 million and up 9.7% year-on-year. Unlike its competitor American Airlines (AAL) which reported a 4.9% fall in revenue per available seat mile against the previous year, United Airlines reported a small increase of 0.6%.

Total operating expenses rose 8.4% year-on-year despite a 7% drop in fuel expenditures. This increase was largely driven by an 18.4% increase in salaries and related costs and comes on the back of industrial action last year. Although revenue grew faster than expenses, United still reported a pre-tax loss of $164 million, a smaller loss than last year’s $264 million. This corresponds to earnings per share of -$0.15 significantly ahead of expectations of a loss of $0.57 per share and ahead of last years $0.63 loss per share. Although United posted a loss for the quarter, this is not unusual for North American Airlines in the first quarter due to seasonal travel patterns.

On a positive note, the company generated $1.5 billion of free cash flow for the quarter, which helped it reduce its total debt burden to $34.8 billion from $37.2 billion a year earlier.

Looking ahead, United Airlines anticipates total capital expenditure in 2024 to be $6.5 billion, down from the initially forecast $9 billion, largely due to delays in the delivery of Boeing planes. It is suggested this will rebound to $7 – $9 billion in 2025 to 2027 to help fund both fleet renewal and steady growth, taking into account the buildup in delays. Despite this significant outlay, the business is still targeting positive free cash flow over the coming three years.

Overall, these results present a positive picture. United Airlines showed solid revenue growth, with effective oversight of costs, leading to a smaller than expected loss. With performance exceeding that of competitor American Airlines and strong free cash flow generation, United looks well positioned for greater profitability in the future.

Q2 Outlook

United Airlines is set to report its results for Q2 2024 in the middle of July. Current expectations are for revenue of $15.11 billion, a rise of 6% compared to the corresponding quarter in 2023. Earnings per share are, however, set to contract around 20% to $4.01 per share. This comes as United Airlines continues to face delays on the delivery of new planes from Boeing, leading to reduced aircraft utilization and overstaffing increasing costs.

Valuation

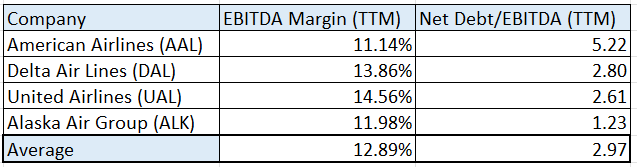

United Airlines currently trades at x4.86 forward earnings, significantly lower than the wider market, and its competitors. It trades at an EV/EBITDA of 4.66 a notable discount compared to peers such as Delta Air Lines (DAL), Alaska Air Group (ALK), and American Airlines (AAL), all fellow large American Airlines. Although United Airlines has faced issues with their fleet of Boeing aircraft and other operational issues, I believe this significant discount cannot be justified given United’s positive outlook.

When we compare United Airlines to its peers, we also see that on other key financial metrics such as EBITDA margin and Net Debt/EBITDA, it is among the best performing. It offers the highest EBITDA margin and the second-lowest Net Debt/EBITDA, which remains comfortably below the industry average.

Table of Key Metric comparisons with data from Seeking Alpha

Given its higher margins, lower debt multiple, and positive outlook, I believe United Airlines shares do not warrant to trade at such a discount to its peers. Additionally, current forecasts suggest growth in earnings per share over the next few years. I therefore rate United Airlines’ shares a “Buy”.

Risks

As with any company, there are several risks that I believe it is important to consider when investing in United Airlines. These risks are almost universal to the airline industry, and I covered them in more detail in my previous article on American Airlines. These are the cyclical nature of the airline industry, fuel prices, and labor relations.

Over the past year, fuel prices have remained fairly stable with the American economy showing continuing signs of growth, helping shore up demand for air travel. Although United Airlines has not faced any significant strike action in recent months, this is an issue that could rise again in the future. Strike action is not the only form of labor action that could affect United, with large pay rises often demanded, significantly adding to labor costs.

Conclusion

In conclusion, United Airlines has faced multiple challenges over the past few years, from the covid pandemic to ongoing problems with Boeing aircraft. Despite these challenges, the airline has appeared resilient, successfully growing revenues and profits with targeted capacity expansion with a focus on highly profitable international routes and mid-continent routes.

After a solid first quarter, which showed improved financials against the previous year and exceeded the performance of some of its peers, United Airlines looks in a solid position. Given these positive developments and outperforming peers on multiple metrics, I believe it should be valued at least the same, if not higher than, its peers. Given these factors, I assign the shares a “Buy” rating.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.