Summary:

- Palantir is reporting great quarterly results and growth rates are accelerating.

- Palantir might profit from the world getting more chaotic, but commercial revenue might see lower growth rates due to the looming recession in the United States.

- But even when being optimistic about Palantir growing with a high pace, the current stock price is not justified in any way making it not a good investment.

Viktor Aheiev/iStock via Getty Images

If you want to criticize me – and you certainly can as not every investing decision or analysis is right (but it doesn’t have to be to make money) – you can point out that I have been constantly wrong about Palantir Technologies Inc. (NYSE:PLTR) as an investment in the last two years. And I certainly must admit that my “Hold” rating in the last articles was not the way to make money. If you invested in Palantir anyway at the point when my articles were published, these trades would have been very profitable. And not only would you have made money, but also clearly outperformed the S&P 500 (SPY).

Especially my article in November 2022, in which I argued that I am still not willing to gamble, did not age well. Since then, the stock increased almost 400% in less than two years, and it would have been a great investment. And we could leave it at that: I was wrong about Palantir and did not get the business and did not understand what a great investment the stock was.

How the Stock Market Works

However, we all know how the stock market and investing works. And we all know the fundamental distinction between investors and traders. Very seldom stocks are trading for a price we can see as the fair value of a stock. In most cases, the stock is either over- or undervalued and sentiment surrounding stocks is either too bullish or too bearish (it is seldom neutral). And of course, what a fair value for a stock should be, is very subjective, but the stock price in the short term has nothing to do with the performance of the business. Over the long run (several decades), the stock price is tracking the fundamental performance of a business closely. And while traders might profit from short-to-mid-term fluctuations of sentiment, long-term investors should rather be focused on the fundamentals of a business.

And Palantir is in my opinion one of the stocks where the stock price is not matching the fundamentals of the business. The short-term performance of the last few quarters – driven by bullish sentiment – drove the stock price higher and made this a good trade, but I don’t think the current stock price makes Palantir a good long-term investment. In one or two years we are looking back at the stock price and wonder how the stock could trade at this price (at least in my opinion).

Quarterly Results

And to get a fundamental picture of Palantir we can start by looking at the last quarterly results. On August 05, 2024, Palantir reported second quarter results, and the company did beat earnings per share as well as revenue estimates. Revenue increased from $533.3 million in Q2/23 to $678.1 million in Q2/24 – resulting in 27.2% top line year-over-year growth. Income from operations jumped from $10.1 million in the same quarter last year to $105.3 million in this quarter – resulting in a growth rate of 943%. And diluted net earnings per share increased 500% from $0.01 in Q2/23 to $0.06 in Q2/24.

We can also look at (adjusted) free cash flow, which is one of the most important metrics. And while free cash flow also grew, growth rates were a little lower than for earnings per share and compared to $96.0 million in Q2/23, free cash flow was $148.7 million in Q2/24 – resulting in 54.9% year-over-year growth. Adjusted free cash flow margin increased from 18% in the same quarter last year to 22% this quarter.

Business Improving

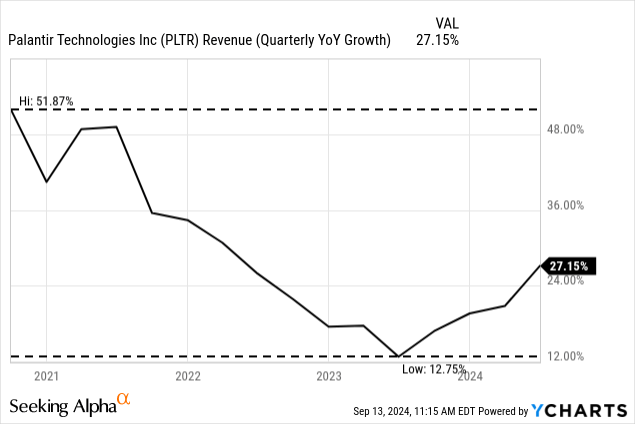

I already stated above that I am rather bearish on Palantir, and I don’t think the stock price is justified (we will get to this later). Nevertheless, we must point out that the business is improving, and top line growth is accelerating. Top line growth accelerated for the fourth quarter in a row and while revenue increased “only” 12.75% in Q2/23, it increased 27.15% in Q2/24.

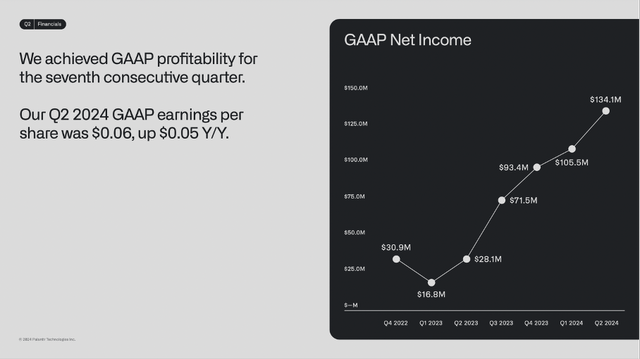

Aside from revenue growth accelerating in the last few quarters, Palantir also made huge steps towards becoming more profitable. Looking at net income in the last few quarters, we see high year-over-year and also quarter-over-quarter growth rates and Palantir is now profitable for the seventh quarter in a row.

Palantir Q2/24 Presentation

Additionally, the number of new deals closed is also improving. In the last five quarters, the number of deals closed with a volume of at least $1 billion is seeing an upward trend (despite the number being higher in Q4/23), it is especially the deals with at least $10 million that is accelerating. While Palantir closed 18 deals in the same quarter last year and only 12 deals in Q3/23, it was 27 deals in the last quarter.

|

Deals |

Q2/23 |

Q3/23 |

Q4/23 |

Q1/24 |

Q2/24 |

|---|---|---|---|---|---|

|

At least $1 million |

66 |

80 |

103 |

87 |

96 |

|

At least $5 million |

30 |

29 |

37 |

27 |

33 |

|

At least $10 million |

18 |

12 |

21 |

15 |

27 |

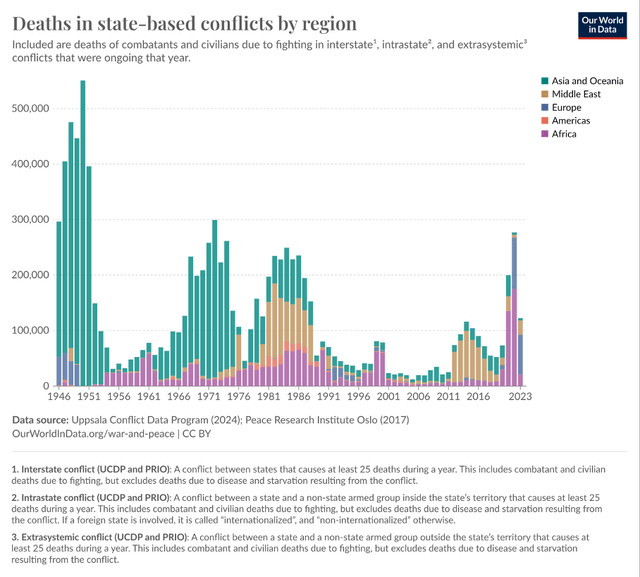

Another important aspect is the world getting more unstable and it seems like we are shifting more and more towards internal and external conflicts. I already wrote about this extensively in a previous article about Palantir. In this article I wrote:

And it seems like Palantir is well positioned for an irrational world – that seems to get more irrational from year to year. This is actually a rather bullish argument for Palantir as revenue generated in the next few years could increase as the world seems to get more chaotic and complex and governments (and companies) are searching for help and guidance to navigate in such a complicated world.

While the number of deaths in state-based conflicts was lower again than in the previous year, I don’t think anybody would argue the world got safer or more stable in 2024 than in 2023 or 2022. And when looking at the number of deaths in sate-based conflicts over the last few decades, the numbers in the last three years were the three highest since the 1990s.

Our World in Data

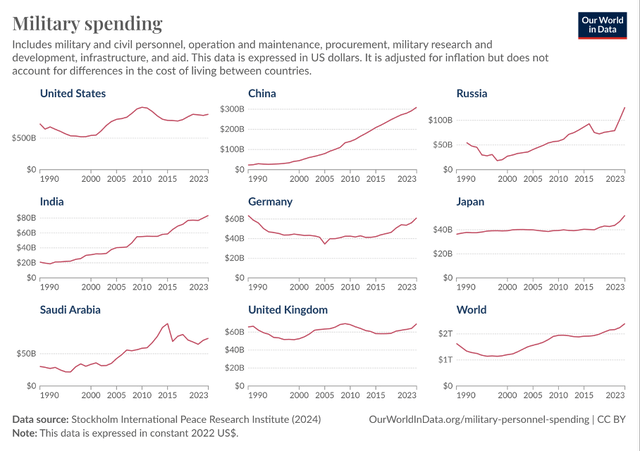

We can also see that the military spendings are increasing and we can assume that Palantir will benefit from increased military spending as fighting wars is not only about soldiers and tanks and bombs but also about digital warfare and AI.

Our World in Data

Palantir During a Recession?

And while the question of peace and war might be important for Palantir, we should not ignore that the United Sates seem to be headed into a recession and the signs are getting clearer. I have mentioned these arguments in several articles in the last few weeks as this information is important for almost every business and every sector.

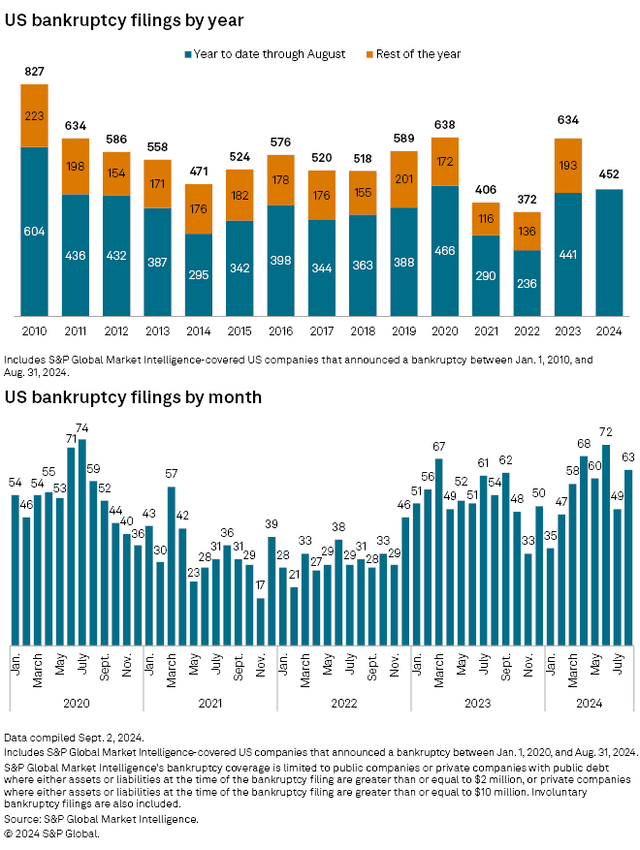

In the following section I will give another short overview of the important metrics that are in my opinion hinting towards a recession in the United States. We can start by looking at the number of bankruptcies in the United States and see the number constantly crawling higher. And the United States seems to be headed for the highest number of bankruptcies since 2010.

S&P Global

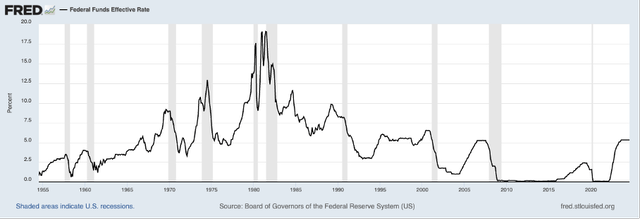

Another metric we can look at is the FED pivot. At this point it almost seems certain that the FED will lower interest rates in September (probably by 50 basis points) and market participants are also rather certain additional rate cuts are coming. And as we can see in the chart below, the FED pivot (the central bankers switching from increasing interest rates to lowering interest rates again) often preceded a recession.

FRED

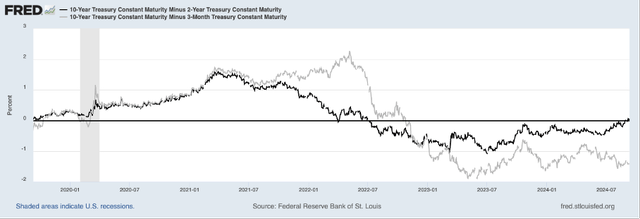

Another clear warning sign is the inversion of the yield curve (early warning sign) and the re-inversion of the yield curve (later warning sign). And now the 10-year vs. 2-year treasury yield is above zero again with the 10-year vs. 3-month yield most likely following in the coming months.

FRED

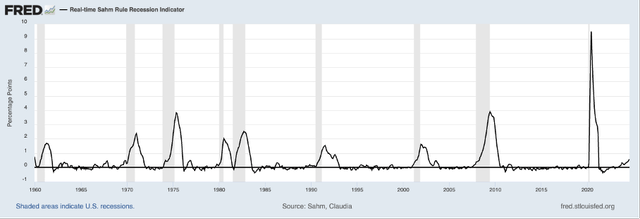

We can also look at the Sahm Rule, another rather precise recession indicator, which has been sending a clear warning sign in the recent past that a recession is upon us.

FRED

When looking at the two different segments, we can start by the government revenue (which is still responsible for more than 50% of total revenue). And not only will existing contracts last during recessions, but especially governments might also renew contracts and even close new contracts with Palantir.

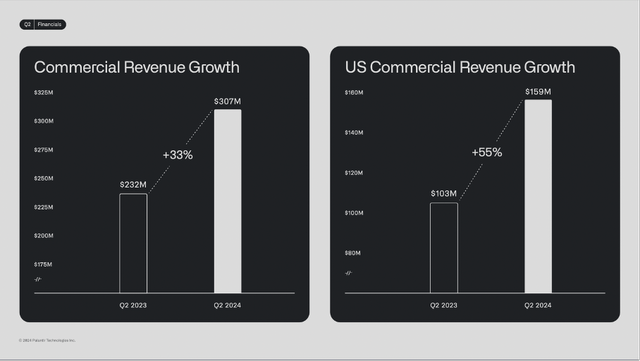

And while we can argue that government revenue might be rather stable – even during a recession – the situation might be different for commercial. In the last few quarters, it was especially commercial revenue growing with a high pace. In the second quarter of fiscal 2024, commercial revenue was $307.4 million (45.3% of total revenue). And in the second quarter, the commercial revenue was growing 33% year-over-year (with the commercial revenue in the United States growing even 55%).

Palantir Q2/24 Presentation

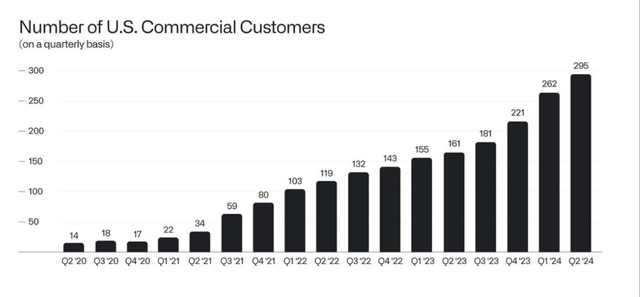

When looking at the number of U.S. commercial customers, Palantir reported 295 in the second quarter of fiscal 2024. In the same quarter last year, the number was only 161 and we can see growth accelerating here in the last few quarters.

Palantir Q2/24 Letter from Karp

And we don’t have much data how Palantir will perform during a recession, but I really don’t think Palantir will keep up the high growth rates during a recession. And Palantir needs high growth rates to justify the current stock price – a point we will get to in the next section.

Simply Overvalued

On the one hand, we have a business that seems to be improving and accelerating growth and might profit from a world getting more divided and “chaotic”. On the other hand, the United States are also headed for a recession, which can be a problem for businesses. But the biggest problem for the company and especially the stock as an investment is the extremely high stock price.

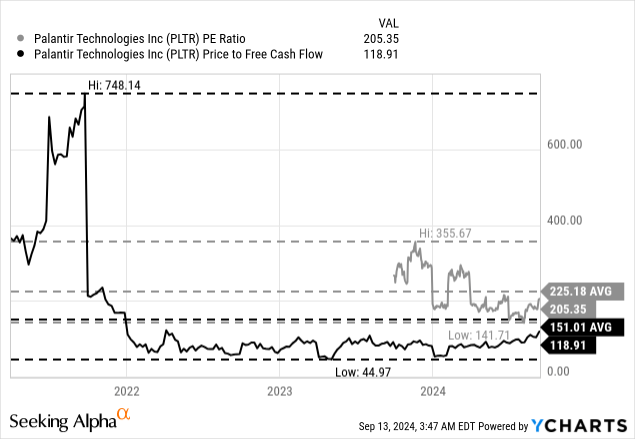

At the time of writing, Palantir is trading for 119 times earnings and 205 times free cash flow. And while we can make the argument that Palantir is trading below the average price-free-cash-flow ratio and the average price-earnings ratio of the past, this argument is rather weak. First, we are rather looking at short timeframes and second, these are extremely high valuation multiples and especially the short timeframe is making is likely that the stock can be overvalued almost the entire time of its existence (making average numbers rather useless).

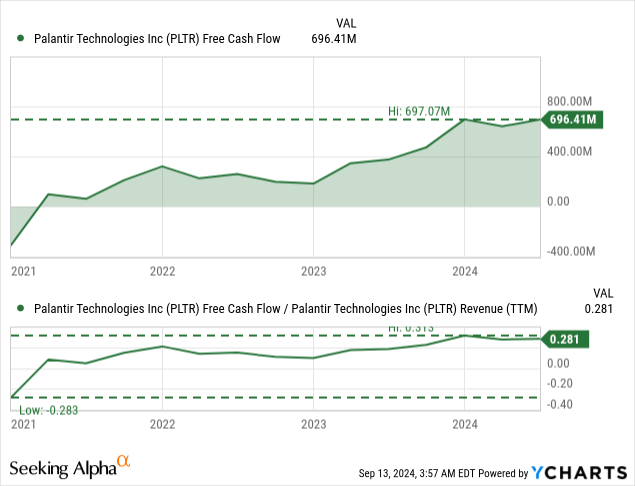

Additionally, we must consider that free cash flow conversion is already extremely high. Right now, the company is generating 28.1% of revenue as free cash flow – a metric that is limiting the upside potential and growth most likely must come from top line growth and not margin improvement.

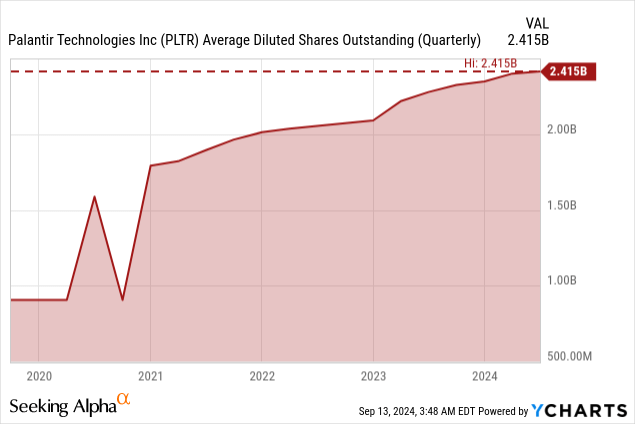

But in the end, we are once again using a discount cash flow calculation to get more accurate numbers and make a more reasonable decision if the stock is under- or overvalued. As always, we are calculating with the last reported number of diluted shares outstanding (2,415 million) and a 10% discount rate. As basis we can use the upper end of the company’s free cash flow guidance of $1 billion.

In the past, I often calculated with 6% growth until perpetuity (and I still think it is possible to justify these higher terminal growth rates for high-quality businesses). Nevertheless, it also seems reasonable to be a little more cautious and follow the recommendations of the CFI (and others) and use a lower terminal growth rate. Nevertheless, I would still argue that Palantir will be able to generate a wide economic moat around its business, making 4% growth for perpetuity a reasonable assumption. When calculating with these assumptions, Palantir must grow 29% in the next 10 years to be fairly valued.

One might argue that 29% growth is reasonable – especially as Palantir was growing with a much higher pace in the last few quarters. But we must put these numbers a little into context. First, we must point out that Palantir is continuing to increase the number of outstanding shares. In the second quarter of fiscal 2023, the company reported 2,278 million diluted shares outstanding and in the second quarter of fiscal 2024, the company reported 2,415 million diluted shares outstanding – 6.0% year-over-year growth. When taking this into account, Palantir must grow 35% in the next ten years to offset the dilution (assuming it will remain at this level).

Second, growth probably must come from the top line. As pointed out above, 28% of revenue is already ending up as free cash flow, and I have my doubts Palantir can increase this margin. Therefore, 35% growth has to come from the top line and at least since early 2022, the company did not grow its top line at such a pace, and I don’t think the company will be able to grow at such a pace in the next 10 years.

Conclusion

I might have been wrong about Palantir – at least in the short term. And considering the unstable world that seems to be headed more towards war and chaos than towards peace and stability is certainly a tailwind for Palantir. On the other hand, the looming recession in the United States will most likely have a negative impact on the commercial revenue (the driver of growth in the last few quarters).

But in the end, the argument why I am bearish about Palantir is very simple: the stock price is too high and not justified in any way. I assume it is rather unlikely that investors will generate a reasonable profit by investing in Palantir in the next few years. The stock price is more than priced for perfection.

When talking about valuations – especially in times where bullish sentiment is close to its peak – we are often confronted with an argument similar to a line Alexander C. Karp wrote in the opening statement of his last letter:

The playbooks of the past are no longer working. And even the people who had believed in them now know this.

Times are certainly changing. Companies must adapt and playbooks of the past (including investing strategies of the past) might not work so well anymore. But this does not apply to valuation, which is a timeless concept. It will always matter what price we are paying and when overpaying for an asset the investment will be less profitable or not profitable at all.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.