Summary:

- Palantir’s Q3 2024 results highlight a 30% YoY growth rate, driven by the successful monetization of their AIP platform and a scalable growth strategy.

- The U.S. government segment shows significant growth, doubling YoY revenue growth for three consecutive quarters, indicating strong future potential.

- Palantir has truly solved sales efficiency, managing to achieve high-quality, organic growth rates while expanding margins.

- Average revenue per customer increased for the second quarter in a row. However, the slowdown in customer acquisition could become a risk.

Andreas Rentz

Since I initiated my coverage of Palantir (NYSE:PLTR) back in January, the stock is coming close to being up 200%. The story is still in its infancy, despite the company being founded 20 years ago. For each passing quarter, we are given more information to digest in order to further our understanding of the business. However, no quarter to date has been as pivotal as Palantir’s Q3 2024 results. Not because of Palantir reaching a 30% year-over-year ((YoY)) growth rate, but because of what the composition of that 30% growth rate implies. For example, most of my questions and concerns in my previous article regarding sustainability of efficient growth were answered. In this article, I will provide you with all the details of the quarter and what conclusions we can draw from them to revalue the business.

Peeling back the layers

A year and a half ago, Palantir was trading in the mid-single digits following a deceleration of the revenue growth profile for the business. That also coincided with the launch of artificial intelligence platform (AIP), the platform that reinvigorated the whole business. Suddenly, there was an avenue of growth, a paved path for Palantir to capitalize on the surging hype surrounding artificial intelligence (AI).

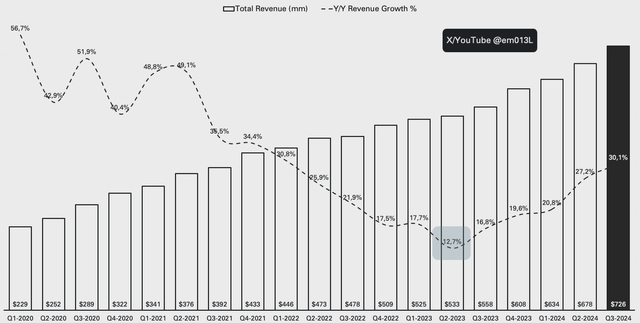

Emir Mulahalilovic, Palantir SEC Filings

AIP launched with a new go-to-market strategy, utilizing intensive 1-3 day bootcamps where customers and potential customers could attend and experience the AIP platform. These bootcamps proved to deliver solutions and use cases within a 3-day span, a process which usually can take the better part of a year, if not several years. Palantir has had powerful software for a long time, but had no real way of getting it to potential customers. Since the launch of AIP and the bootcamps strategy, the growth has re-accelerated, hitting 30.1% as of Q3 of 2024.

The Palantir CEO Alex Karp famously said the following during the Q1 2023 earnings call, just as AIP launched:

our strategy on AI is just to take the whole market. We have no pricing strategy. We’re going to create a lot of value. We’re going to get hundreds of customers and we will price it as we go. One of the things we’ve seen over and over again is, when you’re ahead of the market, you need to take territory.

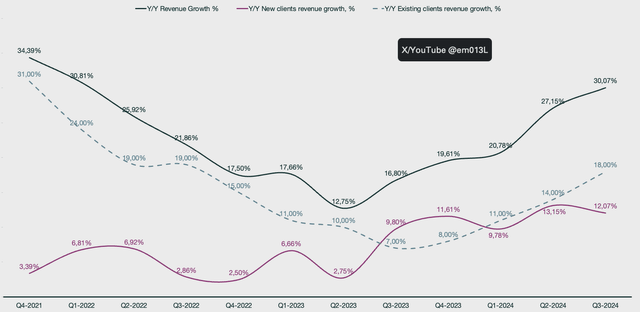

There has been no word on what the pricing strategy will be like to date, a year and a half later. Instead, as investors, we need to extrapolate the data we are given. AIP is more or less proven with over a thousand bootcamps at this point, as well as multiple AIPCons where customers showcase the value they generate using it for the world to see. One of the more effective ways to gauge when AIP is starting to become increasingly monetized is to view the revenue growth split between existing and new customers. Existing customers constitute customers who Palantir has recognized revenue from for a longer period than twelve months, meaning they are captured in the net dollar retention statistic.

Emir Mulahalilovic, Palantir SEC Filings

This chart paints an interesting picture for investors. For most periods, Palantir’s growth was made up of existing clients, leaning into an acquire-expand-scale (AES) revenue model of the past. Palantir would run a demo for a potential customer at cost, sign an entry contract, and then scale up once customers actually realize the value that Palantir solutions deliver. The AES model wasn’t scalable enough, though, and it started to show as Palantir’s revenue base grew bigger; it got harder to grow. Palantir bottomed two quarters after the launch of AIP and has since then been on an accelerated growth trajectory for existing clients, where the last three periods of growth have primarily come from existing clients rather than new ones. This could be a sign that AIP monetization has started to be meaningful, and since it’s a very scalable and cost-efficient way of growing, I see Palantir accelerate growth further.

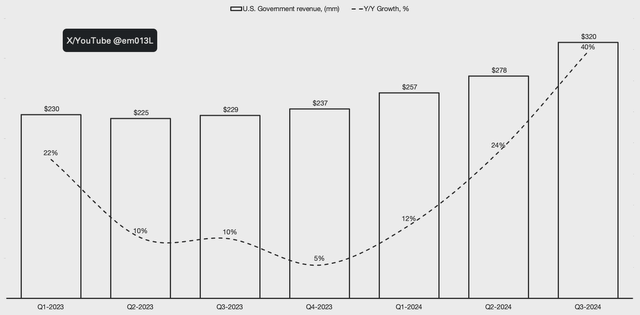

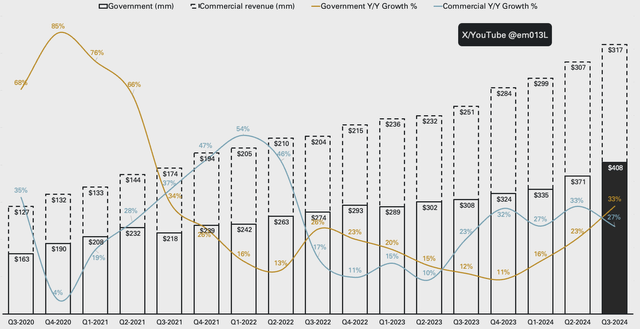

If we peel back another layer, we see another interesting emerging story. For quite a few periods now, all the excitement has been around commercial clients, primarily in the United States. A notable revenue segment that is not talked about enough in my opinion is the U.S. government, which is actually growing immensely. When I first shared my valuation model on Seeking Alpha, there was a great deal of skepticism surrounding my government growth projections. The thesis was simple: the department of defense will allocate increasingly more of their budget towards AI, and Palantir historically holds roughly 25% of the market share of that spend. The reallocations would result in immense growth for Palantir’s government segment, and that is what is happening now.

Emir Mulahalilovic, Palantir SEC Filings

After bottoming at 5% year-over-year ((YoY)) growth, Palantir has doubled that to 12%, and then doubled to 24%, and then is close to doubling it once again at 40% for each subsequent quarter. Currently, the U.S. government makes up 78% of the total government revenue. This means that there is a lot of room for international government to grow as well, considering there is increasingly more global unrest. This type of revenue is sticky, and just as I was writing this article, the Navy signed an estimated $920 million contract with Palantir. I expect a lot of expansion in the government segment, and that is also reflected in my valuation model.

Looking at the government segment against the commercial segment as a whole, it is clear that the government has been a drag on revenue growth, as government makes up a majority of Palantir’s revenue. Government finally bottomed as of Q4 of 2023 and has since then accelerated violently from 11% in Q4 of 2023 to 33% this past quarter, surpassing commercial growth that saw 27% growth. Each segment has seen weak periods but has also covered for one another at times of weakness. That relieves a lot of pressure on the company, allowing them to focus on sustainable, profitable growth rather than the trap of “growth at all costs.”

Emir Mulahalilovic, Palantir SEC Filings

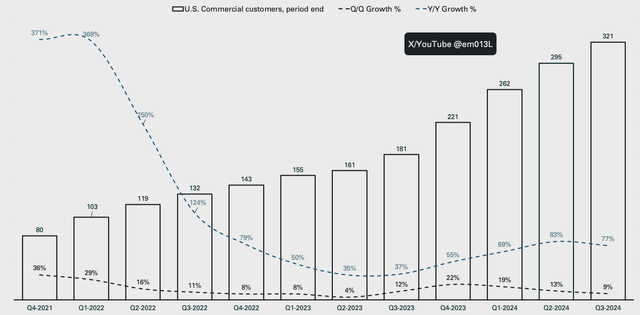

While the government segment is very exciting to me personally, I find that most investors look to the commercial segment as their main focus, and for good reason. Most notably, the U.S. commercial segment is the largest beneficiary of the AIP bootcamp strategy, a property that is evident in the numbers.

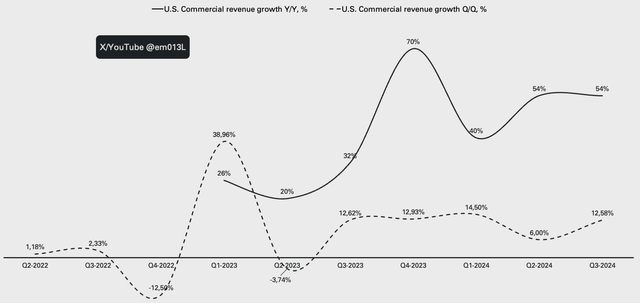

Emir Mulahalilovic, Palantir SEC Filings

Q4 of 2023 grew U.S. commercial revenue at 70%, a major headline for the quarterly results. However, it was against a very weak comparison period in 2022. The next quarter, Palantir only grew 40% against a stronger comparison and then accelerated to 54% against a weak comparison period again. Q3 of 2024 is the first quarter that allows us to see a normalized growth rate against a proper comparison period, and Palantir delivered another 54% YoY quarter while also accelerating quarterly growth. The YoY growth rates are accelerating, much like the U.S. government, likely as a result of AIP monetization.

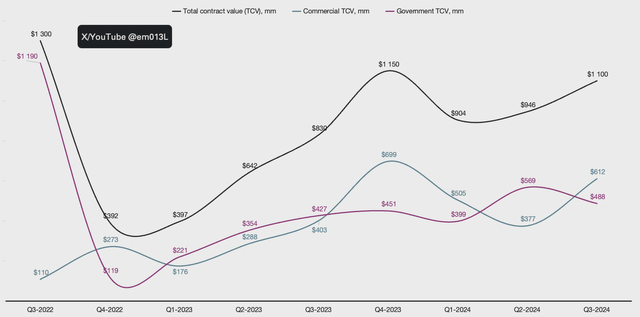

Looking at total contract value, there is a clear uptrend. The reported dollar amount is the sum of all the contracts signed for each reporting period. While the time of recognition isn’t made clear, seeing this accelerate means that Palantir is unlikely to suddenly see a slowdown in growth.

Emir Mulahalilovic, Palantir SEC Filings

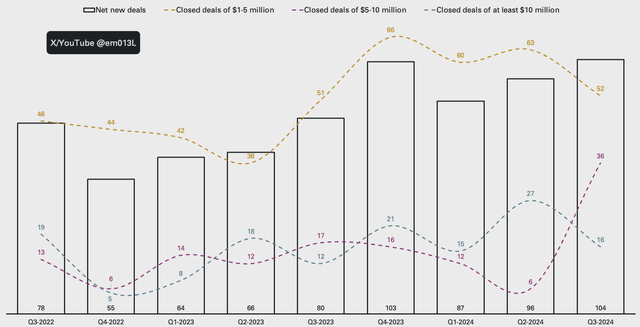

Total contract value can also be broken down into the deals signed per revenue grouping. Palantir reports this is deal sizes of $1-5 million, $5-10 million, and more than $10 million. The past two quarters saw a surge in the larger deal size groups. What I want to see is an acceleration in net new deals and also increasingly fewer low-dollar deals. This quarter recorded 30% YoY growth in net new deals, while also recording the lowest amount of $1-5 million deals on a percentage of the sum basis.

Emir Mulahalilovic, Palantir SEC Filings

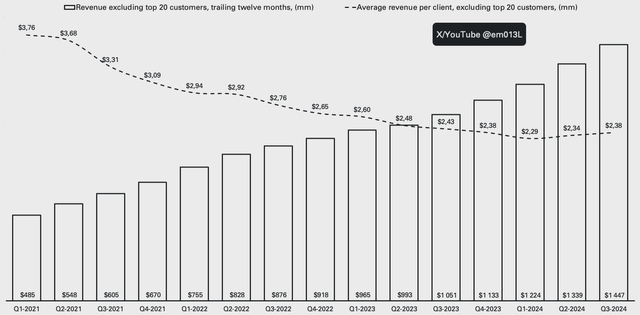

The quarter is very impressive across all the data points so far, but the result that got me the most excited is the acceleration of average revenue per client. This has been down trending since we could track it in the filings, but the past two quarters saw an acceleration. It was exciting last quarter, but one period of growth is not a trend; now we have two. What makes this impressive is that Palantir is increasingly becoming available at lower price points, and they are increasingly adding more customers, which should lower the average. Historically, customers had to purchase a full Foundry stack, even if they were only trying to solve a small use case. Now Foundry can be acquired in smaller packages, including AIP that has been more or less given away for free for a time. This calculation excludes the top 20 customers, as those 20 customers make up 46% of all revenue. Including them would inflate the representation of the average customer.

Emir Mulahalilovic, Palantir SEC Filings

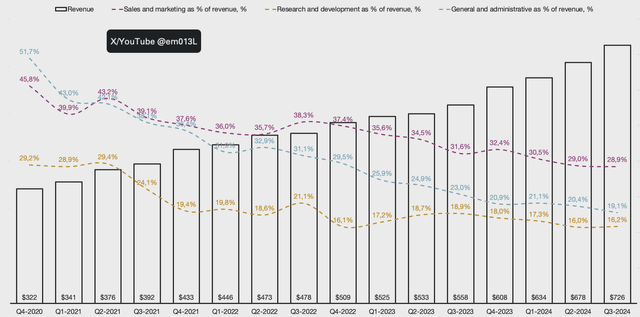

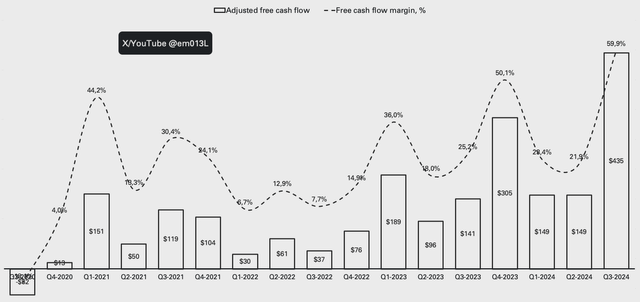

Margin expansion could continue for a long time to come

One of the dynamics with Palantir that is truly impressive is their ability to be at the forefront of technology, servicing any industry, scaling their revenue growth, and releasing several new platforms, all while expanding their margins. Palantir has more or less static operating expenses and no excessive capital expenditures. For each passing quarter, the dollar amount spent on operating expenses is close to being static, and when you combine that with ever-increasing revenue, you get margin expansion. I would not underestimate Palantir’s capital-light operations and the ability to increase margins for a long time to come. Currently, I project free cash flow to the firm margins to reach 48% by 2033.

Emir Mulahalilovic, Palantir SEC Filings

To understand what margins may look like in future periods, I make sure to measure several key performance indicators in order to better my understanding of the business.

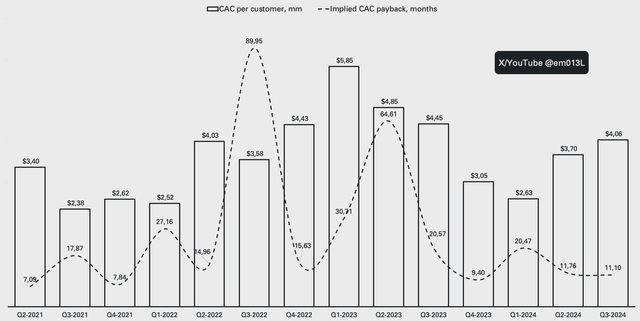

I like to track customer acquisition cost (CAC) as well as the time it takes to recoup the cost. The formula for the calculation is available in my previous Palantir articles if you wish to calculate it yourself. Since the launch of AIP and bootcamps, Palantir has found a more cost-efficient way to scale up their customer count, as evident by the downtrend since Q1 of 2023. The periods prior to 2023 were heavily impacted by Palantir investing in special purpose acquisition companies ((SPACs)) in exchange for them becoming customers and are not representative.

Emir Mulahalilovic, Palantir SEC Filings

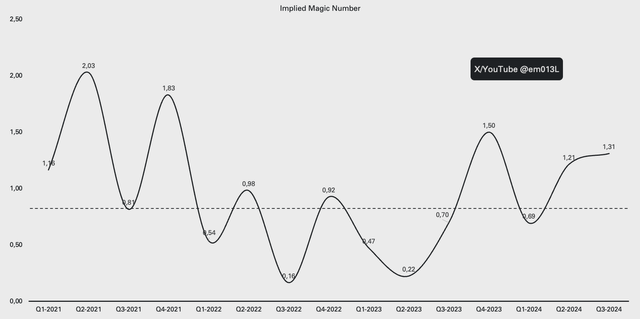

We can see a similar trend if we track the magic number, a metric often used to measure sales efficiency in software-as-a-service ((SaaS)) businesses. The formula for calculating it is available in previous articles, but in essence, the magic number looks at implied annual recurring revenue for the current period and divides it by the previous period sales and marketing spend. This in turn gives us a ratio that speaks of how efficient the sales cycle is for the business. Scoring above 0.75 means that the business is efficient in its sales process, and anything below 0.5 is indicative of issues with the business model. Similar to the previous two charts, we see a positive trend since the start of 2023. 1.31 is a very healthy ratio and speaks of a very efficient sales strategy and business model.

Emir Mulahalilovic, Palantir SEC Filings

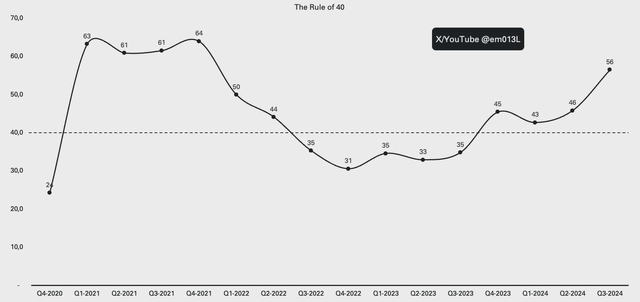

Similarly to the magic number, the rule of 40 is another SaaS metric that tells the quality of growth that a business has. A business may grow at a rapid clip but at extreme losses, or it could be very profitable but barely grow. The rule of 40 combines the profit margin and growth rate, and the resulting number should ideally be 40 or higher to indicate high-quality growth. Depending on the stage the business is at in its maturity, this can be calculated in different ways. Palantir reports this number using adjusted operating margins combined with YoY revenue growth. I find it a bit bloated and inaccurate; therefore, I calculate the rule of 40 metric using trailing twelve months of revenue growth as well as trailing twelve months of free cash flow margin. Similarly, here, Palantir posts impressive results with a large uptick from the prior quarter, reaching 56.

Emir Mulahalilovic, Palantir SEC Filings

The resulting margins are equally positive. Free cash flow is lumpy when viewed on a quarterly basis due to the timing of cash recognition of signed contracts. With that in mind, Palantir reported a record quarter in terms of adjusted free cash flow margins. The adjustment is adding back cash expenses related to stock-based compensation payroll taxes, a small amount in aggregate.

Emir Mulahaliliovic, Palantir SEC Filings

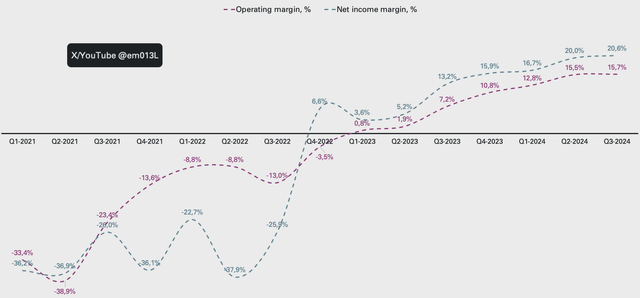

Similarly, as operating costs kept decreasing, Palantir also recorded record operating and net profit margins.

Emir Mulahalilovic, Palantir SEC Filings

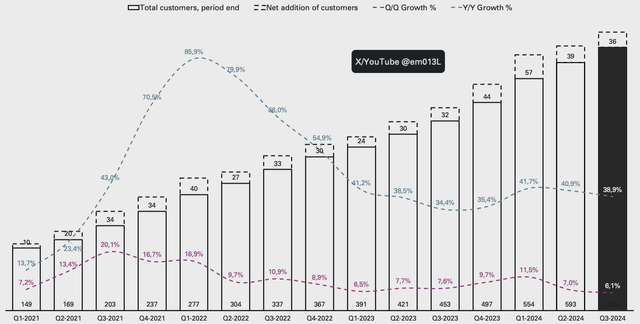

A new risk to account for

Palantir is anti-fragile in nature. Palantir strives under any political environment, does not have any debt, and targets any and every industry, removing risks that are industry-specific and cyclical. They are also set to grow in any type of economy. If the economy is slow, companies will want to become more efficient, which benefits Palantir as they are an enabler towards that goal. If the economy soars, more money will be spent on software, especially AI software spending.

However, every company does face risk. While it certainly won’t bankrupt the company as they are now increasingly more profitable, there has been a slowdown in customer count growth. Typically, that would also result in a slowdown in revenue growth, but it didn’t. That is a peculiar characteristic that goes against common logic, but CEO Alex Karp commented the following during the recent Q3 earnings call:

an average normal way of looking at Palantir be like, great, you have a 44% growth on $2 billion base in the U.S. and you have a Rule of 68. Get that 68 down to 50 and maybe you can grow. But in fact, that way of looking at a business misunderstands the way in which Palantir builds. We believe that by investing and we know at this point, instead of trying to have 10,000 clients, all of whom hate you, that’s kind of what people want, 10,000 clients that hate you, but they can’t give you a product.

We want a smaller number of the world’s best partners that, quite frankly are dominating with our product. And the way you do that is by having by not blowing up your margin and getting 10,000 sales people, it’s actually by going deeper on the product. And in fact, what we see is the deeper and the better the product, the more we drive sales, the more we have our cultural singular advantage as Palantir, not as a commodity product.

Alex Karp makes it sound deliberate. That also makes sense from a market dominance perspective. If industry leaders adopt Palantir solutions, the other participants in the industry are likely to follow in order not to be left behind. It also allows Palantir to get front-line research and development toward solving the problems the industry faces, which can then easily be repurposed and sold to other businesses.

Emir Mulahalilovic, Palantir SEC Filings

It should not be ignored, though. AIP bootcamps have been ramping up, and initially, we saw a close correlation between the number of bootcamps ran and the net addition of customers. That has since been lost, and it makes me curious as to how this will develop. I still expect an acceleration by next quarter, but this is a risk to keep an eye on.

Emir Mulahalilovic, Palantir SEC Filings

The same slowdown is visible while tracking U.S. commercial customers, the largest beneficiary of the AIP bootcamp strategy.

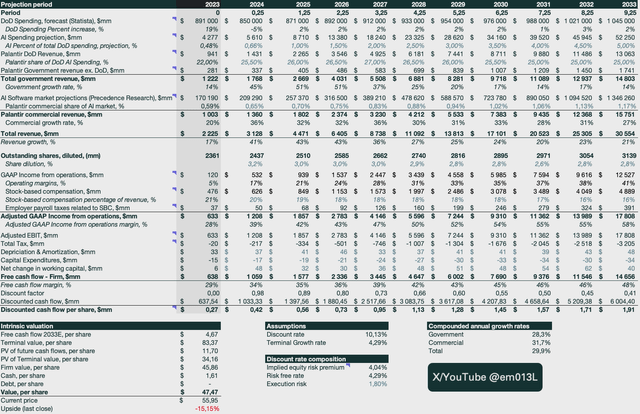

Intrinsic valuation

When I value Palantir, I use a sum-of-the-parts approach to modeling. The reason for that is the different growth profiles for the two segments. The government business is largely modeled with an anchor to the department of defense budget forecast by Statista, where I project an increased amount of spending directed towards AI solutions. This follows Palantir’s software being used in Ukraine and by Israel, as well as increasingly more often within the U.S., cementing Palantir as the only software prime.

Palantir’s commercial segment is difficult to project since Palantir is going after all types of industries, as well as all verticals within each industry. During the Q2 earnings call, Palantir announced an ERP platform, and a few weeks later during AIPcon, a customer claimed that traditional ERP systems are dead and will be replaced with Palantir. The problem is gauging the growth potential, considering that the TAM is practically endless. It is important to stay rooted in reality, and while it is true, that theoretically, there’s no end to how wide Palantir’s solution will be able to reach, it is also true that it’s intangible at the time of writing. Instead, I anchor the commercial results to an AI software market projection by Presedence Research and assign Palantir a market share.

My previous articles detail my approach to valuing Palantir in more detail, including adjustments for stock-based compensation, dilution, and how I view reinvestment for the business. They also explain my approach to calculating the discount rate and other various inputs.

Emir Mulahalilovic, Palantir SEC Filings, Statista, Precedence Research

The main changes to my Q2 model are that I increased the risk, which is reflected in the discount rate. While a second consecutive quarter of improved efficiency and accelerated growth reduces risk, the customer count trend that is forming could require a new approach to the story.

In addition, I am seeing margin improvements in accordance with my expectations, to the point that I felt comfortable raising the margin profile. I was considering increasing operating margins after the Q2 earnings, but one period of quarterly data was not enough to justify the adjustment. The margin improvement is quite large, moving the free cash flow to the firm margin of the 2033 period from 30% to 48%. I can’t see any realistic obstacle that would stop Palantir from reaching those margins, even though they may look absurd from a historical perspective. With low and more or less static operating expenses, combined with low reinvestment requirements, Palantir will become a cash-making machine.

This results in a fair intrinsic value per share of ~$47, an implied -15% downside to fair intrinsic value compared to where Palantir trades at the time of writing.

Summary

Palantir reported a magnificent quarter full of hints of what the future holds for the company. They showed that Q2 was not a fluke simply due to a weak comparison period, Q3 had a normalized comparison period, and Palantir accelerated on all fronts. We also saw further confirmation of AIP starting to become monetized, driving accelerated revenue growth within existing customers.

Notably, the quality of growth is impressively high, scoring 56 in the rule of 40 while also being sales efficient. Key highlights include three consecutive quarters of essentially doubling the YoY revenue growth for the U.S. government segment, as well as the second quarter in a row of increasing the average revenue per client.

Unfortunately, I am not the only one to recognize how well-positioned Palantir is for the future, as the stock has rallied ~35% after the quarterly report. My updated fair intrinsic value for the business is ~$47 per share, a strong buy if shares would trade at the time of reporting the quarter. Now the stock is at ~$56, and I downgraded my rating to a hold, despite a large increase in my intrinsic valuation compared to post-Q2 earnings.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of PLTR either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.