Summary:

- Palantir Technologies has shown a solid uptrend, gaining 124.14% over the last year, outperforming the S&P 500 by 96%.

- Its Q2 2024 performance was very strong and indicative of a consistent and sustainable growth trajectory.

- PLTR’s innovative products, strategic partnerships, and strong upward momentum make it an attractive long-term investment opportunity.

- The company’s core strength lies in its advanced data integration and analytics platforms, Gotham and Foundry, which cater to government and commercial sectors, driving growth and customer acquisition.

hapabapa

Investment Thesis

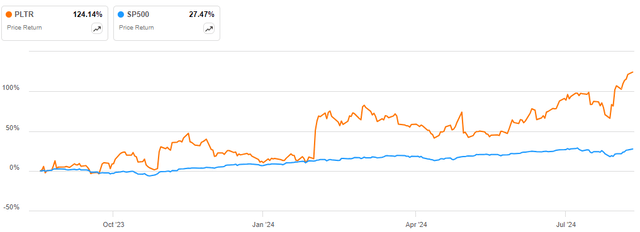

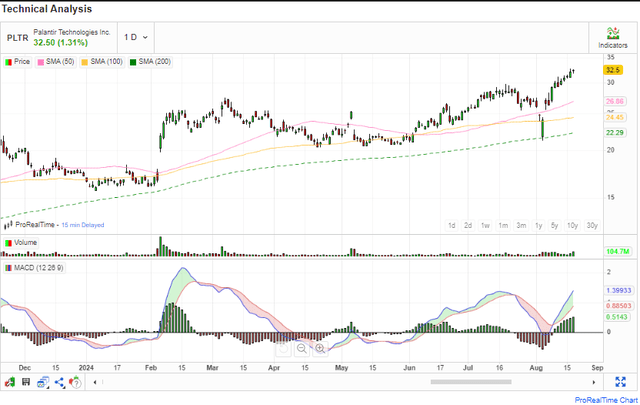

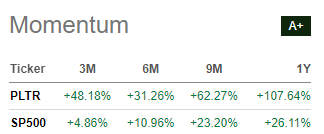

I am bullish on Palantir Technologies (NYSE:PLTR) and I recommend it to investors. The stock has been on a solid uptrend since bouncing off its lows at about $6 in December 2022. Following this upward momentum, it has gained 124.14% over the last year, outperforming the S&P 500 by a margin of more than 96%.

Based on the stock’s momentum values, the current uptrend appears to be very strong lending credence to my buy recommendation.

Seeking Alpha

Besides the strong upward momentum, PLTR is an attractive long-term investment opportunity given its innovative products and strategic partnerships. I believe these factors are long-term growth drivers which will lead to value creation for shareholders.

A Brief Company Overview

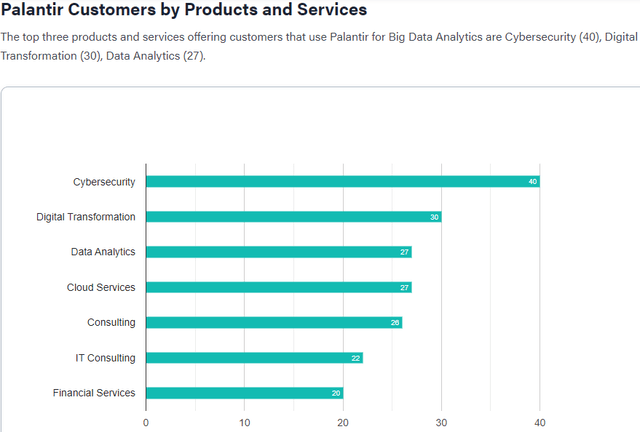

Palantir Technologies was founded in 2003, and it is a publicly traded company that develops big data analytics software systems with its headquarters in Denver, Colorado. The company has two major products, namely Palantir Foundry and Palantir Gotham. These unique offerings serve as a competitive advantage given its unique attributes which speak about the company’s innovative abilities, as I will discuss later in this article.

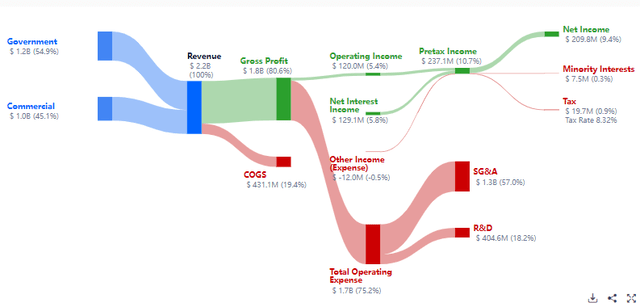

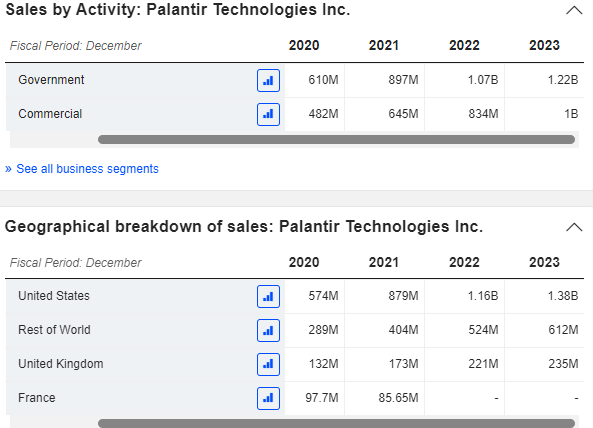

The two platforms are designed to offer interactive, machine-assisted analysis by integrating, safeguarding, and maintaining data to enable human-driven analysis. Initially, the company targeted federal entities of the USIC, but over time it has gradually grown its customer base to include government and private companies both locally and globally. Below is its revenue breakdown by business line and geography.

Market Screener

The Products: The Core Of PLTR’s Strength

This company’s fundamental strength stems from its advanced data integration and analytics platforms (Gotham and Foundry). These platforms enable organizations to effectively integrate, manage, and analyze a lot of data from various sources, culminating in leading actionable insights that enable easy and informed decision-making. Through these platforms, its users are able to detect patterns hidden within complex data sets, something which is critical for intelligence and counterterrorism operations. In addition, PLTR’s introduction of the Apollo Artificial Intelligence Platform [AIP] is a demonstration of its dedication to innovation and market expansion. Let us dive deeper into the company’s two major platforms so as to understand their unique attributes.

The first one is the Palantir Gotham platform, which is an operating system intended primarily for government and defense entities. It has several unique attributes that make it stand out. To begin with, it has an AI-powered decision-making, which provides soldiers with a kill chain driven by AI. This feature helps in improving situational awareness and expediting crucial decisions in contemporary battle spaces. Secondly, through sensor tasking, Gotham is able to assign tasks to sensors right from drones to satellites using either user inputs or AI- driven algorithms. This unique attribute enables the platform to achieve a high level of autonomous and efficient operations. Another unique attribute worth noting is the strong data integration. This feature enables data visualization and management, making it easy to handle data of any form and volume. In addition, the platform has a mixed reality which is capable of converting any place into an instant command center.

Due to these attributes, Gotham is a powerful tool for organizations that require robust data integration and analytical capacities, majorly in defense and intelligence where timely and accurate information is crucial.

Comparing Gotham to its competitors (Alteryx, Tableau, Snowflake, etc.), it places a great emphasis on security and operational efficiencies inside intricate settings. Although its competitor systems may provide predictive analytics tools, Gotham’s AI inclusion for crucial and sensitive operations leading to precise and easy decision-making is a standout. Further, it differentiates itself from more commercially oriented analytical platforms through its emphasis on mixed reality and sensor tasking, essentially suited to the special requirements of defense and intelligence activities.

While Gotham is designed to suit government operations, particularly defense and intelligence units, Palantir Foundry, the second unique and key product, is designed for commercial use. It offers an operating system for contemporary businesses. The platform has several unique attributes. First, it has an ontology-based data integration a feature that enables customers to design models that accurately represent the relationships that exist in the actual data within their organization, an ability not found in traditional data integration technologies. Given this attribute, complex analysis as decision-making is made simpler and more precise. Further, its safety and scalability attributes make it attractive. It prioritizes enterprise-scale analytics and offers strong security features such as audit logs and flexible access controls to safeguard sensitive data throughout analysis. Again, it has automation and collaboration attributes which make it excellent at promoting cooperation amongst various teams inside a company. Through this feature, teams can concentrate on gaining insights rather than handling data management as the whole data pipeline right from intake to analysis is automated. Another key feature is the AI-powered workflow, which streamlines the data science process by allowing users to develop and deploy models within it through direct integration of AI and machine learning capabilities.

In a nutshell, with the above features, the platform’s advantages over competitors such as Alteryx, Tableau, and others are its all-inclusive approach to data integration, teamwork, and AI. Looking at these two platforms, besides them being unique, I draw a key lesson in market segmentation from them. Each of them has been designed to target a specific market with its unique needs, which alludes to the company’s understanding of its market and effectively segmenting it to satisfy its needs with unique and customer-tailored products. In my view, this is a major competitive edge for the company.

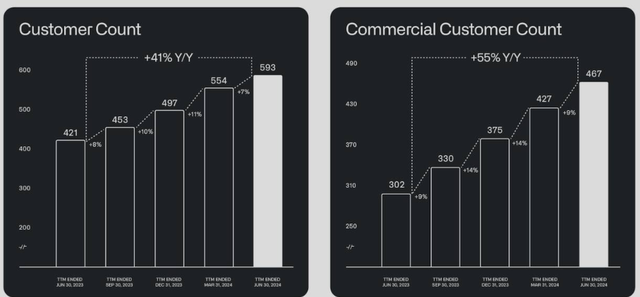

In light of the above distinct products, I believe that is what forms PLTR’s core strength and that explains why its customer acquisition is very impressive as exhibited by a 41% customer count growth YoY and 55% commercial customer count growth YoY.

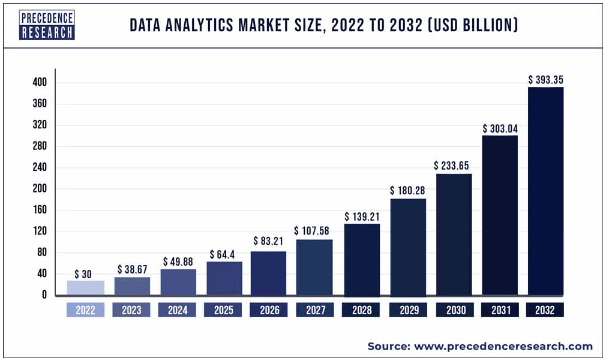

With the above product mix and promising customer growth trajectory, I am optimistic about the company’s ability to leverage the projected global data analytics market growth, which is expected to grow at a CAGR of 29.4% between 2023-2031.

Precedence Research

Strategic Partnerships

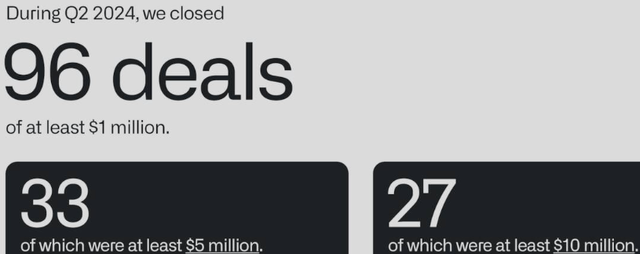

Palantir has partnerships with both government and private organizations demonstrating how competitive its two major projects are, and this bodes well for its growth. These strategic partnerships not only ensure a stable market share but also consistent revenue streams. The company’s upward revisions of annual projections and win of new contracts are indicative of its sustained momentum and long-term growth potential. To demonstrate how competitive and sustainable the company is, in its Q2 2024, it closed 96 deals of at least $1 million.

Further, Palantir has established a solid relationship with the government sector, as shown by its frequent signing of contracts with US government organizations to deploy its AI software platform. In the MRQ, its total remaining deal value soared by 26% YoY and 5% sequentially to $4.3 billion, demonstrating its robust long-term growth potential. One of its major contracts with government agencies is its $480 million deal with the US army for its maven smart system prototype, which runs up to May 2029.

Alongside the federal business section, the company has also achieved notable progress in the commercial sector with its overall commercial revenue rising by 33% to $307 million and the remaining performance obligation [RPO] growing by 41% to $1.4 billion YoY in Q2 2024. Its commercial customers are highly diversified, alluding to a broad risk distribution in this promising market segment.

Through its strategic partnerships, the company has developed a stable revenue streams that help to offset the risks related to its contract-based business model. Its two major revenue streams are well-balanced, with each contributing almost 50% of the total revenue. This suggests that it has a balanced risk distribution, which is very healthy because the company can survive in case of a downturn in one of its target markets as opposed to a scenario when its targeted government entities alone.

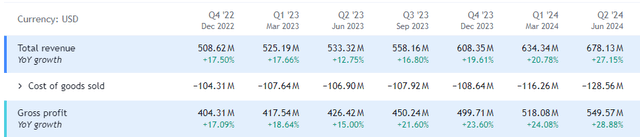

MRQ Performance: It’s Rosy Here

PLTR released its Q2 2024 results on 5th August 2024. The company had what I would term a strong quarterly performance. Here are some of the highlights and my thoughts on the results. First off, its revenue grew by 27% YoY to $678 million, beating estimates by $25 million. This demonstrated a strong growth trajectory, since it was at least the 7th successive quarter of revenue and gross margin growth by double digits. In my view, this shows how appealing the company’s products are and how the market acceptance and adoption are growing.

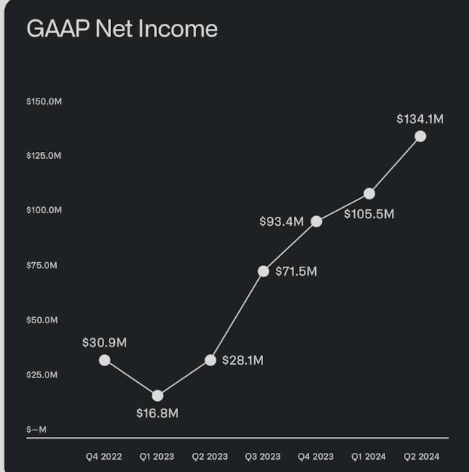

Notably, it generated a record net income of $134 million (20% margin) which was the highest quarterly profit in 20-year history.

PLTR Q2 Presentation

In addition, the US commercial markets saw a revenue growth of 55% YoY, a demonstration of the company’s market penetration in this target market. These highlights coupled with others previously mentioned in this analysis such as the 96 closed deals sum up Palantir’s solid performance.

My thoughts about the quarterly performance are bullish. The solid double growth digits which have been consistent are an epitome of a robust and sustainable growth trajectory and the company’s ability to capitalize on the growing demand for advanced AI systems. Its significant revenue and net income growth signify its strategic focus on creating value and investing in innovative technologies is resonating with its customers.

Above all, its remarkable performance in the commercial market illustrates its robust market position and room for expansion which is also cemented by its ability to land new deals, clearly seen by the 96 closed in the MRQ. In summary, its financials demonstrate an improving revenue and profitability status, which is encouraging for stakeholders.

Regression Analysis: 3-Year Price Target Model

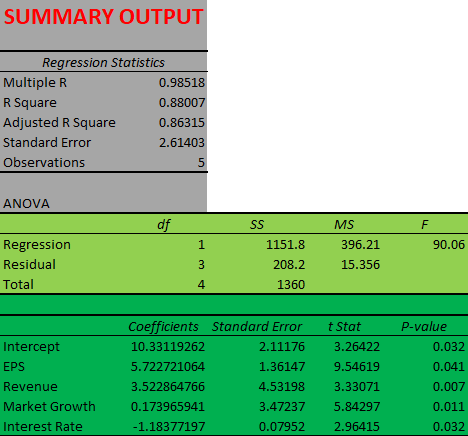

While I am bullish on this stock, I will use a multiple regression analysis model to estimate my price target for the stock by 2027. I am basing my model on solid fundamental inputs to reflect both the industry and company-specific stock catalysts. To be specific, the independent variables are a blend of company-specific factors (revenue and EPS) and macroeconomic aspects (interest rates and market growth). For these inputs, I will use data for the last five years to estimate the overall model and then project the future stock price using the estimated values of the specific inputs by 2027. I have several assumptions for my model. First off, I assume that there is a linear relationship between the stock and the independent variables. Secondly, I am assuming that the effect of change in X variables on the Y variable is constantly independent, and my last assumption is the projected future values of the X variables will be at least achieved. In the event the estimated future values are below expectations, that will mark the main drawback of my model, which will result in a revised price target accordingly.

I used EPS and revenue in my model to reflect the company’s financial health which is essential in long-term stock performance. The macroeconomic factors in my model reflect the external factors that influence stock performance and this shows how comprehensive my model is in terms of scope. Specifically, the market data reflects the future earnings growth potential because a market that grows rapidly implies that revenues and profits are likely to grow. Interest rate on the other hand acts as a risk factor in my model. This is because debt financing attracts higher interest expenses when the interest rates are high resulting in shrinking profit margins which can ultimately deteriorate stock value.

In light of this justification, I ran the model at a 95% confidence interval, and below is the output.

Author

The output has an adjusted R square of 0.863 meaning that it accounts for about 86.3% of the dependent variable variability and therefore this is a good model for this analysis. This is because a higher R square implies that a bigger percentage of the variation is accounted for by the model. In addition, all the t-stat values are above 2 and all the p-values are below 0.05 which is the confidence interval meaning that all the variables have statistical significance, and therefore they are valid predictors of the Y variable (stock price).

According to the output, EPS, revenue, and market growth have positive beta coefficients meaning that any additional unit in these variables would result in a positive impact on the stock price equivalent to their respective beta values. On the contrary, the interest rate has a negative beta coefficient meaning that any additional unit on this variable has a negative effect on the stock price equivalent to its coefficient value.

This leads us to the overall model equation as follows;

Y=Bo+B1X1+B2X2+B3X3-B4X4+e, Where;

B0-Y Intercept

B1-EPS coefficient

X1-EPS

B2- Revenue coefficient

X2-Revenue

B3- Market growth coefficient

X3-Market growth

B4- interest rate coefficient

X4-Interest rate

e-the standard error.

With this overall model, I forecasted the stock price by 2027 which marks my price target for the next three years. I used the estimated revenue, EPS, interest rates, and market size by 2027 to do the forecasting. For revenue and EPS I used the data from seeking alpha while for market growth I used the data from precedence research presented earlier in this article. I used the estimated fed rate of 2.90% by 2027 as my projected interest rate. The estimated revenue, EPS, and market value as of 2027 are $5.13 billion, $0.67, and $107.58 billion respectively. Inserting these values in the overall model equation yields an estimated stock price of about $52.66 which translates to a 65.7% upside potential by 2027. Given this solid growth potential and the current upward momentum, I recommend a buy-and-hold strategy here.

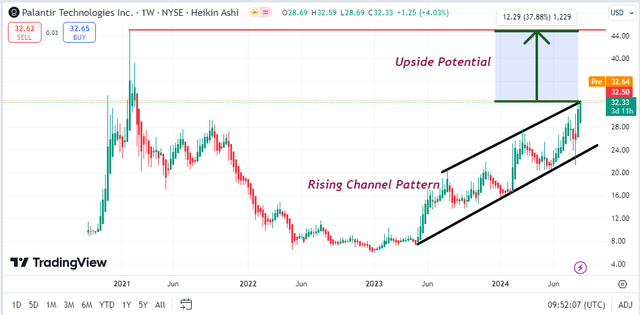

Technical Take

As I mentioned earlier in this article, this stock is currently in an upward momentum in what is a clear rising channel characterized by higher highs and higher lows. It has a clear resistance at the $45.40 price mark which is my price target in the current bullish momentum.

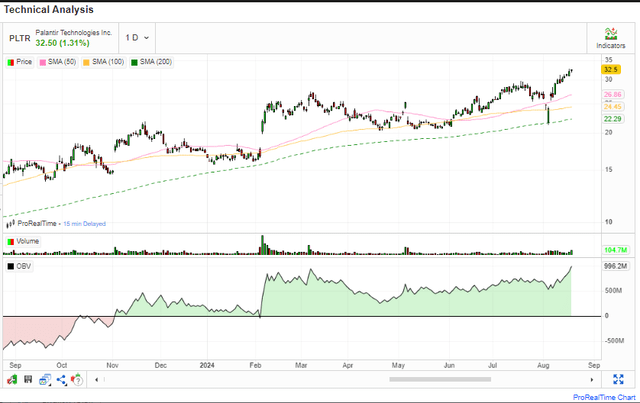

While I have this bullish outlook, let’s dive deeper and assess how strong the uptrend is to make a more informed decision. To begin with, the price is currently above the 50-day, 100-day, and 200-day MAs meaning that it is bullish in the short, mid, and long term. Further, the 50-day MA crossed above the 100-day MA in July forming the golden cross which is a bullish sustainability confirmatory signal. While trading volume is essential in sustaining a stock’s trajectory, it is very promising to note the consistently growing OBV which indicates a growing cumulative trading volume a sign of soaring demand for this stock.

Lastly, the MACD is also exhibiting a very strong bullish outlook which further lends credence to my buy decision. The MACD is above the signal line and diverging from the signal line an indication that the upward momentum is very strong. Further, they are both above the zero confirming that the uptrend is indeed solid and this also is explained by the growing histogram above the zero line.

In conclusion, PLTR is a strong upward momentum with a potential resistance at $45.40 translating to a 39.69% upside potential. Given this background, I believe this stock is a buy.

Risks

Although I am bullish on this stock, investing in PLTR has its risks just like any other investment. My main concern about investing here is its customer concentration. The company generates significant revenue, more than 50%, from a small number of government contracts. This is a concern because government priorities for spending can shift, or it can fail to renew the contracts, which could be a significant blow to the company’s financial health, which would mean my bullish stance is reversed.

Conclusion

Palantir is a prudent investment opportunity for investors seeking to diversify into the big data and AI analytics sector. The company’s long-term outlook is bright backed by its unique offering which positions the company strategically to leverage the solid market growth. Its solid upside potential by 2027 leads me to a buy-and-hold strategy recommendation.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.