Summary:

- Palantir is up over 37% since my last coverage after it reported outstanding Q2 FY24 results, with revenue and earnings beating estimates.

- With strength in its US Commercial segment from unrelenting AIP demand as it closes a record number of $5M and $10M deals, it is unlocking higher operating leverage.

- However, with the recent addition to the S&P 500, I believe the stock has gotten way ahead of itself, when taking management’s FY24 guidance and consensus estimates thereafter.

- With Palantir commanding the highest multiple in the SaaS complex, there is more downside than upside in the short term. Therefore, I am downgrading my rating to a “sell” with a price target of $27.

Michael Vi

By Amrita Roy, Produced by Colorado Wealth Management Fund

Introduction & investment thesis

I last wrote about Palantir (NYSE:PLTR) in June, where I had initiated a “hold” rating due to valuation concerns. In August, the stock dropped to $21.23, down 15% from my price at publication. However, since then, it has climbed more than 60% to an all-time high price of $35.20.

While part of the reason for the stock’s outperformance is tied to its Q2 FY24 earnings, where revenue and earnings beat expectations with strength in the US Commercial segment from unrelenting AIP (Artificial Intelligence Platform) demand, along with management raising its FY24 guidance, I believe that the stock has gotten way ahead of itself when you take future consensus growth expectations into consideration. While one can argue that the company is positioned to beat those estimates in the future given its past operational track record and the robust demand it is seeing for AIP, the stock does not offer the necessary risk-reward at the moment, should that outcome not materialize.

Simultaneously, I also believe that one of the other reasons for the recent surge in the stock price is tied to its addition to the S&P 500 index, and while historically newly added companies to the index tend to outperform in the first three months, the boost is likely to fade. Plus, with Peter Thiel’s recent filing to sell up to $1B in Palantir shares, there is mounting evidence that we may be due for a sizable correction in the stock price.

I am not arguing against management’s execution or the company fundamentals. I admit that the acceleration in the company’s US Commercial segment since the launch of AIP a year ago, along with growing GAAP profitability, has been beyond impressive. However, as investors, we have to remind ourselves not to fall in love with the stocks we own, but to manage them with sufficient risk-reward in mind.

Given where Palantir is currently trading, I believe that there is more downside than upside in the short term. As a result, I will downgrade my rating from a “hold” to a “sell” with a price target of $27.

Q2 Recap: US commercial is the hero of the growth story, while it smashes Rule of 40

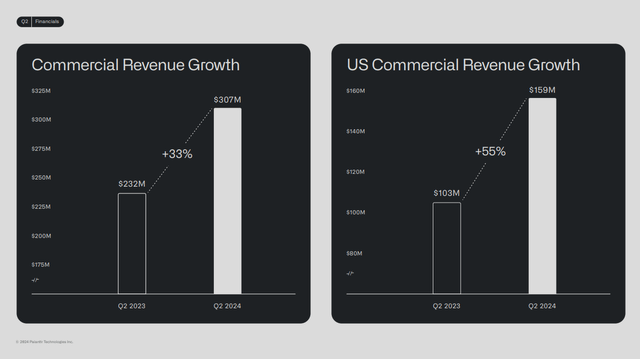

Palantir reported its Q2 FY24 earnings, where total revenue grew 27% YoY to $678M beating estimates. Out of the $678M in revenue, Government revenue accounted for roughly 55% of Total Revenue, growing 23% YoY. But the main hero of this growth story is its Commercial segment which is growing at a faster rate of 33% YoY and accounting for a growing share of Total Revenue when we compare it to the prior year.

Particularly, when it comes to the Commercial revenue segment, its US market saw a growth rate of 55% YoY to $159M. While it saw a slowdown in its growth pace on a sequential basis to 6%, its annual growth rate indicates a reacceleration in trend, boosting investor optimism. This was driven by persistent demand for their enterprise platform, AIP (Artificial Intelligence Platform), that makes artificial capabilities useful to large organizations, providing them with a structural advantage over their competitors.

Q2 FY24 Earnings Slides: Growth of US Commercial Revenue segment

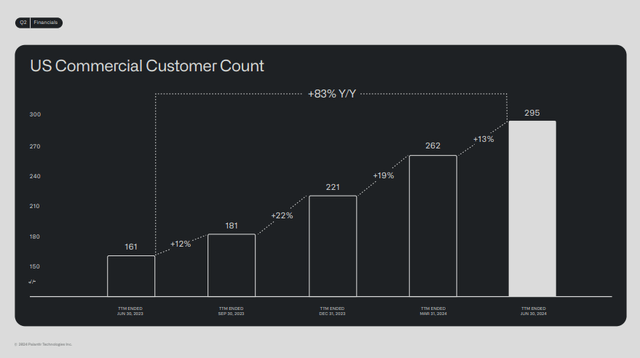

What is even more impressive is that over 4 years ago, Palantir had just 14 commercial customers in the US. With the launch of AIP over a year ago, its US commercial customer count stands at 295, growing 83% YoY, as it captures the enterprise AI opportunity as the management claims that they solve the “prototype to production” problem like no other company.

Q2 FY24 Earnings Slides: Growth rate of US Commercial Customers

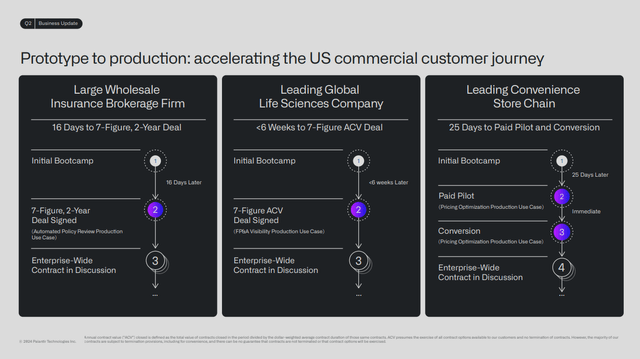

In Q2, the company closed 96 Commercial deals with at least $1M of TCV (Total Contract Value), which grew 45% YoY and 10% QoQ. However, with a closer look at this data point, we can see that the company saw a sequential acceleration in its $5M and $10M deals, which grew 22% and 80% QoQ to 33 and 27 respectively. This is driven by a combination of a higher volume of existing customers signing expansion deals with deepening product-level relationships as well as new customer acquisition where they leverage their go-to-market motion of bootcamps and pilots to accelerate customer journey towards high-value production use cases, with TCV growing 152% YoY in the US Commercial segment.

Q2 FY24 Earnings Slides: Accelerating sales cycle from Prototype to Production

At the same time, Palantir and Microsoft (MSFT) also announced a significant advancement in their partnership in August, where Palantir will deploy their suite of products in Microsoft Azure Government and in the Azure Government Secret and Top Secret Clouds, enabling operators to safely and responsibly build AI-driven operational workloads across Defense and Intelligence verticals for the US government. This should further drive deeper adoption of AIP in the federal sector, thus boosting the top line.

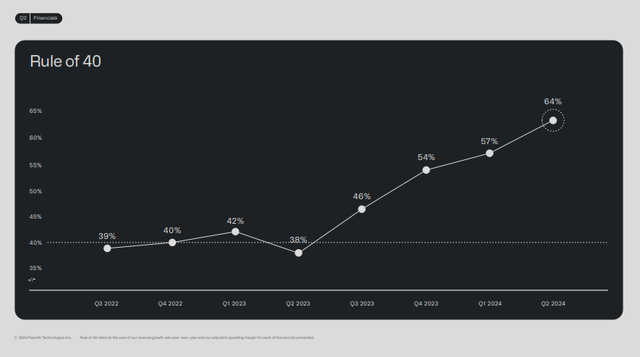

Shifting gears to profitability, Palantir generated $254M in Adjusted Operating income, which grew 88% YoY with a margin expansion of 1200 basis points to 37%. Simultaneously, the company also achieved GAAP operating profitability for the sixth consecutive quarter with a GAAP operating margin of 16%, up 1400 basis points YoY. It is incredible that operating expenses just grew just 6% YoY for the magnitude of revenue growth. In other words, it saw its revenue growth accelerate while expanding margins at the same time, unlocking the “holy grail” in the world of SaaS with a Rule of 40 score from 57 in Q1 to 64 in Q2.

Q2 FY24 Earnings Slides: Smashing the Rule of 40

I believe that this is made possible by its go-to-market strategy, which focuses on AIP Bootcamps and AIPCon that leverages the strength of its product to unlock potential client AI use cases instead of hoarding large numbers of salespeople. So far, with this strategy, it is seeing a steady increase in the number of clients along with existing clients expanding their usage of the platform, with the 12-month revenue from Top 20 customers growing 9% YoY to $57M/customer, thus enabling it to unlock operating leverage.

Despite outperformance, here are 4 reasons to turn cautious on the stock.

I admit, there is a lot to like about Palantir.

However, like I said earlier, while a company may be exceptional, as in this case, it is important not to fall hopelessly in love with the stock.

So, let’s take a look at a list of reasons why it is time to turn cautious on the stock and book some of your profits.

-

International Revenue is a headwind: Although Palantir’s US Commercial Segment is booming, let’s not lose sight of the fact that over 35% of its revenue is generated outside of the US, which is growing at a much slower pace of 15% YoY growth rate. When it comes to its international commercial revenue, it saw a 1% sequential decline because of headwinds in Europe, and the management further pointed out that Q3 FY24 international commercial revenue will remain under pressure.

-

Tougher comps ahead: I am not arguing against the fact that Palantir is doing an impressive job at closing a record number of deals within days or weeks of initial bootcamp given its strength in the enterprise AI landscape. However, if we take a look at the bigger picture, there may be a slowdown in enterprise AI spending, with Gartner throwing in caution, saying that nearly one of every three genAI projects will be scrapped by next year due to escalating costs or unclear business value. This may spell trouble for Palantir, especially if demand peaks and sales cycles start to lengthen amid tougher comps.

-

Short-term glory from the S&P 500 addition is likely to fade: With Palantir added to the S&P 500, it is undoubtedly a validation moment for the company. However, since the announcement that the company has already jumped over 13%, and while historical data is usually in favor of newly added companies outperforming the index in the first three months as asset managers reallocate their portfolios, the boost tends to fade away.

-

Plus, Peter Thiel has also filed to sell up to $1B worth of Palantir shares. This represents close to 1.2% of the stock’s current market cap and therefore may subject the stock to selling pressures.

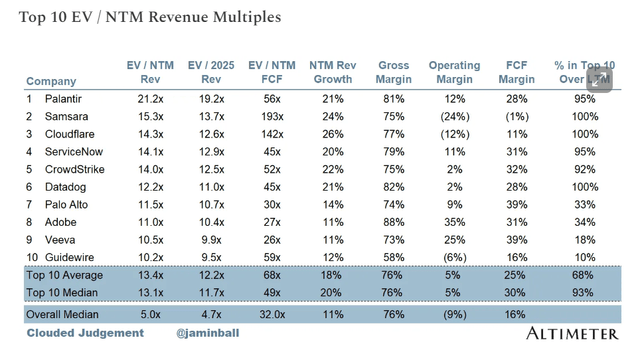

This is the 5th and final reason (and the biggest of them all): Overextended valuation

Palantir currently holds the #1 spot for the most richly valued software company based on its revenue multiple. It is trading at an eye-watering 21.2x NTM revenue, which is a big jump even from the #2 spot of Samsara (IOT) at 15.3x. The same is true even when you look at forward 12-month revenue multiples. Furthermore, this is taking place at a time when the overall SaaS industry has been under pressure over the last year, taking IGV (IGV) as a proxy, which has underperformed the Nasdaq 100.

While one may argue that Palantir deserves a higher premium given its superior fundamentals and business outcomes, its current valuation leaves it highly exposed to downturns to the stock price, especially when we look at revenue multiples relative to revenue growth rates across other companies in the SaaS industry such as ServiceNow (NOW), Datadog (DDOG), CrowdStrike (CRWD), and Cloudflare (NET).

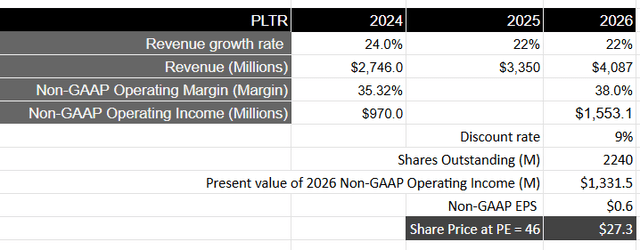

For FY24, the management has raised guidance for both revenue and earnings, where Palantir is now expected to grow its revenues 24% YoY to $2.746B with an Adjusted Operating income of approximately $970M with a margin of 35.3%. However, when we look ahead, we see that consensus estimates point to a revenue slowdown from its current levels in the low twenties range over the next two years.

Taking a slightly higher estimate than consensus at a 22% YoY growth rate over the next 2 years, given the company’s track record of beat and raise, it should generate a total revenue of close to $4B by FY26 as AIP adoption grows among existing and new customers alongside strength in its Government segment.

From a profitability standpoint, assuming that the company can continue to unlock margins by 100 basis points every year over the next 2 years through its efficient go-to-market strategy, it should generate close over $1.5B in Adjusted Operating income, which is equivalent to a present value of $1.3B when discounted at 8%.

Taking the S&P 500 as a proxy, where its companies grow their earnings on average by 8% over a 10-year period, with a price-to-earnings ratio of 15-18, Palantir should command a multiple of 2.5-2.75x, given the growth rate of its earnings during this period of time. This will translate to a PE ratio of 46, or a price target of $27, which represents a downside of close to 20% from its current levels.

My final verdict and conclusions

While this is a higher price target than my previous one, I am changing my rating from “hold” to “sell.” Once again, I am not arguing against the fundamentals, which I think are solid. But, given the stock’s recent spike in price, there are elevated expectations, exposing the stock to more downside than upside, with a possible price volatility of 20% in the short term. While long-term investors may want to initiate a position should that opportunity arise, existing investors may want to trim or sell their positions to book profits at these current levels to avoid the volatility punch ahead.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.