Summary:

- There are numerous red flags indicating that the market’s optimism around Palantir’s stock has reached its absolute peak.

- Insider selling, particularly by CEO Alex Karp, and a high RSI indicate peak market optimism and potential overbought conditions.

- The company’s financials are robust, with strong revenue growth and operating leverage, but stock-based compensation significantly impacts free cash flow.

- I believe current valuation assumptions are unrealistic, suggesting downside potential; I recommend realizing gains now and re-entering later at a better price.

hapabapa

Investment thesis

My previous cautious thesis about Palantir’s stock (NYSE:PLTR) did not age well. The stock soared by 65% since June 11 when my thesis went live. As my readers might remember, I am a Palantir bull from the secular perspective. However, the valuation looked too generous to me back in June.

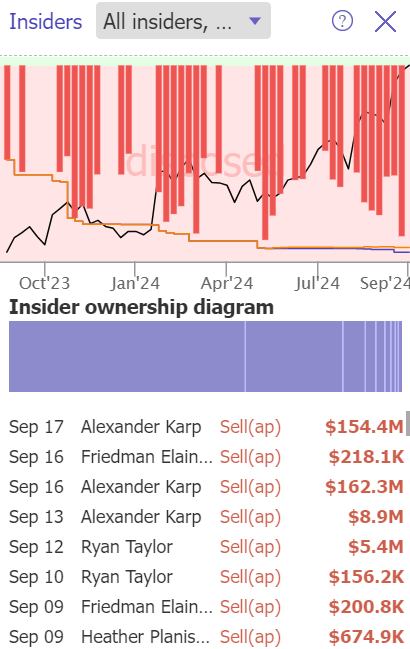

Today, I want to refresh my thesis by sharing insights about recent developments and an updated valuation analysis. Palantir remains extremely strong fundamentally, and the market appears to be ignoring the overvaluation. However, insiders are selling the stock aggressively. The CEO recently sold stock amounting to approximately 7% of his net worth, marking a significant sell-off by a key insider.

This is risky, but I downgrade Palantir to a “Sell” rating because the stock is too expensive even for Palantir. I am trimming my position in the stock because I believe that the market’s optimism is at its peak. I usually don’t try to time the market, but several red flags are evident. This suggests a good opportunity to realize capital gains now and re-enter the position later at a better price in my view.

Recent developments

I want to start with sharing the information about the recent substantial insider selling. As we see below, insiders were not buying the stock at all over the last twelve months. But the much bigger warning sign is that Alex Karp, the CEO, sold PLTR stock worth more than $300 million last week. To understand the context here, I want to emphasize that $300 million represents a large portion of Mr. Karp’s $4.1 billion net worth, and this is a huge red flag for me.

TrendSpider

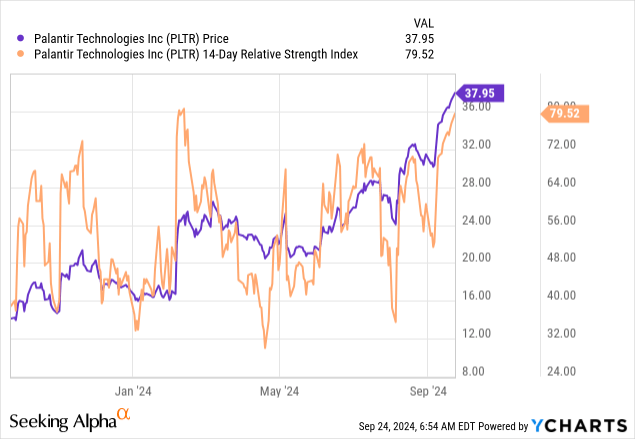

Another red flag is PLTR’s RSI indicator. According to the below chart, the RSI is currently very close to 80. This indicates that the stock is significantly overbought. The last time PLTR reached that high in terms of the RSI was in early 2024, and there was a notable share price pullback after it. Therefore, I think that selling the stock when the RSI is close to 80 is wise.

Please do not misunderstand me, I am not a PLTR bear. I have just emphasized two huge red flags which might mean that the optimism around the stock is highly likely at the peak. In the next few paragraphs, I will explain how positive developments were unfolding recently as well.

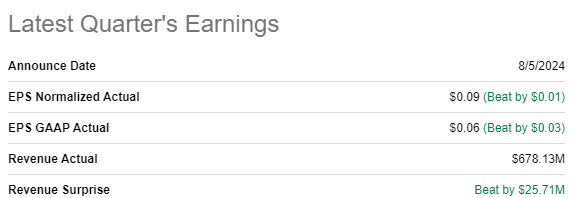

The latest quarterly earnings were released on August 5, surpassing revenue and EPS estimates. Solid revenue growth momentum accelerated with a 27% YoY growth. The adjusted EPS expanded from $0.05 to $0.09 YoY.

Seeking Alpha

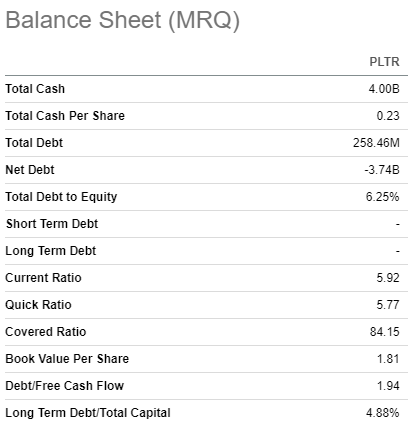

Palantir continued demonstrating impressive operating leverage during the quarter, which fueled the EPS growth. Palantir’s gross margin expanded from roughly 80% to 81% on a YoY basis. The operating margin did extremely well with a YoY expansion from 1.9% to 15.5%. Strong operating leverage enabled PLTR to generate $72 million free cash flow [FCF] during the quarter. On the other hand, the stock-based compensation [SBC] is still high. If we deduct a $142 million SBC during the quarter, the FCF goes below zero. Still, the company’s financial position is extremely strong with a $4 billion outstanding cash balance and only $258 million total debt.

The company’s ample liquidity and almost no leverage is an apparent fundamental strength, as it supports financial flexibility. Being financially flexible is crucial for a growth company as it increases the potential to fuel organic growth, acquisitions, and investing in innovation.

Seeking Alpha

Another important positive factor is that the management continues developing business and working on expanding the footprint. The latest notable contract awards included almost a $100 million five-year contract with DEVCOM Army Research Laboratory. Another contract of almost the same amount was with the U.S. Army to supply user licenses for the Maven Smart System AI tool. On the other hand, these contracts seem less significant when compared to the company’s $85 billion market cap.

To conclude, I still consider PLTR a compelling business with great long-term potential. However, stock price growth is rarely linear, and the combination of a sky-high RSI and substantial insider selling by the CEO suggests that we are likely witnessing peak optimism around PLTR. In my next section, I update the valuation analysis to prove that the market currently prices in assumptions which, I believe, are almost unrealistic to achieve even for Palantir.

Valuation update

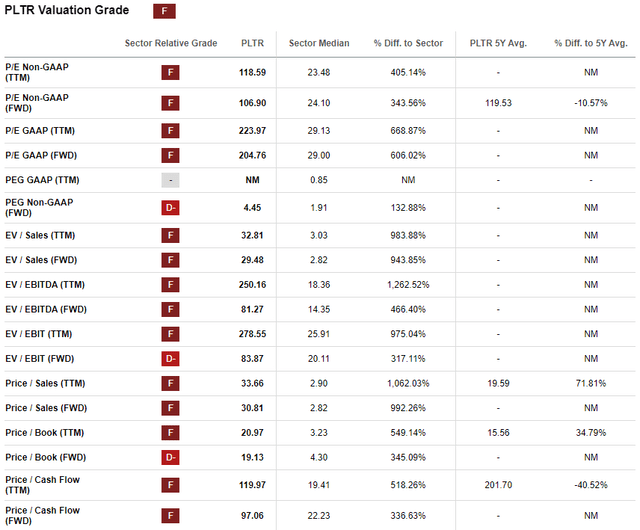

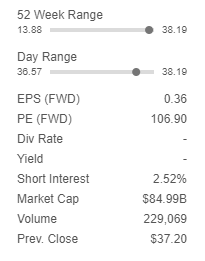

Palantir’s stock price surged by 167% over the last twelve months, beating the broader U.S. market by a wide margin. Performance in 2024 is also impressive, with an immense 121% YTD rally. Palantir’s valuation ratios are inherently high, but at the moment they look way too high even for Palantir. PLTR’s forward Price to FCF ratio of 97 looks extremely high, in my opinion.

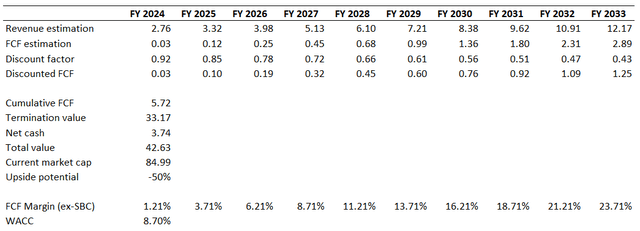

Looking only at valuation ratios is insufficient to value a growth stock in my opinion, especially one like Palantir. Therefore, an update to my previous DCF model is required. I reiterate the same 8.7% WACC, which is a recommended level from valueinvesting.io.

As usual, I rely on long-term revenue consensus estimates for my DCF analysis. Wall Street projects an 18% revenue CAGR for the next decade, which looks fair given strong AI tailwinds and PLTR’s exceptional ability to drive growth. The TTM levered FCF ex-SBC margin is 1.2%, which is the assumption for my base year. Due to Palantir’s historically strong EBITDA growth, I expect the FCF margin to expand by 2.5 percentage points yearly.

According to my DCF simulation number one, the business’s fair value is $43 billion. This is roughly half the current market cap, meaning that there is a large downside potential.

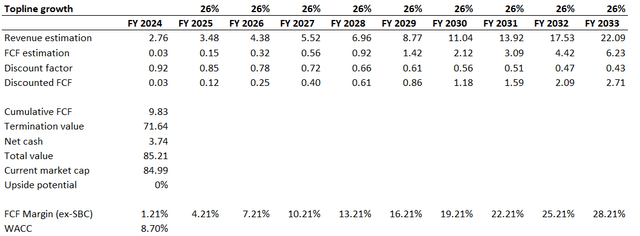

I want to emphasize how sky-high the valuation is by simulating the scenario number two. In order to justify the current $85 billion market cap, I have to incorporate a 26% revenue CAGR and a three percentage point yearly FCF margin expansion. I am not saying that these assumptions are unrealistic to achieve, but these targets are extremely challenging.

All in all, I think that the stock is wildly overvalued. The current market cap looks extremely unrealistic, even for a PLTR bull like me.

Risks to my bearish thesis

The market is rarely wrong, and an insignificant short interest might indicate that I might be missing some strong near-term catalysts. According to Seeking Alpha, the PLTR short interest is only 2.5%. Therefore, it does not look like the market considers PLTR overvalued as I do.

Seeking Alpha

I also have to emphasize readers’ attention that my previous two cautious calls did not age well. As I mentioned in the first paragraph of this article, the stock soared by almost 65% since my previous thesis. Therefore, there is a chance that I might be wrong again.

The Fed recently started cutting interest rates, which is also a big positive factor for all growth stocks. If the Fed moves faster than expected with its monetary easing, this might add more optimism around PLTR.

Bottom line

Palantir demonstrates impressive improvements in its financial performance, which supports my overall bullishness from the long-term perspective. On the other hand, the valuation is so high that I cannot pass up the opportunity to realize my gains and wait for better opportunities to increase my stake again. All in all, I think that PLTR is a “Sell” at the moment.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of PLTR either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.