Summary:

- Palantir delivered strong Q3 earnings, beating estimates and raising FY 2024 guidance, driven by robust growth in both commercial and government segments.

- The recent performance is fueling concerns regarding the firm’s valuation.

- PLTR’s leadership in AI and data management could justify its premium, with significant long-term growth potential, substantial productivity, and cost-saving advantages for its clients.

- Consider dollar-cost averaging if you want to get on the train.

- For those sitting on significant profits, remember that despite PLTR’s strong potential, trees don’t grow to the sky.

Milan_Jovic

Introduction

On 4th October, we initiated on Palantir (NYSE:PLTR) with a BUY rating. In this initiation, we dived deep into PLTR’s history, business model, and disruptive products. We mentioned that the firm has a solid track record and historically worked with reputed U.S. government agencies and major commercial players.

With its Foundry, Apollo, and A.I. platform, we developed our view that PLTR could be a major player in the fast-moving data management industry.

For those who haven’t seen our initiation yet, we invite you to check it out.

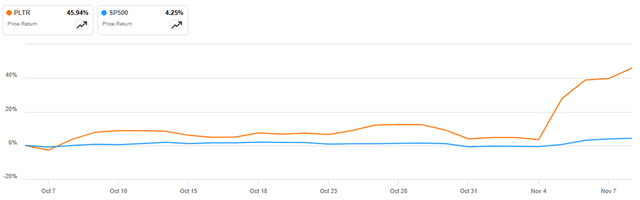

Since our first article, PLTR outperformed the S&P 500 (SP500) by 41.69%.

This outperformance has been mainly driven by the firm’s strong Q3 earnings, with a +23% intraday performance.

This reaction is now driving concern regarding the company valuation.

In this article, we will first examine the firm’s recent earnings. Then, we will discuss valuation and mention what, in our view, could justify it. To finish, we will adopt a more nuanced tone regarding PLTR position within a portfolio and how to manage it.

Q3 Earnings – Beating Expectations and Revising Guidance Upward

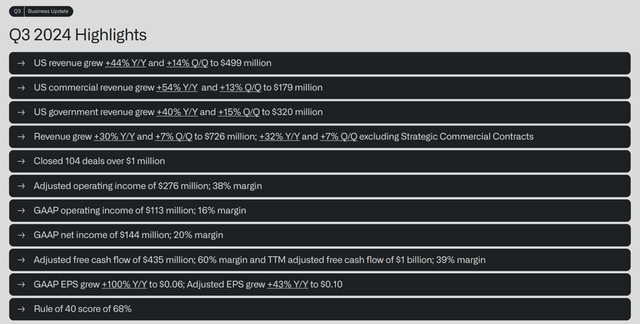

PLTR delivered very strong earnings for Q3 2024. The firm generated $726m in revenue this quarter, up 30% YoY and up 7% sequentially, beating estimates by $22m. On the bottom line, EPS came out at $0.10, beating estimates of $0.09.

The group growth has been strong across all segments. On the commercial segment, growth was close to 27% on an annual basis and around 54% for the U.S. commercial sub-segment.

On the government segment, growth was around 33% YoY, with a 40% YoY growth for the U.S. government sub-segment.

This quarter, the firm generated $435m in cash, a strong cash generation characterized by a 38% operating margin.

Management raised guidance for FY 2024 and now expects revenue to stand at $2 805 – $2 809b. The group was initially forecasting revenues at $2 742 – $2 750b.

Management also expects to generate $1b in cash flow for FY 2024. It guided initially $800m – $1b.

Finally, management increased their adjusted income from operations guidance to a $1.054 – $1.058b from the initial range of $966m – $974m. As the AI revolution is accelerating, this quarter once again shows how solid the demand for PLTR products is, especially in the U.S. commercial segment.

Valuation is Expensive – That’s Factual

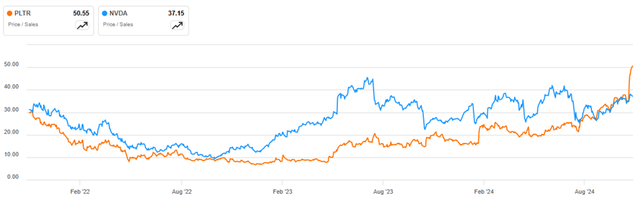

After the recent rally, PLTR valuation has gone through the roof.

The firm now trades at a 50.5 price-to-sales multiple, making it the most expensive company on that metric among the S&P 500.

The second is NVIDIA (NVDA) with a price-to-sales multiple of 37.

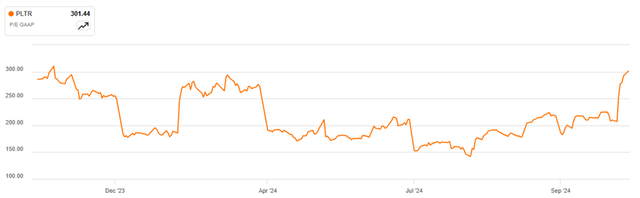

PLTR also has a P/E close to 300.

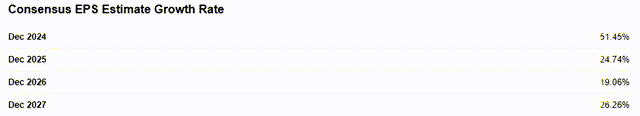

Many consider that for high-growth companies, it is more relevant to take a look at the PEG ratio.

We have done the calculations using the Consensus EPS Estimate Growth Rate.

Even when looking at that ratio, the firm valuation is very expensive.

PLTR trades at a PEG that stands around 13. This implies that for every 1% of expected earnings growth, investors are effectively paying 13 times the company’s earnings.

These ratios show how expensive PLTR is.

But could it be justified? If we believe that PLTR will be one of the main winners of the future multi-trillion A.I. economy, it might be.

In any case, we better manage our position on that name carefully.

That’s what we’ll discuss at the end of this article.

Proven Expertise and Major Triggers Supporting Long-Term Growth

We believe that PLTR is at the forefront of the AI revolution in a “winner takes all” environment.

As many tech companies are developing their own AI models, we think that there is a risk of commoditization that could drive down prices for A.I. software and LLMs. However, thanks to PLTR’s long track record and top-tier AI products, we have the conviction that over the long term, the company will follow a different path.

PLTR was one of the first companies to address the data management market for both government agencies and commercial entities. Even though it has been listed in 2020, this company has been focused on AI since 2003! This experience and all these years of dealing with massive amounts of data are precious for PLTR.

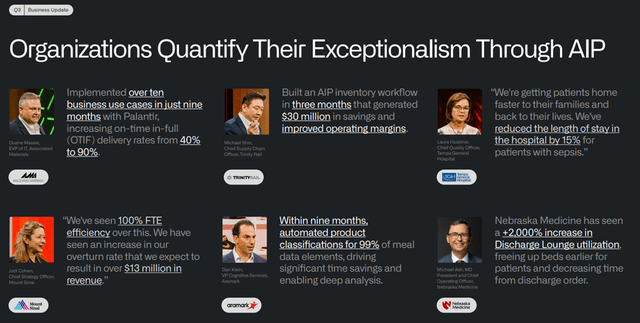

As proof of its superiority, there are clear examples of how PLTR’s products are revolutionizing operations and providing an asymmetrical competitive advantage to its clients.

In this logic, we are confident that PLTR’s software will become a key productivity and cost-saving asset for many companies in the future.

U.S. Government – Concrete Case of Palantir Superiority

Many defense and software companies have worked with the U.S. government but delivered poor results.

Working with the government should imply the highest standards. Yet in practice, many companies treat the government as a “cash cow” once contracts are signed. The government rarely changes its partners or processes, as doing so is time-consuming and inconvenient, despite long-term potential losses.

We think that PLTR has disrupted this trend with its top-tier, transformative products. Recent examples illustrate the critical improvements PLTR’s solutions provide, such as the “Maven Smart System,” which enables targeting operations previously requiring over 2,000 agents. These can now be handled with only 20 agents. This shift implies major time and cost savings, while significantly enhancing military force effectiveness and productivity.

This example can be seen as anecdotal, but it shows, in our view, how massive PLTR improvement can be.

Trump Administration – Reducing Cost, Focus on Efficiency

On the U.S. government segment, which now accounts for 66% of the firm revenue in the U.S., we have the conviction that the Trump administration, influenced by leaders like Elon Musk through the upcoming Department of Government efficiency, will fundamentally change government spending philosophy.

Billions of taxpayer money are lost annually due to bureaucratic inefficiencies. The Trump administration has the goal to address this challenge. In this logic, we are convinced that PLTR solutions will see significant growth and larger adoption across U.S. departments following this logic of reducing costs while improving productivity.

U.S. Commercial – Empowering Businesses With Asymmetrical Advantages

Following its success with government applications, PLTR expanded its focus to the commercial sector. We believe the TAM and growth potential here may be even more compelling, given the high competition and cost-saving imperatives in the private sector.

PLTR has delivered striking examples of its impact, demonstrating how it can revolutionize company processes by exploiting data to give its clients a competitive advantage.

For example, PLTR partnered with one of the largest U.S. insurers, deploying 78 AI agents to automate the firm’s underwriting process. Originally taking two weeks, the process is now reduced to just three hours. This time efficiency provides a significant advantage, allowing this insurer to finalize contracts while its competitors have completed less than 15% of their processing.

You take a look at other organizations’ concrete examples below:

Valuation Considerations – Our take

At its current valuation, PLTR is one of the most expensive companies in the S&P 500. While this may seem high, we believe it’s partly justified by the strength of PLTR’s competitive edge and its leading position in AI-powered data solutions. With an $800 billion total addressable market, PLTR stands out as a “first mover,” known for its unique products, strong experience, and long track record. As PLTR keeps driving real productivity gains and cost savings for clients, we think its high valuation is likely to persist.

However, we remain cautious with PLTR following earnings releases. The company is priced for perfection, as it is expected to be a major leader and disruptor in the AI space. This high valuation means a big responsibility to management and implies a perfect execution.

Conclusion – Manage Your Risk

In just one month, PLTR stock has performed impressively and rose by 45%. Given the factors we’ve discussed before, we’re maintaining our BUY rating, but we encourage readers to stay cautious.

With 55% of PLTR shares held by retail investors, there’s a chance that more people who missed the initial rally will want to jump in now. For those looking to start a position, we recommend doing so gradually, using a DCA approach.

For those sitting on significant profits, remember that despite PLTR’s strong potential, trees don’t grow to the sky. Don’t get too attached to your holding, stay rational, and consider taking some profits. In this logic, we advise you to consider reasonable levels where you might gradually reduce your position.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.