Summary:

- Palantir Technologies Inc. is uniquely positioned in the AI rally, avoiding the cyclical nature of hardware-focused companies.

- The company is already implementing large language models and driving real-world value with diverse applications.

- Palantir’s recent uptick in results and customer growth indicate potential for future top-line growth and margin expansion.

- Despite these recent positive developments, we believe that from a fundamental point of view shares are priced for perfection even in an optimistic scenario.

Eugene Mymrin/Moment via Getty Images

Investment Thesis

In the world of booming equity markets, AI being the topic du jour, and companies like Nvidia (NVDA) reaching multi-billion dollar valuations at a record pace, our nature has generally been to question the current narrative. Overall, we began to assess whether valuations, even allowing for tremendous growth, remain justified at current levels.

Interestingly enough, Palantir Technologies Inc. (NYSE:PLTR) was actually one of the first companies we identified before ChatGPT and the AI hype we find ourselves in now, as we felt that future developments in the sector were probably not yet priced into the stock when it was trading below $10 per share. However, after being up 309% since all-time lows in early 2023, we believe the fundamental picture has changed and that even despite the predicted AI tailwind we take into account in our rating, the stock price is likely ahead of the curve, citing certain red flags and fundamental metrics.

Evaluating AI Tailwinds

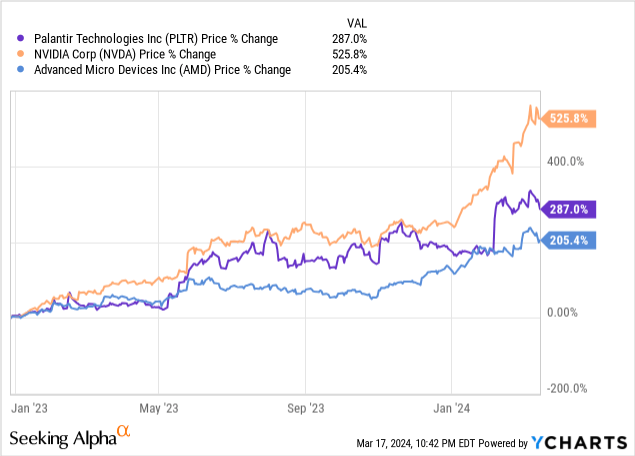

In assessing Palantir’s AI tailwinds with their AIP products, we would first like to highlight the fact that Palantir occupies a unique position in the current AI rally. Unlike other hardware-focused players who are leading this AI rally, such as Nvidia, Advanced Micro Devices (AMD), Taiwan Semiconductor (TSM), and others, we think Palantir is less caught up in the cyclical nature of these companies, which could in our view soon face a GPU glut as interest in AI wanes and the hype cools down.

In this sense, Palantir is quite unique in the sense that it is fairly detached from a potential AI bubble and can benefit from the recent hype without experiencing the cyclical nature of the chip industry, and enjoys very stable revenues from contracts already in place with government agencies and major commercial players. Moreover, Palantir is also already implementing AI and creating real value by concretely implementing large language models to increase productivity with real-world applications. They demonstrated this at AIPCon last week and showed some recent applications that were quite diverse, from the legacy Lowe’s (LOW) retail chain to new concept technologies such as eVTOLs with Archer Aviation (ACHR).

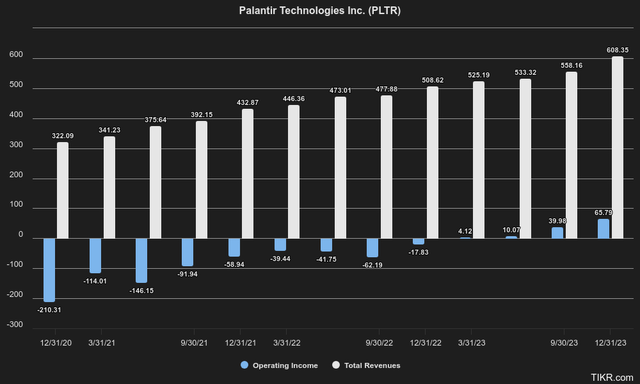

We can see that in recent quarters Palantir is not only re-accelerating top-line revenue growth, but also achieving operational leverage as recent operating margins have risen from negative to a stellar 10.8%. This contrasts with other major tech players who are currently investing heavily in hardware and building large language models, pouring billions into R&D in the hope that future products and revenue streams will be derived from these models.

Latest Q4 results also confirmed the recent uplift in results mostly as a result of the uptick in US Commercial customers which was up 55% YoY, or jumped from 181 customers to 221 last quarter. We believe there to be a lot of future leverage to be left in terms of top line growth as well as margin expansion on the already existing customer base which has notably widened.

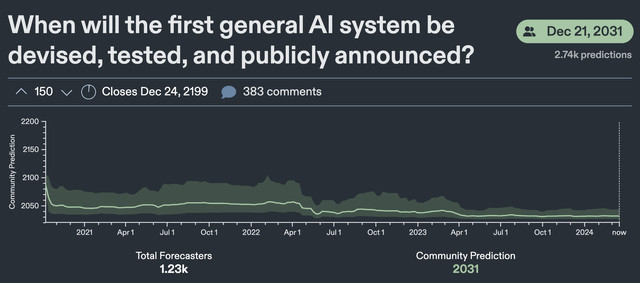

But going back to assessing AI tailwinds, we’ve previously successfully forecasted the advancements in AI using Metaculus, which is a platform that aggregates quantitative predictions from a large community to optimally predict future events. One of the largest polls which asks the question of when the “first general AI system be devised, tested, and publicly announced,” and is currently at December 2031. Before the rally in AI stocks, we saw this timeline shrink from around 2050 to 2030 right up until April 2022 and gave us the judgement that market participants were underpricing future developments in AI. During the recent AI rally, however, over the last 24 months, the timeline has remained fairly flat after the introduction of ChatGPT.

This in our eyes means that the aggregate market has finally caught up with AI developments, and likely has priced it in fully in current valuations. This also means that if we were to be in a potential AI Bubble like the dot-com bubble, we believe it to be likely more the later stage of a bubble, prompting us to be rather held back on buying after the recent rally and would wait for more breakthroughs in the AI space for confirmation.

On the government side, Palantir has been crushing AI developments, for example, with Project Maven already at the forefront of AI warfare being used on the battlefield. Earlier this month, Palantir also surprised positively by winning the U.S. Army’s 2-year TITAN contract worth $178 million, which is surprising given also the hardware nature of the project and the fact that the government chose Palantir over Raytheon (RTX).

The Fundamental Picture

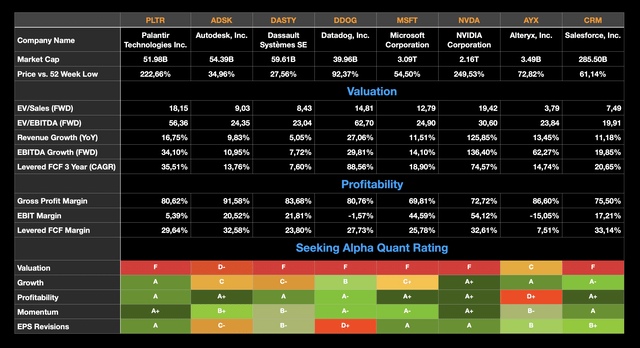

Fundamentally, we believe Palantir’s fundamentals may not currently outweigh the AI windfalls mentioned above. From a relative valuation perspective, we listed a number of metrics and determined that, in our opinion, Palantir remains very expensive at 18.15x forward EV/Sales ratio and 56.36x forward EV/EBITDA. We consider this very expensive despite revenue growth of 16.75% compared to other competitors in the software/ AI space such as Alteryx (AYX), Salesforce (CRM) and Microsoft (MSFT), which have similar growth characteristics but generally trade at less than 25x EV/EBITDA.

Author’s Visuals, Seeking Alpha Data

Even Nvidia, which has a $2.16 trillion valuation, currently sits at an EV/EBITDA ratio of 30.60x forward with triple-digit ratios in terms of revenue and EBITDA growth. However, Palantir’s valuation could soon become more reasonable as EBIT margins increase and finally move closer to the software industry average.

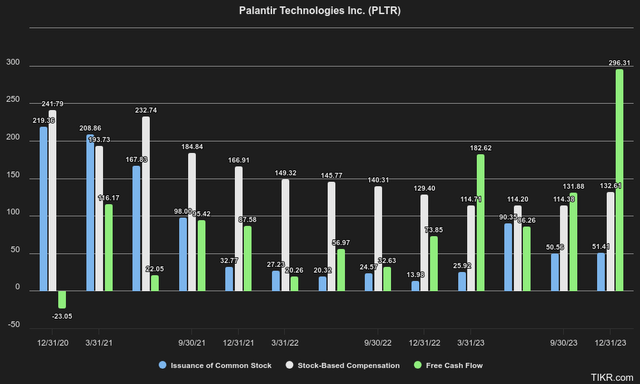

These numbers seem relatively optimistic, however, as we prefer to define Palantir’s true profitability as its current ability to generate free cash flow minus share-based compensation. We believe this is a metric that reflects Palantir’s true profitability, given the large nature of stock-based compensation and insider sales, which we will discuss in a moment. Although this metric gets better each quarter, in the fourth quarter Palantir brought in $296.31 million in FCF, but still issued $132.61 million in stock-based compensation. That leaves $163.7 million in adjusted FCF or an annualized rate of $654.8 million. If we convert this to a multiple, the stock stands at 79.38x adjusted free cash flow, which we still think is pretty exuberant despite an expected revenue growth rate of nearly 20%.

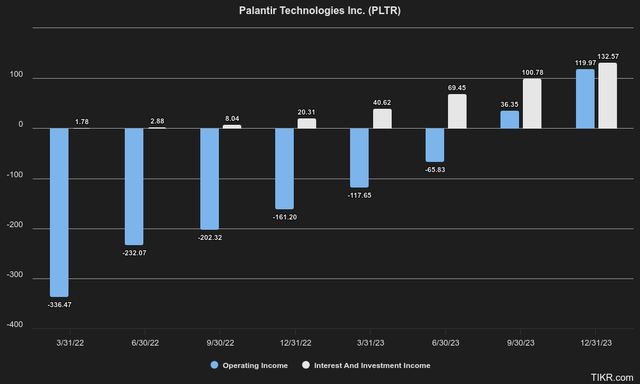

From an operating income perspective, Palantir is currently trading at 197.52x annualized Q4 operating income, which clocked in at $263.16M, which may come as a surprise to some as it is trading at a lower P/E ratio of 122.31 based on Q4 annualized net income of $425M. Something that many analysts actually overlook is, the fact that in the fourth quarter, beyond the $65.79 million in operating income, Palantir generated $44.55 million in interest and investment income from securities such as U.S. Treasuries from Palantir’s $3.67 billion Total Cash And Short Term Investments, combined with the fact that Palantir has hardly any debt.

Over the past 12 months, Palantir actually generated more money from their balance sheet in terms of interest income than they generated income from operations. Which makes sense, given rising interest rates over the past 2 years, with the yield on 2-year U.S. Treasuries rising from nearly 0% to 4.73%.

Currently, Palantir is expected to generate somewhere north of $170-$180M in interest income on their $3.67B of cash and short-term investments. At the core profitability level, even if we were to value Palantir on its gross profit, it still trades at a staggering 26x Q4 annualized gross profit.

More Red Flags

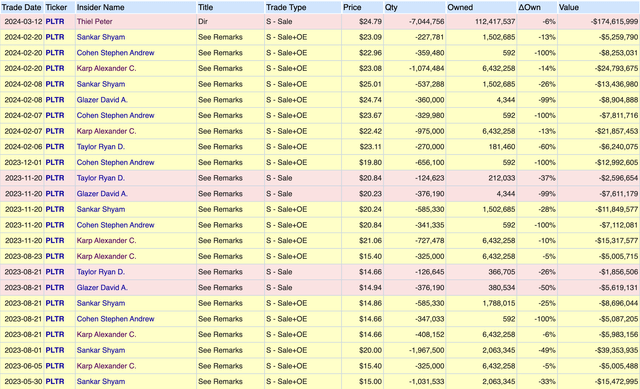

To dig deeper into stock-based compensation, we discount this factor when valuing Palantir, given both the nature and magnitude of stock-based compensation. Over the past 12 months, stock-based compensation amounted to a whopping $475.90M, and according to our calculations, insiders have sold/exercised stock options for more than $452M.

Since in our view insiders use stock-based compensation almost as a salary, it is quite essential to the profitability/functioning of the organization to retain talent as a software company. While CEO Alex Karp’s shares are stagnant, he still exercises options and sells shares for tens of millions of dollars a year, which has a dilutive effect for existing shareholders. On the other hand, share-based compensation has gradually declined over the past 2 years, while free cash flow has increased, which we see as a very positive development.

One of Palantir’s founders, Peter Thiel, also sold $174.6M worth of shares, or about 6% of his total holdings, which we would also regard as a red flag. It is unknown why he sold shares, but we think it is probably overvaluation, as Peter Thiel has a net worth of $7.2BN, making it quite unlikely in our judgment that the sale was for liquidity reasons. Palantir itself also issued more shares when the share price rose in 2021 and 2023 instead of raising capital through debt issuance and despite the fact that the company already had ample liquidity on its balance sheet and was cash flow positive.

In 2022, for example, very little capital was raised through the issuance of common stock when the share price was depressed. This was also at a time when we believed the company was undervalued, and we gave a buy rating when the stock was trading below $10. All these insider sales, along with the issuance of more common shares, also give us negative signals about the people closest to the business and indirectly express in their actions that shares are likely to trade at a premium.

The Bottom Line

In July 2022, when Palantir was trading at $9.76 per share, well before the release of ChatGPT and the general hype around AI, we gave our opinion that investors might underestimate Palantir’s AI potential. Since this article, our idea has generated a significant alpha of 140.68% versus 32.61% for the S&P 500 (SP500).

However, the recent price action has caused us to reconsider our rating and ultimately change it from “Hold” to “Sell,” as we believe the current AI tailwinds may not outweigh the premium valuation Palantir is currently trading at. In a perfect scenario, with annualized revenue of 2.43 billion in Q4 and hypothetical EBIT margins of 45%, which is close to Microsoft’s margins and well above the industry average of 25.30%, Palantir would generate $1.10 billion in EBIT. Even if in an optimistic scenario where we forecast 30% revenue growth due to AI windfalls, at 1x Price to Earnings to Growth (PEG) or an EBIT multiplier of 30x, we are left with a valuation of 32.85BN or about $14.86 per share.

As Warren Buffett and Charlie Munger famously stated, investors should seek to buy great companies at fair prices. We believe Palantir is an absolutely great company, given the sticky nature of their revenue streams, the fact that they are fairly recession-proof, have a strong cushion with their balance sheet and have a great product offering. But as things stand now, we believe the shares are priced close to perfection.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.