Summary:

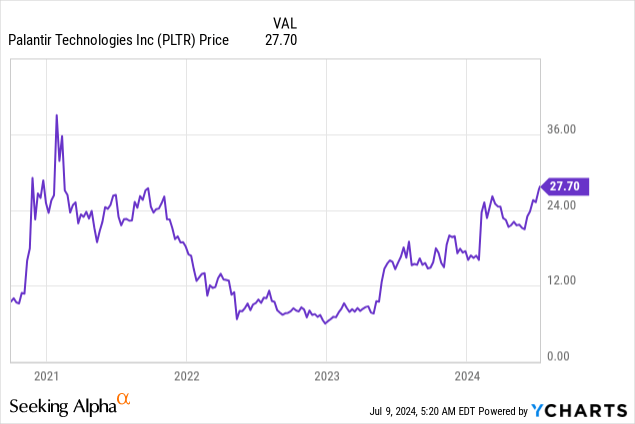

- Palantir stock has surged over 60% year to date, driven by AI enthusiasm and US government business growth.

- Though the stock is trading at over 20x current year revenue, I recommend continuing to hold for further upside.

- The company is re-accelerating its government business, which continues to deliver more than half of Palantir’s revenue.

- The company also notes that “bootcamp” style trials for Palantir products have helped to compress sales cycles, whereas many software peers are reporting deal cycle elongation.

Michael Vi

Without a doubt, the single best-performing stock in my portfolio over the past quarter has been Palantir (NYSE:PLTR). Fueled by rabid AI enthusiasm and a re-acceleration in its all-important US government business, Palantir has been on a tear since reporting Q1 results.

Year to date, the stock is now up more than 60%. With such a sharp rise in so short a time, naturally investors should re-assess their positions to see if it makes sense to keep holding.

This is not a short-term trade, but a multi-year investment to hold on to

I last wrote a bullish opinion on Palantir in March, when the stock was still hovering in the low $20s. And despite the sharp gains in the stock since then, it’s not just sheer stubbornness that has kept me holding Palantir since I got in sub-$10 immediately after its IPO: its conviction that the company will continue to grow at a ~20% clip and continue filling its massive global TAM. In short, I’m retaining my buy call on Palantir.

To me, there are very few companies that have cracked the code on near-universal applicability as Palantir has. The company’s big-data mining capabilities touch companies of all industries as well as governments: and amid the recent urgency to invest in machine learning and AI-driven technologies, Palantir’s pipeline has never looked fuller.

Here’s my full long-term bull case for Palantir:

- Palantir’s AI/big data applications have limitless capabilities and use cases. Palantir isn’t a software company that serves only one or a limited set of use cases. Data and inferences that can be made from data are prevalent in just about everything: which explains why Palantir is such a powerful tool for both public and private sector clients. Big data is also the feeder to AI, as the two work hand in hand.

- Stepping up go-to-market momentum, especially in the commercial segment. Palantir is chasing growth across a wide variety of channels. The company has stepped up its sales hiring, a nod at the broad market opportunity it has and the need for more territory coverage. Palantir has also deepened relationships with ISVs (integrated service vendors) that can resell Palantir’s products without its involvement and offer additional coverage that Palantir’s direct sales force can’t handle. The company’s growing base of commercial revenue also proves that there is plenty of untapped market opportunity even in the small/midsize business space.

- Best in breed- While there are now dozens of prominent AI companies in the market and many more that claim to be AI specialists, very few companies have Palantir’s cachet, especially with its reputation of working for high-clearance U.S. government and military projects.

- Free cash flow and GAAP profitability- Palantir has maintained GAAP profitability for several quarters and continues to generate healthy free cash flow, which means the business is self-financing (a departure from many other rapid-growth software companies that continue to need to raise capital to finance their losses).

- Fortress balance sheet- Palantir has over $3 billion of net cash on its balance sheet, which gives it plenty of financial flexibility to pursue buybacks and acquisitions for growth if it so chooses.

The trade-off we need to live with: valuation

The big concern here for Palantir isn’t so much a fundamental risk (the company’s growth trajectory seems to bear no headwinds, and it’s already profitable and becoming even more so), but a valuation concern. I’ll be the first to admit that I’m slightly uncomfortable holding a stock that commands such premium, top-of-market-cycle multiples.

At current share prices near $28, Palantir trades at a market cap of $61.69 billion. After we net off the $3.87 billion of cash (against no debt) on Palantir’s most recent balance sheet, the company’s resulting enterprise value is $57.82 billion.

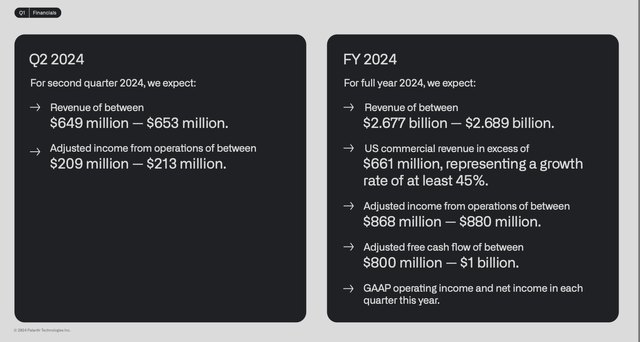

Meanwhile, for the current fiscal year FY24, Palantir has guided to a revenue range of $2.677-$2.689 billion, which represents 20-21% y/y growth and a boost from the company’s prior outlook of 19-20% y/y growth. And looking ahead to FY25, Wall Street analysts have a consensus target of $3.26 billion in revenue, or 21% y/y growth.

Palantir outlook (Palantir Q1 earnings deck)

This puts Palantir’s valuation multiples at:

- 21.5x EV/FY24 revenue

- 17.7x EV/FY25 revenue

Needless to say, very few companies can command premiums this exorbitant. But when my confidence in Palantir is over a multi-year stretch as it grows to become a future tech mega-cap, I’m willing to forego my usual inclination to time my purchases and hold on to this stock for the long haul.

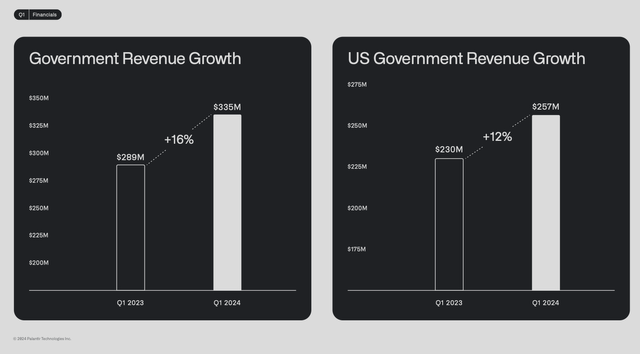

Acceleration in U.S. government revenue is the highlight in Q1

Luckily, Palantir’s latest Q1 results gave us plenty of reasons to defend the stock’s premium valuation.

The number-one highlight to call out is re-acceleration in the U.S. government business, which saw a temporary slowdown in growth toward the back half of FY23.

Palantir Q1 government results (Palantir Q1 earnings deck)

Government revenue grew 16% y/y to $335 million, which accelerated four points ahead of 12% y/y growth in Q4. This was driven in particular by the U.S., which is the lion’s share of government revenue: up 12% y/y to $257 million, where growth rates doubled relative to 6% y/y growth in Q4. Unfortunately, given the size of the government business (contributing to over half of current revenue), Palantir will likely always have a lumpier business than most other software companies.

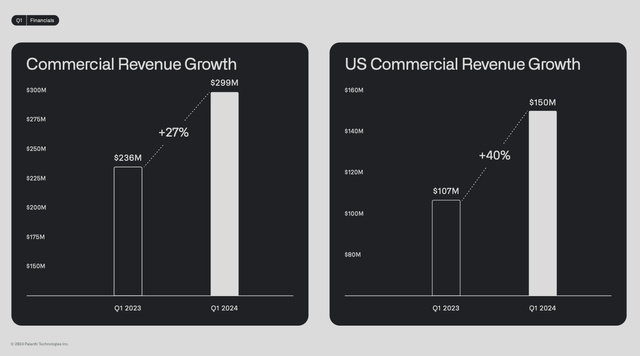

The biggest growth vector for Palantir, however, is in enterprise, where revenue grew much faster than the government segment, up 27% y/y to $299 million. Again the U.S. paved the way, with 40% y/y revenue growth.

Palantir Q1 commercial results (Palantir Q1 earnings deck)

Increased urgency of investing in AI solutions has driven very strong demand for Palantir’s AiP solution. But part of the company’s success also owes to new sales initiatives as well. The company has begun rolling out “bootcamp” programs for prospects interested in adopting Palantir products, which the company has noted has been very substantial for conversion rates.

And whereas many software rivals are reporting elongation of deal cycles from higher budget scrutiny in the current macro environment, Palantir’s Chief Revenue Officer Ryan Taylor noted the opposite on the Q1 earnings call (key points highlighted below):

While still early days, our focus is on building the foundations of a long-term business. We intend to relentlessly continue landing new customers and subsequently expanding those engagements as our products gain traction and have meaningful impact within enterprises. Not only are we increasing the volume of new customers, but I’m pleased with our ability to grow these new customers as well.

With regards to landing new customers, we’ve sustained our high volume of bootcamps with over 915 organizations participating to date to meet inbound demand. We are also seeing substantial deal cycle compression. As one example, a leading utility company signed a seven-figure deal just five days after completing a bootcamp. Another customer immediately signed a paid engagement after just one day of their multi-day bootcamp and then converted to a seven-figure deal three weeks later. We expect the favorable unit economics and higher throughput to continue to accelerate our business.”

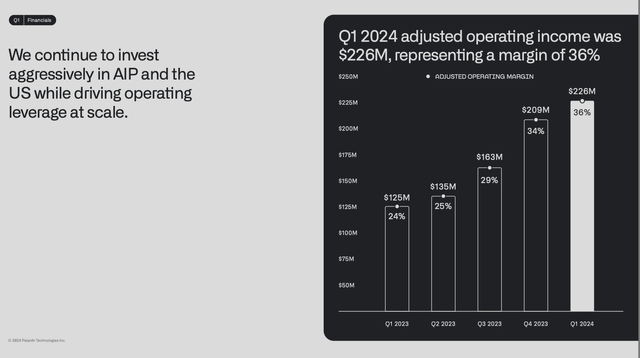

Palantir is achieving this very profitably as well. The company saw adjusted operating margins tick up to a record high of 36% in the quarter, up 12 points y/y.

Palantir operating margins (Palantir Q1 earnings deck)

Given the recent success of these bootcamp programs and the company’s bullishness on its opportunities in the U.S. for both its commercial and public sector segments, Palantir does plan on investing more into U.S. sales resources in the back half of the year, so we’ll need to monitor any resulting impact to the company’s progress on margins.

Key takeaways

In my view, Palantir’s penetration into its overall market, especially in the enterprise, is still nascent: which is why I’m willing to accept holding on to a stock with a tremendous valuation premium for the long haul. I wouldn’t necessarily add to an existing position at these levels nor would I be overly exposed to this stock (not more than 5% of your portfolio), but the stock still has plenty of catalysts under its sails to continue propelling this rally.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of PLTR either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.