Summary:

- Palantir’s earnings surged, pushing its market cap towards $100 billion, driven by strong AI capabilities and rapid customer turnaround in diverse industries.

- The company achieved 44% YoY U.S. revenue growth, with commercial revenue outpacing government revenue, and a GAAP net income nearing $600 million.

- Palantir boasts no debt, $4.6 billion in cash, and a 1.6% annual adjusted FCF yield, with expectations of continued revenue and margin growth.

- Despite valuation risks, Palantir’s impressive AI-driven portfolio and profitability make it our top tech pick for the 2020s.

Michael Vi

Palantir (NYSE: NYSE:PLTR) had great Q3 earnings, moving up by double-digits after hours and pushing the company towards a $100+ billion market capitalization. The company has more than doubled since we made it our top technology pick of the 2020s, and despite being all-time highs, the company’s positioning makes it a great opportunity.

Artificial Intelligence and Palantir

The question around AI isn’t just its power. It’s how do companies that are not on the forefront of tech, companies that aren’t Meta and Google, use AI.

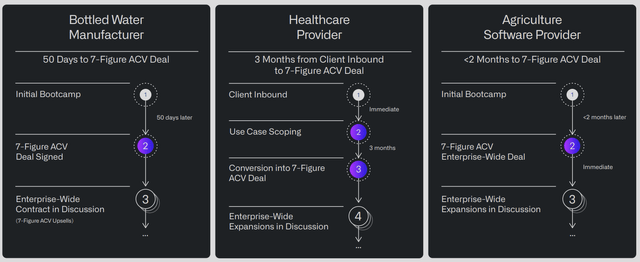

Palantir Investor Presentation

Our central thesis is around the fact that for these hundreds of other companies generating massive amounts of data and not knowing what to do with it, Palantir can be helpful. The company’s bootcamps and existing portfolios can show immediate and quick returns, and the company has become incredible at turning around customers.

The above chart shows how the company in 3 different industries managed to get 7-figure deals with a quick turnaround.

Palantir Financial Performance

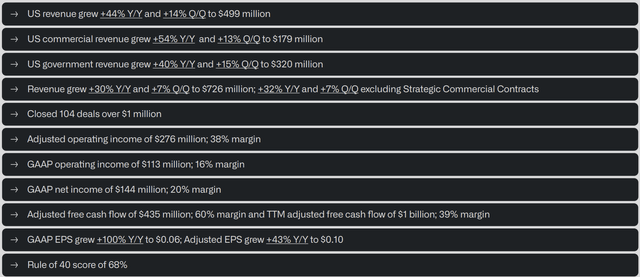

The chart below shows the company’s continued financial strength.

Palantir Investor Presentation

The company saw 44% YoY growth in U.S. revenue and 14% QoQ growth to roughly $2 billion annualized. The company maintains an incredibly strong government division, which is the majority of revenue here. However, YoY the company’s commercial revenue grew even faster, showing its ability with companies that could move quicker.

Overall revenue is now close to more than $3 billion annualized with 30% YoY growth. The company closed 104 deals with >$1 million, and it has pushed up to a 20% margin. The company’s GAAP net income is almost $600 million annualized, and the company’s TTM adjusted FCF crossed $1 billion. The company’s revenue growth has maintained strong margin here.

The company’s GAAP EPS doubled YoY and the company’s adjusted FCF yield is now 1.6% annualized. That comes with a rule of 40 score of 68%.

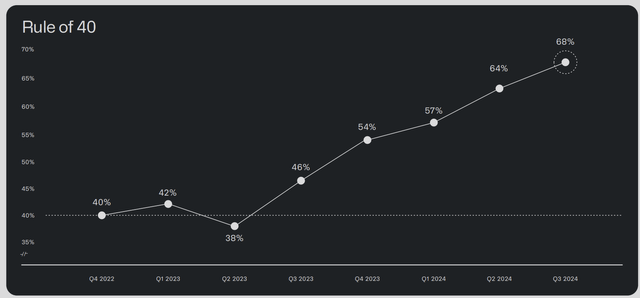

Palantir Financial Growth

The Rule of 40 is the company’s combined revenue growth rate and profit margin should be at least 40%.

Palantir Investor Presentation

The company has managed to consistently grow, taking advantage of artificial intelligence, and the company’s current score is 68%. That number has been trending up, and it’s incredibly impressive to see. The company’s growth in margins should lead to increased cash flow and the company’s ability to both justify and grow its valuation.

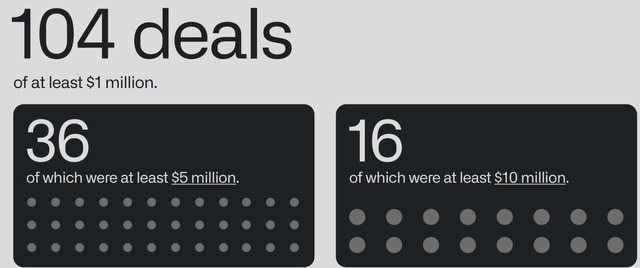

Palantir Investor Presentation

Enterprise deals are sticky, but the company’s B2B pipeline was always slow to ramp up. Artificial intelligence and the goal of companies to not miss out has changed that narrative, and it’s enabling slow-moving organizations to finally come to work with Palantir. The ramping scale of the company’s deals have been enormous.

More importantly, the company has been able to not only grow its number of customers, it’s been able to grow its average revenue per customer. With 36 deals of at least $5 million and 16 deals of at least $10 million, the company is seeing large deals with a number of customers. This will be essential for the company’s future success.

Palantir Shareholder Returns

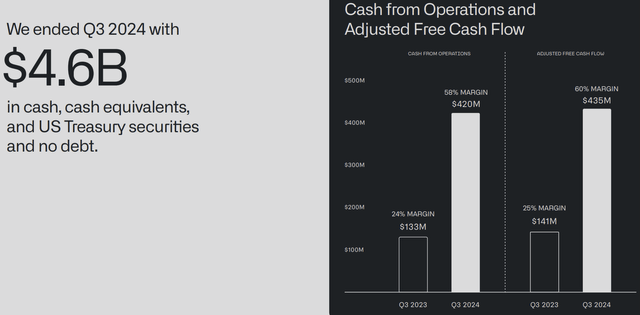

Palantir is no longer losing money, in fact, they’re starting to generate a substantial and growing amount of cash flows.

Palantir Investor Presentation

The company has no debt and $4.6 billion in cash and cash equivalents. The company’s adjusted FCF margin has increased substantially, and the company is now sitting at a ~1.6% annual adjusted FCF yield based on the most recent quarter annualized. The company has more than doubled margins and more than tripled FCF YoY.

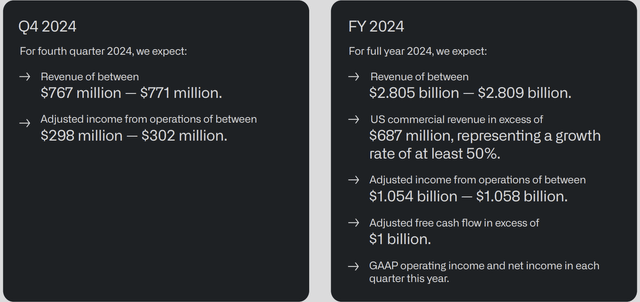

Palantir Investor Presentation

For the 4th quarter, the company expects to see continued improvements. The company’s revenue in the most recent quarter was $726 million and the company expects that to hit $770 million with almost 10% QoQ growth. Adjusted income from operations will grow to ~$300 million, roughly 10% growth from $276 million.

For the financial year, the company expects >$1 billion in adjusted FCF and $2.8 billion in quarterly revenue. While 60% margins means the company can’t double its margins again, growing revenue will still enable the company to have strong FCF. That will enable the company to be able to generate lofty shareholder returns.

Thesis Risk

The largest risk to our thesis is Palantir’s valuation. At $100 billion in market cap, and to continue driving future returns, the company needs to grow its FCF by several multiples. That’s a lofty target for the company, and if it fails to achieve that, its share price could drop substantially, hurting its ability to drive future returns.

Conclusion

Palantir has an impressive portfolio and the company has continued to perform incredibly well in the day of artificial intelligence. The company’s data offerings are incredibly interesting for non-leading tech companies that don’t have the ability to build their own AI and figure out all of the different uses completely independently.

The company has managed to quickly become profitable, and it’s generating strong and growing FCF. While margin growth will slow down, revenue growth remains strong going into the end of the year. The company remains our top tech pick of the 2020s, and we expect its strong returns to continue. Let us know your thoughts in the comments below.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of PLTR either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

You Only Get 1 Chance To Retire, Join The #1 Retirement Service

The Retirement Forum provides actionable ideals, a high-yield safe retirement portfolio, and macroeconomic outlooks, all to help you maximize your capital and your income. We search the entire market to help you maximize returns.

Recommendations from a top 0.2% TipRanks author!

Retirement is complicated, and you only get once chance to do it right. Don’t miss out because you didn’t know what was out there.

We provide:

- Model portfolios to generate high retirement cash flow.

- Deep-dive actionable research.

- Recommendation spreadsheets and option strategies.