Summary:

- Palantir Technologies Inc.’s outperformance has continued to baffle me as the stock outperformed.

- Palantir’s Q3 earnings release has silenced its doubters, justifying its business model and go-to-market strategy.

- Palantir’s differentiated AI growth strategy and rapid prototype-to-production capability have proved effective.

- However, Palantir Technologies’ forward adjusted earnings multiple of more than 140x suggests the market has gone FOMO, understating downside risks.

- I argue why investors should consider taking some risks off the table, as the party is likely to run late.

Michael Vi

Palantir: AI Train Carries On. But, For How Long More?

The Palantir Technologies Inc. (NYSE:PLTR) AI train has shown no signs of stopping anytime soon, as the AI data analytics and platform company recently delivered another stellar earnings beat. In my previous PLTR article, I highlighted my deep concerns about the sustainability of its frothy valuation. Even though the company has demonstrated the viability of its business model, I assessed that the market has gone FOMO on the stock. However, PLTR has outperformed the S&P 500 (SPX, SPY) since then, downplaying my concerns.

In Palantir’s Q3 earnings release, the AI platform company delivered a remarkable double beat on revenue and adjusted earnings. In addition, it also posted solid guidance that sent Wall Street scrambling to upgrade its price targets. Hence, it’s increasingly clear that Palantir’s ability to “eviscerate” bearish prognosticators was likely understated. Why?

AI investors should be cognizant that the AI infrastructure investments theme has benefited the picks-and-shovels play like Nvidia (NVDA), TSMC (TSM), Arista Networks (ANET), Vertiv (VRT), and its leading peers. As a result, their respective stock has also outperformed the market, as the AI CapEx growth story has indicated little signs of stopping. Hyperscaler and data center operators are expected to continue investing aggressively through the end of the decade. AMD’s (AMD) updated forecast suggests a 60% CAGR in AI accelerators TAM through 2028, reaching $500B. Hence, AI infra investment opportunities have been bolstered, as Morgan Stanley expects hyperscaler CapEx to hit $300B in 2025.

PLTR And Software Stocks Outperformed

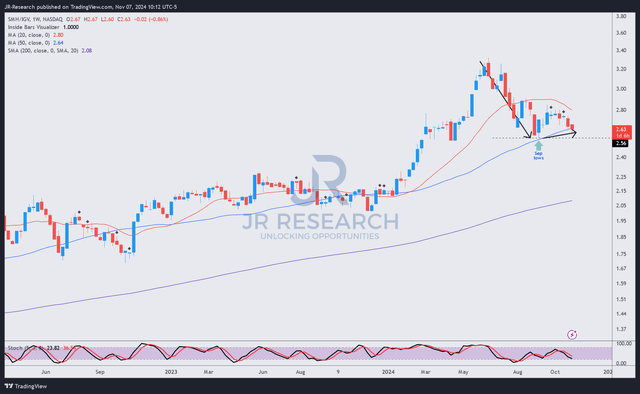

SMH/IGV price chart (weekly, medium-term, adjusted for dividends) (TradingView)

Semiconductor ETF investors (SMH, SOXX) outperformed its software peers represented in the iShares Expanded Tech-Software Sector ETF (IGV) until SMH/IGV peaked in June 2024. However, semi-stocks have lost relative traction since then, as IGV regained momentum, reaching a new high in October 2024.

Therefore, the market’s momentum seems to have shifted toward software companies, indicating the market’s rising confidence in their ability to monetize AI. Consequently, it has made PLTR’s outperformance against the IGV since December 2022 even more staggering. Recent reports suggest that traditional enterprise software companies could face increased pressure for possible IT budget cuts in favor of more investments in Generative AI projects. While top enterprise companies like Salesforce (CRM), Microsoft (MSFT), and ServiceNow (NOW) are behemoths in their own right, possible budget reallocation could affect their growth cadence.

Palantir’s pure-play AI growth opportunity has afforded it a possible best-in-class AI play compared to its enterprise software peers. Furthermore, PLTR’s position within the value chain is highly differentiated, focusing on its ontology to deliver a high utility and value proposition of AI deployment within multiple industry verticals. Given its data analytics opportunity, its ability to avoid the commoditization of large language models (“LLMs”) should assure investors about the company’s ability to grow its margins. In addition, Palantir’s growing commercial segment has strengthened its diversification, augmenting its AI growth thesis ahead of its enterprise software peers. Hence, it has demonstrated the company’s ability to scale quickly through its modular go-to-market strategy. It has also allowed Palantir to possibly avoid the rearchitecting of the IT cost base by its customers as companies reassess their focus on traditional IT projects against Gen AI ones.

Moreover, Palantir has demonstrated its ability to deliver prototypes to production quickly, resulting in high deal values. Hence, the market has likely raised its confidence in Palantir’s ability to secure potentially more significant opportunities, demonstrated by the robust growth cadence in its US commercial (revenue up 54%) and government business (revenue up 40%) in Q3. Therefore, it seems like the Alex Karp-led company has validated its pure-play AI business model, even as its enterprise software peers face the heightened risks of churn from their more “traditional” products.

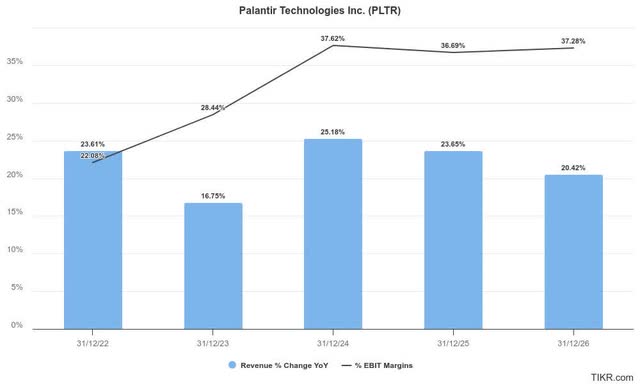

Palantir Needs A Much Higher Growth Profile

Wall Street’s estimates on Palantir have been bolstered, corroborating the market’s optimism. In addition, the company is also expected to deliver YoY revenue growth of more than 20% through 2026. Its adjusted operating margin is also expected to remain robust, underscoring its significant profitability potential (“A” profitability grade) relative to its technology sector peers (XLK). Hence, buying sentiments on PLTR are justified (“A+” momentum grade), although its assessed overvaluation has heightened the risks of a subsequent collapse.

PLTR’s adjusted forward EPS multiple of 145x is markedly above its sector median of 25.2x. However, a 20%+ growth rate through 2026 doesn’t seem to justify the high earnings multiple that investors have reflected. I worry about the increasing possibility of a steep decline, as retail investors likely comprise nearly 48% of its ownership base. An unanticipated missed guidance or bad news could send PLTR’s sentiments spiraling downward as these investors aim to protect gains or reduce losses.

There’s little doubt that Palantir is a highly consequential AI company that has demonstrated its business model and value proposition for its customers and investors. However, adding new positions in PLTR is embedded with potentially significant volatility risks, given its high earnings multiple. Although the company’s commercial opportunity has likely diversified its previous reliance on government business, the market has also incorporated substantial optimism into its valuation.

Is PLTR Stock A Buy, Sell, Or Hold?

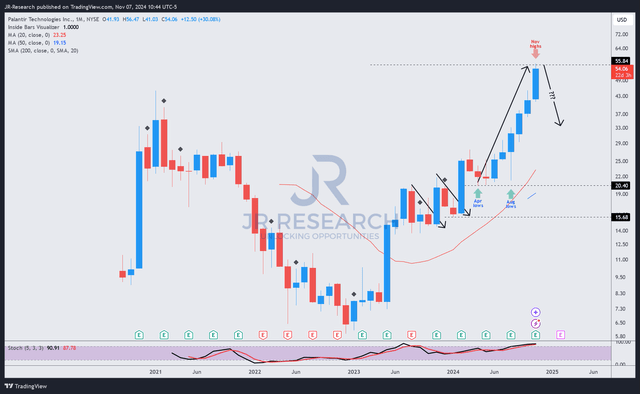

PLTR price chart (weekly, medium-term) (TradingView)

PLTR has been on a rampaging run since it bottomed in August 2024. Given its relative outperformance, investors have not experienced a pullback since then.

While I’ve not assessed a bearish reversal yet, as PLTR buyers jumped in and took it toward newer highs, its frothy valuations are challenging to justify. Unless Wall Street’s estimates can be raised much higher, I consider it increasingly unattractive for investors to keep hanging on to a stock with an adjusted forward earnings multiple of almost 150x.

When the market turns FOMO (which is also justified by PLTR’s price action), it’s time to get out.

Rating: Maintain Sell.

Important note: Investors are reminded to do their due diligence and not rely on the information provided as financial advice. Consider this article as supplementing your required research. Please always apply independent thinking. Note that the rating is not intended to time a specific entry/exit at the point of writing, unless otherwise specified.

I Want To Hear From You

Have constructive commentary to improve our thesis? Spotted a critical gap in our view? Saw something important that we didn’t? Agree or disagree? Comment below with the aim of helping everyone in the community to learn better!

Analyst’s Disclosure: I/we have a beneficial long position in the shares of NVDA, TSM, CRM, IGV, MSFT, NOW, AMD either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

A Unique Price Action-based Growth Investing Service

- We believe price action is a leading indicator.

- We called the TSLA top in late 2021.

- We then picked TSLA’s bottom in December 2022.

- We updated members that the NASDAQ had long-term bearish price action signals in November 2021.

- We told members that the S&P 500 likely bottomed in October 2022.

- Members navigated the turning points of the market confidently in our service.

- Members tuned out the noise in the financial media and focused on what really matters: Price Action.

Sign up now for a Risk-Free 14-Day free trial!