Summary:

- Palantir continues to demonstrate why it has the best AI software product in the market.

- Perhaps, that is why investors won’t stop buying the stock.

- The problem is that years of future Revenue and earnings growth have already been priced into the stock.

- Palantir’s valuation has 10x-ed in less than two years, returning to 2021 valuation levels.

- We know what happened next…

Drew Angerer/Getty Images News

Introduction

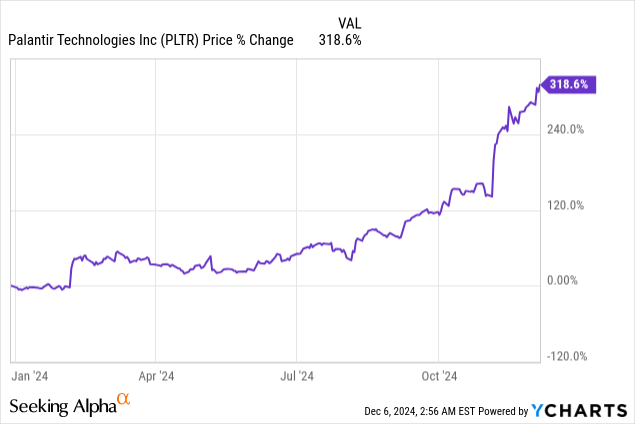

Palantir (NASDAQ:PLTR) — the so-called Messi of AI — has gained extreme momentum over the last few quarters. The stock has quadrupled this year after tripling the previous year, a feat no one saw coming.

A few months ago, I mentioned that the stock was overheating despite accelerating fundamentals, which prompted me to downgrade my rating on Palantir stock from Buy to Hold.

At that time, the stock was trading at an EV to Revenue multiple of 26x. I thought this valuation was already too rich, so I expected limited upside potential for the stock in the near term.

Boy was I wrong.

Since my previous article, its valuation has more than doubled, reaching what I think would be unsustainable levels.

For this reason, I am downgrading Palantir stock yet again.

Growth: Government Took the Spotlight

Sure, Palantir’s valuation expansion is partly attributed to its improving fundamentals.

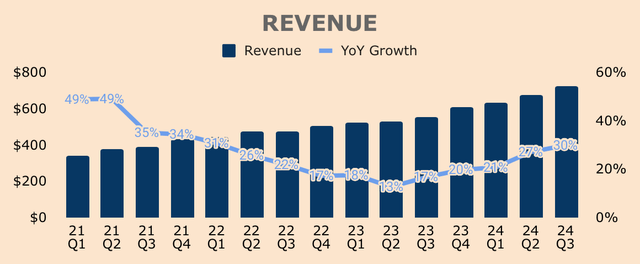

For one, growth continued to accelerate with Q3 Revenue growing 30% YoY to $726M. This beat the high end of management’s guidance by $25M and analyst estimates by $22M.

As you can see below, growth has increased for 5 straight quarters, signifying unprecedented demand for Palantir’s software offerings — its Artificial Intelligence Platform in particular — and the immense value they bring to Palantir’s government and commercial customers.

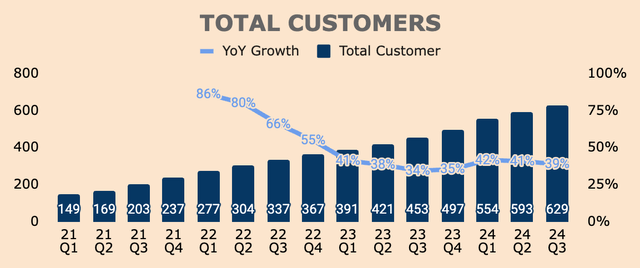

Speaking of which, Revenue growth was driven by a 39% YoY increase in Total Customers, to 629 as of Q3. Revenue from its largest customers continues to expand with Revenue Per Top 20 Customers up 12% YoY to $60M per customer. All these imply solid ecosystem expansion, customer retention, and monetization.

Mind you, Palantir’s customer base includes some of the largest and most important organizations in the world, which is a testament to Palantir’s unmatched technology. At the same time, the highest of qualities of customers translates to the highest of qualities of Revenue for Palantir, indicating stable and predictable Revenue growth for years to come.

This has always been Palantir’s business strategy: to build the best products for the best customers — and grow along with them.

We want a smaller number of the world’s best partners that, quite frankly are dominating with our product. And the way you do that is by having by not blowing up your margin and getting 10,000 sales people, it’s actually by going deeper on the product. And in fact, what we see is the deeper and the better the product, the more we drive sales, the more we have our cultural singular advantage as Palantir, not as a commodity product. It’s like we are not a commodity. We do not want our customers to be commodities, we want them to be individual Titans that are dominating their industry or the battlefield.

(CEO Alex Karp — Palantir FY2024 Q3 Earnings Call)

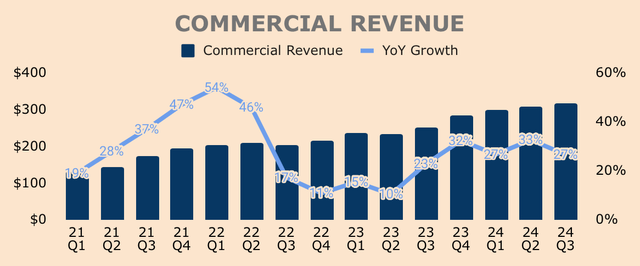

Looking at each segment, Commercial Revenue was $317M, up 27% YoY, driven by a 51% YoY increase in the number of Commercial Customers to 498. As with the last few quarters, the US market drove the bulk of the growth. “As America once again forges ahead, our allies and partners in Europe are being left behind”:

- US Commercial Revenue was $179M, up 54% YoY, with US Commercial Customers up 77% YoY to 498. Growth was mainly due to strong demand for its AIP offering.

- Despite a 19% YoY increase in International Commercial Customers to 177, International Commercial Revenue only grew 3% YoY to $138M.

It’s worth noting that Commercial Revenue includes strategic commercial contracts — or SPAC-ulative Revenue I like to call it. Excluding the impact from these contracts, Commercial Revenue would have grown 30% instead of 27%.

That said, we can expect strong Commercial Revenue growth moving forward as the deal pipeline remains robust, with Commercial TCV booked up 52% YoY and 62% QoQ, to $612M as of Q3.

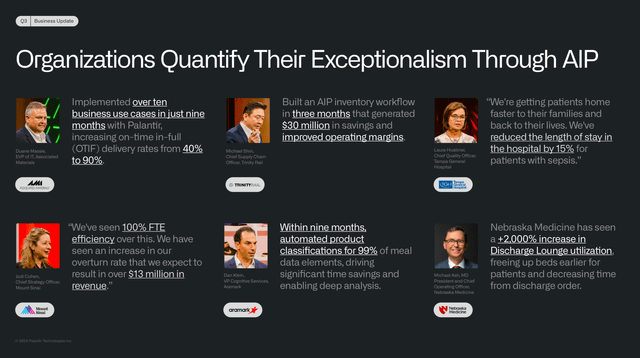

With AIP proven to deliver exceptional results for its clients, there’s little doubt that more customers will flock to Palantir for its best-in-class AI offering.

Palantir FY2024 Q3 Investor Presentation

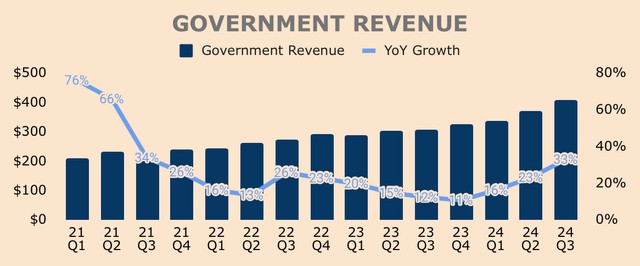

Switching gears, Palantir’s Government segment was the star of the show with growth accelerating 10pp sequentially. In Q3, Government Revenue was $408M, up 33% YoY. The US market continues to be the key driver of growth:

- US Government Revenue was $320M, up 40% YoY, due to “continued execution in existing programs, new awards reflecting the growing demand for AI in our government software offerings, and favorable deal timing in the quarter”.

- On the other hand, International Government Revenue was $88M, up only 13% YoY, due to “less favorable deal timing”.

I think the growth of the Government segment was a pleasant surprise for many, especially given the fact that growth for the segment has been slowing down in the better part of 2022 and 2023.

Palantir’s deep ties with governments all over the world is one of the key components of the company’s investment thesis, and to see the segment accelerate growth like this is definitely a major confidence booster for the bulls.

As a result of strong growth across both segments, management also raised their full-year Revenue guidance:

- 2024 Revenue is expected to be $2.809B at the high end, up from $2.750B and beating analyst estimates of $2.760B. This implies Q4 Revenue of about $771M, up 27% YoY, which is well above analyst estimates of $744M.

- 2024 US Commercial Revenue of at least $687M. This implies Q4 US Commercial Revenue of at least $199M, up at least 52% YoY.

Having said that, I expect Palantir to maintain strong growth over the next few quarters as demand for AIP continues to gain traction, as “companies and government agencies race to implement the technical infrastructure that is necessary to unleash the power of language models across their proprietary and most valuable datasets”.

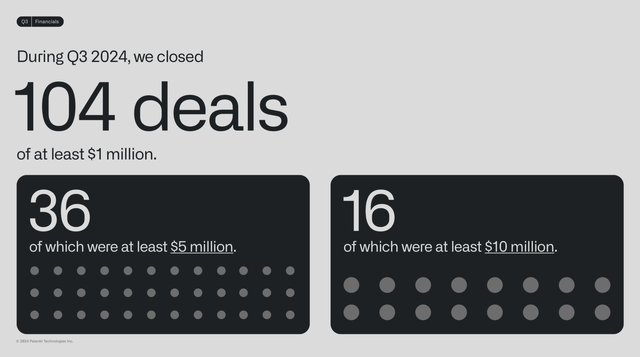

With a record 104 deals over $1M in Q3 and arguably the best software that bridges the gap between AI, data, and operations, I’m confident that Palantir has a massive growth runway ahead as it continues to dominate the AI space.

Palantir FY2024 Q3 Investor Presentation

Profitability: Exceptional Earnings Growth

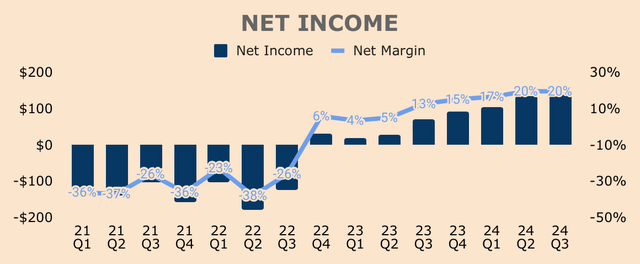

Turning to profitability, Palantir delivered GAAP Operating Income of $113M, representing a 16% Margin, which improved 9pp YoY. Adjusted Operating Income was $276M, representing a 38% Margin, which improved 9pp YoY as well.

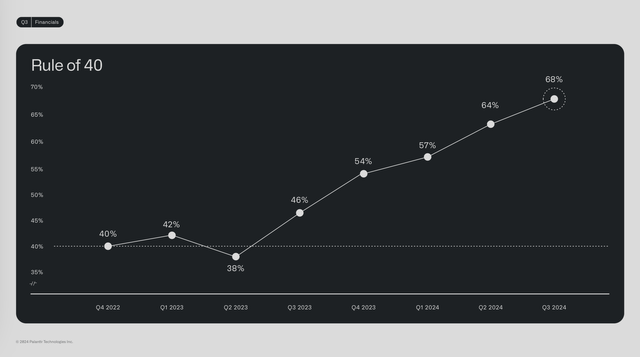

Adding Revenue growth of 30% and Adjusted Operating Margin of 38%, we get a Rule of 40 score of 68%, which is a record high for Palantir. This not only reflects Palantir’s improving scalability and efficiency but also the company’s best-in-class products:

We are going to maintain the contradiction of having both high margins and high growth. It’s not one or the other. They’re actually interplayed and they’re not a contradiction. They power each other. That’s how you have world class products. That’s what you see in your numbers.

(CEO Alex Karp — Palantir FY2024 Q3 Earnings Call)

Palantir FY2024 Q3 Investor Presentation

In Q4, management expects Adjusted Operating Income of $302M at the high end, implying a 39% Margin against their Q4 Revenue guidance of $771M. In other words, expect margins to expand further.

The bottom line continues to improve as well. GAAP Net income was $144M at a 20% Margin, which improved 7pp YoY. GAAP EPS was $0.06, growing 100% YoY. Adjusted EPS was $0.10, growing 43% YoY, and beating analyst estimates by a penny.

]In short, Palantir continues to drive profitable growth while expanding margins at the same time. This is a recipe for strong earnings growth, a major reason why investors won’t stop bidding up Palantir stock.

Health: Dilution Does Not Matter

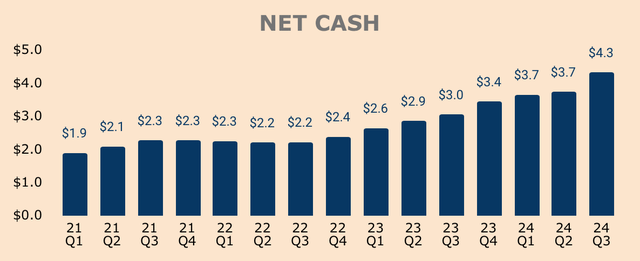

As a result of excellent growth and profitability, Palantir’s cash pile continues to expand. As of Q3, Palantir has $4.3B of Net Cash with virtually zero debt on its balance sheet.

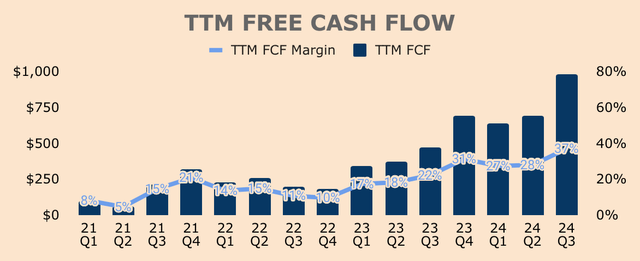

Free Cash Flow was $416M in Q3, representing a FCF Margin of 57%. Such a high FCF Margin was due to the impact of favorable deal timing. To smoothen out this impact, we look at Palantir’s trailing twelve-month FCF, which was a record $980M in Q3, representing a TTM FCF Margin of 37%, which improved 15pp YoY.

FCF is one of the most important metrics to track — most other metrics are just noise. This includes Stock-Based Compensation, which has been a key bear argument against owning Palantir stock.

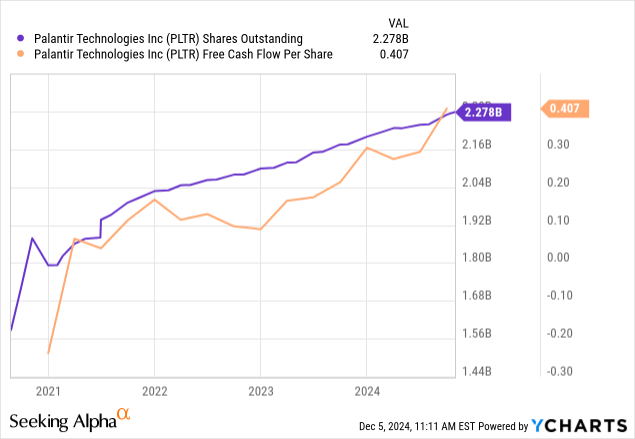

However, despite SBC accounting for about 20% of Revenue and ongoing shareholder dilution, Palantir’s FCF Per Share continues to track higher, which is all that matters. For reference, TTM FCF Per Share in Q3 was $0.41, up 92% YoY from $0.21.

That said, Palantir has a pristine balance sheet and a robust FCF profile, displaying strong financial health overall.

Valuation: Deja Vu?

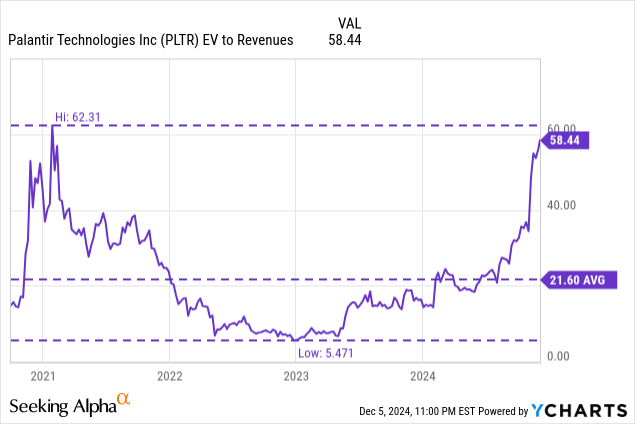

As it stands, Palantir trades at a hefty EV to Revenue multiple of 58x, making it the most expensive SaaS stock in the market. As you can see below, its multiple has more than 10x-ed from 5x to 58x, in less than two years.

This valuation expansion can be attributed to a few factors such as the launch of AIP, accelerating fundamentals, and S&P 500 inclusion. All kinds of news and deals released by the company have also fueled the rally to a certain extent. Heck, even transferring its stock from the NYSE to the NASDAQ caused the stock to pop 11% the following day.

Some of its price action is justifiable, but some just make zero sense.

Today, Palantir’s multiple is just a few digits shy of its peak multiple of 62x back in 2021. It is essentially back to its 2021 valuation, which was extremely frothy, and we know what happened next — the stock collapsed by 85% in the following two years.

I’m not saying Palantir will decline by 80%+ from here — it’s a much stronger business with far superior fundamentals compared to its 2021 version. It certainly deserves a premium.

However, I do think its current valuation is unsustainable and that a correction is more than likely. By how much? That’s up to the markets to decide. But in my view, a multiple of 30x is possible, and even then, it is still expensive for my liking.

The stock could certainly run a lot more with catalysts such as NASDAQ 100 inclusion and Palantir CTO possibly joining the Pentagon for a top research and engineering job.

There’s also the Santa Claus Rally to close out the year. I think very few investors will be booking in gains in December only to pay taxes on those gains a few months later.

However, as we enter the New Year, I believe we will begin to see some selling pressure.

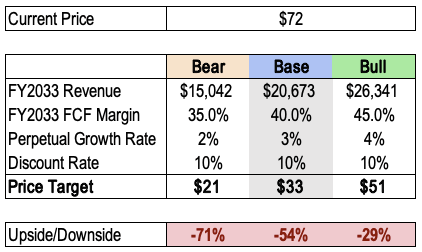

As for me, I’m raising my base-case price target from $26 to $33, which assumes a:

- 25% Revenue CAGR for the next 10 years

- Long-term 40% FCF Margin

- 3% Perpetual Growth Rate

- 10% Discount Rate

With a price target of $33, I expect a downside potential of about 54%, based on the current price of $72.

Even in the bull case where I project an aggressive 30% Revenue CAGR and 45% FCF Margin, I only get a price target of $51, which represents a downside potential of 29%.

Author’s Analysis

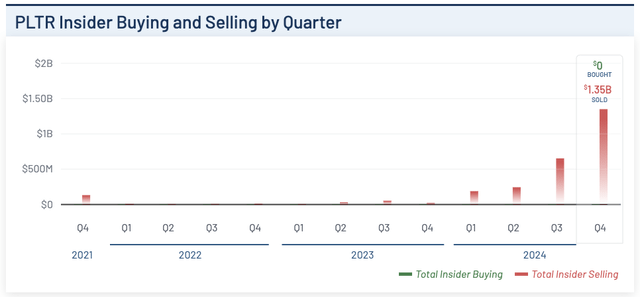

As you can tell, Palantir’s valuation, by virtually all valuation methods, looks very expensive. For this reason, I’m downgrading Palantir stock from a Hold to a Sell.

I rarely give out Sell ratings but considering the stock’s recent explosion and unsustainably high valuations, I think it’s wise to recommend a Sell at this point — I’ve recently trimmed my position too.

Even insiders are selling shares at a record pace, unloading $1.4B in Q4 so far.

Risks

- Valuation: There’s no doubt that Palantir will be one of the key players in the emerging AI market. However, it seems that investors have priced in a perfect future for Palantir — so much of its future Revenue and earnings growth has already been priced into the stock. At a $160B Market Cap with only $2.6B of Revenue and $477M of Net Income, Palantir stock is severely overvalued. Don’t get me wrong. I am confident the business will do very well in the next few years. But the stock? Not so much.

- Tougher Comps: Palantir launched AIP in Q2 last year with the platform only beginning to ramp in Q3 last year, which means Palantir will face tougher YoY comps in Q4 onwards, thus making growth acceleration much more difficult from here. The markets may not like any sort of growth slowdown, especially considering its super-premium valuation.

Thesis

Palantir continues to display strong topline growth as AIP takes the world by storm. We’ve already seen Commercial customers aggressively adopt AIP over the last few quarters, but the exciting thing is that Government customers have only started to “embrace AI”. Government customers tend to have higher budgets compared to their Commercial counterparts so increased utilization of AI should drive massive growth for Palantir.

What’s more, Palantir’s profitability metrics continue to improve as the company gains massive operating leverage and economies of scale.

There’s no denying that Palantir will drive strong Revenue and earnings growth for years or even decades to come.

The problem is that a few years’ worth of growth has already been priced into the stock, so much so that it has made Palantir stock unsustainably overvalued.

Trading at an EV to Revenue multiple of nearly 60x, Palantir stock is back to 2021 valuation levels where the stock crashed more than 80% in the ensuing two years.

History may not repeat itself. But it often rhymes.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of PLTR either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.