Summary:

- Palantir’s latest earnings results show its potential to scale and expand its business with increased revenues and profitability.

- The demand for PLTR’s artificial intelligence platform, AIP, is not slowing down, leading to aggressive growth in commercial revenues.

- Despite being overvalued and facing potential market risks, Palantir’s shares could continue appreciating due to the company’s solid growth story.

Bloomberg/Bloomberg via Getty Images

Palantir Technologies (NYSE:PLTR) is firing on all cylinders, and it seems that nothing can stop it from continuing to scale and expand its business in the future. As one of the biggest bulls who have covered the company extensively here on Seeking Alpha, I was impressed but not surprised about the latest earnings results that were released earlier this month. After Palantir joined the AI fray with the launch of AIP last year, it became obvious that the company has great potential to quickly scale its operations at a minimal cost and aggressively expand its customer base at the same time.

The latest earnings results proved this to be the case and while it would be fair to say that after the latest rally, Palantir’s shares are likely to be in the overvaluation territory, there are still reasons to believe that they have more room for growth in the near term. That’s why I’m sticking with my BUY rating, as it seems that the end of Palantir’s growth story is nowhere near in sight.

Palantir Goes Beast Mode

My latest article on Palantir was published back in November, and there I discussed how its artificial intelligence platform called AIP could become a real game changer for the company that could aggressively scale the overall business. The latest earnings results for Q4 that were released earlier this month showed that AIP indeed has the potential to expand Palantir’s footprint across the commercial and government sectors and help the company create additional shareholder value for years to come.

Thanks to the increased demand for large language models from different organizations, Palantir managed to increase its revenues in Q4 by 19.6% Y/Y to $608.5 million, above the street expectations by $5.55 million. At the same time, the company also had a fifth consecutive quarter of delivering a profit in Q4, as its net income during the period was $93.4 million.

Going forward, there are reasons to believe that Palantir will continue to generate such impressive returns in the following quarters. This is due to the fact that the demand for AIP is not slowing down, as Palantir’s commercial revenues in the United States in Q4 aggressively increased by 70% Y/Y in large thanks to the scaling of the company’s artificial intelligence platform.

While there was a lot of criticism from Palantir’s bears almost a year ago about how the company was using the ongoing AI frenzy to prop up its shares, the latest earnings data clearly shows that AIP is not another short-lived hype project. The company already expects at least a 40% revenue growth rate for US commercial revenues in 2024, which indicates that the demand for AIP is still there. Add to all of this the fact that Palantir organized over 500 boot camps on AIP for its clients while its CEO Alex Karp said that the platform is the future of the company, and it becomes obvious that the growth story is far from over.

All of this makes it possible for Palantir to continue to generate aggressive returns in the following quarters and exceed expectations. This should help the company’s stock retain its momentum for a while. After the exceptional performance in the recent quarter, the street has already made dozens of upside revisions recently as it believes that Palantir would be able to increase its revenues and earnings by over 20% Y/Y in the following years.

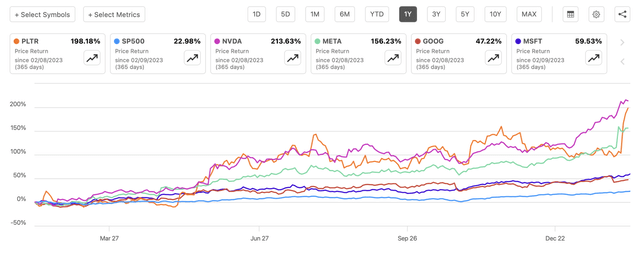

Add to all of this the potential inclusion into the S&P 500 index in the next few months, and it becomes obvious that the shares likely have more room for growth, as it appears that nothing could undermine the company’s growth story at this stage. Palantir’s shares even managed to outperform most stocks from the Magnificent 7 except for Nvidia (NVDA) in the last year, and it seems that as long as they retain their momentum, almost nothing could stop them from appreciating further.

The Performance Of Palantir’s Shares Against Others (Seeking Alpha)

Major Risks To Consider

At this stage, it makes sense to believe that as long as the market continues to grow and help Palantir retain its momentum, then its shares will be able to further appreciate and create additional shareholder value along the way. However, the moment the market changes its direction even in the short-term, Palantir would likely be hit the most given its rapid appreciation in recent weeks. While currently there are no major risks to the growth story on the horizon, the potential worsening of the macro environment caused by global issues such as the increase in geopolitical tensions across the globe or deflation in China could have a domino effect and result in a depreciation of assets. This has already happened countless times in the past and considering that it’s impossible to price in all of the external risks at this time, there’s always a possibility that the growth story could be undermined by external factors that are outside of the company’s control.

Therefore, by trading at over 70 times its forward earnings, Palantir stands to lose the most in case the market changes direction. It would be also fair to say that at the current price, Palantir is also overvalued in comparison to the broader market, and it’s easy to understand why Seeking Alpha’s Quant system gives its stock a grade of F for valuation given the multiples at which the business is trading.

However, the fact that Palantir is overvalued in comparison to others doesn’t necessarily mean that its stock is destined to depreciate in the foreseeable future. Back in 2020 and 2021, there were numerous cases of companies trading at triple-digit multiples, and it didn’t stop their shares from appreciating further due to the favorable market environment. Therefore, it’s safe to assume that as long as the market continues to rally, Palantir’s shares would likely appreciate as well due to the solid growth story. At the same time, if the market falls – Palantir stands to lose more than the others due to the high multiples at which its shares currently trade.

The Bottom Line

Other than the valuation argument, there’s nothing not to like about Palantir at this stage. All the major talking points of Palantir’s bears have become mostly irrelevant in recent quarters as the business became profitable and continues to grow at an aggressive rate at the same time.

Given the great performance last quarter and the ample opportunities that Palantir can and likely will monetize in the following months, I decided to stick with my BUY rating. This is due to the fact that there’s an indication that as long as the business continues to grow at an aggressive double-digit rate in the following quarters – then its shares are likely to appreciate even more. This has already happened in 2021 when Palantir was trading at greater multiples than today despite being significantly smaller in size. We could see a repeat of the same scenario in 2024, especially since the macro risks continue to subside with each passing quarter, while the end of Palantir’s growth story is nowhere near in sight.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of PLTR either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Bohdan Kucheriavyi is not a financial/investment advisor, broker, or dealer. He's solely sharing personal experience and opinion; therefore, all strategies, tips, suggestions, and recommendations shared are solely for informational purposes. There are risks associated with investing in securities. Investing in stocks, bonds, options, exchange-traded funds, mutual funds, and money market funds involves the risk of loss. Loss of principal is possible. Some high-risk investments may use leverage, which will accentuate gains & losses. Foreign investing involves special risks, including greater volatility and political, economic, and currency risks and differences in accounting methods. A security’s or a firm’s past investment performance is not a guarantee or predictor of future investment performance.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.