Summary:

- Palantir has reported very good 40% YoY US commercial revenue growth in the recent quarter, but other key metrics do not support a strong bullish sentiment in the stock.

- The YoY US government revenue growth was only 12% and this segment contributes over 40% of the total revenue base.

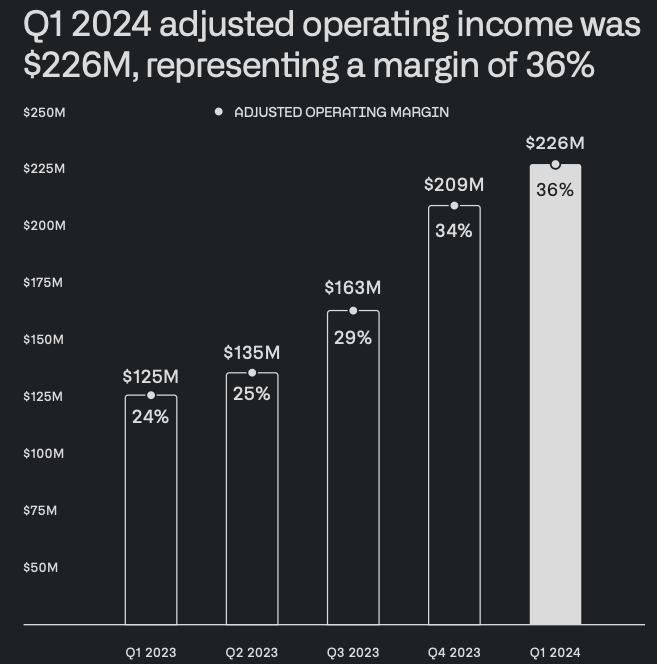

- Palantir’s adjusted operating margin has also expanded to 36% from 24% a year ago, and it is unlikely that there can be significant improvement from an already high margin level.

- Palantir’s AI growth potential is strong, but investors should wait for a pull back to add this stock, which makes the stock a Sell at the current price.

Michael Vi/iStock Editorial via Getty Images

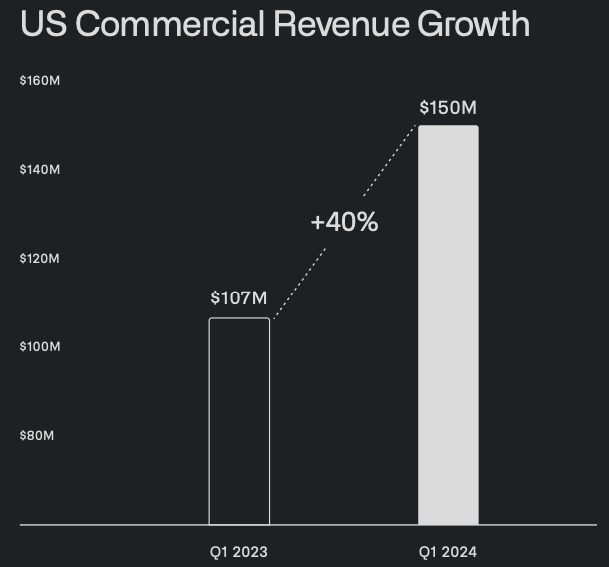

Palantir (NYSE:PLTR) stock has been range-bound between $20 and $25 for the past few months. Some of the strong positives for the company are more than matched by the negatives. The most positive factor working in favor of Palantir is the AI boom, and Wall Street is ready to give a higher valuation multiple for companies working in this sector. There is also a FOMO factor working within the top management of several companies, and they are willing to pay top dollars to try new AI software. This helped Palantir in reporting a 40% YoY growth in US commercial revenue growth in the recent quarter. However, the US commercial revenue was only $150 million out of the total revenue base of $634 million, or less than 25%.

On the other hand, US government revenue contributed $257 million or 40% of the total revenue base, while the YoY revenue growth was only 12%. The adjusted operating margin has also increased to 36% in the recent quarter from 24% a year ago, and it is likely that this metric will soon face an upper limit.

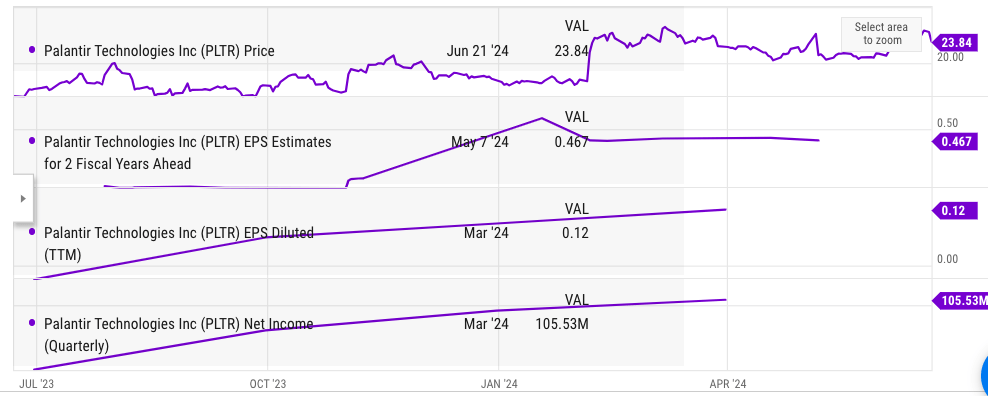

The real negative part of Palantir’s investment sentiment is its valuation. The stock is trading at 24 times sales, while the YoY revenue growth was only 21%. The consensus EPS estimate for 2 fiscal years ahead is $0.46 which means that the stock is already trading at more than 50 times the projected earnings two years from now. A lot can happen in the next two years, and this sky-high valuation could pull down the future returns potential of any investment. Palantir is still a good company with strong growth potential, but investors should wait for a pullback in the stock to $15-$16 which will bring the EV/sales ratio to 14. This is closer to other peers in this segment and bigger tech players like Microsoft (MSFT).

The growth story remains strong

Palantir used to make a bulk of its revenue from government contracts a few years back. However, it has ramped up selling the AI services to commercial clients, which is showing good progress. The YoY revenue growth in the US commercial segment was 40%. The commercial customer count increased by 69% on a Y/Y basis, which also shows a growth in the pipeline. This customer base should drive future revenue growth in the commercial segment.

Company Filings

Figure: Growth in US commercial revenue. Source: Company Filings

We could also see an inflection in growth as the AI services built by Palantir gain wider acceptance among commercial clients. The AI hype is still alive and strong, and clients in different industries are willing to experiment with how these tools can improve the efficiency of their business.

The current growth momentum could continue for the next few quarters and at 40% CAGR, the US commercial revenue base should reach $300 million by the first quarter of 2026. This means that the annualized revenue from this segment should cross a billion dollars by the end of 2025. Wall Street could take this as a very good growth trajectory for the company.

The negatives are also quite big

While most bullish analysts look at the US commercial growth, we also need to look at the revenue contribution of this segment. In the recent quarter, US commercial revenue was $150 million out of a total revenue base of $634. Hence, the revenue contribution of this segment is less than 25%. On the other hand, the US government revenue grew by only 12% on a Y/Y basis, while it contributed a massive 40% to the total revenue base. This segment has pulled down the overall Y/Y revenue growth to only 21%. At the current growth trajectory, it will take Palantir another three years before the revenue contribution of US commercial exceeds the US government segment.

Another major negative is the already high adjusted margin rate of 36%. Higher margin is a positive metric, but it also limits the ability of the company to show greater improvement in this metric over the next few quarters. Hence, most of the future EPS growth would need to come from revenue growth.

Company Filings

Figure: Growth in adjusted operating margin of the company. Source: Company Filings

The massive improvement in net income and EPS over the last few quarters was driven by improvement in operating margin. The YoY revenue growth at 21% has played a relatively smaller part in the improvement of EPS. In an optimistic scenario, if the company manages to deliver 45% adjusted operating margin by the first quarter of 2025, it will be a 25% improvement over the recent quarterly 36% margin. On the other hand, a jump from 24% in the year-ago quarter to 36% has helped improve the profitability by 50%.

It should be noted that there are a lot of companies building new AI tools. Even bigger cloud players like Amazon’s (AMZN) AWS and Microsoft (MSFT) are also launching new AI services on their cloud platform regularly. Over the last few years, AWS has rarely managed to show an operating margin of over 30%. Hence, this could limit Palantir’s ability to report a very high improvement in adjusted operating margin from the already high level of 36%.

Future stock trajectory

Palantir’s astronomical valuation is the biggest negative for the stock. The trailing twelve-month revenue is $2.3 billion, while the market cap is over $50 billion. Even if we remove the $4 billion in cash reserves, the EV/sales ratio is more than 20 times. The Y/Y revenue growth is only 21%, and it will take a long time before the EV/sales ratio can come down to a reasonable level.

The consensus EPS estimate for 2 fiscal years ahead is $0.46. The current stock price is more than 50 times this metric. A lot of changes have happened in the last two years including the tech bear rally of 2022, AI hype of 2023, macroeconomic swings, geopolitical challenges and more. We can be sure that Palantir will face a lot of challenges over the next 2 years. Due to the already high valuation, any major bullish rally would require a big change in the growth trajectory.

Ycharts

Figure: Key EPS growth metrics of Palantir. Source: Ycharts

Investors looking to add Palantir to their portfolio should wait for a pullback and a more reasonable valuation.

Forward expectations and Sell rating

Palantir provides services that have a strong moat within its government contracts. There are few alternatives that can compete with the company, which is helping in improving the pricing leverage. The company has reported good improvement in margins as new AI tech is being launched. I believe the growth in the commercial business will also be quite strong the company could deliver 30%-40% CAGR growth in the US commercial business for the next few years. Investors looking for an AI stock can find Palantir as a good option. It has a longer growth runway than many Big Tech companies, which are already over a trillion dollars in market cap.

However, the high valuation multiple is the main headwind for the stock. Even a single missed quarterly earnings could give a good correction in the stock due to the current elevated valuation. I believe we could see a correction to $15-$16 or 30% from the current price within the next 2 quarters. This will bring the EV/sales ratio to 14 which is closer to other services companies in this segment.

This should provide a better entry point for this company and also give investors a better margin of safety.

Investor Takeaway

Palantir shows 40% YoY growth in the US commercial segment, but this business contributes less than 25% of the total revenue base. On the other hand, the US government revenue contributes 40% of the revenue, while it showed only 12% YoY growth. Palantir’s overall revenue growth of 21% is quite low to justify the 20 times EV/sales ratio.

Palantir’s adjusted operating margin has also reached a high level of 36%, and it would be difficult for the company to show similar progress in this metric from the current levels. Any quarterly miss could cause a big correction in the stock, and investors looking to enter should wait for a better entry point of closer to $15 before pulling the trigger. I rate the stock a Sell at the current point.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.