Summary:

- I am initiating Palantir stock with a Buy for mid to long-term investors, despite its lofty valuation.

- I believe Palantir’s U.S. commercial business will make a bigger chunk of revenue, positioning it for more upside surprise.

- In my opinion, the company’s AIP innovations, particularly the recent Warp Speed offering, will drive new customer conversions and expansions, positioning Palantir for sustained top-line growth through 2025.

- I share my positive sentiment on Palantir here and why I see more upside into 2025.

Abstract Aerial Art

Investment thesis

Palantir (NYSE:PLTR) is expensive, trading at premium multiples, currently at 28x EV/Sales, compared to the peer group average of 9.3x. I’m starting off with this as I think this has been the main pushback against jumping into the stock at current levels, the elephant in the room, if you will. Investors aren’t fond of Palantir’s premium valuation and are, understandably, concerned that the stock has run up too much over the past six months, pricing in a lot of the positives ahead. I disagree. In fact, I think there is more upside potential to the stock due to the company’s position within AI and the new product cycle after AIP. I’m initiating the stock with a buy rating, targeted at mid-to-long-term investors.

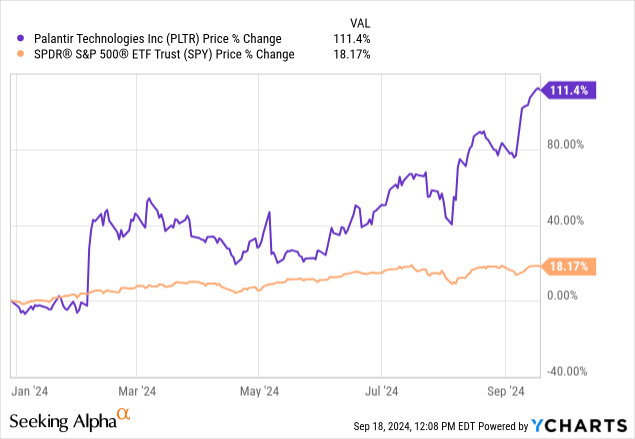

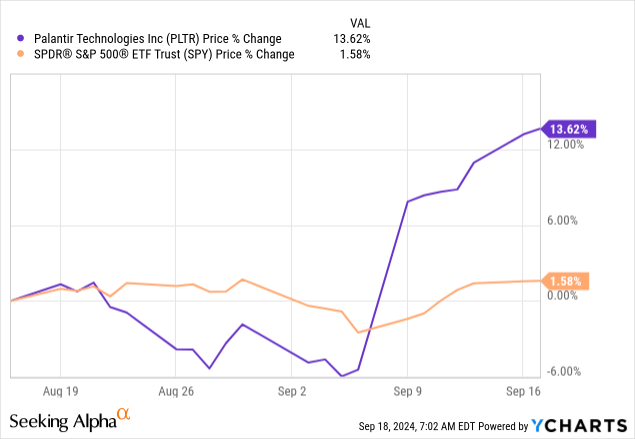

The company provides data mining services through three software platforms: Gotham, Apollo, and Foundry, with Apollo delivering “eye-watering agility and responsiveness.” The company is showing an upward trajectory in its government business along with its commercial business; continued momentum is reflected in the stock, which is up 112.8% YTD versus the S&P 500, up 18.3%, as seen below. I see room for upside surprise on the back of two factors. 1. Continued acceleration in US commercial revenue to make up a larger chunk of total revenue, and 2. The company’s build-out of Warp Speed on AIP (Artificial Intelligence Platform) positioning it for new customer conversions, and expansions in existing customers.

YCharts

I believe Palantir has sustainable growth catalysts at play that will support outperformance for 2025 and hush any concerns about the sustainability of its growth trajectory. The last earnings, 2Q24, report was encouraging, to say the least, and the stock is up ~50% since early August. I am giving the stock a buy to mid to long-term investors, and although a lot of the positives of the Warp Speed and soon-to-be S&P 500 inclusion are priced in with the recent stock rally, I think there are more tailwinds ahead to support top-line growth.

Outlook for US commercial & government businesses: More upside in 2HFY24

With tech peers facing headwinds from the uncertain economic state, Palantir seems to be relatively resilient and doing well for itself in terms of its US businesses. Here’s a breakdown of the company’s businesses and how I’m expecting them to play into top-line growth for 2025:

US commercial business:

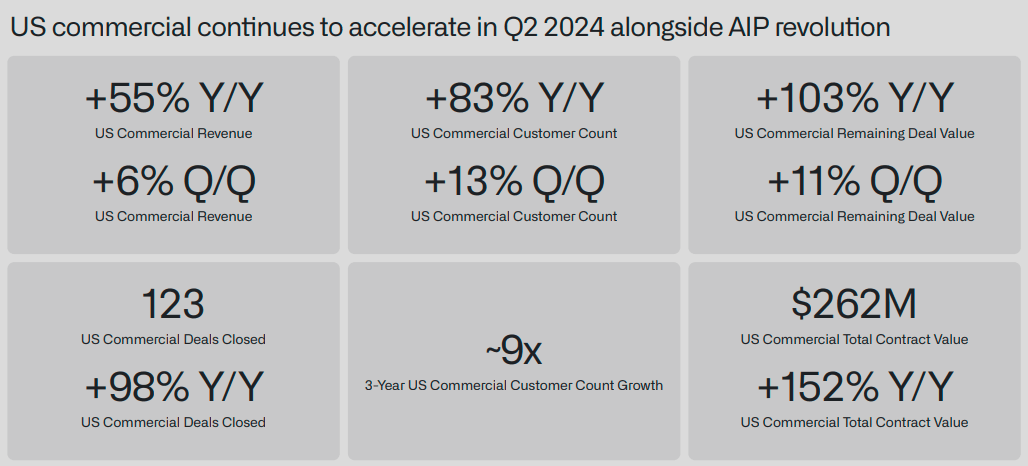

Palantir 2Q24 presentation

I use Palantir’s 2Q24 results to better gauge where the company is headed in terms of financial performance and innovation. With that in mind, this quarter’s results confirm the accelerated demand for Palantir’s AIP, which drove new customer conversions and expansions for existing customers in the US. Revenue in US commercial business was up 55% year over year to $159 million, as seen above from the 2Q24 presentation; with the exclusion of revenue from strategic commercial contracts, revenue came in at a 70% increase year over year. There are some sustainability woes around high double-digit commercial revenue growth persisting for Palantir, but I think those are ill-founded as they don’t account for the macro backdrop.

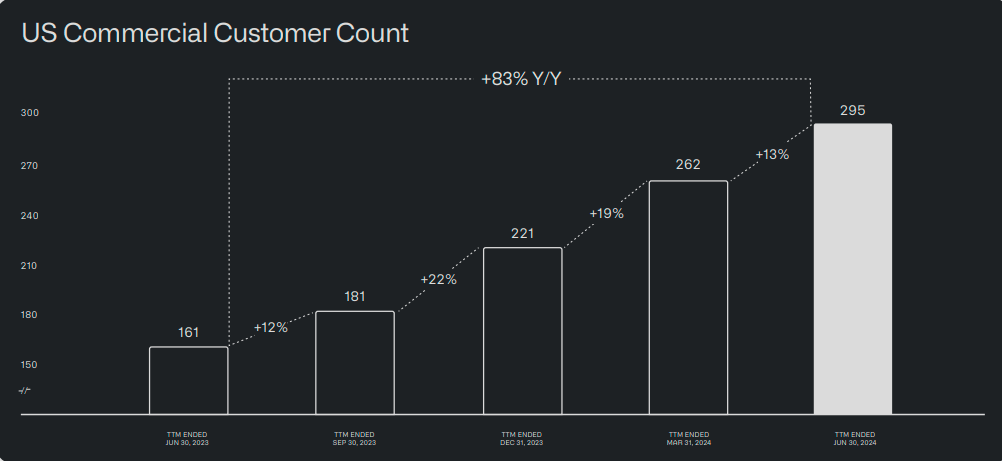

I think we’ll see sustained high growth for commercial revenue in the 4Q24 and FY25 timeframe as we enter a more favorable interest rate environment. Management booked $262 million of US commercial TCV; that’s a 152% growth year over year, and the commercial customer count grew 83% year over year to 295 customers. I expect Palantir to continue with its upward trend in U.S. Customer Count in a more favorable interest rate environment. I also believe the company is better positioned to land new customers while expanding engagements due to its focus on bootcamps’ go-to-market motion in prototyping AI capabilities.

Along with that, I believe management’s focus on taking their customers “across the chasm from prototype to production” shows success through the seven-figure deal they closed with a large wholesale insurance brokerage firm only 16 days after the bootcamp. Another win was a leading convenience store chain that turned from prototype to paid pilot after 25 days of the boot camp and “converted the inventory management and pricing optimization use-case into initial production immediately following the pilot.” I believe we’ll see more of these wins next quarter due to bootcamps, and I think the company’s strategy has been successful in this regard. The numbers talk.

Palantir 2Q24 presentation

Contrary to US commercial revenue, international commercial revenue increased 15% year over year and declined 1% quarterly due to headwinds in Europe. Looking forward, management is expecting revenue from strategic contracts to decline to $6 million—$8 million in 3Q24, compared to $9 million in 2Q24 and $15 million in 3Q24. This is a notable decline, but one that’s already been factored for or disclaimed by management.

US government business:

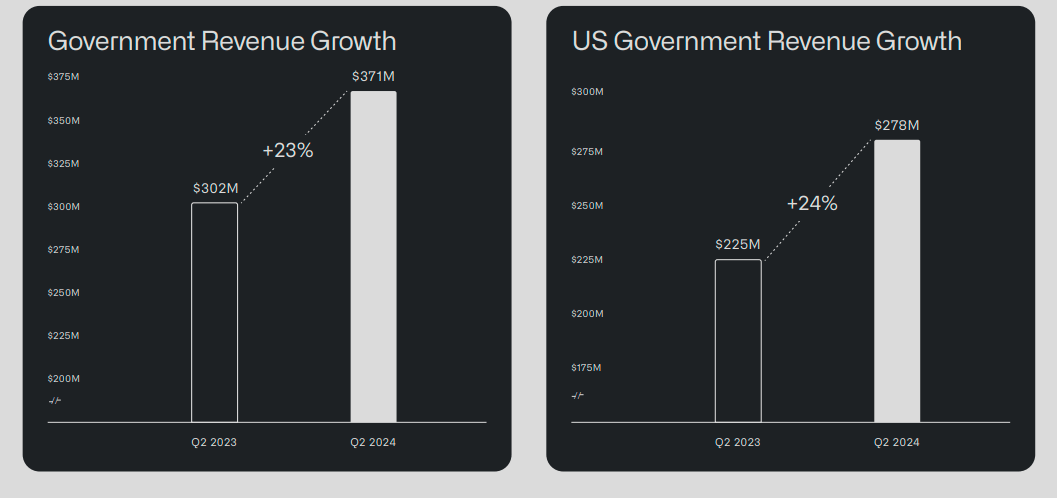

Palantir 2Q24 presentation

2Q24 revenue growth reflects the scale of Palantir’s enterprise software delivery and should extend into the second half of the fiscal year. US government revenue was up 24% year over year to $278 million, as seen above, and had “notable” awards in 2Q. Now, history is repeating itself, and the company witnessed the strongest US government bookings in 2Q since 2022. I expect this upward trajectory to continue into 2025 and believe the current political unrest in the Middle East will further expand Palantir’s reach as its services are increasingly needed. Said awards included a production contract from the Department of Defense and the Chief Digital and Artificial Intelligence Office to “deploy and scale an AI-enabled operating system across the DoD, starting with an initial order of $153 million to support certain combatant commands and the joint staff,” with additional awards up to $480 million over the next five years. I believe this goes to prove the “criticality” of Palantir’s software capabilities, and expect the company to collect awards of this kind as it grows its offerings.

International government revenue grew 21% year over year to $93 million. 2Q24 TCV bookings came in at a 47% increase to $946 million, and net dollar retention was 144%, a 300 basis points increase from last quarter, driven by 1. Expansions in existing customers and 2. New customers from 2Q23. But net dollar retention doesn’t reflect revenue coming from new customers acquired over the last 12 months, and I believe next quarter’s earnings will show the acceleration “in velocity in our US commercial business over the past year.”

Warp speed: a new AI offering

I am especially a fan of Palantir’s continued innovation on the AI front. The most recent offering is Warp Speed, a platform aimed mainly at tackling existing limitations in enterprise resource planning or ERP. The AI platform was designed to “power American reindustrialization” amid rising concerns over U.S. manufacturing capabilities in the industrial and defense sectors. The platform is designed to reimagine how to “bond atoms with bits,” according to Palantir CTO Shyam Sankar. Palantir is vocal about its support to the U.S. and its allies in the Middle East, and I believe Warp Speed positions the company to differentiate itself from competitors in the industry with its advanced AI capabilities. Amid ongoing conflicts in the Middle East, I believe Warp Speed capabilities are more needed now than ever and will help bolster U.S. manufacturing capabilities.

What’s interesting about Warp Speed is that it doesn’t only integrate ERP but takes it to the next level and integrates manufacturing execution system or MES, product lifecycle management or PLM, and programmable logic controllers or PLC. The creation of Warp Speed comes after years of experience “on the factory floors, helping customers build plans, trains, automobiles, and even ships,” according to management. At present, Palantir powers the production of jet engines, weapon systems within the industrial base, and satellites. I believe this puts the company on the forefront of such innovations, and will eventually increase government spend on the defense front. I believe that will work in Palantir’s favor, as the Warp Speed offering will further enhance the popularity of its AIP.

What could go wrong?

The stock ran up so much in 2024, and investors fear growth may come to a sudden halt. One 5-star investor called Wright’s Research recognizes the AI tailwinds are positive but doesn’t think it’s enough to offset the “ridiculous valuation.” According to Wright’s Research, the only way Palantir is undervalued is if it were to “shock investors and deliver in excess of 20% compounded revenue growth over the next 10 years.” There’s also a lot of worry around higher insider selling activity for Palantir and other names that ran up on AI growth. I’m not too worried because the $300 million worth of shares sold by Palantir CEO Alexander Karp on September 16 and 17 were part of planned transactions established in December last year. Co-founder Peter Thiel filed to sell around $1 billion in stock, also further raising concerns in an already shaky investor confidence. I don’t think investors should center their investment strategy around these insider activities. As Ed Lin explained, executives and directors often adopt plans, and “the plans automatically execute trades when preset conditions, such as price, volume, and timing, are met” rather than being based on non-public information about the stock’s trajectory. I believe such transactions remain a routine in corporate governance, and Palantir’s long-term tailwinds, even at such a hefty valuation, are still intact.

Valuation

Palantir’s valuation is a point of concern among investors, and while the stock is expensive at current levels, I don’t think many recognize Palantir’s growth prospects, specifically with its AIP and new innovations around it. According to data sourced from Refinitiv, the majority of street analysts, making up over 36%, give the stock a hold, and ~30% of Street analysts are a buy and strong buy. Around 21% of Street Analysts give the stock a sell and around 10.5% give it a strong sell.

I believe the numbers reflect mixed analysts’ consensus and uncertainty around the stock. The median PT number was $23.5 in mid-June and maintained the price through July, but rebounded nicely to $28 in August, which is currently at the same level. The mean PT followed suit and was $21.4 in June and went slightly up in July to $22.2. The mean PT went up in August to $25 and is currently at $26.9, confirming my positive thesis on the stock. Palantir currently has a P/E ratio of 101.6, significantly lower than the group average of 204.3.

As previously mentioned, the EV/Sales ratio 28.1 is significantly higher than the group average 9.3, according to data from Refinitiv. This means that the stock is currently trading at premium levels, but I see management’s balance in profitability and investments in AIP worth the price as it has many upsides ahead.

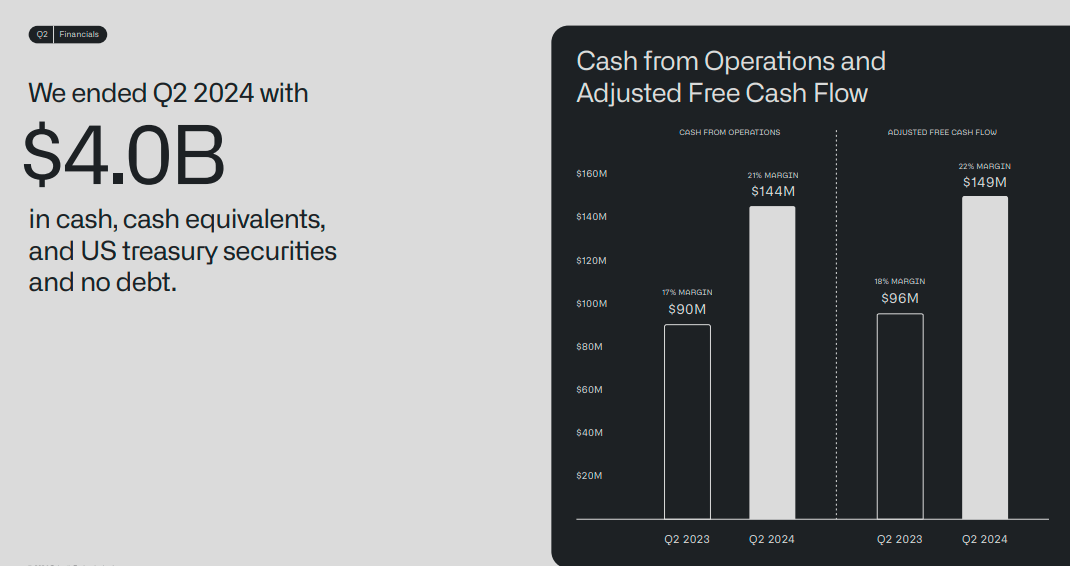

YCharts

The stock is outperforming the S&P 500 on the one-month chart and is 13.62% against the S&P 500, up 1.58%, as seen above. Management had its sixth consecutive quarter of GAAP operating profit at a record $105 million in GAAP operating income, and represents a 16% margin. Revenue and profitability backed the company’s Rule of 40 by a 7-point increase to 64 in the second quarter from the previous 57 in the first quarter. Now, what I’m really excited about is management’s impressive performance in terms of new customers. Cash flow from operations came in at $144 million, and adjusted free cash flow was $149 million, representing 21% and 22% of the margin, respectively, as seen below. Due to government and commercial year-end collections, management is expecting cash flow to “ramp through the back half of the year.”

Palantir 2Q24 presentation

What’s next?

I see more upside ahead and think Palantir is better positioned for outperformance as the government business is taking off and isn’t a point of concern. I believe the company AIP makes it a leader in artificial intelligence and machine learning, and even more so now through the recent Warp Speed offering aimed to power American reindustrialization. I expect 3Q24 to come in with new deals, as 2Q24 witnessed the signing of 27 deals worth $10 million and the closing of around $1 billion TCV.

I expect AIP to continue backing existing customers signing expansion deals and expect AIP driven deals to further impact the US commercial business positively. Management is currently building on the US and government businesses growth and now expects revenue in the range of $697 million- $701 million and adjusted income from operations in the range of $233 million- $237 million. For FY2024, management raised guidance for revenue, US commercial revenue, and adjusted income from operations. I believe the company has enough growth prospects ahead, better positioning it for outperformance into 2025.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.