Summary:

- Palantir stock has rallied 30% since reporting Q3 earnings.

- The company continues to post impressive operating results and strong margins and free cash flow.

- With extreme growth baked into the stock price, valuation concerns remain.

AlexSecret

Palantir (NYSE:PLTR) reported third quarter earnings this week to market applause as revenues, especially in the commercial space, continued to demonstrate strong growth. The company’s AI offerings appear to be gaining traction and, despite an extremely high valuation, investors seem willing to take the risk. While shares are still too rich for me to consider jumping in, I’m upgrading PLTR from a Sell to a Hold due to the robust growth profile and management’s sound execution.

I previously covered PLTR back in late September in an article where I concluded that, despite impressive progress in monetizing AI offerings, the stock’s valuation was too rich. That piece can be read here. In the weeks that followed, shares have risen more than 50% compared to the S&P 500’s measly 3% gain. It goes without saying that my thesis didn’t pan out, but now the question I have to ask myself becomes: was I wrong or was I just early? (The answer is in the first paragraph, but I’m trying to set up some suspense here, so bear with me).

In this article, I’ll evaluate some of the new information that has come out since my original rating and attempt to answer that question.

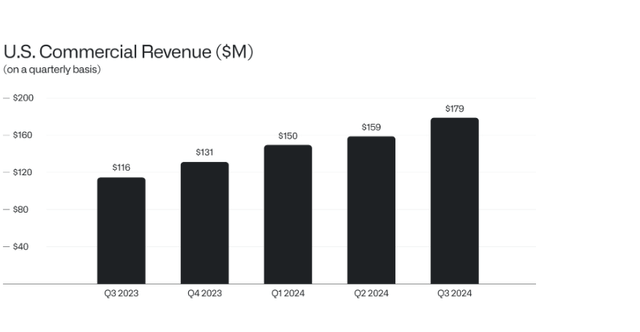

The major catalyst for PLTR was the company’s Q3 earnings report, which showed continued momentum in commercial AI revenue, upbeat guidance, impressive cash flow, and led to a stock rally of 30% for the week. US revenue, which is now nearly 70% of total revenue, came in at $499 million (+44% YoY/+14% QoQ) led by a 54% YoY increase in commercial revenue and continued strength in government revenue with a 40% YoY increase.

The untapped commercial market is the crown jewel for PLTR and these results affirmed the company is making headway, as seen by the robust revenue growth and a 39% YoY and 6% QoQ increase in customer count.

Another part of the PLTR bull thesis is how lean and scale-able the company is: Not many companies are seeing growth this rapid while also turning a profit, generating cash flow, and expanding margins. Free cash flow for Q3 was $435 million, or 60% of revenue, which emphasizes an already pristine balance sheet containing $4.6 billion in cash & equivalents & short-term treasuries compared to zero long-term debt, and the company’s net income margin improved to 33.2% (+210 bps YoY).

Building out its AI platform to service additional customers comes with relatively minimal additional expenses and provides economies of scale that could potentially bolster Palantir’s operating results exponentially.

While Q3 results were good, guidance was the real showstopper. Q4 revenue is expected to be $769 million at the midpoint (+26% YoY/+6% QoQ) and US commercial revenue is expected to be $687 million+ for FY2024, a growth rate higher than 50%. Palantir continues to add new customers and to extract value from its existing customers to drive growth, and it appears much of the market remains ripe for the picking.

The business model here is truly quite remarkable: virtually no one has figured out how to generate revenue from AI applications other than Palantir, opening a major first-mover advantage. I argued in my previous article that the barriers to entry here are low and that margins will trend down long-term as more businesses chase the opportunity, and I still believe that to be the case. That said, it certainly doesn’t appear that this will happen in the next few quarters.

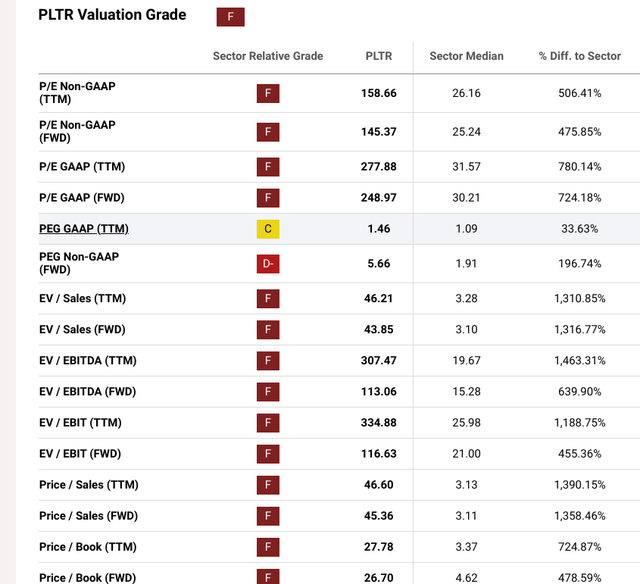

So it’s all sunshine and rainbows, then? Not quite. If you had discovered this stock and recognized its potential in 2023, you’d have a very convincing buy case. As it stands, PLTR’s valuation, as I discussed in my last article, is downright eye-watering:

A forward P/S of 45 is bonkers and even if Palantir managed to maintain a profit margin of, say, 35% which is higher than its current margin, it would need to achieve roughly $10 billion in annual revenue to achieve a P/E close to the likes of Nvidia (NVDA) and other AI darlings. At TTM revenue of $2.6 billion, that would require 30% annual revenue growth for the next 5 years. That’s 5 years during which profit margins need to stay elevated, no significant competition enters the space, no macroeconomic factors rock the boat, and new customers continue to buy into the AI offering. It’s evident the stock is baking in a fair amount of assumed success.

That said, there is obviously a significant amount of upside potential should Palantir be able to execute on its vision, and despite some concerns about insider selling, management and especially CEO Alex Karp have undeniably done an impressive job positioning the company in the commercial space. Based on quarterly results and Q4 guidance, there appears to be more financial momentum and investor enthusiasm than I originally expected, and therefore I am upgrading PLTR to a Hold. There is growth potential for those with enough risk tolerance to chase it, but due to the valuation concerns, I can’t justify a Buy rating. The stock is a high-risk, high-reward opportunity and ultimately a bet on the tangible business benefits of AI and companies’ willingness to spend on those potential benefits.

Investor Takeaway

Palantir has continued to demonstrate outperformance and has solid momentum going into the end of the fiscal year. Customer count and revenue are rising, margins are robust, and cash flow is solid and improving. The company’s AI platform is for real and companies are starting to buy into the hype to improve their own operating performance.

While Palantir is undoubtedly a great company, the stock still leaves much to be desired. At $54 a share and just $0.20 in TTM diluted EPS, the company would need to maintain an extremely high-growth rate to earn its valuation, and while I think it has the management and products to do it, I think there are better bang-for-the-buck opportunities in this market that don’t depend on such outsized expectations. For those with a long investing horizon and high-risk tolerance, PLTR could make for a speculative position, but most other investors should wait for a better price, in my opinion.

Thanks for reading!

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.