Summary:

- Palantir Technologies’ stock is overvalued at 51x 2024 sales despite robust growth in operating profits and free cash flow.

- The company reported a 30% YoY sales growth in Q3, with significant gains in both government and commercial segments.

- PLTR’s free cash flow margin reached 60%, tripling from last year, showcasing strong financial health and profitability.

- Despite impressive performance, I rate Palantir as a ‘Hold’ due to its aggressive valuation compared to industry giants like Microsoft.

hapabapa

The stock of Palantir Technologies Inc. (NYSE:PLTR) went into an up channel since the year that has pushed the stock as high as $66.

The software/AI company had a very robust third quarter as well, with both operating profits and free cash flow skyrocketing amid growing interest in Palantir Technologies’ AI platform. This platform allows companies to leverage the power of artificial intelligence in the context of structuring and analyzing organizational data.

Palantir Technologies’ stock price has risen so much that investors are now required to pay a whopping 51x 2024 sales, which by all means is an indefensible valuation multiple even when accounting for the considerable progress the company has made in 2024.

My Rating History

My last stock classification on Palantir Technologies was ‘Sell‘ primarily because I was deeply concerned about investors paying 21x leading sales for a piece of the software/AI company’s business.

Palantir Technologies, to be fair, made a strong case for its platform business in the third quarter, however, which is when it reported robust sales and free cash flow growth as well as a surge in operating profits.

Taking into account the substantial improvement in business performance, I am modifying my stock classification for Palantir Technologies to ‘Hold’, but still think that PLTR is overvalued.

Palantir Technologies’ Operating Profits Are Skyrocketing

Software analytics is starting to become a serious business, and Palantir Technologies has provided some compelling evidence recently that proved that the AI/software company is profiting from this growing trend of companies and governments spending more money on software intelligence.

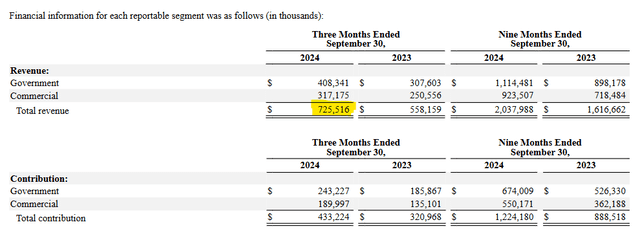

In the third quarter, Palantir Technologies brought in, across segments, total sales of $725.5 million, reflecting YoY growth of 30%. Palantir Technologies’ business falls into two distinct categories: Governments and Commercial. In the first, the software/AI company produced $408.3 million in sales, up 33% YoY, whereas Commercial’s 3Q24 sales amounted to $317.2 million, up 27% YoY. Within the Commercial segment, the U.S. Commercial business is firing on all cylinders, producing $179.2 million in sales, up 54% YoY.

Total Revenue (Palantir Technologies Inc.)

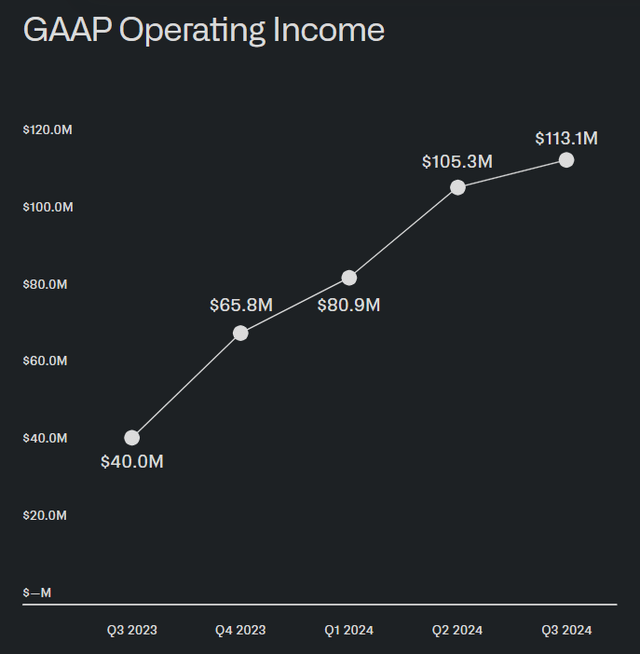

Due to higher sales growth and success signing up new customers for Palantir Technologies’ AIP platform, the company engineered a solid upswing in profitability in 2024. In the third quarter, Palantir Technologies achieved its highest amount of GAAP operating income ever, $113.1 million. Compared to the year ago period, the AI company increased its profitability by 183%.

GAAP Operating Income (Palantir Technologies Inc.)

How important AIP is becoming for Palantir Technologies can be seen in the company kicking off its first developer conference, Defcon, in November in order to speed up product development.

Other factors contributing to the success of Palantir Technologies relate to the company’s expanded partnership with Microsoft that makes its software platforms (Foundry, Gotham, Apollo, and AIP) available within Microsoft Azure Government.

Free Cash Flow Upscaling

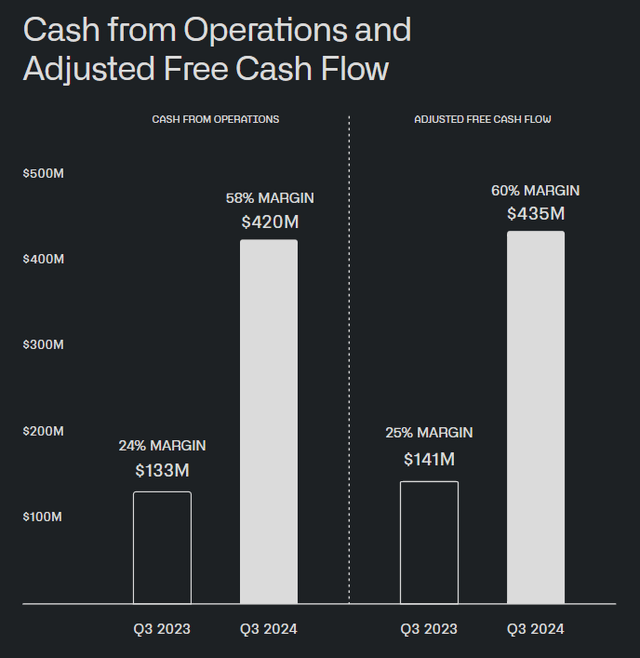

With robust growth in sales and operating profits, it is no surprise to see Palantir Technologies also doing well in terms of growing its free cash flow. As of September 30, 2024, the platform produced $435 million in free cash flow, which equates to an eye-popping margin of 60%.

Palantir Technologies’ free cash flow tripled compared to the third quarter last year, which is when the company pulled in only $141 million in free cash flow.

Not only is Palantir Technologies’ free cash flow skyrocketing, the company is also becoming more profitable as it keeps 60 cents per FCF dollar created on its platform (as opposed to just 25 cents last year).

Cash From Operations And Adjusted Free Cash Flow (Palantir Technologies Inc.)

Is 51x Leading Sales A Fair Price To Pay?

Obviously, Palantir Technologies’ valuation is doing better than I anticipated, and I can’t deny the considerable progress the company has made in the last couple of quarters.

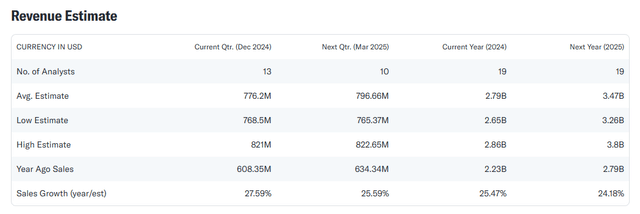

The market has also adjusted its sales estimates higher this year and the expectation is now for Palantir Technologies to rake in $2.8 billion in sales, which reconciles with the updated forecast of $2.805–2.809 billion in sales for the present financial year.

Since Palantir Technologies’ stock price sits at $62 at the time of writing, the valuation reflects a 51x 2024 sales multiple. This is 50x sales, not 50x earnings, and by any stretch of the imagination a very, very aggressive valuation that I think can’t be justified, even when taking into account that Palantir Technologies is now solidly profitable.

With that said, in acknowledgment of the company’s stronger-than-expected growth in terms of sales, operating and free cash flow, I am modifying my stock classification to ‘Hold.’

Microsoft Corp. (MSFT), which is one of the most profitable software companies in the world, is anticipated to have $278 billion in sales this year and has a market valuation of $3.1 trillion. This reflects a sales multiple of 11.0x, meaning Palantir Technologies, with an expected 2024 sales volume of only $2.8 billion, is more than four times as expensive as Palantir Technologies.

Revenue Estimate (Yahoo Finance)

Why The Investment Thesis Might Be Off

Palantir Technologies is extremely richly valued and there are obvious risk relating to the company’s sales multiple.

The software/AI company is growing more quickly than anticipated, which is good for Palantir Technologies and its investors, but I am still very skeptical here that this growth is realistically priced.

On the flip side, Palantir Technologies is tapping into an attractive investment opportunity, software intelligence, which companies and governments are increasingly comfortable spending a large amount of money on.

In this sense, there is an opportunity for Palantir Technologies for sustained growth, though I think it would take many years for the software/AI company to grow into its present $140 billion market valuation.

My Conclusion

Palantir Technologies is deserving of a higher stock classification following the release of better-than-expected third quarter earnings at the start of the month. With that said, though, I would be lying if I said that Palantir Technologies, selling at 51x 2024 sales, is an attractive investment opportunity.

The software/AI company was very successful in the third quarter in terms up growing its operating profits and Palantir Technologies deserves credit for its substantial free cash flow upscaling: A 60% free cash flow margin is stellar, and the company is seeing some very robust growth here as well, particularly as far as AIP is concerned.

I acknowledge Palantir Technologies’ success in terms of free cash flow growth by modifying my stock classification to ‘Hold.’ However, I don’t think that Palantir Technologies is worth more than four times as much as Microsoft.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.