Summary:

- Since my last report on PLTR, Palantir’s stock has surged by ~35% to $37 per share, catalyzed by multiple partnership announcements, AIPCon event, and inclusion into the S&P 500.

- Despite Palantir’s robust business momentum, its valuation is detached from financial realities, as seen through a reverse DCF model in this note.

- Insiders are selling aggressively, and I am trimming again. Read on to learn why!

hapabapa

Introduction

In early August, I downgraded Palantir Technologies Inc. (NYSE:PLTR) to a tactical “Sell” rating after yet another post-ER pop:

As of Q2, Palantir’s business momentum is robust, with the AI/data enterprise software company delivering a solid mix of revenue growth and profitability. While I am impressed with Palantir’s quarterly business performance and management’s forward outlook, PLTR’s valuation is detached from the financial realities of the business. Based on its 5-year expected CAGR return, Palantir stock is virtually dead money.

Key Takeaway: Due to unfavorable long-term risk/reward, I am downgrading Palantir Technologies Inc. stock to a tactical “Sell” at $27.7 per share.

Source: Palantir Soars On Q2 Beat, But Its Stock Is Dead Money (Rating Downgrade)

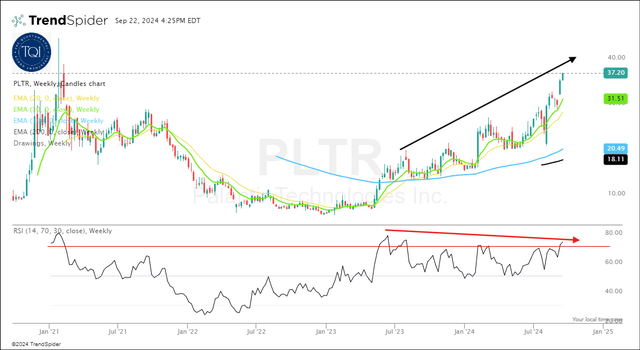

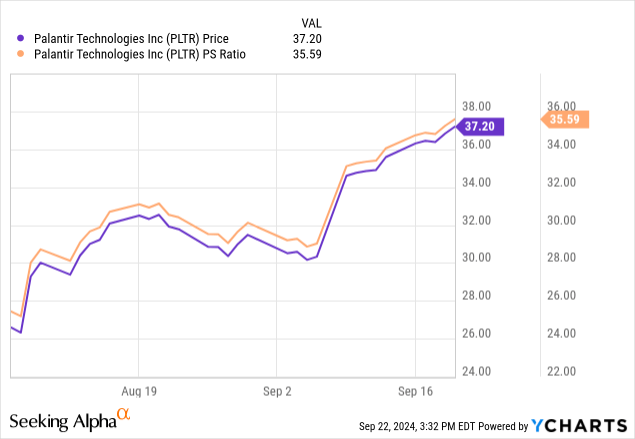

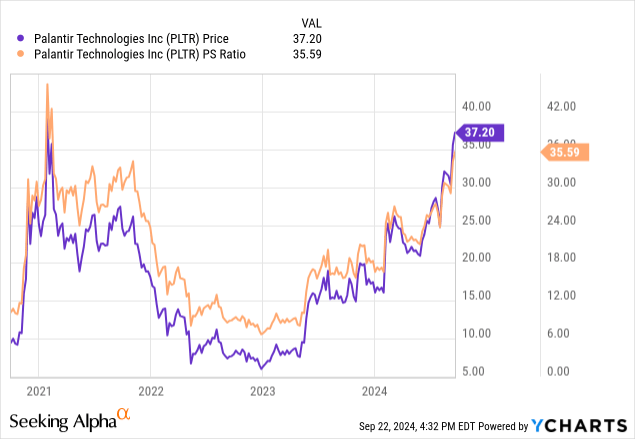

Since the publication of this report, Palantir stock has shot up by ~35% to $37 per share, with bidding up PLTR stock from ~25x P/S to ~36x P/S on the back of exciting partnership announcements [like Microsoft, BP], Palantir’s AIPCon event, and yesterday’s inclusion to the S&P 500 (SPX)(SPY).

Given Palantir’s bullish price action, trimming in the $20s looks like a mistake. However, at TQI, we invest and divest based on long-term risk/reward and do so in a staggered manner.

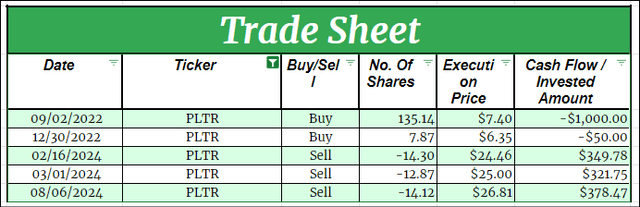

Palantir Trade Activity (TQI’s Moonshot Growth Portfolio) Current Palantir Position (TQI’s Moonshot Growth Portfolio) TQI Chats

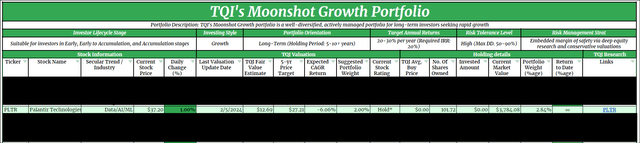

After trimming Palantir on three separate occasions this year, we have divested our principal investment in PLTR stock. While I have stuck with our plan of letting the house money ride since our last sale in early August, Palantir’s current weight [2.84%] in our Moonshot Growth portfolio is well above our target allocation of 2%. And so, in light of PLTR’s explosive run-up over the past month or so, I think it is time for a re-evaluation!

Is Palantir’s Trading Multiple Expansion Justified?

While swathes of investors are chomping at the bit to buy PLTR stock right now at an exorbitant ~36x P/S multiple, it wasn’t long ago that PLTR was trading at just ~5-6x P/S, and at the time, few buyers were to be found.

So, what’s changed?

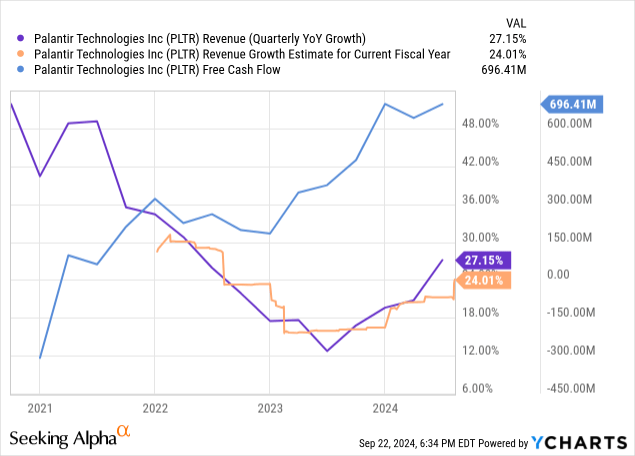

Well, for starters, Palantir has re-accelerated top-line growth in recent quarters [driven by Palantir AIP-led hypergrowth in US Commercial revenues] and turned into a free cash flow generating machine!

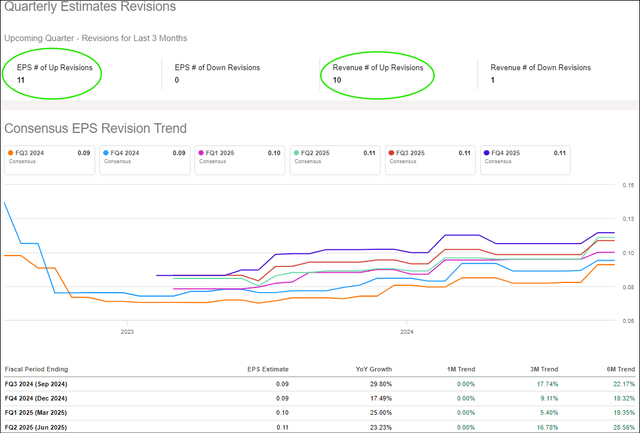

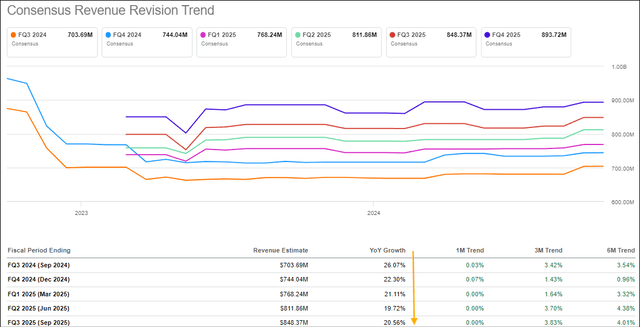

And, with Palantir AIP [artificial intelligence platform] rapidly gaining traction among large enterprise customers, consensus revenue and earnings expectations for Palantir have been climbing higher, as evidenced by these broadly positive quarterly revision trends.

Palantir’s Quarterly Earnings Forecasts (Seeking Alpha) Palantir’s Quarterly Revenue Forecasts (Seeking Alpha)

As I shared in my Q2 review, Palantir is showing robust momentum from a business standpoint. Today, Palantir is one of the few recognizable early winners in the AI era. As such, investors are willing to pay 36x sales for the data/AI/ML company. However, valuations are inherently subjective. While financial metrics like revenue, profit, and growth rates provide objective data, their interpretation and weight in determining a company’s worth vary significantly. Factors such as market trends, industry competition, potential future earnings, and even investors’ personal preferences can influence how a company is valued at any given point in time.

In my view, the efficient market hypothesis is a fallacy, as stocks could easily get detached from their intrinsic values and stay at elevated or depressed levels for long periods of time.

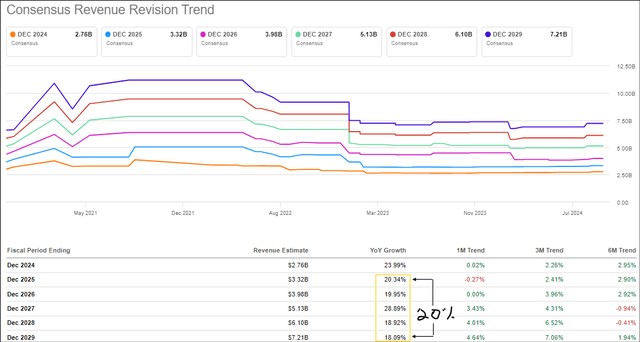

Palantir’s Annual Revenue Forecasts (Seeking Alpha)

Despite Palantir’s robust margin profile, its trading multiple is out of whack with forward growth estimates [5-year expected CAGR sales growth: ~20%]. Let’s visualize this through a reverse DCF model.

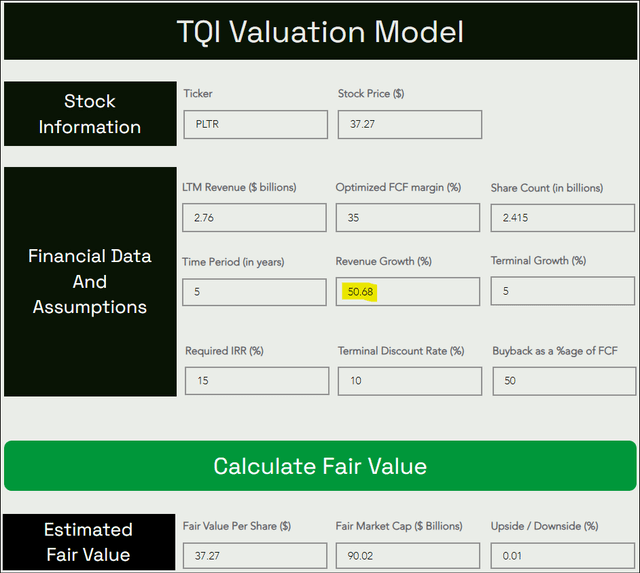

Palantir Reverse DCF Model

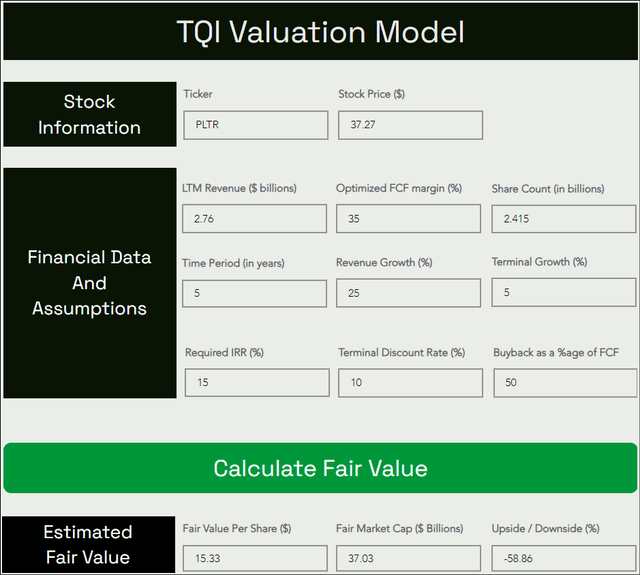

For this exercise, I modeled PLTR with a 2024E revenue base of $2.76B [up from $2.75B] and assumed an optimized FCF margin of 35% [significantly higher than current margins]. All other assumptions are straightforward and self-explanatory, but if you have any questions, please share them in the comments section below.

For a detailed explanation of these assumptions, refer to –

TQI Valuation Model (Free to use at TQIG.org)

According to this reverse DCF model result, the market is currently pricing a 5-year CAGR sales growth rate of 50.68% into Palantir’s stock!

With consensus analyst estimates suggesting a 5-year CAGR sales growth rate of ~20%, there’s a spectacular mismatch between business realities (as measured by several Wall Street analysts) and market pricing of PLTR stock.

Now, can all analysts be wrong? Sure, forward analyst estimates can be wrong for Palantir or any stock out there. However, a 36x P/S and 126x P/FCF multiple is rare, and Palantir isn’t quite delivering hypergrowth [growing at ~27% y/y] to justify such outrageous valuation multiples.

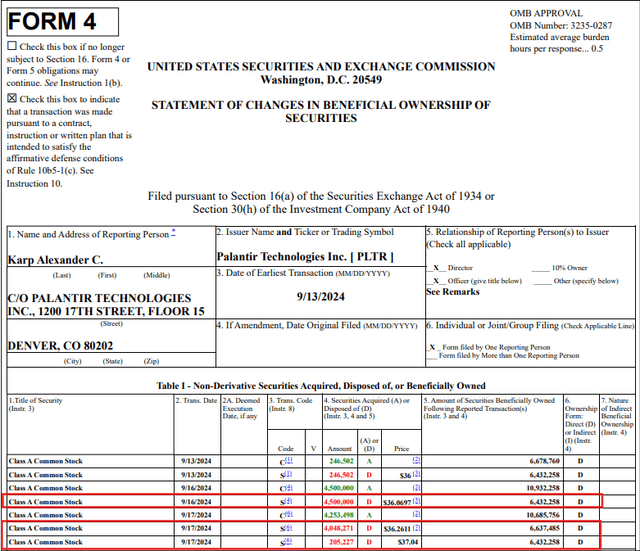

Insiders Get It And Are Selling Aggressively

Palantir’s dynamic CEO, Alex Karp, seemingly never fails to hype up Palantir’s business prospects during media appearances and earnings conference calls. However, he just sold ~8.7M PLTR shares worth over $300M under a 10b5-1 trading plan soon after exercising stock options.

Palantir SEC filing 09_17_2024

And Karp isn’t alone. Palantir’s co-founder and legendary tech investor – Peter Thiel – recently filed a new 10b5-1 trading plan to sell up to 28.5M PLTR shares (worth up to ~$1B) in the near future!

But, AI, AI, AI?

Look, Palantir is a great company, and its AI potential is real. However, current market pricing for PLTR stock is irrationally exuberant. Palantir insiders understand this reality and are selling aggressively.

Concluding Thoughts

Recent S&P 500 index inclusions like Uber (UBER) have showcased active investors’ affinity to front-run passive index investors – boosting stock prices (and consequently, valuation multiples) ahead of index inclusion dates and then selling into forced buying from rules-based indexers.

In my view, a good chunk of Palantir’s latest leg up is a result of this dynamic!

From a technical standpoint, Palantir is enjoying strong price momentum right now; however, with weekly RSI in overbought territory (>70) and PLTR’s price diverging from RSI, a corrective pullback could be just around the corner, especially now that Palantir’s inclusion into the S&P 500 index is completed.

Based on reasonable assumptions for future growth [5-year CAGR sales growth: 25%] and margins [FCF margin: 35%], TQI’s fair value estimate for Palantir stands at $15.33 per share.

TQI Valuation Model (Free to use at TQIG.org)

Given its recent run-up from $27 to $37 per share, Palantir’s potential downside to our fair value estimate has increased from -45% at our previous assessment to -59%!

Now, as I have said in the past, we shouldn’t dismiss the idea of investing in Palantir solely due to its premium valuation, as history shows that winning stocks can be overvalued for long periods [e.g., Amazon.com, Inc. (AMZN), Tesla, Inc. (TSLA), NVIDIA Corporation (NVDA), etc.]. So, let’s take a look at Palantir’s long-term risk/reward to formulate an informed decision:

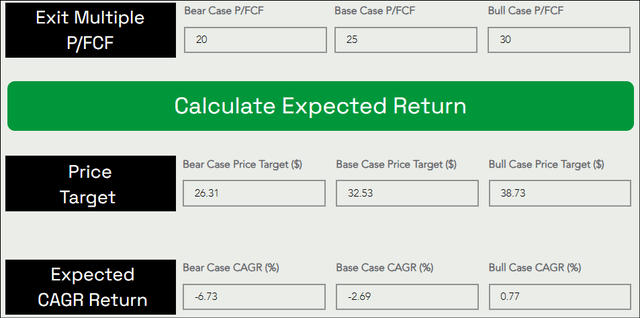

Assuming an aggressive exit multiple of 25x P/FCF, I see Palantir stock declining from $37 to $32.5 per share at a CAGR rate of -2.7% by 2029.

TQI Valuation Model (Free to use at TQIG.org)

Despite modeling Palantir with above-consensus assumptions, the expected 5-year CAGR return for PLTR stock is abysmal. In fact, with a negative expected 5-year CAGR return, Palantir looks worse than dead money.

As we saw in this note, Palantir insiders are selling right now, and I think it is for a good reason. While I am open to continuously re-evaluating Palantir over coming months and quarters as new financial information comes to light, at this point, I continue to view PLTR stock as a tactical “Sell” and we will trim our PLTR long position again at TQI over the next few days.

Key Takeaway: Due to unfavorable long-term risk/reward, I continue to rate Palantir Technologies Inc. stock a tactical “Sell” at $37 per share.

Thanks for reading, and happy investing. Please share your thoughts, concerns, and/or questions in the comments section below.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of PLTR either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

We Are In An Asset Bubble, And TQI Can Help You Navigate It Profitably!

Your investing journey is unique, and so are your investment goals and risk tolerance levels. This is precisely why we designed our investing group – “The Quantamental Investor” – to help you build a robust investing operation that can fulfill (and exceed) your long-term financial goals.

At TQI, we are pursuing bold, active investing with proactive risk management to navigate this highly uncertain macroeconomic environment. Join our investing community and take control of your financial future today.