Summary:

- Palantir’s share price has crossed $20, pushing its market capitalization past $40 billion, benefiting from artificial intelligence and its robust big data platform.

- The company had a strong Q1 with 40% YoY growth in its US commercial segment and overall revenue growth of 21% YoY.

- Palantir has won significant contracts, including a $178 million deal with the US Army, and has identified $90 million in savings for the VA, showcasing the strength of its offerings.

Michael Vi

Palantir (NYSE:PLTR) has benefited from artificial intelligence as it becomes a large big data company. Meanwhile, its share price has crossed $20, pushing its market capitalization past $40 billion. The company has a robust big data platform, and now that artificial intelligence has companies searching for innovation again, the company is well positioned to grow long-term revenue and earnings with robust contracts.

Palantir Q1 2024 Highlights

The company had an incredibly strong Q1 for the year as it’s continued to achieve strong growth and focus on its portfolio.

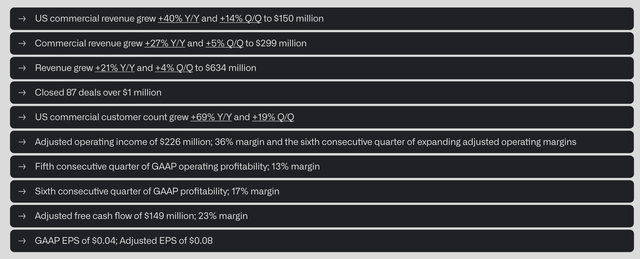

Palantir Investor Presentation

The company saw 40% YoY growth in its US commercial segment, including massive QoQ growth of 14%. The company’s commercial revenue grew 27% YoY as well, with 5% QoQ growth to $299 million. US commercial revenue now makes up more than 50% of the company’s commercial revenue, and we expect that growth to continue in upcoming quarters. Overall revenue grew a massive 21% YoY and 4% QoQ.

The company earned $634 million in quarterly revenue, and it expects that to continue with $650 million in 2Q revenue, and $675 million average for the year. The company has continued to close numerous deals, and growing revenue enables margins to grow even faster. The company had a 36% operating income margin and a 17% GAAP profitability margin. Adjusted FCF came in at a massive 23% margin.

High fixed costs for the company mean that it’ll continue to generate increasing margins as revenue grows, enabling even faster cash flow growth.

Palantir Portfolio Wins

As artificial intelligence warfare continues to grow in Israel and Ukraine, combined with the overall growth of artificial intelligence, the company has had a number of portfolio wins. More so, it’s showing the strength of artificial intelligence on both sides of the battlefield, both cost savings at home, and next-generation equipment.

Palantir Investor Presentation Palantir Investor Presentation

The company won a $178 million contract in the quarter with the US army to deliver Titan next generation deep-sensing capability. This is an over-the-horizon system that is the first artificial intelligence vehicle that will enable sensor fusion with Palantir’s portfolio of software assets. As war becomes increasingly technological, Palantir’s technology will become integral to the battlefield, providing it with reliable long-term revenue in a fractured world.

Another example is Palantir and the VA. The VA has long been discussed as an inefficient government agency, and Palantir’s contract has identified $90 million in savings in a mere 6 months. These portfolio wins will continue to save other organizations money, and thereby earn Palantir longer contracts. These portfolio wins show the strength of its offerings as it continues to do something no other company can do.

Palantir Financials

Palantir’s quarterly performance comes with incredibly strong quarterly numbers.

Palantir Investor Presentation

The company saw 40% YoY growth in U.S. commercial revenue and 14% QoQ growth. That pace of QoQ growth is breakneck and shows that U.S. companies are effectively trying to gain access to the company’s assets as fast as they can be deployed. The company grew its U.S. customer count by a massive 69% YoY and 19% QoQ which shows the long-term potential of the company’s platform.

More importantly, the company first onboards customers, and then it has a long history of growing contract size. This is evidence by the customer count growing much faster than revenue originally. We expect revenue growth to eventually catch up to customer count growth. The company’s US commercial remaining deal value grew 74% YoY and 14% QoQ showing a unique ability to maintain customers for the long term.

This shows the company’s strong financial picture in the quarter.

Palantir Growth

Palantir has an incredibly strong pipeline as it works to both onboard new customers and show them the value of its existing services to increase contract size.

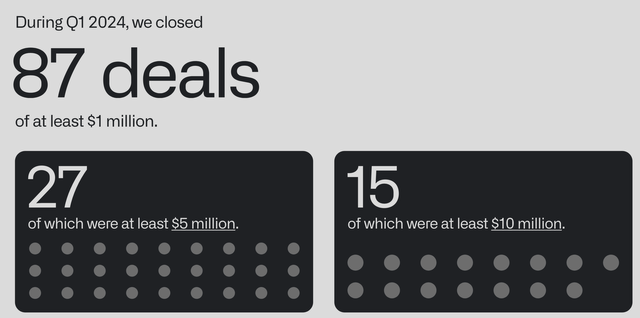

Palantir Investor Presentation

The company managed to close 87 deals in Q1 2024 of at least $1 million, of which 15 of these deals were at least $10 million. The company’s customer count has grown by 42% YoY, and more impressively, the company’s commercial customer count has gone up by 53% YoY. The company’s traditional source of strength was government contracts, but with the excitement around artificial intelligence, its commercial business is growing quickly too.

We expect the combination of revenue growth and growing margins on that revenue to support the company’s long-term FCF and ability to drive shareholder returns.

Our View

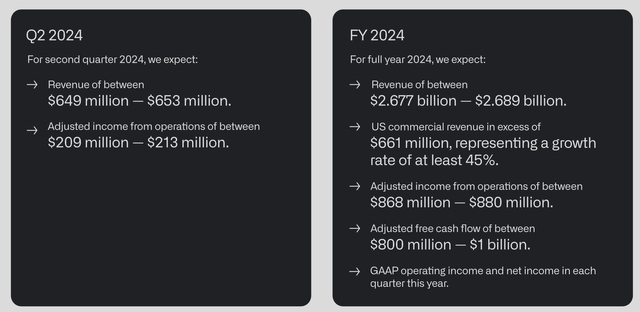

The company continues to expect a strong year with growing revenue and income supporting shareholder returns.

Palantir Investor Presentation

The company expects roughly $650 million in revenue in 2Q 2024, with ~$210 million in adjusted income from operations. For the FY 2024, the company expects just under $2.7 billion in revenue, which is ~$675 million on a quarterly basis. Commercial revenue from the US is expected to grow 45% YoY, and make up ~25% of the company’s revenue, with a strong runway for future growth in upcoming years.

Most importantly, the company’s phase where it’s losing money is finally over. The company expects to generate GAAP operating income and net income in each quarter of the year. For the overall year, the company expects roughly $875 million in adjusted income from operations along with a massive $900 million in FCF, or a FCF yield that’s well over 2%. The company has almost $4 billion in cash on hand and its FCF will continue to support that.

The company’s rapid growth phase has finally turned into strong profits, as we always expected, and this highlights how the company is a valuable investment.

Thesis Risk

The largest risk to our thesis is that Palantir is a more than $40 billion company that is currently trading at a FCF yield of ~2%. That’s strong YoY growth for the company, but to justify its valuation over the long term it needs to increase that by ~5-10x in the coming decade. That’s tough to do, but supported by the artificial intelligence revolution, it’s something we expect the company to be able to accomplish.

Conclusion

Palantir is a company that works primarily with corporate clients. That means that it takes a long time to grow and build up its portfolio of contracts, and convince customers to come over onto its side. The growth of artificial intelligence and companies’ fears of being left behind have been a massive boon for it, as customers rush to sign deals worth millions of dollars with Palantir and its easy-to-use pipeline.

Palantir has achieved profitability and expects to maintain GAAP profitability for every single quarter in 2024. The company expects to have a more than 2% FCF yield for 2024, and with incredibly strong growth, especially in the goldmine that is U.S. commercial customers, we expect its growth to remain strong. That enables the FCF of the company to continue growing, which will support long-term shareholder returns.

Let us know your thoughts in the comments below.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of PLTR either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

You Only Get 1 Chance To Retire, Join The #1 Retirement Service

The Retirement Forum provides actionable ideals, a high-yield safe retirement portfolio, and macroeconomic outlooks, all to help you maximize your capital and your income. We search the entire market to help you maximize returns.

Recommendations from a top 0.2% TipRanks author!

Retirement is complicated and you only get once chance to do it right. Don’t miss out because you didn’t know what was out there.

We provide:

- Model portfolios to generate high retirement cash flow.

- Deep-dive actionable research.

- Recommendation spreadsheets and option strategies.