Summary:

- Palantir’s share price is in bubble territory, which could become a problem as underlying momentum begins to fade.

- This can be seen across a number of metrics, like the volume of AIP bootcamps and net commercial customer additions.

- The ramp of several government projects also appears to be flattering the growth of Palantir’s government business.

- The fanaticism the stock inspires and the potential for large government contracts make it a risky short candidate though.

hapabapa

Palantir’s (NASDAQ:PLTR) share price has moved firmly into bubble territory in recent months, with the stock continuing to trend higher even as momentum in the company’s fundamentals begins to falter. As a result, there is a large amount of downside risk, although this must be weighed against a potential boost from a change of President. In particular, a focus on upgrading the government’s data infrastructure could accelerate Palantir’s growth.

I previously suggested that Palantir had a strong business, with government and defense in particular, providing a large growth opportunity. Palantir has also demonstrated that it can drive adoption amongst commercial customers, although there is growing evidence that this growth will be relatively short lived. I continue to think that the current spending environment is unsustainable and that Palantir’s growth will stabilize/slow in coming quarters. This is unlikely to impact the share price until investor sentiment shifts though.

Expanding Government Opportunity

Given the stated objectives of the incoming Trump administration and the ties between Palantir and Trump’s team, Palantir could reasonably be expected to receive a large boost from the US government in coming years. Peter Thiel (Palantir co-founder) is a Trump supporter and JD Vance previously worked with Thiel.

The administration’s desire to increase government efficiency could be used to justify wider adoption of Palantir’s focus. The company’s software has also been used to support immigration law enforcement in the past. Palantir’s Warp Speed also aligns with Trump’s aim of reshoring manufacturing. I tend to think that this makes Palantir a poor short candidate, as a handful of large government contracts could easily propel the stock higher.

Palantir Business Updates

Titan fully ramped in the third quarter, which likely provided Palantir’s government business with a meaningful boost. Titan is worth 178 million USD, although it is unclear over what period this is likely to be recognized. Revenue from the Department of Defense increased 21% sequentially though. Assuming Titan is now at its maximum run rate, sequential growth of Palantir’s US government revenue could be significantly weaker in Q4.

Mission manager is also a growth driver within government at the moment, with infrastructure like Rubix and Apollo helping to provide other companies with market access. This is one of the more interesting aspects of Palantir’s business that remains underappreciated at the moment. If the Trump administration pushes for more partnership between government and industry, these types of capabilities could be in strong demand.

Bootcamps remain a key go-to-market motion, but this part of the business appears to be rapidly losing momentum. AIP Bootcamps had been completed with over 1,025 organizations at the end of Q2 since the program was launched in mid-2023. This was up from 915 in Q1 and 560 at the end of 2023. Unsurprisingly, Palantir didn’t provide any details on bootcamp volumes in the third quarter. Presumably the trend of lower bootcamp volumes continued in the third quarter though, which will likely see growth of the customer base continue to decelerate in coming quarters.

Financial Analysis

Palantir’s revenue increased 30% YoY in the third quarter to 726 million USD, driven by its business in the US. Excluding the impact of revenue from strategic commercial contracts, growth was 32% YoY.

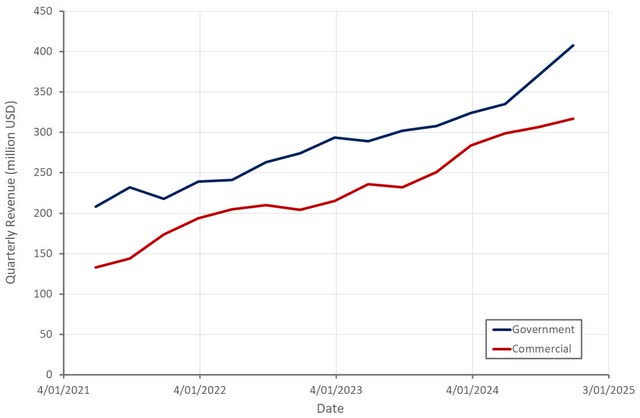

Government revenue was up 33% YoY to 408 million USD, driven by US government revenue, which was up 40%. Commercial revenue totaled 317 million USD, an increase of 26% YoY, driven by US commercial revenue growth of 54%. International commercial revenue totaled 138 million USD, up 3% YoY, which Palantir attributed to headwinds in Europe and a drop in government sponsored enterprise revenue in the Middle East.

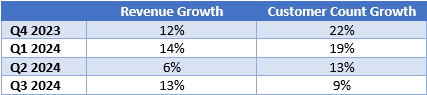

Table 1: Palantir US Commercial Business Sequential Growth (source: Created by author using data from Palantir)

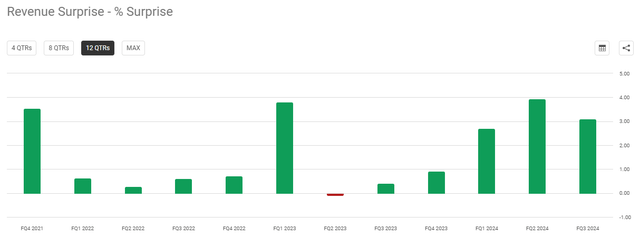

Palantir expects 767-771 million USD in the fourth quarter, representing a 26% growth rate at the midpoint. Given a typical beat, Palantir’s YoY growth should remain fairly stable though.

US commercial revenue is expected to total 687 million USD in 2024, implying 11% YoY growth in the fourth quarter. This would be a fairly solid result given that growth of the company’s customer count continues to decelerate.

Figure 1: Palantir Revenue (source: Created by author using data from Palantir)

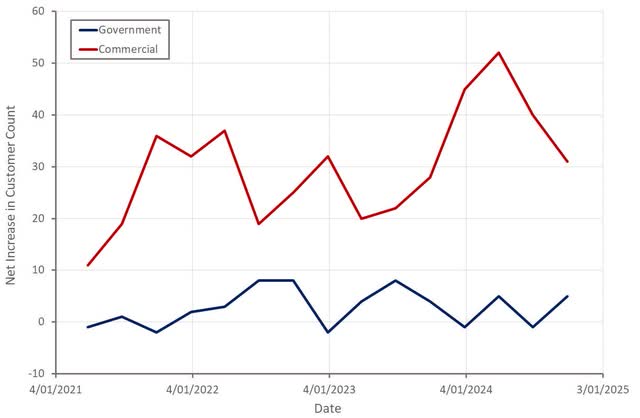

Palantir’s customer count grew 39% YoY in the third quarter to 629 customers. This was driven by growth of the company’s US commercial customer base, which increased 77% YoY to 321 customers. Growth of this segment continues to rapidly decelerate though, and if AIP bootcamps are an indication, this is likely set to continue.

Net dollar retention increased to 118% and is now beginning to reflect some of the momentum in Palantir’s business over the past 12 months. I tend to think that expansion within existing customers will ensure Palantir’s commercial growth remains fairly robust over the next year, even as expansion of the customer base slows.

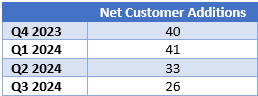

Table 2: Palantir US Commercial Net Customer Additions (source: Created by author using data from Palantir) Figure 2: Palantir Net Customer Additions (source: Created by author using data from Palantir)

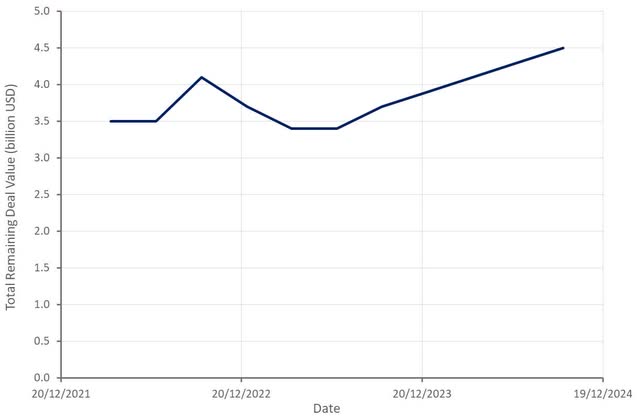

Palantir booked 1.1 billion USD TCV in the third quarter, an increase of 33% YoY. Third quarter commercial TCV booked was 612 million USD, up 52%. The company ended the third quarter with 4.5 billion USD in total remaining deal value, an increase of 22% YoY.

Figure 3: Palantir Total Remaining Deal Volume (source: Created by author using data from Palantir)

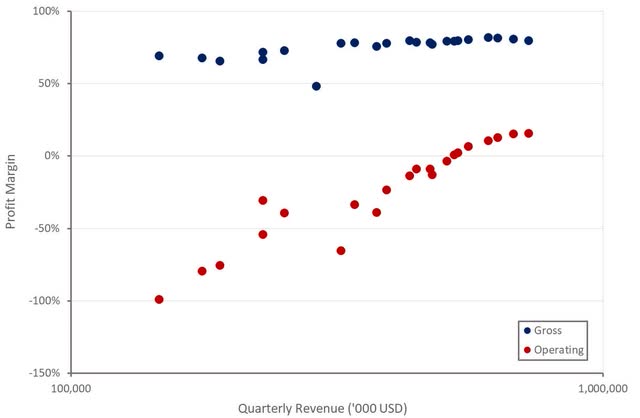

While Palantir’s margins continue to improve with scale and the company’s cash flows are strong, improvements in operating profitability have begun to stall. This isn’t particularly important given the strength of Palantir’s cash flows and its strong growth though.

Figure 4: Palantir Profit Margins (source: Created by author using data from Palantir)

Conclusion

While Palantir has had a strong year on the back of an expanding product portfolio and customers trying to leverage the capabilities of LLMs, its business appears to be losing momentum. In particular, the commercial growth burst looks like it will be fairly short lived. The number of AIP bootcamps has fallen off a cliff and growth of Palantir’s commercial customer base is following. Expansion within existing customers is likely to keep growth robust in coming quarters, this will not last indefinitely though.

Commercial weakness may not matter given the size of the government opportunity and Palantir’s historical ability to drive adoption in this segment. Government growth has accelerated in recent quarters and could be aided significantly by Trump’s presidency. There is little visibility into this part of the business though, making it difficult to predict what will happen going forward.

Figure 6: Palantir Revenue Surprise (source: Seeking Alpha)

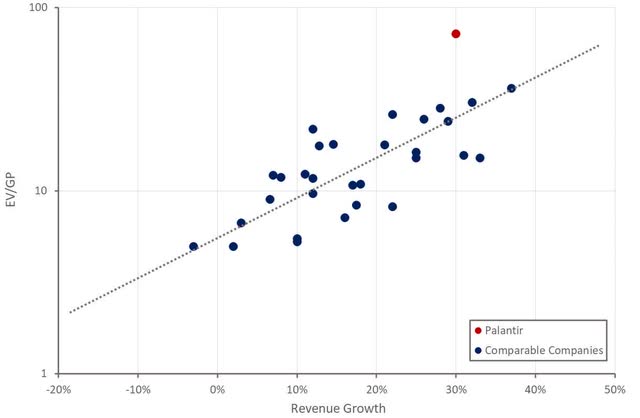

Palantir’s valuation is extraordinarily high due to both the company’s current revenue multiple and the amount of future implied growth in absolute dollar terms. There is a real question whether Palantir’s market is even large enough to drive strong returns for shareholders from current levels.

Given the recent loss of momentum, I expect growth to stabilize in the mid to high 20% range in coming quarters. Under normal circumstances, Palantir’s growth and profitability would only support something like a 25 USD share price. Palantir’s share price has been divorced from fundamentals for months though, and it is not really clear when this situation will resolve.

Figure 7: Palantir Relative Valuation (source: Created by author using data from Seeking Alpha)

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.