Summary:

- Despite the fact that Palantir trades at ~18x forward revenue, the stock still retains vast upside potential.

- Palantir’s commercial segment is still in its early days and has shown strong growth, especially in the U.S. where AI adoption has gone mainstream.

- While most software companies have seen a slowdown in new enterprise bookings; Palantir has reported the opposite.

- The company continues to improve operating margins and scores well on “Rule of 40” metrics with a score above 50.

Michael Vi

I’m something of a valuation hawk. As stocks get expensive, I tend to retreat and either park more in cash or take more contrarian positions. At the moment, cognizant of an S&P 500 that is hovering at all-time highs, I have more than 30% of my portfolio allocated to cash.

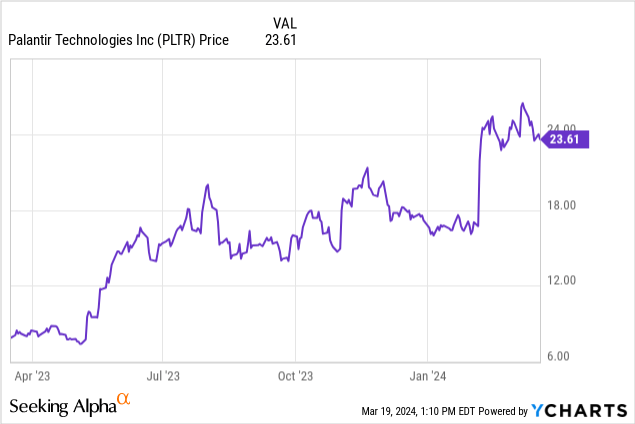

There are few exceptions in which I hold on to some momentum-driven positions, and Palantir (NYSE:PLTR) is one of them. I’ve held onto this big data software company since its IPO, and despite already enjoying substantial gains in this year’s AI boom, I’m still holding on for further upside. Year to date, Palantir has already advanced more than 40%; capping off a rally that has seen the stock price nearly triple over the past year: and yet, there’s still room to grow further.

Amid a heady valuation, we have to recognize that Palantir’s commercial arm is still in its early days

I last wrote a cautiously optimistic note on Palantir in November, when the stock was trading just under $20. At the time, I cheered the company’s growth tailwinds while advising investors to be cautious on putting all of their eggs in this basket. Amid Palantir’s higher share price now, I maintain a similarly bullish position. My recommendation is to keep exposure to Palantir – it’s fine to sell off a small chunk of your gains as I have, and definitely don’t overload on this stock at $24 – but in the long run, I continue to believe in further upside ahead.

The biggest risk to Palantir, of course, is its valuation. At current share prices near $24, Palantir trades at a market cap of $52.29 billion; and after we net off the $3.67 billion of cash on its most recent balance sheet (which also has no debt against it), we arrive at an enterprise value of $48.62 billion.

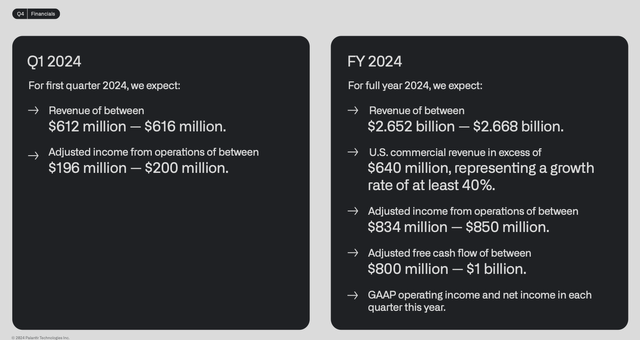

For the current fiscal year FY24, meanwhile, Palantir has guided to $2.65-$2.67 billion in revenue, representing 19-20% y/y growth:

Palantir FY24 outlook (Palantir Q4 earnings deck)

At the midpoints of Palantir’s initial ranges (which have a track record of being raised throughout the year), Palantir trades at:

- 18.3x EV/FY24 revenue

- 54x FY24 FCF

There’s no arguing that these are heady multiples. But at the same time, I’d counterargue that Palantir’s sales efforts in its commercial segment are still in its early days: especially with recent adoption trends for AI products that are spurring many companies off the bench. We’ll cover Palantir’s most recent results in the next section, but note that we’ve seen a tremendous acceleration in commercial customer adds, particularly in the U.S.

This is prominent because most software companies have reported slowdowns in new deal signings, driven by macro hardships – but Palantir has reported the opposite. This is a company that is fully capable of bucking the macro trends and pursuing tremendous long-term growth opportunities, driven by the myriad of use cases that AI and big data technologies support.

All in all, while I’ve peeled off chunks of a lot of my stock portfolio to make room for cash (gunpowder in case the market turns south again), I’ve retained the bulk of my Palantir position. It’s one of the few exceptions where I feel comfortable holding onto a very richly valued stock given the tremendous growth opportunities ahead.

Q4 download

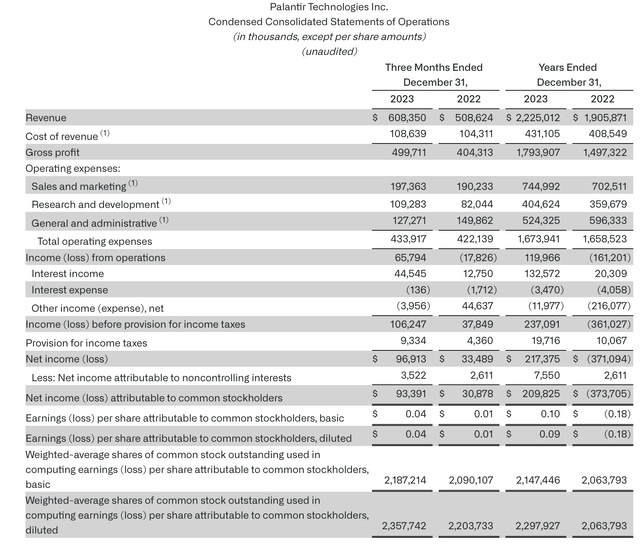

We’ll now cover Palantir’s latest results in greater detail. The Q4 earnings summary is shown below:

Palantir Q4 results (Palantir Q4 earnings deck)

Palantir’s revenue grew 20% y/y to $608.4 million, beating Wall Street’s expectations of $602.8 million (+19% y/y); and importantly, accelerating three points versus 17% y/y growth in Q3.

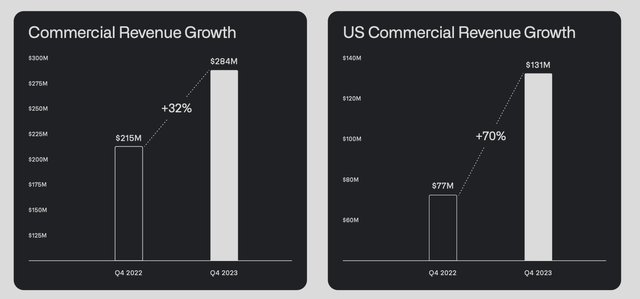

This acceleration was driven entirely by Palantir’s commercial segment, which saw 32% y/y growth to $284 million in revenue, representing 47% or roughly half of overall revenue. Growth was particularly strong in the U.S., meanwhile, which grew 70% y/y to $131 million in revenue.

Palantir commercial results (Palantir Q4 earnings deck)

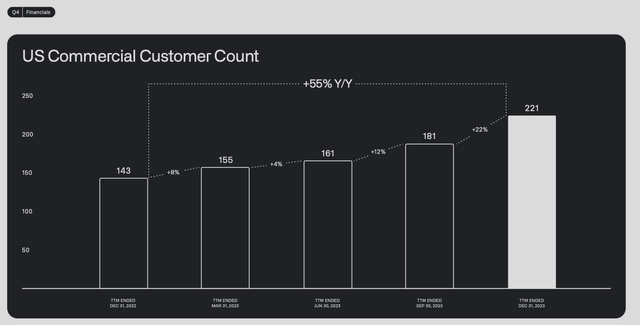

It’s clear to see here what the AI boom of 2024 has meant for Palantir. The chart below shows that Palantir’s still-low count of U.S. commercial customers grew 55% y/y to 221. To date until this quarter, Palantir had not added 40 customers in a single quarter yet – demonstrating that AI adoption has truly reached an inflection point that is starting to produce acceleration in Palantir’s results.

Palantir commercial customer counts (Palantir Q4 earnings deck)

Speaking to the U.S. commercial strength on the Q4 earnings call, CEO Alex Karp said as follows:

In our US commercial business, the expanding addressable market, driven by AIP, is propelling growth both through new customer acquisitions and expansions with existing customers. I’ve never before seen the level of customer enthusiasm and demand that we are currently seeing from AIP in US commercial.

With regard to new customer acquisition, the expanding addressable market is reflected in the greater scale of the top of our sales funnel. And now we’re doubling down on how we’re converting bootcamps to enterprise deals. We’re already seeing evidence of bootcamps helping to significantly compress sales cycles and accelerate the rate of new customer acquisition, which rose to 22% sequentially for US commercial in Q4 versus 12% and 4% in Q3 and Q2, respectively. And we more than doubled the number of US commercial deals with TCV of $1 million or more from the fourth quarter in 2022 to 2023 […]

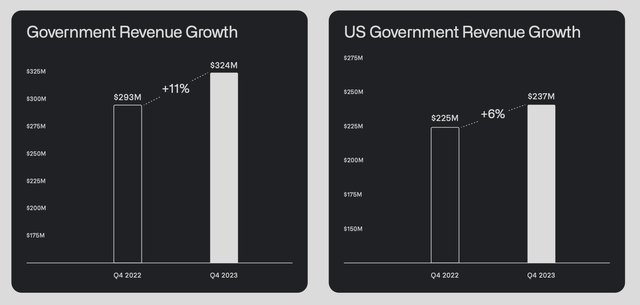

Government results, in contrast, did slow down, with overall government revenue of 11% y/y growth lagging the total company growth rate. Over time, however, while I continue to view the government business as a stable base of lucrative contracts, I believe commercial adoption will drive enterprise to be the lion’s share of Palantir’s business.

Palantir government results (Palantir Q4 earnings deck)

From a profitability standpoint, note that Palantir’s operating margins, adjusted for stock-based comp, also skyrocketed to 34%, up 12 points from 22% in the year-ago Q4 – putting Palantir squarely in the “Rule of 40” category.

Key takeaways

With such a massive commercial opportunity ahead of it, and trends accelerating particularly in the U.S. driven by more mainstream interest in AI technologies, there are plenty of reasons to stay invested in Palantir despite its meaty valuation. I’d recommend holding onto the bulk of your position for further upside.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of PLTR either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.