Summary:

- Palantir reported strong Q1 FY24 earnings with revenue and earnings growing 21% and 76% YoY respectively, driven by acceleration in the commercial segment as it invests in AIP.

- During the quarter, the company was able to acquire new customers, while expanding usage of AIP among existing customers across use cases and industries, as it drives successful bootcamps.

- Simultaneously, the company is well positioned in the government segment, as it was awarded $178M by the US Army to build TITAN Next Generation Deep Sensing capability.

- Although I am optimistic about the company’s long-term prospects, I believe upside may be capped in the short-term, especially with growing probabilities of a pullback in the overall market.

- Plus, momentum in AIP may take a breather as companies slow their spending on training new models in the coming business cycles. Assessing both the “good” and the “bad”, I will rate it a “hold”.

Michael Vi

Introduction & Investment Thesis

Palantir (NYSE:PLTR) builds and deploys software platforms that serve as the central operating systems for customers, enabling them to integrate their data, decisions, and operations to improve business outcomes. The company reported its Q1 FY24 earnings in May, where revenue and earnings grew 21% and 76% YoY, respectively, beating estimates on both counts. The strength in revenue was driven by acceleration in the commercial segment as the company continues to invest in its Artificial Intelligence Platform (“AIP”) to land new customers and drive deeper adoption where it is expanding across use cases and industries. Simultaneously, it is also well positioned in its government segment, which currently accounts for 52% of Total revenue as it was awarded $178M by the US Army in Q1 to build TITAN Next Generation Deep Sensing capability.

While I am optimistic about the company’s long-term future, especially as it unlocks operating leverage, its upside may be capped in the short term as its growth prospects look to be fully priced in. Plus, the company may face some headwinds if it sees some slowdown in its AIP momentum as the AI capex cycle matures. Therefore, given the risk-reward, I will choose to be on the sidelines and wait for a better entry point to initiate a position. In the meantime, I will rate the stock a “hold” at its current levels.

The good: Momentum in the “commercial” segment as adoption of AIP grows along with improving profitability

Palantir reported its Q1 FY24 earnings, where revenue grew 21% YoY to $634M driven by continuous acceleration in the commercial business that grew 27% YoY, contributing over 47% of Total revenue, as they continue to invest aggressively in AIP while driving operating leverage at scale.

Here is a quick primer on Palantir that has built four principal software platforms, which include Gotham, Foundry, Apollo, and AIP. While Gotham allows the government to integrate data from different sources in one platform to help detect patterns, connections, inconsistencies, etc., Foundry does a similar job for enterprises in order to help them detect risks before they materialize, spot inefficiencies, and even get new product ideas. In 2023, Palantir started deploying their newest offering, AIP, which is designed for customers across governments and enterprises to create their own AI models by allowing them to access its servers and real-time information feeds, thus enabling these institutions to make effective decisions within the legal, ethical, and security constraints that they require.

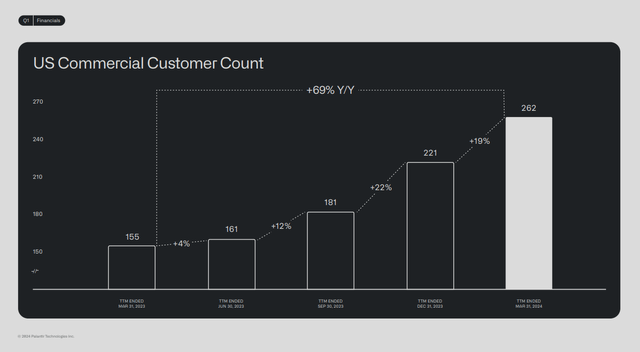

In terms of customer acquisition in the commercial segment, the company closed 87 deals of at least $1M, with 31% of them above $5M, bringing the total commercial customer count to 427, growing 53% YoY. Out of the 427 commercial customers, US commercial customers account for 61% of the total number and are growing at a faster rate of 69% YoY. During the earnings call, management outlined that they were seeing deal compression, and I believe part of that could be attributed to the success of their high volume of bootcamps, with over 915 organizations participating to date. I personally like this approach as it allows potential customers with an opportunity to test and begin building on the platform, with a leading utility company signing a seven-figure deal five days after completing a bootcamp, while another customer signed a paid engagement that eventually converted to a seven-figure deal three weeks later, demonstrating the urgency of these customers to build custom solutions with better time to value compared to other software systems. Plus, given the endless applications of AIP, Palantir is able to penetrate across a wide range of industries.

Q1 FY24 Earnings Slides: Growth of US Commercial Customers

Simultaneously, the company is also seeing growing adoption among its existing customer base, with management discussing that the recurring theme in customer conversations is centered around AI strategy beyond chat and unlocking the value of LLMs by taking unstructured inputs, such as emails, PDFs, audio, comments, etc., and turning them into structured actions and outputs. This is the case as customers such as Lowe’s (LOW), Cleveland Clinic, and General Mills (GIS) are expanding their use cases, leading to higher ACV (Average Contract value). Here are a few examples that management talked about during the earnings call:

“Lowe’s accelerated its engagement from a starting point of no AI to utilizing production-level AI for over 1,000 customer service agents, resulting in a 75% reduction in overdue tasks. As one of its directors noted, “We achieved this in just four months and onboarded 1,000 users within three weeks of rollout”. Cleveland Clinic committed to a 10-year expansion deal to deploy more broadly across its hospitals. General Mills expanded the scope of its work further last quarter as its Senior Director noted, “We’re saving on average about $14 million annually, and it’s really only deployed to part of our network as we speak”.”

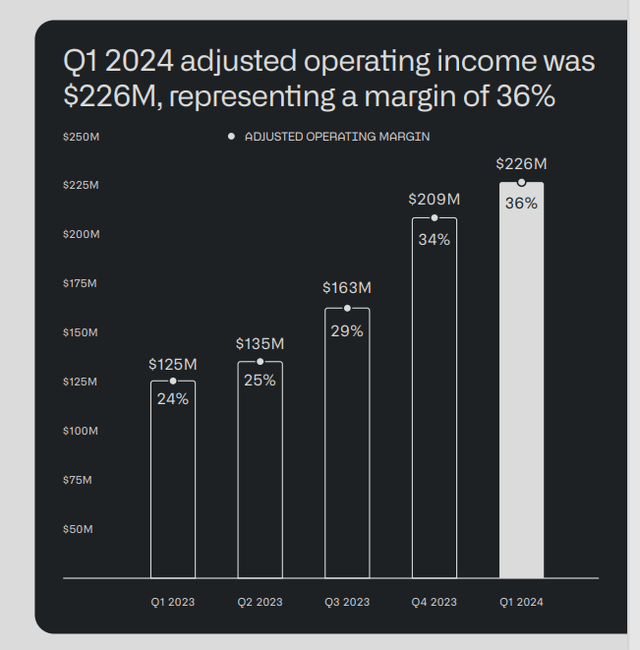

Shifting gears to profitability, the company generated $234.8M in Adjusted EBITDA, which grew 76% YoY. The operating margin jumped to 36%, which is an improvement of 1,200 basis points as operating expenses grew at a much slower rate than revenue growth at 5.7% YoY on a GAAP basis. The company was able to unlock its operating leverage from deepening adoption of AIP on the commercial segment with growing ACV per customer, while acquiring new customers through conducting bootcamps also proved to be efficient on a unit economics basis.

Q1 FY24 Earnings Slides: Growing profitability

The bad: A slowdown in AI capex may dampen AIP adoption

There is no doubt that the current AI boom is acting as a tailwind where enterprises deepen their adoption of AIP as they build custom LLMs, which, after training, will be able to make inferences from the totality of the data, instead of a human being who can work with only part of the data at once. However, this is a function of the current boom in AI capex across companies, and while I believe that AI is a secular trend, we may see a plateau in capex spend in training new models in the coming business cycles, especially as companies gradually start to assess ROI on these investments. Such a shift in sentiment will dampen investor optimism in the short term, as sales cycles may start to lengthen while adoption may weaken, leading to lower ACVs.

Plus, it is important to note that the government segment remains the heavyweight revenue contributor for Palantir, where it faces stiff competition from government contractors and system integrators along with new contracts that are awarded through competitive bidding, which entails substantial costs and a high degree of uncertainty. However, I believe Palantir is well positioned, as it was awarded $178M by the US Army in Q1 to build TITAN Next Generation Deep Sensing capability. I believe this will open up more opportunities as Palantir builds new capabilities for warfighters in this century.

Tying it together: Palantir is a “hold”

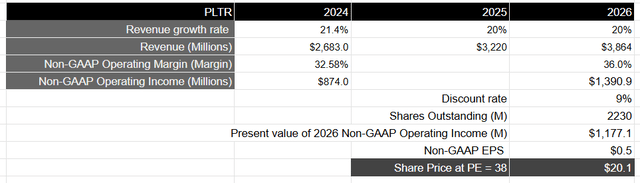

Looking forward, Palantir expects to generate $2.68B in revenue in FY24, which would represent a growth rate of 21.4%, where management raised its guidance for its expectation for US commercial segment to excess of $661M, thus representing close to 25% of Total Revenue, growing at 45% YoY. Assuming that Palantir is able to grow its revenues in the low twenties range over the next two years until FY26, it should generate $3.8B in revenue, as it continues to land new customers and deepen adoption through AIP among customers both in the US and internationally, while seeing moderate to stable growth in its government segment.

On the profitability side, management has guided for Adjusted EBITDA of approximately $874M in FY24, which represents a margin of 32.5%. Assuming it can grow its profitability over the coming years as it is able to expand ACV across its customer base both in the commercial and government segments, while streamlining operating expenses, it should grow its adjusted margin to 36%, which will translate to an Adjusted EBITDA of $1.39B. This is equivalent to a present value of $1.17B when discounted at 9%.

Taking the S&P 500 as a proxy, where its companies grow their earnings on average by 8% over a 10-year period with a price-to-earnings ratio of 15-18, I believe that it should trade at roughly 2.25 times the multiple given the growth rate of its earnings during this period of time. This will translate to a PE ratio of 38, or a price target of $20.00, which is roughly 17% lower than its current price.

Author’s Valuation Model

My final verdict and conclusions

While I am optimistic about Palantir’s long-term growth prospects given the momentum in its commercial segments as it invests in AIP to drive deeper adoption across industries while it gains greater footing in the government segment, I believe that the stock is priced to perfection at its current levels, with limited upside. Plus, with the S&P 500 reaching new all-time highs, with the forward price-to-earnings ratio extended to 21-22, it is above its 5- and 10-year averages of 17.7 and 19.1, respectively. This increases the likelihood of a pullback in the overall market to its long-term average PE ratio, and given the high beta of Palantir of 2.69, there could be greater short-term volatility in the stock price. As a result, I will be waiting on the sidelines for now, waiting for a better entry point to initiate a position in the company, until then, I will rate the stock a “hold”.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.