Summary:

- Palantir’s impressive US revenue growth of 54% in commercial and 40% in government sectors contributed to a 30% overall year-on-year revenue increase.

- Despite strong financials, Palantir’s valuation requires Nvidia-like growth and margin expansion, which may be unrealistic given current market conditions and historical benchmarks.

- A more conservative scenario predicts Palantir’s share price at $35.46 in 10 years, indicating the market may be overvaluing the stock.

- Palantir’s high price-to-sales ratio and P/E ratio suggest extreme valuations, potentially exceeding those of major tech companies during the dot-com bubble.

J Studios

We remember a time before the launch of AIP and ChatGPT, before the AI revolution began, when we rated Palantir Technologies Inc. (NASDAQ:PLTR) a “Buy” because the market was likely underestimating the prospects of AI and Palantir’s business model.

While we issued this “Buy” rating at a price of $9.76 per share, we switched to a “Sell” rating after a couple of Hold ratings earlier this year when the stock rose to $23.5 due to valuation concerns. In hindsight, this decision may have been premature as the stock continued its rally and is now trading at $66. A lot has happened in the meantime, with Palantir moving up into the S&P 500 and moving its listing from the NYSE to the Nasdaq earlier this week, perhaps to be included in the Nasdaq-100 index.

On the contrary, we did do some number crunching and re-ran our valuation models and concluded that Palantir needs an “Nvidia (NVDA) moment”, i.e. an explosion in growth and perfect execution to justify its current valuation, which keeps us from changing our “Sell” rating.

A Continuation Of Growth

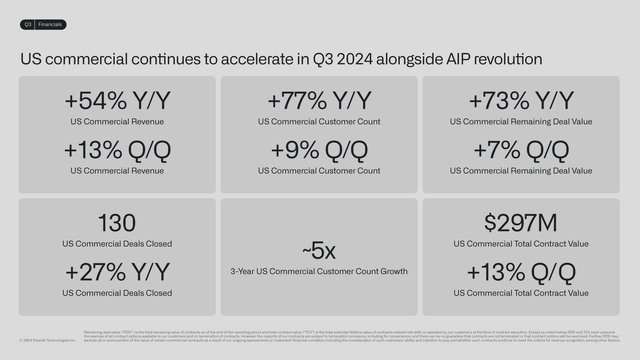

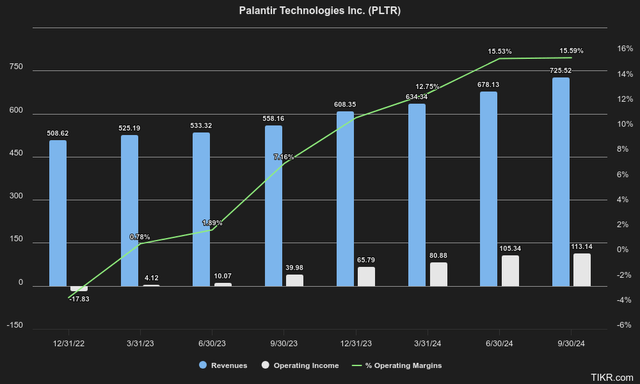

Palantir’s growth surprised us quite positively, primarily due to the increase in revenue from the US business this quarter, as commercial revenue in the US increased by 54% year-on-year and government sector revenue increased by 40%. In the government sector, results were positively impacted by the timing of spending to coincide with the end of the government’s fiscal year. Including international revenue, commercial revenue grew by 27% and government revenue grew by 33%, resulting in overall revenue growth of 30% year-on-year.

And while these results beat estimates on both revenue and earnings, we are seeing some slowing in our business customer count on a quarterly basis, which while still at 9% quarter-over-quarter, is less favorable than the 77% year-over-year revenue growth, including prior quarters.

Margins were also favorable, with GAAP operating margins currently at 15.59%, which translates to an operating profit of $113.14M on revenue of $725.52M for the quarter.

In addition, the company received $52.12M in interest income, which boosts the bottom line and offsets the $4.56B of cash and short-term investments on the balance sheet. Essentially, Palantir has a total net debt of -$4.31BN given this cash position and very low debt, which is also a very good buffer from a balance sheet perspective.

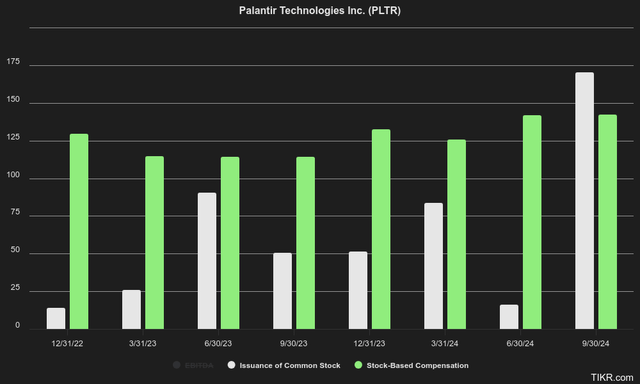

From a GAAP free cash flow perspective, this metric has risen very sharply from $696.41M to $980.32M over the last 12 months, although investors should be aware that Palantir recorded $542.45M worth of stock-based compensation and issued $321.62M worth of common stock over the same period, resulting in some dilution. On the other hand, the company has repurchased $45.60M worth of shares under its share buyback plan in the last 12 months.

Palantir Needs An “Nvidia Moment”

As we watched Palantir’s valuation rise and multiples increase, we began to wonder what kind of growth Palantir would need to justify its current valuation. After crunching some numbers, we realized that Palantir might need an Nvidia moment to excel.

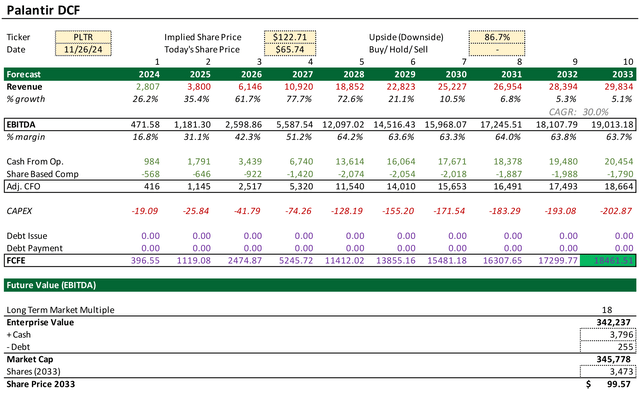

So we applied the same revenue growth and margin expansion levels as Nvidia, using the 671.61% revenue growth that Nvidia will experience between 2020 and 2024, including its year-end estimates. We applied the same growth level for Palantir for the period from 2024 to 2028 and came up with a staggering estimated revenue of $18.85BN. Thereafter, revenue growth slowed, although the compound annual growth rate (CAGR) over the entire period to 2033 is still a staggering 30%, with revenue increasing more than tenfold.

From an EBITDA perspective, we have also factored in this “Nvidia moment” and expect margins to rise rapidly to 64.2% by 2028, which would be quite an achievement given GAAP EBITDA margins were only 16.71% last quarter. Even compared to Nvidia, this would be an achievement as the company is assuming a higher base with EBITDA margins of 34.90% in 2020.

Combining this immense 30% CAGR in revenue and EBITDA margins that exceed those of any other Magnificent 7 company would result in EBITDA of $19.01BN, which at an 18x multiple and after adding excess cash and deducting debt results in a market capitalization of $345.78BN. Dividing this by the expected number of shares outstanding (adjusted for dilution) gives an expected share price of $99.57 at the end of the period. We have performed the same calculations from an adjusted cash flow from operations perspective and expect free cash flow to equity (FCFE) to reach a similar level of $18.46BN at the end of the period.

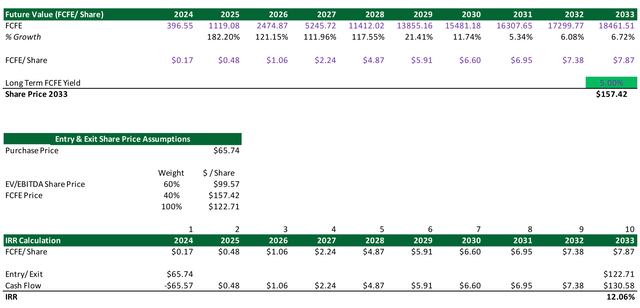

This corresponds to $7.87 on an FCFE/share basis. At a 20x multiple or a 5% FCFE yield, this valuation would be more optimistic, and we would arrive at $157.42 per share. Most of this optimism in this valuation method is due to both a slightly higher multiple and the rapid expansion of the free cash flow margin between 2024 and 2028.

As we believe this extreme margin expansion is pushing the limits and is a far less likely scenario, especially given the massive sales growth taking place at the same time, we take the second approach with a slightly lower 40% weighting, which leads us to a combined price target of $122.71.

Surprisingly, when we input the FCFE/share data and target price into an IRR calculator, we only get an IRR of 12.06%, which we believe is only slightly higher than the S&P 500, which has a CAGR of 11.48% since 1950. This also shows the extreme financial gymnastics Palantir would have to deliver to outperform the historical returns of these benchmarks, at the price at which the company is currently valued.

Even with perfect execution, one might wonder if Palantir is able to grow its revenues at a 30% compound annual growth rate for 10 years while increasing its EBITDA margins further than most software companies or any other Magnificent 7 company. In this regard, we could even say that Palantir needs more than an “Nvidia moment” to justify its valuation. Even during the earnings call, when talking about the Rule of 40 and trading off growth for margin expansion, Palantir’s CEO mentioned that they are probably at the upper end of what is currently possible in terms of growth:

By the way, I don’t think you get higher growth than what we had, honestly, although we of course are always pushing and want even higher growth. (Alex Karp)

As already mentioned, Palantir’s revenue growth has accelerated, but is still at 30% year-on-year, which the company would have to achieve for 10 years in a row for our extremely optimistic valuation model to make sense.

The Downside Scenario Is Excessive

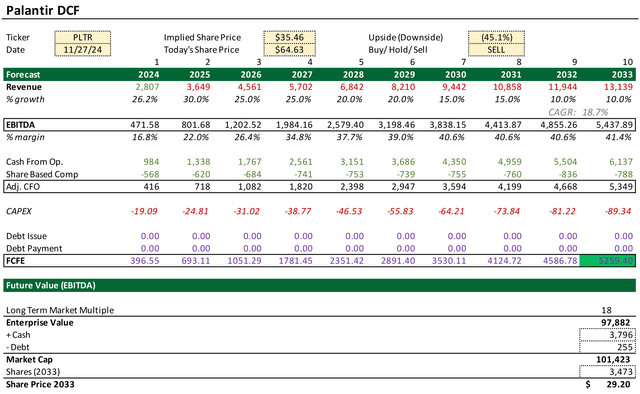

We have therefore examined what a more conservative case would look like, which we believe is more likely. We re-examined our assumptions, assuming annual growth of 30% in 2025, staying in double digits until 2031 and leveling off at 10% thereafter, still a very strong CAGR of 18.7% overall.

Not only that, but we assumed that EBITDA margins would continue to gradually expand to around 41.4%, still above the industry average for software in systems and applications of 28.53%, but also likely reflecting Palantir’s consistency in revenues and its superior moat.

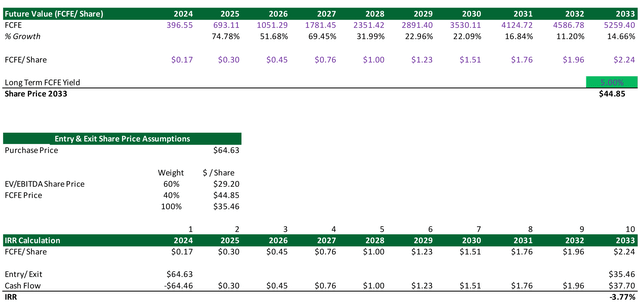

From this perspective, an 18x multiple on EBITDA of $5.44BN yields a market capitalization of just $101.42BN, or $29.20 per share, with an estimated 3.47 billion shares outstanding (diluted). Looking again at the FCFE valuation model below, we apply a 5% FCFE yield to the $2.24 generated at the end of the period and arrive at a price target of $44.85.

Put another way: in a more realistic and conservative scenario, we see Palantir trading at just $35.46 per share over a 10-year period, which equates to a negative IRR of -3.77%. Which again brings us to the point that we firmly believe the market is pricing Palantir beyond perfection right now, with anything that doesn’t deliver Nvidia-style growth and profit margins likely to be punished in the future.

Some Key Considerations

Apart from Palantir reaching extremes on an absolute basis according to our valuation model, we also find it difficult to find opportunities in Palantir when we look at the company on a relative basis.

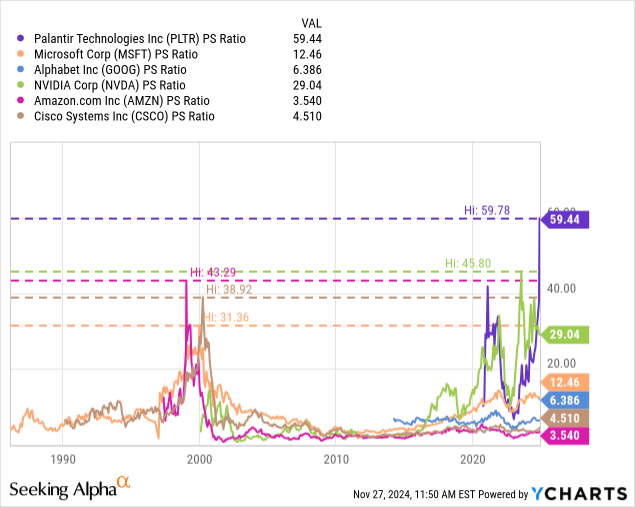

As Palantir is a software-based company, the price-to-sales ratio usually gives us a good first impression of how expensive its valuation is, ignoring the underlying margins of the sector. However, Palantir is now trading at a price-to-sales ratio of 59.44, which is practically higher than anything we have ever seen compared to other well-known software companies. One could even say that Palantir’s valuation has become so extreme from this perspective that it exceeds the valuations of Microsoft, Cisco and Amazon at the height of the dot-com bubble.

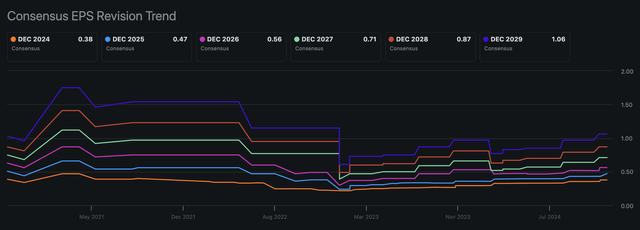

It is interesting to note that this increase in the multiple is much more pronounced than the upward trend in earnings expectations, which are only increasing marginally. Looking at December 2026 earnings per share revisions, estimates were $0.53 per share in the same period last year, and now forecasts are $0.56 per share.

However, out of the last 8 quarters, 7 exceeded earnings per share, which shows that the forecasts are probably not optimistic enough. However, looking at the EPS estimates for 2026, Palantir is currently trading at a P/E ratio of 116.90 at the end of 2026. In 2033, the year we can see furthest into the future for estimates, Palantir is still trading at a P/E of 32.54, something we have never seen before.

Another important aspect of this rally, in our view, is the momentum Palantir has seen as the attention of the AI revolution shifts from foundational companies like Nvidia and LLM builders to companies that are more focused on end-user value. As we have pointed out in previous articles, we see a high risk that there will end up being an AI hardware overbuild, which could actually benefit Palantir as it should reduce the cost of training models and inference. We strongly agree with this fact, which was highlighted during the earnings call:

The market has been focused on AI supply, the models. We see this clearly in the progress, but also in the capital sunk into these models. Indeed, the models continue to improve, but more importantly, the models across both open and closed source are becoming more similar. They are converging, all while pricing for inference is dropping like a rock. This only strengthens our conviction that the value is in the application and workflow layer, which is where we excel.

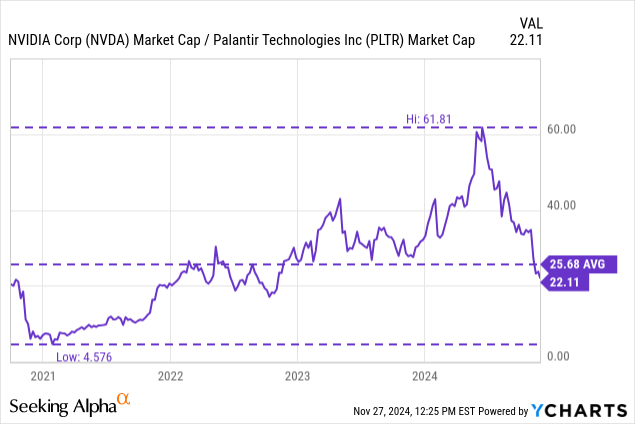

Another way to look at this momentum would be to calculate the rate of change of Nvidia’s market capitalization compared to Palantir, or a ratio of Nvidia to Palantir. As you can see below, Palantir has only recently caught up to Nvidia’s huge rally, with this ratio falling from 61.81 to 22.11 in just a few months, as Nvidia continued to trade relatively flat over this period.

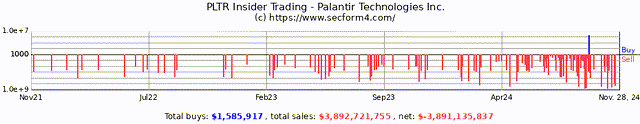

Finally, we would like to highlight the fact that insiders have increased the pressure in terms of insider selling as the stock has risen in recent months. We believe this is significant, especially in cases like Peter Thiel, who is not only a co-founder but has also proven to be a great investor when you look at his venture capital track record. According to our estimates, the other founder and current CEO Alex Karp has sold approx. 1.95 billion dollars worth of shares this year alone.

The Bottom Line

Looking at recent growth and earnings estimates and forward multiples, the recent rally in Palantir’s stock appears to be mainly driven by speculation and multiple expansion, in our opinion. For Palantir’s valuation to make sense at current levels, we believe management would need to achieve perfect Nvidia-style growth over the next 10 years, i.e. grow revenues at a 30% compound annual growth rate while expanding margins well beyond those of an average software company.

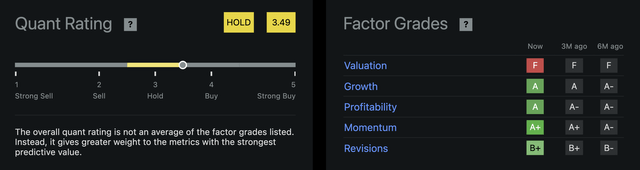

And even if it were to achieve the above targets, we forecast an IRR of only 12.06%, offering little alpha above benchmarks while carrying massive risk in terms of future earnings growth. Seeking Alpha’s Quant also recognizes these valuation issues and rates Palantir with an F, despite the company performing very well in terms of growth, profitability, momentum and earnings revisions and earns a “Hold” rating.

However, we believe that these valuation issues have reached such an extent that they are likely to outweigh all other factors, which is why we currently rate Palantir a “Sell”.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.