Summary:

- Palantir’s stock has surged recently, driven by commercial revenue growth, margin improvement, and potential mass adoption in AI, despite concerns about overvaluation and stretched technicals.

- Palantir’s unique technology, large addressable market, and potential for margin expansion position it similarly to NVIDIA’s pre-AI revolution phase, suggesting significant upside.

- With a potential target price of $100, Palantir could more than double, reflecting its unappreciated potential and substantial market opportunity.

Jamesbowyer/E+ via Getty Images

Thesis Summary

Palantir’s (NYSE:PLTR) stock has taken off like a rocket in the last month, and the stock has even crossed the $40 level on Friday.

This has prompted a lot of bearish articles, claiming the valuation is too extreme and that the stock has gone too far.

Palantir was already a stock that divided the room when it was trading 50% lower, and both bears and bulls seem to be doubling down.

And while I agree that the valuation seems stretched, and the technicals seem stretched, there must be some reason for this rally.

Palantir has been gaining momentum and new contracts in the last month.

Is this a sustainable trend? Has something changed fundamentally?

Is Palantir undergoing an NVIDIA (NVDA) moment?

Palantir Rally

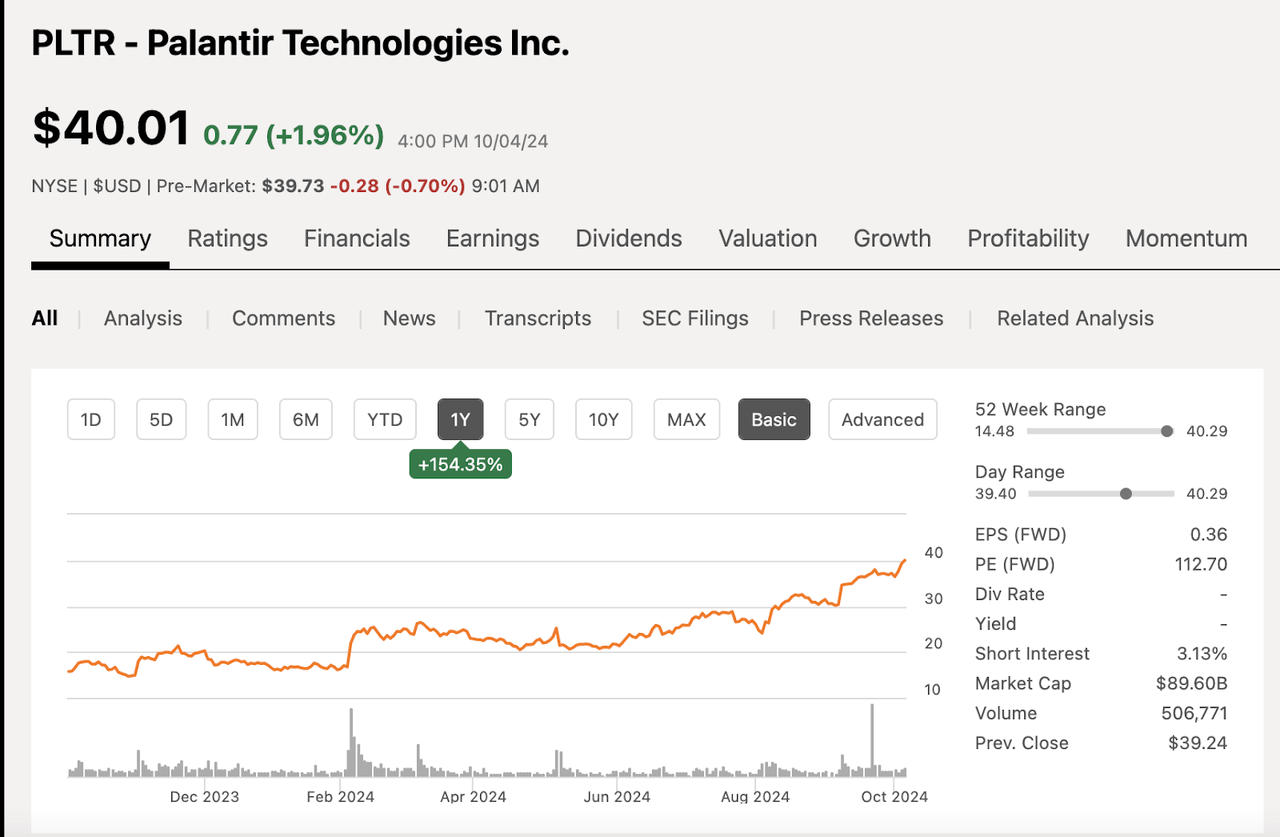

Palantir’s stock is up 150% in the last year and has almost doubled since the flash crash in early August.

Palantir Price (SA)

What’s going on with Palantir? The rally seems to me like a culmination of momentum that Palantir has been building over the last few months.

Not for nothing, I wrote numerous articles over the year signalling Palantir was a strong buy due to dynamics we could appreciate in the latest earnings, including:

-

Commercial revenue growth

-

Margin improvement

-

Potential for mass adoption in AIP

In the last few weeks, Palantir has scored multiple partnerships that reinforce this idea.

New and existing customers across the commercial and federal landscapes continue signing up for multiple aspects of the PLTR tech stack based on our recent checks as the company introduces new valuable use cases to customers with more organizations seeking to drive efficiencies on the back of AI,

Source: Dan Ives, SA Press Release

These deals include a multi-million dollar deal extension with APA Corporation (APA), a $100 million deal with the army and a deal with Nebraska Healthcare to expand AI applications in the sector through AIP.

Palantir is firing on all cylinders, but is this already priced in?

Valuation Seems Stretched

This seems like an obvious conclusion.

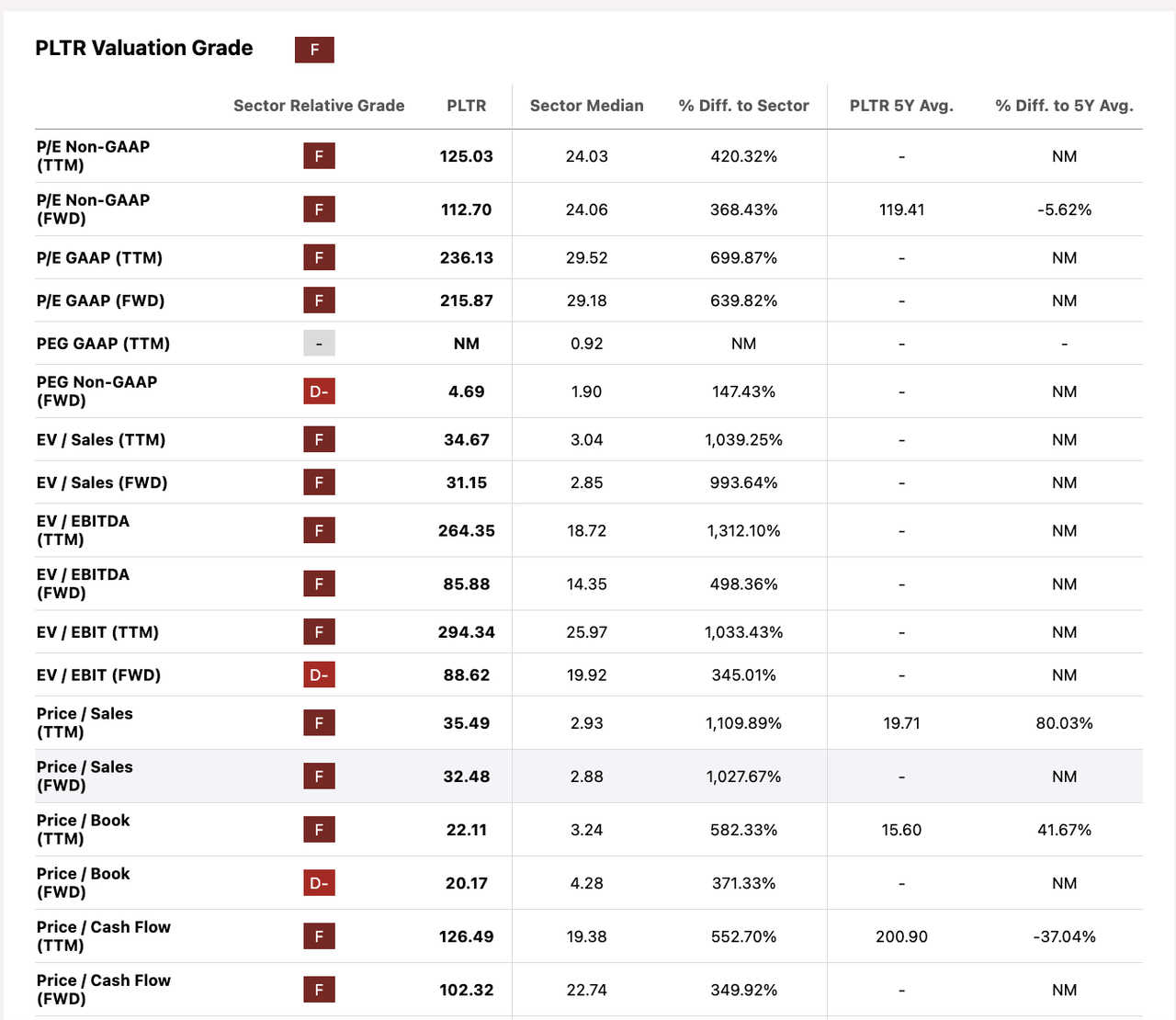

PLTR valuation grade (SA)

By any stretch of the imagination, Palantir is overvalued. There’s not a single metric here where we can cut Palantir some slack. Even using growth estimates of earnings in the PEG, Palantir still trades at 4.6x forward earnings (Non-GAAP).

Taking current analyst EPS estimates into account, Palantir will continue to be overvalued for some time.

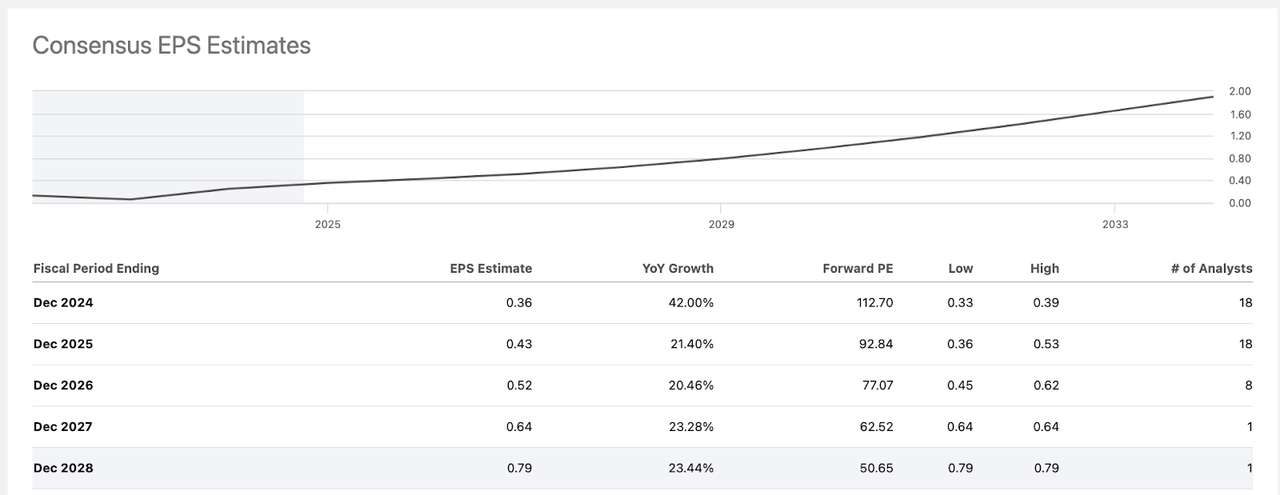

Palantir EPS estimates (SA)

Though EPS can likely grow at a fast pace, Palantir still trades at over 50x its 2028 earnings.

Technicals Seem Stretched

Another observation that seems quite obvious on the surface.

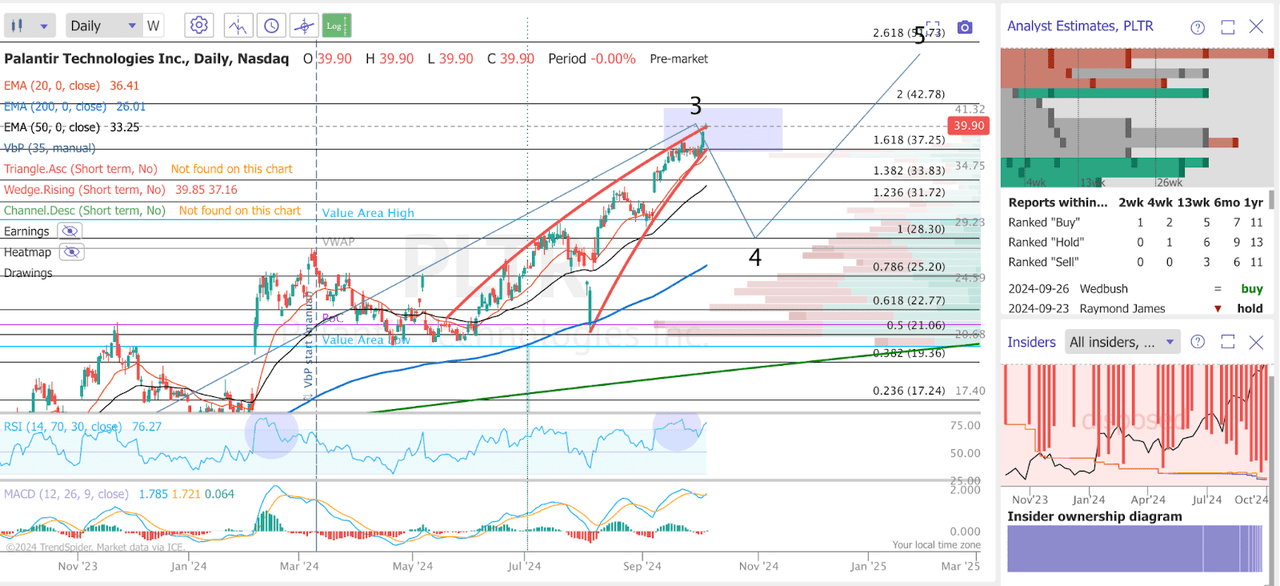

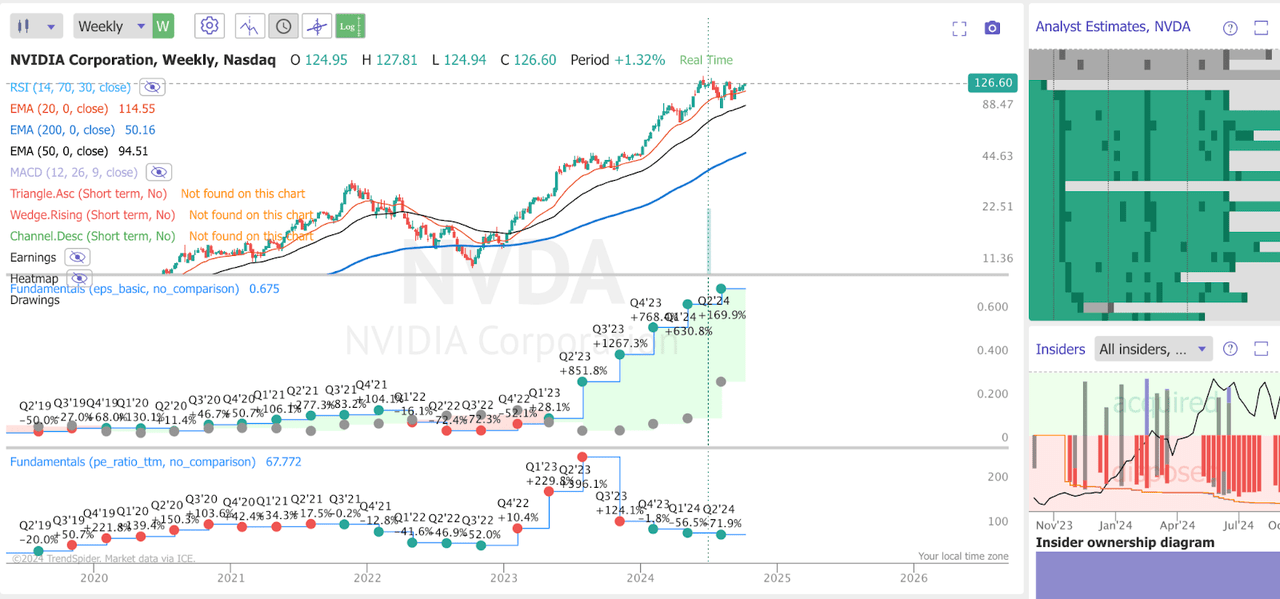

Palantir TA (Trendspider)

Palantir has rallied almost 100% since it sold off to $21. The RSI is overbought on the daily and weekly time-frames, and we are arguably forming a bearish divergence, showing the price could be getting exhausted.

We have actually reached my target of around $40, which I mentioned in my last article, an area in which I said I would shed some of my position.

While I still believe we could be due for a sell-off, this might be a train you want to stay on for the long term.

Is this Palantir’s NVIDIA moment?

Looking at valuations and technical analysis is obviously very helpful, but it’s not a perfect tool. If it was, a lot more investors would have been able to see that NVIDIA was about to explode higher, and this was not the case.

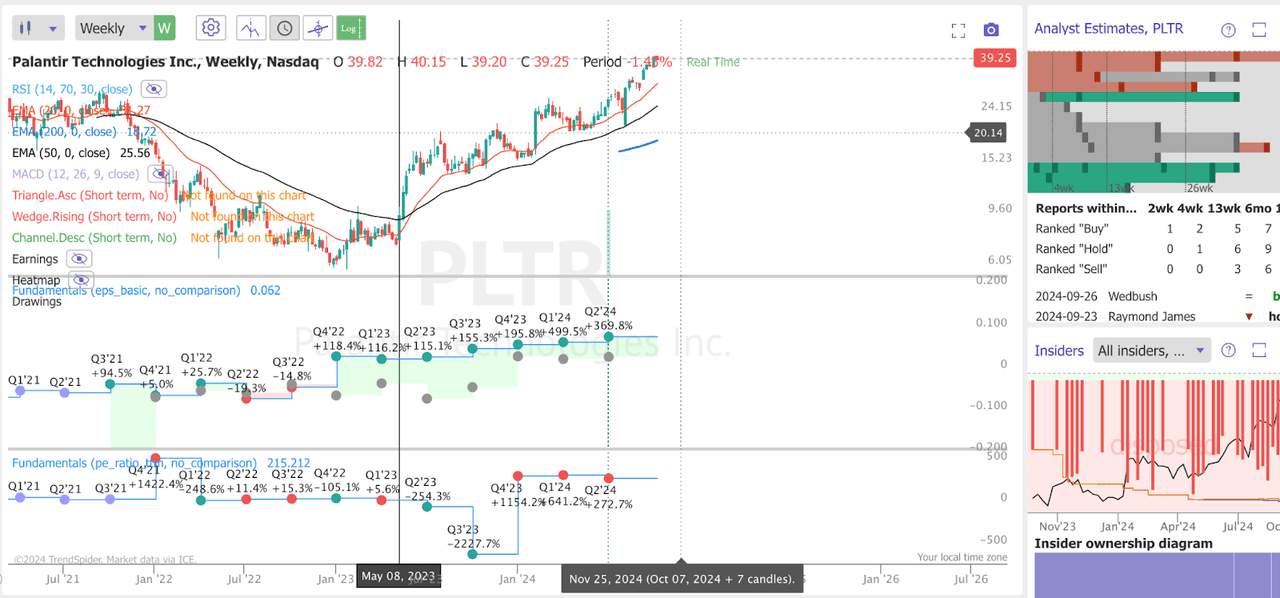

Let’s look at NVIDIA’s price evolution, EPS and PE ratio over the last few years.

NVIDA Price, EPS and PE ratio (Trendspider)

Above we can see NVIDIA’s price, in the pane below the EPS and then below that the TTM PE.

First off, notice that ahead of the rally, NVIDIA was barely making a profit, and had seen EPS fall for a solid year. But the EPS bottomed out, and so did the price.

By many metrics, NVIDIA seemed like an obvious sell after the price more than tripled. The PE ratio is above 200 at one point.

However, as earnings kept growing exponentially, the PE actually began to fall, and so the stock rallied even further.

NVIDIA has delivered over 2000% returns in the last 5 years.

Now, let’s look at Palantir.

Palantir Price, EPS and PE ratio (Trendspider)

Similar to NVIDIA, Palantir bottomed as its EPS were decreasing, and the company was not even profitable back then.

The PE ratio is a bit more volatile here since earnings were negative at one point, but we can also see that, in recent quarters, the PE has actually remained flat, while since the EPS and the price both increased in tandem.

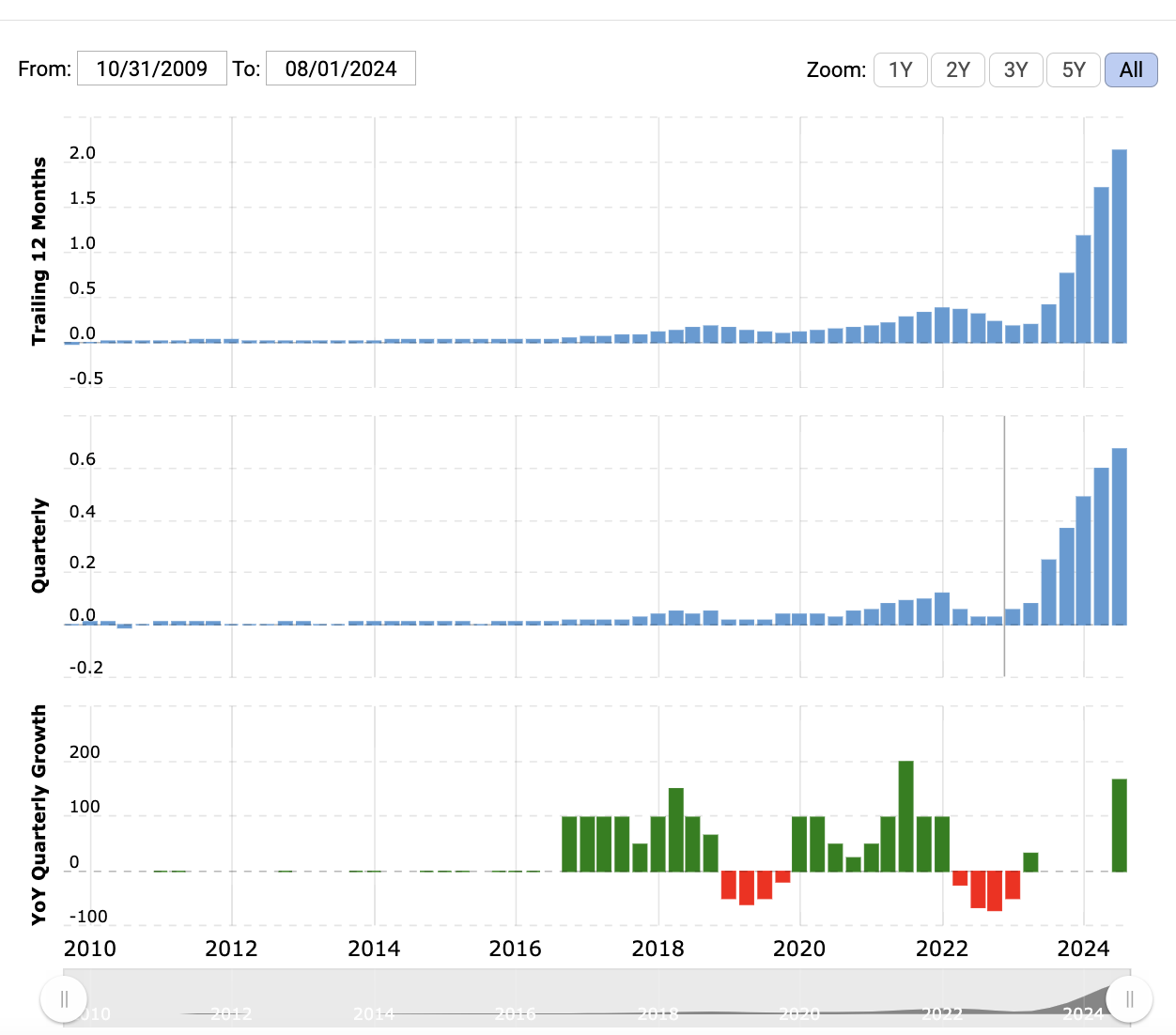

Now, another look at NVIDIA’s earnings.

NVIDIA EPS (Macrotrends)

As we can see, ahead of the AI revolution, NVIDIA was barely breaking even. Operating margins at the lows were close to 17% but it only took two good quarters to really change this.

Palantir’s Unappreciated Potential

I argue, therefore, that Palantir is actually quite similar to 2020 NVIDIA, and this relies on three key insights.

Unique Technology

With AIP, Palantir has really proved that it has a unique technology that stands in a league of its own, much like NVIDIA’s microchips.

And as far as I can tell, we’re really the only company to figure out how to help our customers get beyond chat, leveraging the investments that we’ve made in ontology, really harnessing this pattern of implementation where you’re taking unstructured inputs and turning them into structured actions and outputs that drive economic value in the enterprise.

Source: Earnings Call

In fact, we could even say that, like NVIDIA, Palantir has been waiting decades for this moment. Particularly, its ontology, which helps create digital assets from real-life business structures, actually allows companies to harness the full capabilities of AI technology.

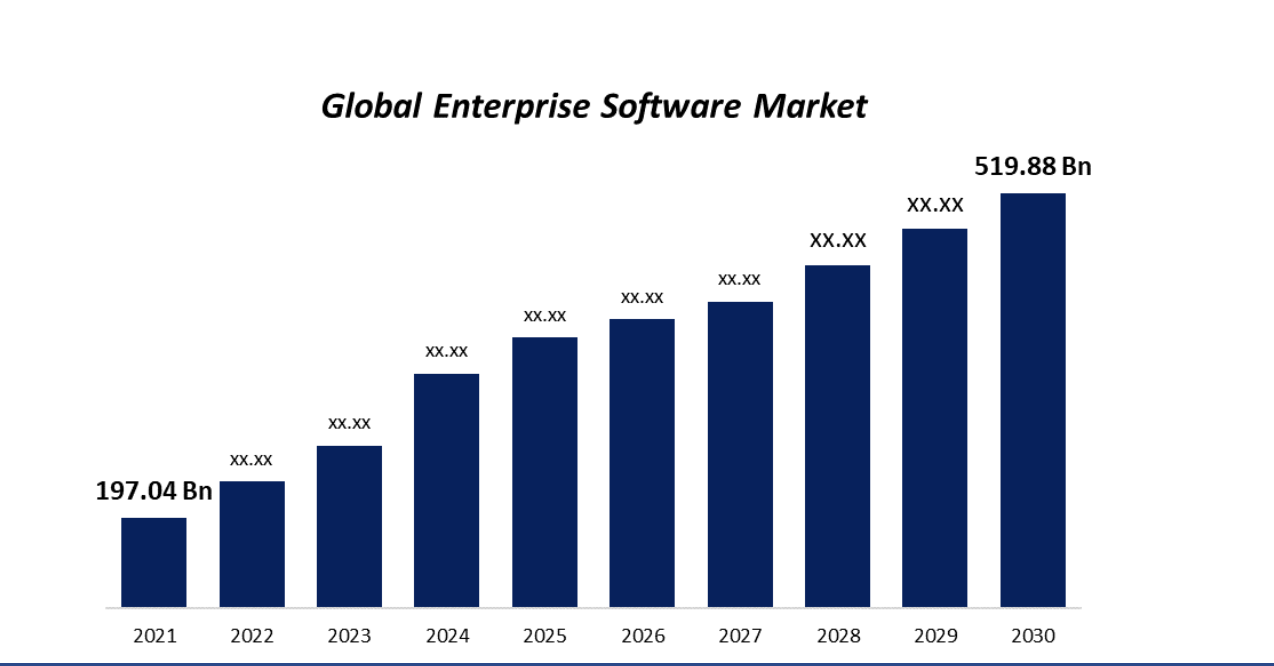

Large TAM

People underestimate just how huge this market opportunity is. Palantir’s AIP can potentially tackle all aspects of the Enterprise Software Market, which is expected to reach over $500 billion by 2030.

Global Enterprise Software Market (Spherical Insights)

How much market share can Palantir capture in the next five years? Even a small sliver of this market could lead to huge increases in revenues.

Potential For Margin Expansion

While Palantir does rely heavily on sales agents, and there are large investments necessary in R&D, AIP specifically is software, and its revenues could come with a high margin. This is especially true as AIP becomes more commonplace.

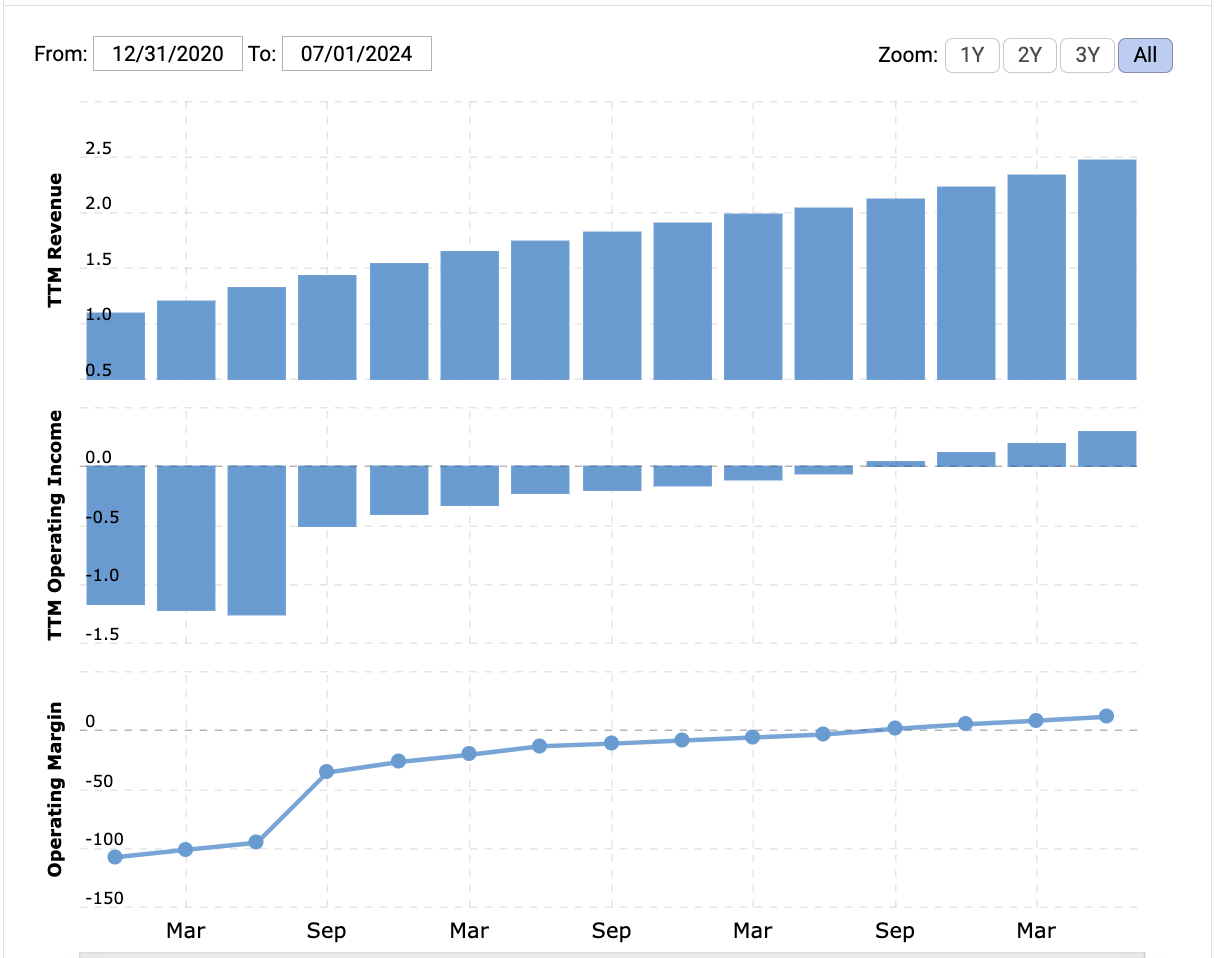

PLTR margins (Macrotrends)

Comparing it to NVIDIA again, Palantir’s operating margin now sits at 11%, not far from where NVIDIA’s margin was before the AI rally started.

Palantir: Path to $100

I call this Palantir’s unappreciated potential because I believe many analysts and investors still don’t see that revenues could really explode higher soon. I’ve mentioned already Palantir is tackling a $500 billion market, and currently estimates have revenues by 2030 of $8.3 billion.

But what if Palantir could capture a relatively meager 2.5% of that Enterprise Software Market?

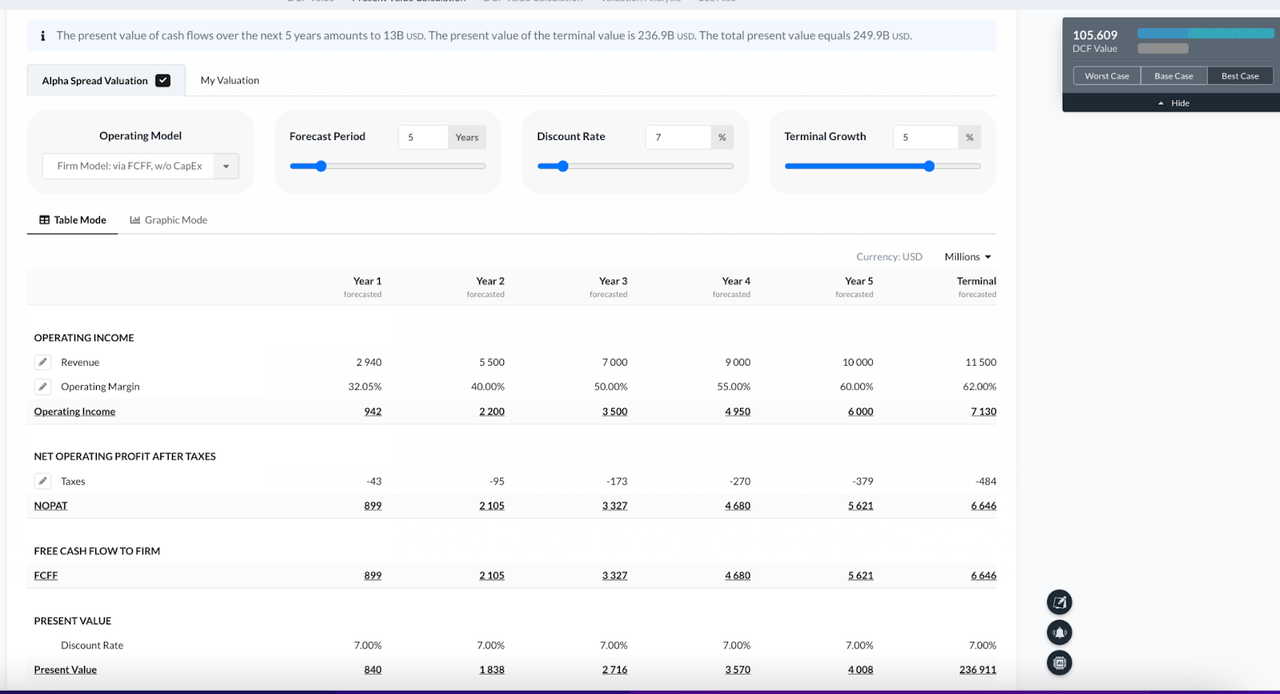

In the DCF analysis below, we assume Palantir can grow revenues to around $11,5 billion in the next five years. Furthermore, we project operating margin can increase to around 60% as revenues climb.

In other words, this is a similar path to what NVIDIA experienced, though with more moderate growth rates.

Palantir DCF (Alphaspread)

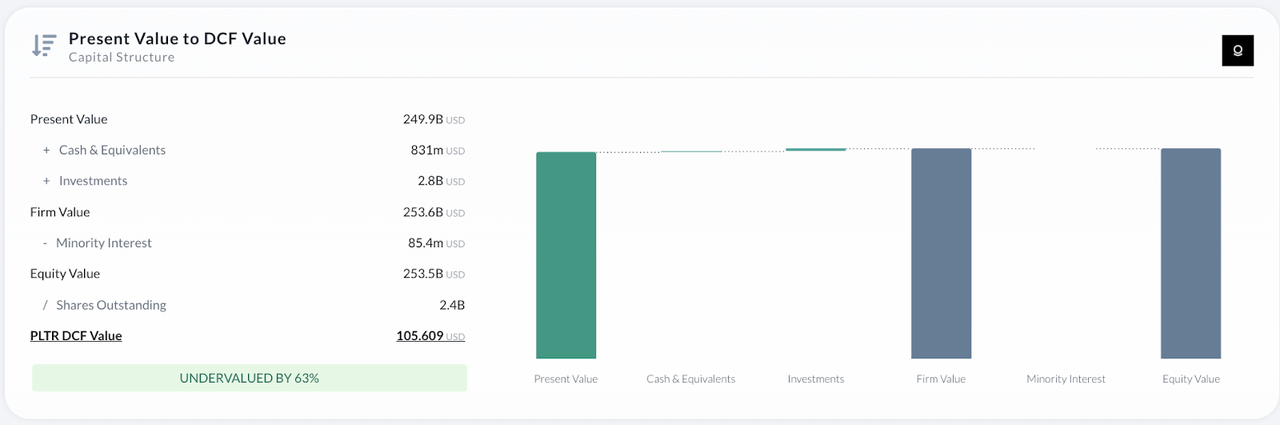

We’ve also applied a 7% discount rate and a 5% terminal growth rate which gives us a target price of $105.

Palantir DCF Value (Alphaspread)

Yes, this is very bullish, but it is possible.

My point here is that analysts can’t predict moves like this. They didn’t with NVIDIA and they won’t with Palantir.

Final Thoughts

Palantir has the right ingredients here. With a PT of $100, Palantir could still more than double from here, and that would still be a more modest rally than what NVIDIA did. I maintain a buy rating on Palantir, though I acknowledge that we could sell off somewhat in the next week.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of PLTR either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.