Summary:

- Palantir and Oracle have announced a strategic partnership to host and deploy Palantir’s platforms across Oracle Cloud Infrastructure.

- Oracle’s modular approach should reduce software costs and increase availability across regions with varying data privacy laws.

- This partnership may debottleneck Palantir’s sales process and allow for faster and more seamless deployments.

champpixs

Palantir (NYSE:PLTR) and Oracle (ORCL) announced a partnership to jointly deliver cloud and AI solutions across businesses and governments. This changes the story in two impactful ways for each company. For Oracle, the partnership will give the firm access to the highly sought-after and underserved sovereign government space. For Palantir, this resolves two challenges.

The first was voiced in their Q3’24 earnings call in which the firm faced minor headwinds in building their sales staff to cater to the heightened demand for their product. The second is that with Oracle’s regionally scaled, modular data centers, Palantir’s software can be hosted regionally at Oracle’s locations with ease and should allow for ease in maintaining localized data privacy laws.

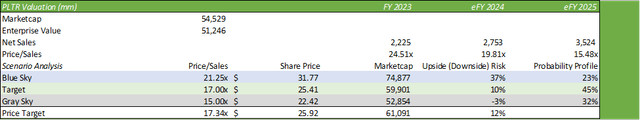

I believe this is a positive catalyst for both companies and will increase my forecasts and price targets. I provide PLTR shares a Strong Buy recommendation with a price target of $25.92/share, valued at 17.34x eFY25 price/sales.

This partnership is both surprising and not. Palantir’s platform offerings compete with Oracle’s OBIEE & OBIA offerings for enterprise business intelligence and optimization. Though this partnership was not anticipated, it shouldn’t be viewed as far left field as one might presume. Much of the tech sector has been working towards cross-integration as opposed to independent silos for the sake of data integrity, cybersecurity, and customer experience.

This can be seen across various platforms such as Microsoft (MSFT) Azure and VMware (AVGO) in which Microsoft competes across virtual servers, cyber, and communications. Microsoft created a direct pathway for cloud applications hosting on VMware’s cloud platform for customers. Microsoft also has a partnership with Oracle with whom the competition is even fierce for both hyperscaler data centers and ERP applications with their Microsoft Dynamics offering.

As discussed in my report covering Oracle, the firm is building over 20 data centers in coordination with Microsoft Azure. Intel (INTC) is working to do the same with their foundry business, decoupling the design and manufacturing process later this year in order to manufacture competitors’ advanced chip sets.

Oracle & Palantir’s partnership will allow for more seamless deployment of Palantir’s platforms in which Foundry will be hosted on Oracle Cloud Infrastructure and Gotham and AI Platforms deployable across Oracle’s distributed cloud network. This partnership will benefit both firms greatly despite the competition factor. I believe that Oracle’s management may see Palantir’s applications as a potential threat on Oracle’s core software business as Palantir’s AI & decision-making applications may be preferred over Oracle’s BI applications.

I also believe that Oracle’s management is forward-looking enough to see the writing on the wall and would prefer to take a piece of the pie as opposed to losing it all. I also anticipate that this partnership will open the door for Oracle in attracting sales to sovereign governments as they seek to deploy AI-enabled applications. Given Palantir’s deep roots across government entities, I believe that this strategic partnership will benefit both firms within their own respects.

Further, I believe that this partnership will strongly benefit Palantir as this will hasten the deployment of their highly sought-after applications. As management had alluded to in their q4’23 earnings call, the firm is short on sales staff and cannot cater to the market’s heightened demand for their product suite.

Overall, this partnership will allow for a stronger distributed regional deployment as Oracle selectively builds regional data centers worldwide. Given that Oracle’s data centers have a very modular design that is built for scale, this should allow Palantir to distribute their software with ease as compatibility will not be a factor. The regionality of the data centers will also provide Palantir with more access to attaining business in areas with strict data privacy laws that require localized data hosting.

I believe Palantir is making strides in the right direction for superior growth while bolstering their margins. The firm has proven that their offerings can effectively scale and generate significant economies of scale for their bottom line. One factor I find exceptionally appealing is the sales process for their AIP offering. The firm facilitates AIP Bootcamps to engage directly with customers in a small, classroom-like setting.

I believe this intimacy allows for Palantir to get down to the root challenges executives are facing within their firms’ environments and address these challenges with demonstrations using real-time data. This approach has resulted in major wins for Palantir as announced on March 6, 2024, with firms like Lennar, General Mills, Lowe’s, and OpenAI, amongst others, becoming AIP customers and partners. I believe the market underestimates Palantir’s ability to scale their platform and that the only thing holding the firm’s stock back is the general stigma of their ties to military operations.

Looking to financials, I believe that Palantir will have the ability to overshoot their eq1’24 guidance of $612-616mm and far outpace consensus estimates as the software adoption accelerates. I believe that the partnership with Oracle will facilitate strengthening of the sales process and will remove the risk factor of hosting services. Given Oracle’s modular approach to designing data centers, I believe that this removes some operating costs in relation to customization for hardware & software compatibility.

Valuation & Shareholder Value

In terms of risk factors, I believe the positives far outweigh any negative risks that can deteriorate my investment thesis on PLTR. Palantir’s offerings specifically target the heightened interest for enterprises to improve operations while cutting costs. I believe that this partnership will only bolster Palantir’s ability to scale their products to new markets and open the door for sales acceleration.

Downside risks to consider include negative market sentiment towards their ties to military operations. Though I do not believe this to be a negative factor, I believe that some investors may opt to overlook Palantir as an investment option for “ethical” purposes. PLTR shares also trade at a relatively high valuation at 24.51x trailing sales and any hitch to the growth story can send shares on a quick downward trajectory. As alluded to in the body of this report, Palantir is actively recruiting sales staff to cater to the heightened customer demand. This may add some pressure to operating margins as the new sales staff may require enhanced compensation packages given the demand.

I provide PLTR shares a Strong Buy recommendation with a price target of $25.92/share at 17.34x eFY25 net sales. I believe that the firm does have the ability to achieve my blue-sky scenario if eq1’24 sales far exceed my estimates, which are already above the consensus range of $2.64-2.80b for eFY24. The gray-sky scenario would entail minimal benefit from this Oracle partnership, resulting in figures closer to my previously estimated growth rates.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of PLTR either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.