Summary:

- Palantir’s revenue acceleration trend remains intact in Q3, but decelerating customer growth and tougher comps in FY25 could pressure top-line performance.

- Despite strong Q3 results and high investor optimism, insider selling and potential volatility due to retail investor holdings are additional concerns.

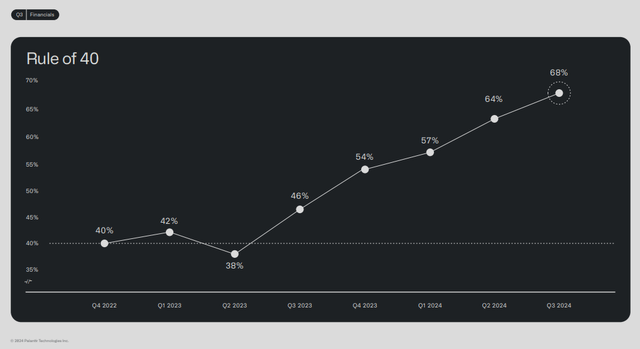

- So far, Palantir’s unique go-to-market strategy and high Rule of 40 score have been able to support its valuation, but maintaining revenue acceleration will be challenging.

- While there is a path for Palantir stock to climb higher to $100/share, it would require demand in Commercial and Government to accelerate from current levels while operating expenses stay anchored.

- Given the mixed outlook, I rate Palantir stock a “hold” while monitoring its ability to navigate decelerating momentum in customer count and tougher comps.

hapabapa

Introduction & Investment Thesis

Two months ago, I made a call that there was a path for Palantir Technologies Inc. (NASDAQ:PLTR) stock to reach $61. The stock was trading at roughly $45 back then.

Even though its NTM (Next 12 Months) revenue and earnings multiple had both increased by over 32%, primarily on the basis of price action, I believed that investor sentiment can continue to stretch its multiple even higher, as the company saw no decelerating signs for demand for its enterprise platform AIP (Artificial Intelligence Platform), while simultaneously unlocking enormous amounts of operating leverage given the design of its go-to-market strategy.

Since then, the stock has exceeded my price target by over 18%, trading at $72, as can be seen below.

SA: Share performance since last “buy” rating

During this period of time, its NTM revenue multiple has expanded over 72% from 28 to 49, while its NTM earnings multiple has stretched over 44% from 106 to 153. While the stock has received several forward revenue and earnings revisions over the last 90 days (that I will discuss later), the bulk of the multiple expansion is driven primarily by the price of the stock moving higher.

One could argue that the ongoing investor optimism is tied to its Q3 FY24 earnings, where Palantir not only beat its revenue and earnings estimates but also kept its revenue acceleration trend alive, thanks to a strong demand environment for AIP and accelerating Government Revenue.

However, when I look deeper into the report, I see that there are some emerging signs of weakness forming with 1) deceleration in the growth rate of its customer count, particularly in its US Commercial segment, and 2) tougher forward comps, where Palantir has to beat its revenues by 2.8% in Q4 FY24 to keep its revenue acceleration trend alive.

There is no doubt that the company has a tremendous moat with AIP, but with early signs of weakness developing amid stretched investor optimism, let’s find out if its current valuation is sustainable.

Q3 Revenue acceleration trend intact, but momentum in Customer Count declines

Palantir reported its Q3 FY24 earnings, where revenue grew 30% YoY to $725.5M, marking the fifth consecutive quarter of revenue acceleration since Q2 FY23, which is remarkable in my opinion. In my previous post, I had said that if Palantir could generate at least $709.9M in Q3 revenue, it would mark a beat of 1.5% against management’s guidance, thus keeping the revenue acceleration trend alive.

Out of the $725.5M, its Commercial revenue grew 27% YoY to $317M, a slight deceleration from the rate of growth in the previous quarter, driven by weakness in its non-US commercial revenue. Meanwhile, its Government revenue growth rate accelerated compared to its previous quarter, growing 33% YoY to $408M, with US government revenue growing slightly faster at 40% YoY, contributing over 78% to Total Government Revenue.

During the earnings call, the management reiterated their optimism in their execution of the “intensifying AI revolution,” citing several examples of customers where they are accelerating prototypes to production from initial bootcamp to deal closing, demonstrating the strong demand environment for AIP. When it comes to its Government segment, the management noted that the acceleration in revenue growth was driven by their DoD (Department of Defense) business, which grew 21% QoQ, as they delivered the next generation Targeting Node through Titan, along with signing a new five-year contract to expand their Maven Smart system AI ML capabilities across US military services.

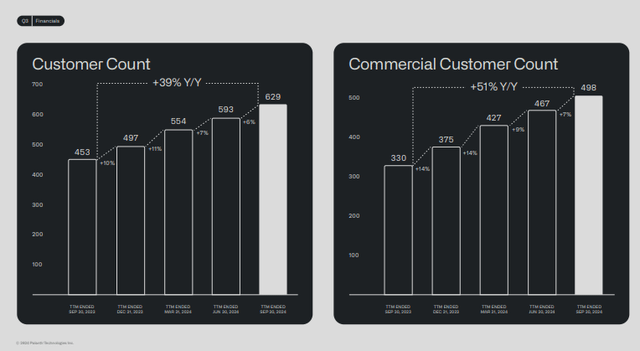

However, when we look one level deeper, we can see that there are some signs of initial weakness emerging in their overall customer count that has been growing at a decelerating pace for two quarters in a row. With its Commercial customers accounting for close to 80% of the total customer count, it too is growing at a decelerating pace for two quarters in a row, as can be seen below.

Q3 FY24 Earnings Slides: Deceleration in Customer Count Momentum

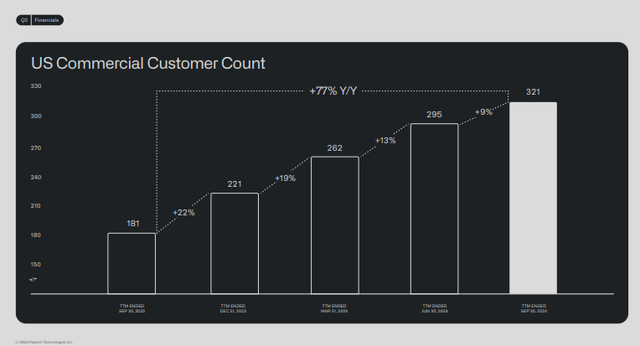

Most importantly, it is the US Commercial customer additions that account for over 50% of all customers who are seeing a marked deceleration for three quarters in a row, as can be seen below.

Q3 FY24 Earnings Slides: Slowdown in rate of growth in US Commercial customer count

During this period of time, Palantir has managed to support investor optimism by steadily growing its Net Dollar Retention rate, which has been accelerating in line with revenue growth since Q3 FY23, as existing customers have expanded their usage of AIP by unlocking business value with new AI use cases. As of Q3 FY24, revenue from their Top 20 customers increased at an accelerating rate compared to the previous quarter, growing 12% YoY to $60M per customer.

However, if Palantir continues to see a deceleration in the rate of new customer wins, it will start to feel top-line pressure.

Forward Revenue guidance suggests deceleration, with tougher comps ahead

In the meantime, while investors are cheering Palantir’s Q3 revenue beat with an intact revenue acceleration trend, it would be wise to take a step back and assess the management’s Q4 revenue guidance, where revenue is projected to grow 26.4% YoY to approximately $769M.

If Palantir just reaches its Q4 guidance, it would mark a deceleration in the revenue trend for the first time since Q2 FY23.

If you look at it another way, Palantir would need to generate at least $790.8M in Q4 to keep its revenue acceleration trend alive. This would require it to beat its Q4 revenue estimates by 2.8%. This is higher than the 1.5% beat it needed in Q3 to keep its revenue acceleration trend alive.

If we look at the past three quarters of FY24, Palantir has beaten its Q1, Q2, and Q3 revenue estimates by 3.2%, 4.1%, and 3.7%, respectively. That is an average beat of 3.6% over the last three quarters.

While its historical outperformance is not a predictor of its future performance, assuming that Palantir beats its Q4 revenue estimate by an average of 3.6%, it would generate close to $797M in revenue, which will keep the revenue acceleration trend alive.

Would it be possible to beat its Q4 revenue estimate by 3.6%? Perhaps, but not guaranteed.

But one thing is certain. Palantir has to work incrementally harder than the previous quarter to beat its revenue target to keep its revenue acceleration trend alive.

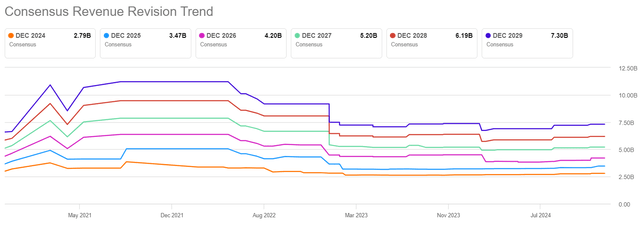

In the meantime, when looking at forward revenue estimates, we can see that the company has received 14 upward revenue revisions over the last 90 days, with its FY25 and FY26 revenue estimates upgraded by 6.91% and 9.58%, respectively, over a period of 6 months.

This could be more or less tied to the magnitude of upward revenue projection from Palantir management for FY24 during the fiscal year, where it expanded its revenue target from $2.66B in Q4 FY23 to $2.807B in Q3 FY24. Assuming that Palantir beats its Q4 FY24 revenue estimates by its average beat rate (over the last 3 quarters) by 3.6%, the company would generate close to $2.835B in revenue, which would be 7% higher than what the management projected at the start of the year.

SA: Forward Revenue revisions by analysts

However, even when taking the upward revenue projections into account, we can see that revenue growth is expected to slow in the coming two years to 24.17% and 21.13% YoY, respectively.

In my previous post, I discussed how Palantir has more than twice the price-to-NTM sales ratio compared to its peers such as ServiceNow, Inc. (NOW), Cloudflare, Inc. (NET), Datadog, Inc. (DDOG), Snowflake Inc. (SNOW) and others, even though they all had similar forward growth rates.

Despite this, Palantir has been able to maintain its supremacy in the SaaS/cloud space, which, I believe, is tied to it crushing its Rule of 40 score (which I will discuss in the next section).

However, with a deceleration in the pace of new customer additions, along with a slowdown in its number of $1M+ deals, I believe that it will enter a period of tougher comps in FY25, which will be harder to beat than before, inducing potential volatility in investor sentiment.

Investor optimism is tied to its “Rule of 40” supremacy

Shifting gears to profitability, Palantir has been consistently beating its quarterly projections for Adjusted Income from Operations, while expanding its margins steadily. During Q3 FY24, Palantir generated $276M in Adjusted Operating income, which grew over 68% YoY, with a margin expansion of 900 basis points to 38%.

In my previous post, I discussed that it is Palantir’s unique go-to-market approach, where it drives customer acquisition and adoption through AIP Bootcamps and AIPCon instead of hoarding salespeople, that enables it to keep its operating expenses low and unlocks tremendous operating leverage in the process. As a result, Palantir boasts an expanding Rule of 40 score of 68%, demonstrating tremendous efficiency, as can be seen below.

Q3 FY24 Earnings Slides: Growing score of Rule of 40

In fact, in the entire SaaS/cloud complex, Palantir carries the highest score for the Rule of 40, which is followed by monday.com Ltd. (MNDY) at 55, Veeva Systems Inc. (VEEV), Adobe Inc. (ADBE) and Atlassian Corporation (TEAM) at 52 and ServiceNow at 51.

Large differences in price targets among Wall Street analysts

With Palantir subject to highly polarizing investor views over the years, let’s take a look at the two contrasting views from BofA (Bank of America) and Jefferies.

On one hand, BofA has raised its price target to $75 from $55 while increasing their next three-year projections for Government revenue from 24% to 29% and Commercial revenue from 32% to 34%. Analysts at BofA believe that Palantir’s penetration in both the government and commercial applications is in the early innings, where the company should benefit from a widening competitive moat as organizations turn to software and AI to grow their margins.

On the other hand, Jefferies downgraded Palantir stock from “hold” to “underperform” with a price target of $28, which is 65% lower than BofA’s price target, citing unsustainable valuation and that Palantir will no longer have easy comps heading into Q4 and FY25, which would make it harder to accelerate growth from here.

At the same time, they also pointed to the increasing pace of insider selling, with Palantir’s CEO, Alex Karp, selling nearly 40M shares for an aggregate of over $1.9B over the last three months and more than 18M shares for more than $1B over the first couple of weeks in November, amounting to over 20% of his entire stake in the company.

Finally, analysts at Jefferies also made an interesting comment, where they noted that with 50% of Palantir’s shares outstanding held by retail investors, the stock is at a higher risk of potential multiple compression should it go out of favor.

Path to $100/share exists, but beware of the assumptions

Moving ahead, I will conduct two valuation models in this post, one that is based on my base case assumptions and the second one, which is based on BofA’s bullish growth targets.

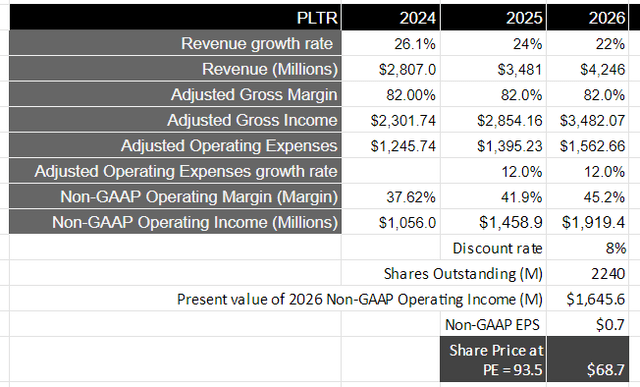

Base Case Valuation Model – Price Target: $68/share

In this valuation model, I have assumed Palantir will achieve its FY24 revenue growth estimates of $2.807M, after which it will grow at a slightly slower pace in the mid to low twenties range over the next two years to generate $4.25B by FY26. These estimates are in line with consensus estimates.

From a profitability standpoint, taking the management’s guidance for Adjusted Operating Income at $1.056B for FY24, it translates to an Adjusted Operating Margin of 37%. However, note that Palantir would have spent roughly $1.245B in Adjusted Operating Expenses which would just have grown less than 7% YoY, assuming an Adjusted Gross Margin of 82% in FY24. This is significantly slower than the rate of revenue growth, enabling the company to unlock the holy grail of the Rule of 40. Therefore, assuming that Palantir continues to grow its adjusted operating expenses in the high single digits to low teens over the next two years, the company should generate close to $1.9B in Adjusted Operating Income, with an expansion in margin of 800 basis points during this period of time to 45%.

With Adjusted Operating income growing at a CAGR (compounded annual growth rate) of 34% during this period of time, I believe the stock can fetch a multiple of 5-5.5 times the average multiple of the S&P 500, especially given the elevated optimism at the moment. This will translate to a forward PE ratio of 93.5, with a price target of $68, which represents a downside of roughly 5% from the stock’s current levels.

Author’s Valuation Model: Base Case

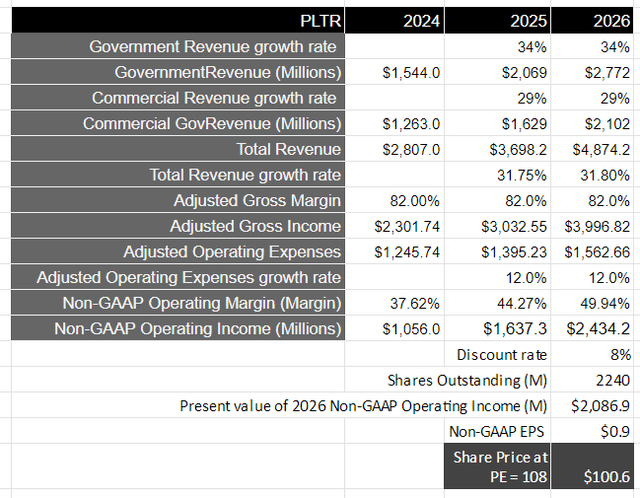

Bull Case Valuation Model – Price Target: $100/share

On the other hand, if we take BofA’s revenue projections into account, where Government and Commercial Revenue grow at a CAGR of 34% and 29% over the next three years, Palantir would have generated a total revenue of $4.87B, which is 14% higher than my base case. In this case, the company doesn’t see a deceleration in its revenue trend and keeps outperforming despite tough comps due to the unrelenting demand environment.

In terms of profitability, keeping the same assumptions as the base case valuation, where adjusted operating expenses grow in the high single to mid-teens level with an Adjusted Gross Margin of 82%, it should see its Adjusted Operating Income grow at a CAGR of 50% over the next two years to $2.4B, with a margin expansion of roughly 1300 basis points (compared to 800 basis points in my base case model) to 50%.

Should this scenario play out, I expect that investor sentiment will continue to get stretched with the forward multiple growing to at least 6 times the average S&P 500 multiple, which would translate to a PE ratio of 108, with a price target of $100, representing an upside of 40% from its current levels.

Author’s Valuation Model: Bull Case

My final verdict and conclusions

So, to conclude, let’s make some things clear.

Palantir’s revenue acceleration trend is still intact, but from Q4 onwards, it has to work harder to keep its acceleration trend alive. That’s right, tougher comps indeed.

Its pace of growing its customer count, particularly in the US commercial segment, is showing signs of deceleration. That can further add to top-line pressures, even though the expansion rate of its platform among existing customers continues to grow at an accelerating rate.

Insider selling has indeed picked up. Given that over 50% of outstanding shares are held by retail investors, it makes the stock prone to large volatility shocks.

So, if you are an existing Palantir investor, you can choose to remain invested, given that nothing fundamentally has changed in the demand landscape, as long as you are comfortable with volatile price action. On the other hand, if you want to book a portion of your profits after its 300%+ YTD run, just like Alex Karp did, that is a viable option too.

In the meantime, I don’t expect a shift in the overall direction of investor sentiment unless there is a fundamental change in the demand landscape.

Does this mean that Palantir stock is headed next to $100/share?

Similar to how all investment decisions carry a risk component to them, Palantir’s path to $100 is dependent on its revenues accelerating from here onwards as the AI revolution intensifies across both Commercial and Government segments while its operating expenses grow in the low teens range. Should it fail to deliver on either the revenue or earnings front, it will likely face severe volatility in its stock price.

On the other hand, under the base case assumptions, the stock is likely to be range-bound for some time.

Therefore, assessing both the “good” and the “bad,” I believe it is prudent for me to rate the stock a “hold” at its current levels while we assess how the company navigates the declining momentum in new customers and a tougher comps environment in FY25.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of NET, VEEV, TEAM either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

I am Amrita and I write primarily about growth software stocks.

I recently joined The REIT Forum and if you are looking for more investment ideas like this one, get them exclusively at The REIT Forum with access to our subscriber only portfolios.