Summary:

- Palantir has revolutionized deep analytical tools for governmental organizations and is expanding into the commercial market, leading to impressive revenue growth and profitability.

- The company’s strong financial position and clean balance sheet provide flexibility for investment opportunities and attract favorable debt finance.

- Despite the recent stock price rally, PLTR still trades below its early 2021 all-time high, presenting a 22% upside potential according to a valuation analysis.

Michael Vi/iStock Editorial via Getty Images

Introduction

In my opinion, Palantir (NYSE:PLTR) has the whole set of qualities that were inherent to the current technological hyper scalers when they were at a similar stage of development. Palantir has revolutionized the field of deep analytical tools for governmental organizations and is now swiftly expanding into the commercial market. This allows PLTR to demonstrate impressive revenue growth by increasing its customer base and exercising pricing power via cross-selling. The exceptional profitability is reinvested into enhancing the company’s offerings, fostering a continuous cycle of improvement that distinguishes Palantir and attracts new customers. This creates a snowball effect, wherein the company’s enhanced capabilities and reputation further fuel its growth and market dominance. Additionally, my valuation analysis suggests there is a 22% upside potential for PLTR, reinforcing my belief that it merits a “Strong Buy” rating.

Fundamental analysis

Palantir is a software company that aims to empower organizations to integrate their data, decisions, and operations at scale effectively. According to PLTR’s 10-Q form, there are three principal software platforms: Gotham, Foundry, and Apollo. Palantir serves a diverse range of clients, encompassing both governmental bodies and commercial enterprises. Its first large contracts were with the Pentagon.

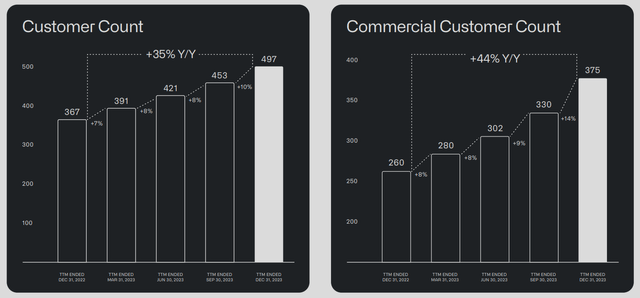

According to the latest earnings presentation, the company had 497 customers, out of which 375 were commercial customers. In the screenshot below, we can see that the growth of commercial customers has been the major growth driver in recent quarters. It is also quite important to underline that Palantir’s commercial business is in the very early stages of development because a total of 375 customers since there are more than 1,500 public companies only in the U.S. with annual revenue exceeding $1 billion, which are large enterprises and highly likely can afford advanced tools from Palantir. Therefore, Palantir still has vast room to expand its commercial business in the U.S., not to mention international expansion opportunities.

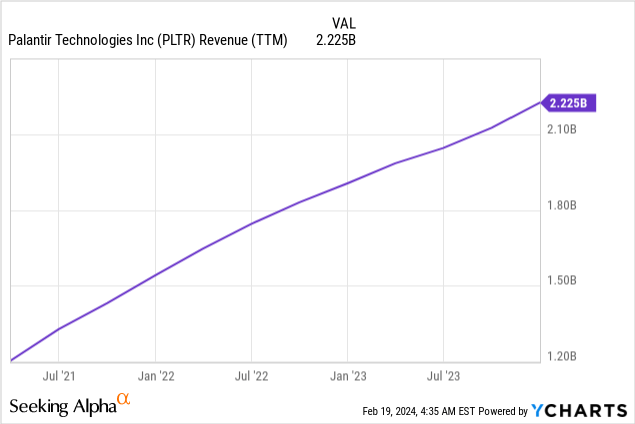

In my opinion, the consistent growth in customer count underscores the high appeal of the company’s offerings. The expanding customer base allowed Palantir to improve its revenue side of the P&L substantially, which looks like a straight line, quite an impressive dynamic. Wall Street analysts are quite optimistic about the company’s revenue growth prospects for the next decade, expecting it to compound at double digits consistently.

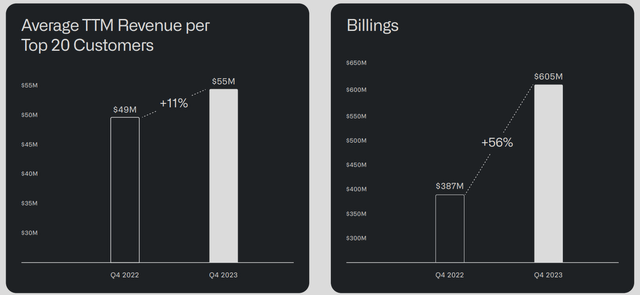

The multiplicative effect for revenue growth is achieved not only with the help of the number of contracts with customers but also with improving the quality of these contracts, i.e., the improved revenue per customer in strong dynamics in billings. The ability to expand average revenue per customer is a solid strength of the business model, meaning it provides Palantir with opportunities to cross-sell its services. The ability to involve more offerings sold to a single customer means increased switching costs for them, which will likely help Palantir to sustain its stellar 108% net dollar retention rate demonstrated in Q4 2023, according to the latest earnings presentation.

It is obvious that there are two primary variables that drive revenue: volume/contract count and price/revenue per contract. Since Palantir demonstrates strength from both sides of the revenue equation, I think this is solid evidence that the company is able to sustain its revenue growth pace for longer.

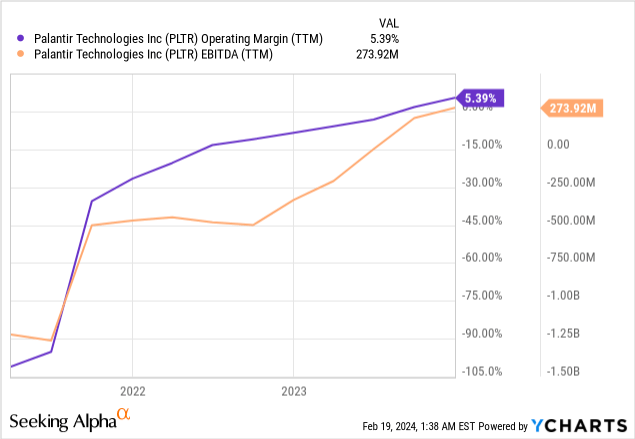

Delivering impressive revenue growth is crucial for young technological companies like Palantir, but the ability to rapidly improve profitability metrics is something that separates genuinely great companies from just good companies. From the perspective of the profitability metrics dynamics, Palantir looks like it has the potential to become a great company. The EBITDA and operating margin are demonstrating very promising dynamics and give high conviction that as the revenue expands, profitability metrics are highly likely to follow further. That is another big positive sign for PLTR potential investors.

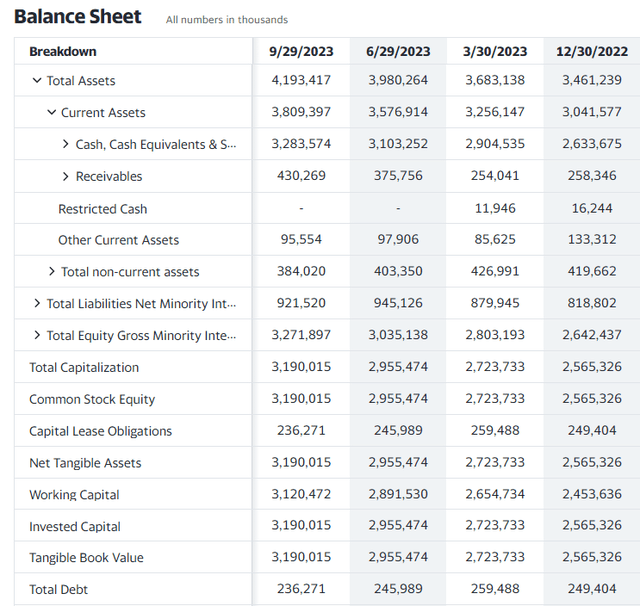

Last but not least, Palantir is in a strong financial position, with an above $3 billion cash position and only $236 million in total debt. Being in this position means that Palantir’s management is able to exercise very solid financial flexibility in case attractive investment opportunities emerge. Having a clean balance sheet like Palantir’s does not only mean that the company can utilize its cash position to invest in new ventures, but is also likely to attract debt finance on favorable terms. While the strong balance sheet is not a positive catalyst itself, it opens a wide window for potential new growth opportunities.

In conclusion, I am confident that Palantir possesses a comprehensive array of strengths poised to generate value for shareholders over the long term. The company’s rapid customer base expansion, coupled with its ability to boost revenue per customer, presents robust revenue growth prospects. Moreover, its high net dollar retention rates and cross-selling opportunities are expected to contribute to further improvement in the cost of revenue.

Valuation analysis

Despite the stock price having more than tripled from May 2023 lows, PLTR still trades substantially below its early 2021 all-time high. The momentum is strong, with the stock rallying by more than 50% over the last six months. The recent rally has led valuation ratios to spike, with the forward P/E ratio at around 169. However, ratios are rarely a good metric to use to assess the valuation of growth companies.

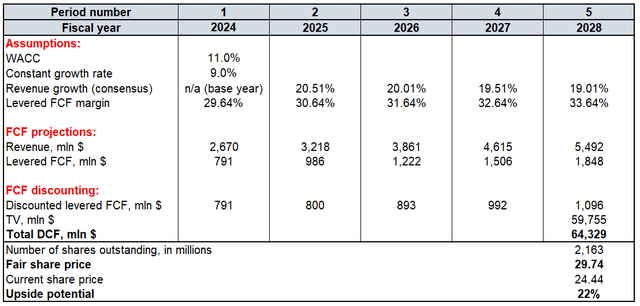

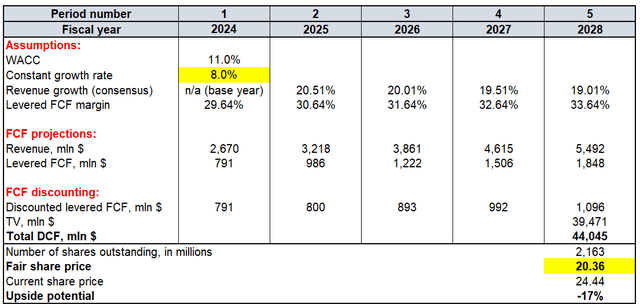

To check whether a staggering 169 P/E ratio is reasonable, I need to run the discounted cash flow (“DCF”) model. Future cash flows will be discounted at an 11% WACC. Given the many Wall Street analysts covering PLTR for the upcoming two years, I take revenue consensus estimates for FY 2024-2025. For years after 2025, I expect a natural 50 basis points revenue growth deceleration. To derive the free cash flow (“FCF”) for the base year, I multiply revenue by the TTM 29.64% levered FCF margin. For subsequent years, I projected a levered FCF margin expansion by one percentage point yearly. Considering all the company’s strengths and secular tailwinds in place, I project a very ambitious 9% constant growth rate for the terminal value (“TV”) calculation. There are 2.16 billion PLTR shares outstanding at the moment.

As my DCF model suggests, PLTR stock’s fair price is $29.74, and I would prefer to round it up to $30. Therefore, there is around 22% upside potential for PLTR, and I consider this attractive.

Mitigating factors

As we have seen in the previous section, there are numerous assumptions that form the fair value of a growth stock. Out of the PLTR’s total cumulative $64 billion DCF, almost $60 billion is represented by the terminal value. That said, if the company demonstrates a notable deceleration of revenue growth compared to consensus estimates, this might lead to a compression of valuation. For instance, dropping the constant growth rate by just 100 basis points decreases the estimated fair share price from $30 to $20.

There are several factors that could potentially hinder PLTR’s revenue growth trajectory. Chief among these is the rapidly evolving technological landscape, which presents a significant risk to Palantir’s future revenue growth. The emergence of new disruptive technologies capable of addressing the same problems as Palantir’s offerings, but in a more efficient manner, could result in a loss of market share for the company, thereby constraining its growth prospects.

Moreover, as a software company, Palantir stores a substantial amount of sensitive information belonging to both itself and its clients. Any breach or leakage of cybersecurity could severely damage Palantir’s reputation and erode customer trust. This could prompt clients to seek alternative solutions that offer greater security, even if they provide less sophisticated analytical capabilities. Protecting sensitive information is paramount for clients, as any compromise could lead to reputational damage and loss of trust among their own customers. Therefore, maintaining robust cybersecurity measures is crucial for Palantir to safeguard its revenue streams and sustain its growth trajectory.

Another potential risk to Palantir’s future financial performance is the uncertainty regarding regulations for the AI-powered tools. There is a significant public discussion at the moment regarding the regulation of advanced tools powered by AI. While AI presents promising opportunities to enhance efficiency across various domains, it also brings significant risks, such as job displacement, concerns regarding the reliability of AI-generated content, and legal implications. If stringent regulations are imposed on AI-powered tools, Palantir could face adverse outcomes. New potential rules may not only disrupt revenue growth potential but also boost compliance costs due to heightened regulatory scrutiny.

Conclusion

I think that the company’s superior performance makes it a good option for investors seeking a growth superstar. The 22% undervaluation looks like a “Strong Buy” signal in my opinion, especially given the strong momentum of the improvement of the company’s financial performance in recent quarters.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.