Summary:

- PLTR stock Q2 results beat consensus, with positive earnings and revenue growth.

- It also expects positive earnings in each quarter of 2024.

- These results pave the groundwork for its inclusion in the S&P 500 index as soon as September 2024.

- Benefits of S&P 500 inclusion for shareholders include reduced stock price volatility, increased visibility, and a potential for a return boost.

PhotoAttractive/E+ via Getty Images

PLTR stock Q2 and S&P 500 criteria

I last wrote on Palantir Technologies (NYSE:PLTR) back in July 2026 before the release of its Q2 earnings report (ER). In that article, entitled “Palantir Stock: I Misjudged The DoD Catalyst, Badly”, I reflected on the role of the DoD (Department of Defense) contracts in its development and analyzed the future impacts of these contracts for its growth. Thus, the article is more geared toward the long term.

In this article, I want to switch to the nearer term and focus on the new developments described in its Q2 ER. I especially want to analyze the potential for its inclusion in the S&P 500 index in the September 2024 quarter and explain why such potential is a substantial positive catalyst that investors should not overlook.

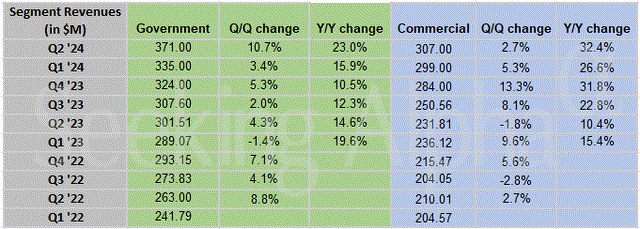

First, let me start with the Q2 results to prime the rest of the discussion. The company delivered strong results and beat consensus on both lines. As you can see from the chart below, both the government and commercial segments kept growing at double-digit rates for another quarter. More specifically, its non-GAAP EPS dialed in at $0.09, beating market consensus by $0.01. Revenue totaled $678.13M, beating consensus estimates by $25.71M. Moreover, for the full year 2024, PLTR upped its guidance range, raising topline guidance to between $2.742 – $2.750 billion vs $2.7B consensus. It also reaffirmed the expectation of positive GAAP operating income and net income in each quarter of this year.

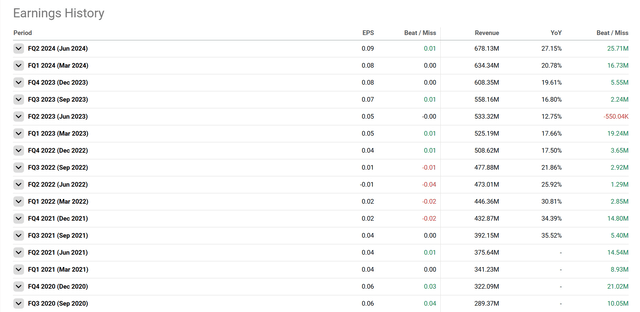

Admittedly, the earnings are still quite small (and thus the valuation multiple is extremely low with an FWD P/E of about 84x as of this writing) and the company did not give normal ranges for its earnings guidance. However, the fact that it has posted another quarter of positive earnings and anticipates positive net income in each quarter of 2024 is also important for S&P500 inclusion. To be eligible for the inclusion, two of the criteria that the company needs to meet are it must report positive earnings in the most recent quarter and the sum of its earnings in the previous four quarters must be positive, including this quarter, PLTR has been reporting GAAP profit for at least 8 consecutive quarters as you can see in the next chart since FQ3 2022. Furthermore, the company’s revenue growth and expanding customer base indicate a very healthy financial trajectory, making it an attractive candidate for the index to include in my view. The S&P 500 index is rebalanced quarterly, and the next rebalancing is scheduled in September 2024. I see good odds for PLTR to be added to the index then.

Next, we will check other criteria for inclusion and elaborate on the potential benefits for shareholders.

PLTR stock: market capitalization

Besides the profitability criteria mentioned above, other criteria for inclusion in the S&P 500 are:

- The company should be from the U.S.

- Its market cap must meet a minimum requirement

- Its shares must be highly liquid.

- At least 50% of its outstanding shares must be available for public trading.

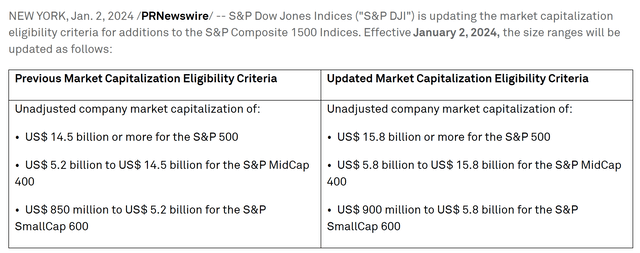

PLTR has met all these requirements based on my analysis of the information released in its Q2 ER. Note that the minimum market cap requirement changes over time. To wit, the chart below compares the most recent requirement to the previous requirement for SP500 inclusion. As seen, as of Jan 2024, the minimum market capitalization requirement for S&P 500 inclusion increased from $14.5 billion to $15.8 billion. Palantir’s market capitalization has grown substantially in recent years. As seen in the second chart below, its market cap has increased from approximately $20 billion in 2021 to the current level of $67.2 billion, far exceeding the minimum requirements.

PLTR stock: potential benefits

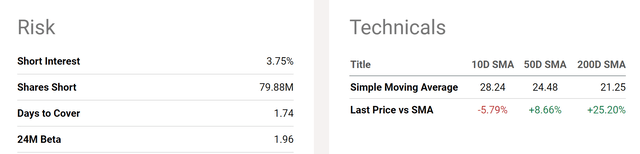

Inclusion in the S&P500 index could be beneficial to shareholders in multiple ways. First, I expect the inclusion to help reduce its stock price volatility. As you can see from the chart below, with a historical beta of 1.96x, the stock price is simply too volatile for many investors. Inclusion in the index forces some institutional investors and index funds to buy and hold PTLR, providing a more stable shareholder base for the company and tending to dampen volatility.

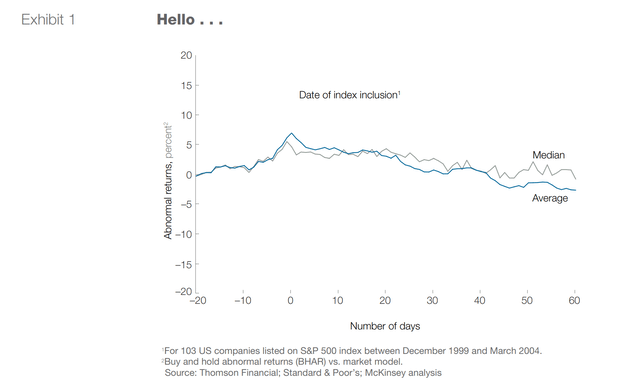

Additionally, being part of the S&P 500 enhances a company’s visibility and credibility, attracting a broader investor base. This can lead to increased investment and, potentially, higher valuation. While not guaranteed, historical data suggests that companies added to the S&P 500 tend to outperform the market, especially in the short term, as you can see from the following research conducted by McKinsey.

Other risks and final thoughts

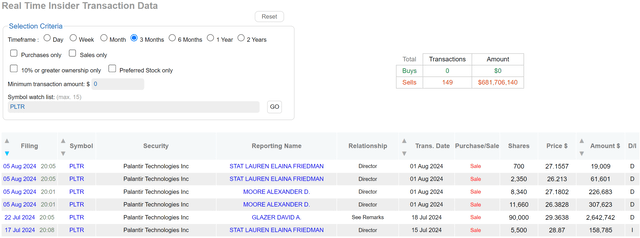

In terms of downside risks, many other SA articles have covered most of the angles already, such as the high valuation as aforementioned, its heavy reliance on government contracts (the focus of my last article), etc. As a result, I will just point out an issue that was less discussed: insider transactions. Recent insider trading activity at PLTR certainly does not indicate a bullish sentiment among the company executives. To wit, the chart below describes insider selling activities on PLTR stock in the past 3 months. As seen, the transactions were all selling activities. Multiple insiders, including directors Lauren Friedman and Alexander Moore, have executed significant stock sales recently. All told, the insiders reported a total sale of $681 million worth of PLTR shares in the past 3 months. While insider selling is not as a definitive bearish sign, as buying is a bullish sign (as insiders can sell for reasons unrelated to business fundamentals). But given the very one-sided picture here, it should be a consideration for potential investors.

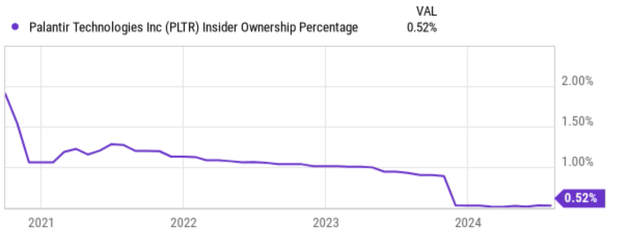

To better contextualize the selling, the chart below shows the insider ownership percentage for PLTR stock in recent quarters. As seen, the recent selling has caused a noticeable decline in insider ownership from 2024. Insider ownership has been quite stable at around 1% between 2022 and 2023. And it dropped noticeably to the current level of 0.52% in the past few months.

All told, the stock is certainly not a good fit for every investor. The extremely high valuation ratios and large volatility are off-putting for more conservative investors. However, for more risk-prone investors, the upside potential is very attractive both in the long-term given the company’s unique strategic positioning, and also in the short term with the prospects of SP500 inclusion as soon as September 2024.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

As you can tell, our core style is to provide actionable and unambiguous ideas from our independent research. If you share this investment style, check out Envision Early Retirement. It provides at least 1x in-depth articles per week on such ideas.

We have helped our members not only to beat the S&P 500 but also avoid heavy drawdowns despite the extreme volatilities in BOTH the equity AND bond market.

Join for a 100% Risk-Free trial and see if our proven method can help you too.