Summary:

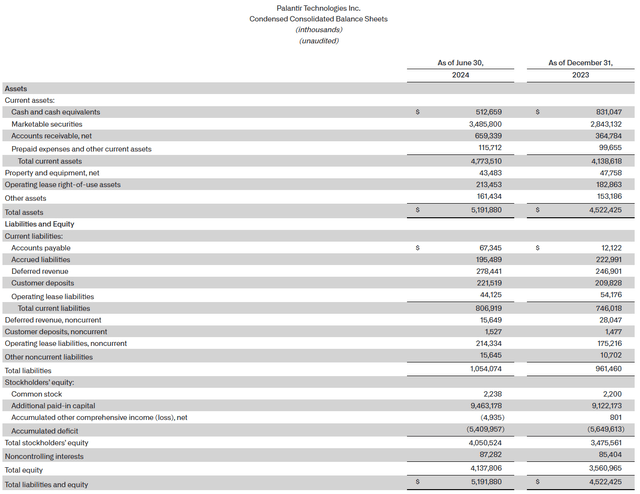

- Palantir’s relevancy has been proven through strong Q2 2024 performance, with significant revenue growth and new client acquisitions.

- PLTR’s customer base continues to expand, with a focus on commercial clients, leading to increased revenue and profitability.

- Palantir’s debt-free business model, high gross profit margin, and consistent net income and free cash flow generation make it a strong investment choice.

Michael Vi

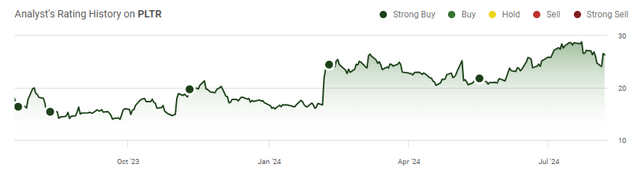

It’s been a long time coming, but the bear thesis regarding Palantir’s (NYSE:PLTR) relevancy has been decimated. The only argument left is valuation, and like Tesla (TSLA), and Amazon (AMZN), PLTR may be a company that will trade at an elevated valuation as the market is forward-looking. Several short reports have been written about PLTR, and some have gone as far as to call PLTR an AI imposter. If there were any doubts heading into Q2 2024, this was the quarter that put the bears back into hibernation. PLTR closed 96 deals worth at least $1 million, signed a 7-year expansion with Tampa General as AIP will be deployed to deliver a care coordination operating system, Panasonic Energy signed a 3-year extension, and PLTR delivered a top and bottom-line beat with record revenues of $678.13 million. Several days later, news broke that PLTR and Microsoft (MSFT) are teaming up to deliver secure cloud, AI, and analytics capabilities to the U.S. defense and intelligence community. Just like Oracle (ORCL), MSFT is teaming up with PLTR rather than trying to compete with PLTR. The two factors that everyone should focus on are that PLTR’s customer base, which consists of the largest organizations globally are expanding its partnerships with PLTR, and the largest software providers that can take a blank check approach toward product development feel it’s more advantageous to partner with PLTR. The bears can continue to maintain their thesis as long as they can remain solvent, but the only opinions that matter are the ones from PLTR’s customers. When the largest governments, corporations, and hospital systems are becoming more entrenched in PLTR’s ecosystem, and expanding their footprint to leverage PLTR’s AI capabilities, that’s information that can’t be refuted. Q2 2024 was an exceptional quarter, and I remain extremely bullish as PLTR has raised guidance and could compound at a quicker rate in the future.

Seeking Alpha

Following up on my previous article about Palantir

Since PLTR went public via the direct listing, I have been very bullish about their business. There was a period when Alex Karp’s (Palantir CEO) antics made me reconsider whether I wanted to remain a shareholder, as I was unclear how this would translate to customer interactions. This all changed later in the year, as I witnessed a transformation in how Alex Karp presented to the analyst community and shareholders. PLTR’s business has been flourishing, and they are taking AI computing by storm. Q2 2024 was a pivotal quarter, and I am following up with a new article to discuss why I am extremely bullish as shares approach their 52-week highs. I have been a shareholder since the direct listing, added more to my position this year in the low to mid $20s, and have been writing about PLTR since January of 2021. It’s easy to have conviction when things are going well, but many have understood the business and championed this investment when shares of PLTR were stagnant in the high single-digits. I am just as bullish today as I was back when PLTR went public, and when shares were trading at $7.11 when my article on December 12, 2022, was published (can be read here). Since my most recent article on May 17, 2024 (can be read here) shares of PLTR have appreciated by 33.41% while the S&P 500 has declined by -0.12%. Despite shares of PLTR posting a 68.35% gain YTD, I am holding every share for the long-term as I believe this investment has tremendous potential going forward.

Seeking Alpha

Risks to investing in Palantir

The only short-term risk that I will agree with from the bear case is the valuation. PLTR’s forward P/E multiple has been stretched as they are expected to earn $0.36 of EPS in 2024. PLTR is trading at 80.86 times 2024’s estimated earnings and 50.36 times 2026’s estimated earnings. To some, this could be considered expensive, and I wouldn’t be surprised if shares are stuck in a range or retrace a bit until more earnings growth is achieved. The other risks are that governments stop utilizing PLTR’s software, and that competitors start to chip away at PLTR’s moat. If PLTR’s growth slows, or they start reporting that companies or governments are dropping them as software providers, the growth story will be seriously impacted. These are risks to consider, and while I am bullish on PLTR’s future, investors should be aware of these risk factors going forward.

Why the bear case about Palantir’s relevancy has been decimated

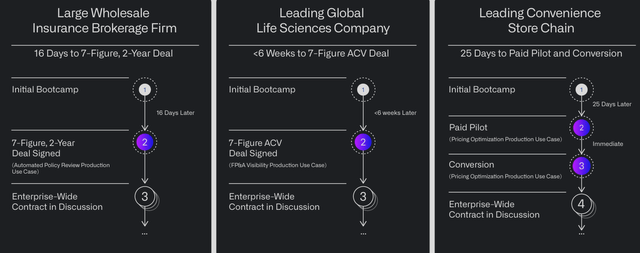

PLTR’s customers are speaking loudly and clearly as they vote with their money. If Palantir’s software wasn’t a top-tier enterprise solution, or if it wasn’t overhauling how companies and governments conduct their operations to drive efficiencies and cost savings, then their growth proposition would have crumbled by now. Quarter after quarter, new deals are signed, and representatives from the largest companies in the world openly discuss how Palantir’s software has transformed their business. PLTR’s AIP platform has been a game-changer for companies looking to leverage cutting-edge AI, and bootcamps have been a critical go-to-market strategy to reach mass-scale adoption. Since launching the bootcamp model, PLTR has completed more than 1,025 AIP bootcamps for organizations domestically and internationally. This methodology has led to 7-figure deals being signed with a wholesale insurance brokerage firm and a global life science company after these companies participated in an AIP bootcamp for just 16 days in one occurrence and six weeks in another. After 25 days, a large-scale convenience store chain went from the initial bootcamp to a paid pilot and is now in an enterprise-wide discussion with PLTR.

Palantir

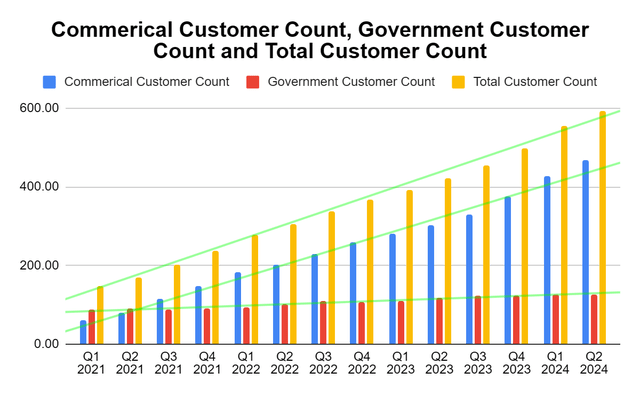

PLTR’s customer base continues to expand, and they’re converting more companies into PLTR customers than ever before. The bedrock for increased revenue and profitability revolves around new customers, new contracts signed, and net dollar retention. This is something that the bears seem to overlook, and for many quarters customer growth in the commercial segment was questioned, no matter what PLTR did. I would like to think that PLTR has shed the stigma of being a black box, considering that their commercial growth continues to progress up and to the right. Everyone has an opinion, but the numbers represent continuous growth in customers, and that is absolutely bullish.

In Q2, PLTR added 40 commercial clients (9.37%) as their total commercial count grew to 467 QoQ. PLTR lost one government client, but delivered 39 net new customers, bringing their total customer count to 593, which was a 7.04% QoQ growth rate. On a YoY basis, PLTR grew its commercial customer count by 165 (54.64%), government clients by seven (5.88%), and their total customer count by 172 (40.86%). The investment community first started seeing PLTR’s customer counts in the quarterly reports after PLTR went public, and I have been tracking them for each new report. In Q1 of 2021, PLTR had 60 commercial customers, 89 government customers, and 149 total customers. The criticisms were that PLTR was nothing more than a black box that catered to the military-industrial complex, and nobody knew what they did. Over the past 13 quarters, PLTR has answered everyone’s questions as their commercial customer base grew by 407 clients to 467, which represents a growth rate of 678.33%. The commercial sector is sending a strong message that PLTR’s software is just as critical for their enterprise-scale businesses as it is for the military-industrial complex. PLTR has added 37 new government customers, which is a 41.57% growth rate over the past 13 quarters. In total, PLTR has grown its combined customer count by 444 or 297.99% since Q1 2021. The other aspect to look at is how impactful AIP has been, considering PLTR added 40 new commercial clients in Q2 2024 compared to 22 in Q2 2023.

Steven Fiorillo, Palantir

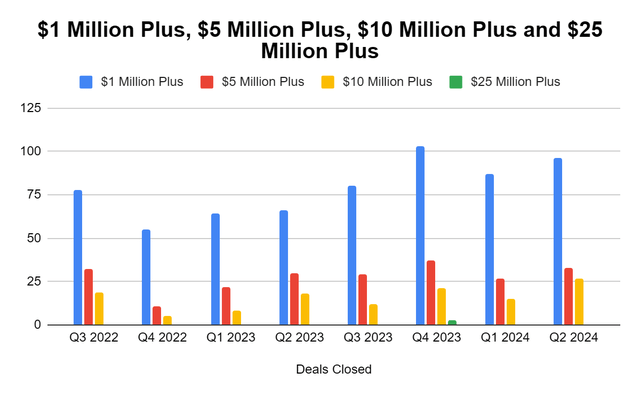

For anyone who thinks that PLTR’s customer count doesn’t translate to real incremental revenue increases, they’re incorrect. PLTR’s deal book continues to expand at a staggering rate. PLTR just produced their second-best quarter for combined deals over $1 million, as they added 156 new deals above this threshold in Q2. PLTR added 96 deals worth at least $1 million in Q2, while adding 33 deals worth at least $5 million and 27 deals worth at least $10 million. Looking back to the first half of 2023, PLTR had added 208 new deals worth over $1 million, which has increased by 37.02% as they have added an additional 77 deals in 2024, bringing their total deals over $1 million to 285. In the first half of 2024, PLTR saw a 40.77% YoY increase in deals over $1 million as they added 53 compared to the first half of 2023, while deals over $5 million grew 15.38% (8 deals), and deals over $10 million grew 61.54% (77 deals). More customers are translating to more large-scale deals, and this is bullish for net dollar retention. This is an important metric because it indicates the recurring revenue retained from existing customers, so anything over 100% means that a company is upselling its clients. PLTR’s net dollar retention in Q2 was 114%, and this is based on the customers for the prior trailing twelve-month period, as it doesn’t include any new customers that are within their first year of service. PLTR’s net dollar retention is based on 421 customers, and this time next year, it will be based on 593, which is a bullish compounding indicator for future revenue.

Steven Fiorillo, Palantir

Palantir’s cutting-edge software has allowed them to grow their revenue and profitability debt-free

Not many companies can sustain organic growth without M&A activity, and even few companies can do this without tapping the debt markets. PLTR has a spotless balance sheet, which allows them significant flexibility and the ability to invest throughout their business. PLTR finished Q2 with $512.66 million in cash on hand, with an additional $3.49 billion in marketable securities. PLTR held $3.48 billion in U.S. Treasury Bills and 8.63 million in publicly traded equities. PLTR finished Q2 with $4 billion in on-hand liquidity and when I look at the balance sheet, there is $0 in short or long-term debt. PLTR is operating a revenue-growing and free cash flow (FCF) generating company without tapping the debt markets. This has allowed them to bring platforms like AIP to market organically without leveraging themselves. The proof is in the numbers. People can dislike Alex Karps’s view, that PLTR works with the U.S. government and its allies, and the hype around AI, but what is irrefutable is PLTR’s ability to produce profitability and grow its war chest. After all the liabilities are stripped away, PLTR has $4.14 billion in shareholder equity on the books, and that’s also free from goodwill. PLTR is operating from a position of strength and isn’t dependent on the Fed to create a better operating environment.

Palantir

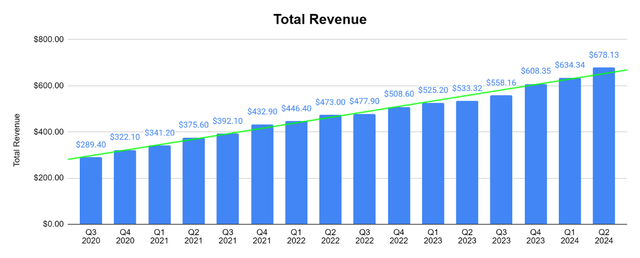

PLTR’s revenue growth is accelerating, as it generated $678.13 million in Q2. On a YoY basis, PLTR grew its revenue by 27.15%, producing an additional $144.81 million in Q2 2024. On a QoQ basis, PLTR’s revenue grew by 6.9% as they added $43.79 million in Q2 2024 compared to adding 1.55% ($8.12 million) in Q2 2023. The U.S. commercial segment played a big role as its revenue grew 55% YoY and 6% QoQ to $159 million as the customer count from this segment increased by 83% YoY to 295 customers. Revenue from the U.S. government grew 24% YoY and increased 8% QoQ to $278 million. PLTR’s combined government segment grew 23% YoY to $371 million, while its commercial revenue increased 33% YoY to $307 million. The commercial segment is on track to become a larger revenue generator by the end of 2025 than the government sector.

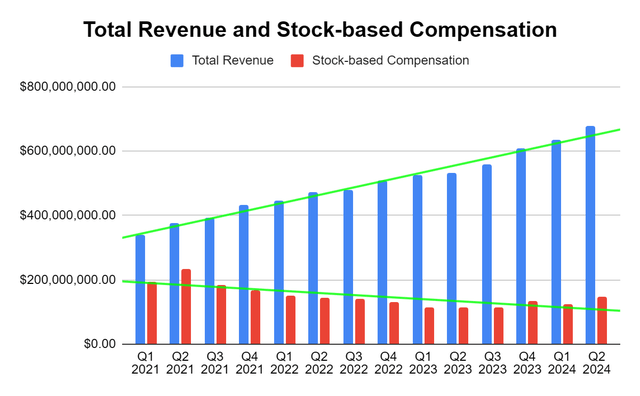

PLTR is exceeding an 80% gross profit margin, which is allowing them to reward their salesforce with stock-based compensation (SBC). The amount of SBC being paid was previously part of the bear case, as the amount of SBC that was paid in Q1 2021 was 56.78% of the revenue generated, while it grew to 61.97% of the revenue generated in Q2 2021. Since then, SBC has declined to as low as 19.81% in Q1 2024, and amounted to 21.79% in Q2 2024. As a long-term shareholder who purchased shares during the direct listing, I am very happy that PLTR is offering SBC as part of the compensation package, especially for the sales team. I want everyone incentivized not just by money, but also by making PLTR more valuable. When everyone within the company has skin in the game, they are rewarded as shareholders, which creates alignment between PLTR and its shareholders. PLTR isn’t borrowing money to pay SBC, and as we have seen from the deals being closed and the products coming to market, PLTR is firing on all cylinders. As long as PLTR continues to grow and SBC stays around these levels, SBC shouldn’t generate negativity the way it once did.

Steven Fiorillo, Seeking Alpha

Steven Fiorillo, Seekings Alpha

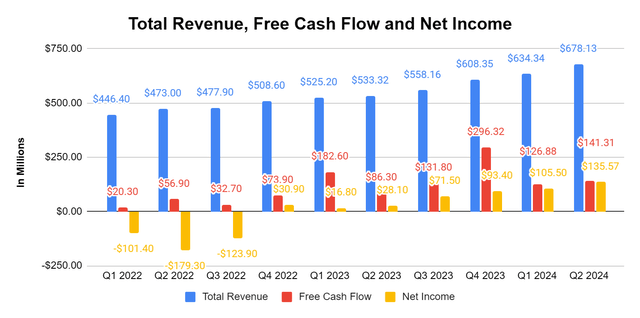

Q2 2024 marks the seventh consecutive quarter of net income, and the 13th consecutive quarter of producing FCF. For anyone who has read my previous articles, I don’t base my investment thesis on adjusted FCF numbers, I look at pure FCF and net income. PLTR adds back in the cash paid for employer payroll taxes related to SBC in their adjusted FCF number, but to me, that’s the cost of doing business. In Q2, PLTR generated $141.31 million in FCF, which was a 20.84% FCF margin, and on a net income level, PLTR generated $135.57 million, which was a 19.99% profit margin. Depending on which profitability metric you prefer, at least 20% of every dollar generated from PLTR is now pure profit. PLTR’s net income has been scaling, and in Q2, it grew by 28.5% ($30.07 million) QoQ and 382.46% ($107.47 million) YoY. Compared to the Q2 2023 TTM numbers of $2.05 billion in revenue, $375.5 million in FCF, and -$48.1 million in net income, PLTR has increased its revenue by 21.22% ($433.96 million) YoY, its FCF by 85.44% ($320.81 million) YoY, and its net income by $454.07 million.

Steven Fiorillo, Seekings Alpha

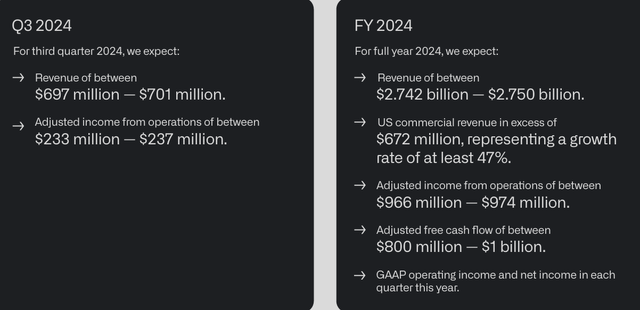

PLTR raised its guidance to $2.74 billion-$2.75 billion for its revenue in 2024, which is an increase of $65 million on the low end and $61 million on the top end. PLTR’s adjusted income is also forecasted to come in higher by $98 million on the low end and $94 million on the high end, as they could produce $974 million in 2024. PLTR is guiding for close to $700 million in revenue for Q3, and I have a feeling they are sandbagging a bit, considering their previous quarterly beats. In 2023, PLTR generated $730.52 billion in adjusted FCF, and is guiding to generate between $800M-$1 billion for 2024. If I take the midpoint of $900 million, they will grow their adjusted FCF by 23.2% ($169.48 million) YoY. While PLTR’s trading at 80.86 times 2024’s estimated earnings and 50.36 times 2026’s estimated earnings, I think they could grow into this multiple and even see more multiple expansion as time progresses. PLTR’s revenue growth has been 20% or higher YoY for the previous three quarters, and on a rule of 40 basis where you combine the revenue growth rate and the profit margin, PLTR is operating at 64%, which is their highest rule of 40 rates since going public. With PLTR’s FCF margin at 20.84% in Q2 and their revenue growth YoY exceeding 20%, I can see PLTR growing their FCF on a forward annual basis by at least 20%. On an adjusted FCF basis, if PLTR does come in at the mid-range, and their FCF increases by 20% on an annualized basis, their adjusted FCF could increase to $2.69 billion in 2030. I don’t think it’s worth trying to fight PLTR as they are continuously adding clients, and driving increased levels of revenue and profitability.

Palantir

Conclusion

If investors aren’t bullish on PLTR here, I have no idea what will make them bullish. PLTR continues to exceed expectations not just on the top and bottom line but also on customer growth. For me, the most impactful aspects are PLTR’s total customer growth, and the number of deals being executed that exceed $1 million. PLTR has added 156 deals in 2024 which were worth more than $1 million, and over the TTM, PLTR has added 570 deals over $1 million, which haven’t been accounted for in net dollar retention yet. MSFT and ORCL can take a blank check approach to software development, yet they are partnering with PLTR to advance secure cloud, AI, and analytics capabilities to governments and commercial enterprises. I think that PLTR is in a prime position to benefit from these massive partnerships while growing its customer base through its AIP bootcamps. We could be in the early stages of accelerated top-line growth and margin expansion for PLTR as more deals are signed. I believe that PLTR will continue to beat expectations and increase guidance.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of PLTR either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Disclaimer: I am not an investment advisor or professional. This article is my own personal opinion and is not meant to be a recommendation of the purchase or sale of stock. The investments and strategies discussed within this article are solely my personal opinions and commentary on the subject. This article has been written for research and educational purposes only. Anything written in this article does not take into account the reader’s particular investment objectives, financial situation, needs, or personal circumstances and is not intended to be specific to you. Investors should conduct their own research before investing to see if the companies discussed in this article fit into their portfolio parameters. Just because something may be an enticing investment for myself or someone else, it may not be the correct investment for you.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.