Summary:

- Palantir Technologies Inc.’s partnership with L3Harris Technologies enhances its market leadership in the US defense sector, integrating AIP with advanced defense solutions.

- Palantir reported 30% revenue growth in Q3, driven by strong performance in US commercial and government markets, raising full-year guidance.

- I forecast 35% growth in Palantir’s commercial business and 20% in government business, driven by AI adoption and strategic partnerships.

- I reiterate a “Buy” rating for PLTR stock with a fair value of $55 per share, supported by robust growth and margin expansion.

Michael Vi

I highlighted Palantir Technologies Inc.’s (NYSE:PLTR) strong execution in US commercial markets in my “Buy” thesis published in August 2024. I think Palantir’s recent partnership with L3Harris Technologies (LHX) could enhance Palantir’s market leadership in the US defense sector.

Palantir just reported a strong Q3 result with 30% revenue growth, beating the market expectations. Palantir indicated accelerated demand for their artificial intelligence platform, or AIP, technology, across both commercial and government markets. I reiterate a “Buy” rating with a fair value of $55 per share.

Partnership With L3Harris

On October 23rd, Palantir and L3Harris Technologies announced a strategic partnership to propel advanced technology development and accelerate digital transformation. I believe the collaboration could benefit Palantir as follows:

- L3Harris is a leader in sensors and software-defined systems for the defense market. Palantir could potentially integrate its AIP platform with L3Harris’s software and hardware solutions, providing comprehensive solutions to the defense market.

- As CEO Alex Karp mentioned, the partnership will ensure that the U.S., and its allies combine the best AI platform and cutting-edge hardware on the battlefield. With the rising regional conflicts, it is mission-critical to deploy AI technology in battlefield as well as national security. I believe the partnership could help Palantir secure more defense projects for their core AIP business.

- During L3Harris’s Q3 earnings call, their management indicated that L3Harris uses Palantir’s products as a unified data layer, enabling L3Harris’s hardware and software layer to support the defense operations and intelligence. It’s worth noting that L3Harris has a strong market leadership in the US defense market, with advanced missile defense technology including hypersonic, counter hypersonic and precise attitude control. As such, the partnership could help both companies further monetize their customer base.

Q3 and Outlook

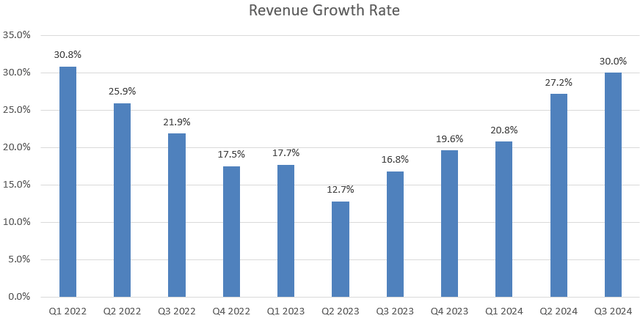

Palantir released its Q3 result on November 4th after the market closed, delivering 30% revenue growth and raising full-year guidance. As illustrated in the chart below, Palantir has experienced an accelerating revenue growth over the past few quarters, driven by strong growth in both US commercial and US government businesses. My key takeaway from the quarter is Palantir’s strong growth in free cash flow and operating profits, delivering 60% FCF margin and 38% adjusted operating margin in Q3. As indicated in their CEO letter, Palantir has benefited from robust growth in the U.S. commercial and government markets as their customers embrace Palantir’s newest AIP platform.

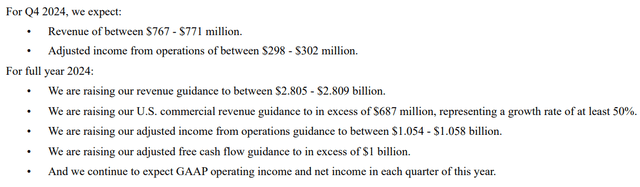

Thanks to their strong results, Palantir raised the revenue and profit guidance for FY24, as detailed below:

I am considering the following factors for their growth from FY25 onwards:

- Commercial Business: As discussed in my previous article, the Artificial Intelligence Platform (AIP) is a key growth driver for Palantir’s commercial market. Palantir has leveraged its AIP to expand into the large enterprise market over recent quarters. For instance, in September 2024, Palantir extended a multi-year, multi-million-dollar deal with APA Corporation (APA), a leading oil and gas company, to deploy AIP across APA’s global portfolio in the coming years. In September 2024, Palantir announced a 5-year deal with BP (BP) to deliver new AI capabilities. I anticipate Palantir will form more partnership with commercial customers to expand their AIP business. Additionally, Palantir uses their boot camps as a go-to-market strategy to attract new customers. As such, I expect Palantir’s commercial business to grow by 35% in the near future.

- Government Business: I continue to forecast Palantir’s government business will grow by 20% in the coming years, driven by their strong market position in defense and battlefield operations. The partnership with L3Harris could help Palantir accelerate its AI penetration in the defense market. As noted in their earnings call, Palantir has achieved strong US government bookings, laying a solid foundation for future growth in the government sector.

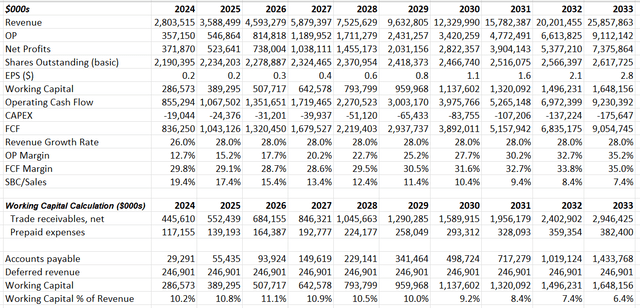

As such, I have revised Palantir’s revenue growth to 28%, up from 22.5% in my previous model. I forecast Palantir will expand its margin expansion by 250bps annually, driven by 130bps from reduction in sales & marketing and stock-based compensation, 30bps from gross profits, 60bps from G&A operating leverage, 30bps from reduced R&D expenses.

I have revised the WACC to 13.8% assuming: risk-free rate 3.6%; beta 2; equity risk premium 5%; equity balance $3.5 billion; Debt $0; tax rate 20%. The DCF can be summarized as follows:

Discounting all the future FCF, the fair value is calculated to be $55 per share, as per my estimates.

Key Risk

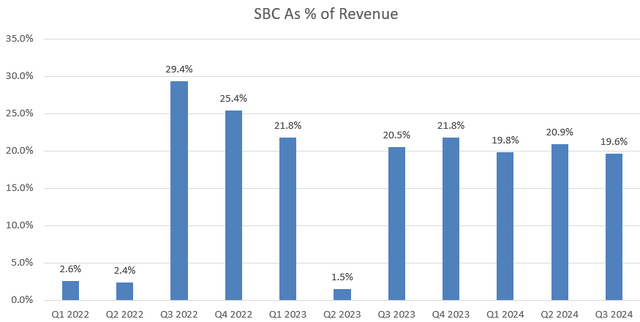

Palantir spent 19.6% of total revenue in stock-based compensation (SBC) in Q3, as depicted in the chart below. As discussed in my previous article, Palantir’s SBC spending is relatively high compared to other software companies. To further expand its operating margin, Palantir needs to reduce SBC expenses.

Conclusion

I am encouraged by the accelerating AI demands from both US commercial and government market, which could continue driving Palantir’s growth. The partnership with L3Harris Technologies could potentially accelerate Palantir’s business growth in the defense market. I reiterate a “Buy” rating with a fair value of $55 per share.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of PLTR either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.