Summary:

- Palantir’s Q3 results exceeded expectations with 30% YoY revenue growth and strong AIP demand, reinforcing my strong buy rating.

- The recent presidential election, with President-elect Trump focusing on government efficiency, adds significant upside potential for Palantir’s AI solutions.

- Despite high traditional valuation metrics, Palantir’s exceptional growth justifies a premium, with forward EPS expected to grow 97.51% YoY.

- Key risks include potential slowing AIP growth, but strategic deals like the Microsoft cloud partnership bolster future growth prospects.

JHVEPhoto

Co-Authored By Noah Cox and Brock Heilig.

Investment Thesis

Palantir (NYSE:PLTR) had an exceptional Q3 on the back of accelerating AIP growth and disciplined execution by the AI innovators management team. While earnings were reported on November 4th, I wanted to take an extra day to analyze earnings because I think the recent presidential election will be a big part of the future of the tech company. Shares are up a whopping 34.09% after the election and the outcome of earnings.

Despite this big run up, I am still a strong buy on Palantir, but I’m even more optimistic about the company than I was even just a few days ago. The data was absolutely incredible for this quarter. The election sweetens the value proposition for the firm.

Strong AIP demand and stories told by AIP customers indicates to me that this company is moving fast in the right direction. My strong buy classification is meant to show that Palantir is building a strong foundation as a company. Now the election helps increase their upside from here

Why I’m Doing Follow Up Coverage

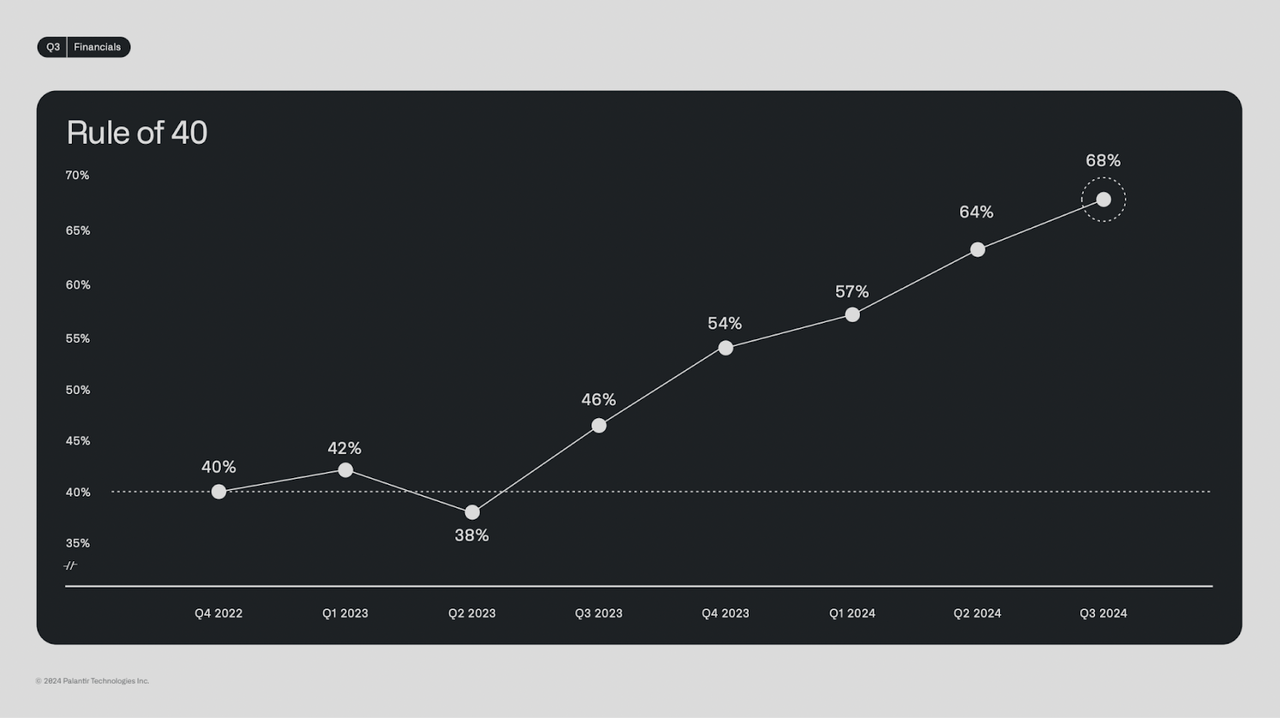

While just a few days ago, I did a deep dive into Palantir ahead of the Q3 earnings report on Monday. At the time, I was bullish on the company based on the strong AIP data we had from Q3. Heading into earnings, Palantir had just signed two $100 million deals, and the software firm also measured out well statistically. According to the Rule of 40, “a software company’s combined revenue growth rate and profit margin should equal or exceed 40%.” Palantir cleared that benchmark by more than 2%. Diving into this in a minute, Palantir continued to grow on their rule of 40 metrics this quarter as well.

I was bullish going into earnings, but I’m even more confident about Palantir after. Every once in a while, you find an exceptional company with an exceptional product, and I believe that this is one of them.

Shares are undeniably expensive from a traditional valuation standpoint (we’ll get into this later) but I think they are worth it. During the quarter, Palantir showed accelerating growth, even though the company is reaching scale. This is hard to do.

Now, with a change in policy in Washington, the firm is well-equipped to ride the wave of planned AI integrations during the next administration.

This is why I’m doing follow-up coverage — to show how paying for an expensive stock is sometimes worth it. I think this is one of those cases, this is a unique case of GARP investing.

Really Strong Quarter

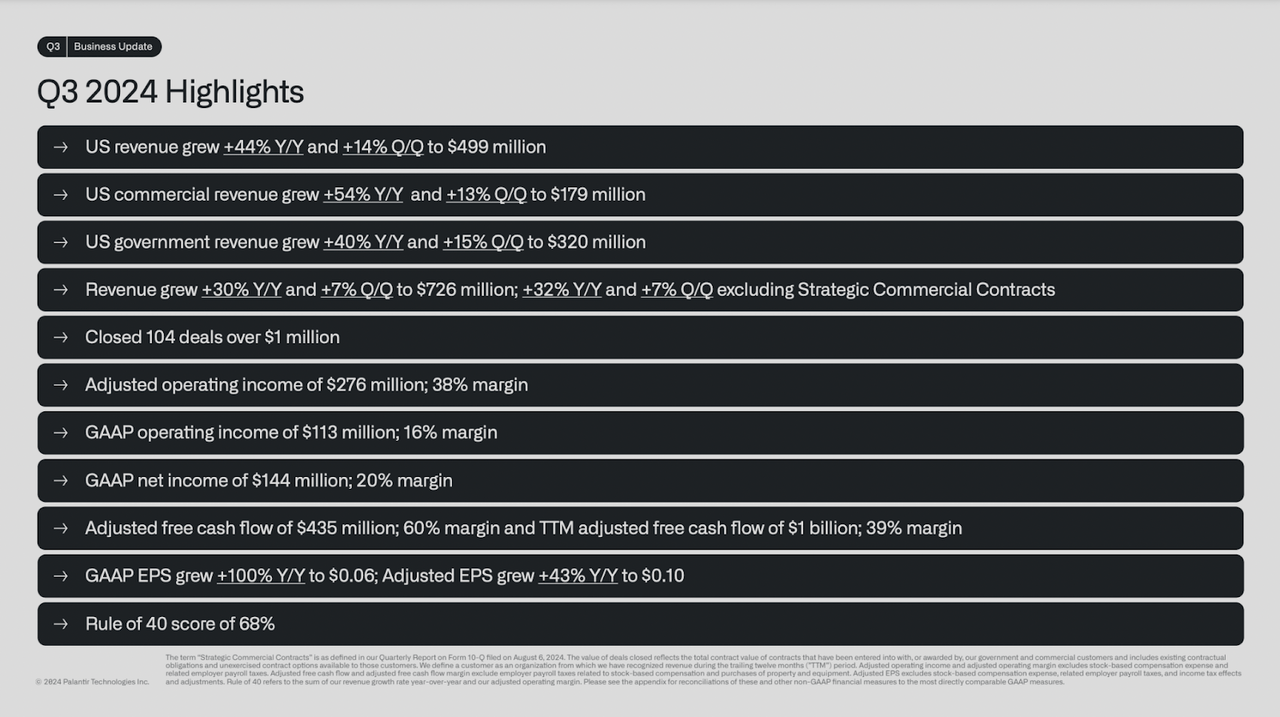

Prior to earnings, 15 analysts projected Palantir’s EPS to be $0.09/share, which would have been nearly 30% YoY growth for the company. Meanwhile, 12 analysts predicted that Palantir would grow 26.07% YoY in terms of revenue, bringing in a projected $703.69 million.

Palantir had no problem exceeding these expectations. CRO and CLO Ryan Taylor discussed the rapid growth in Monday’s earnings call. Revenue beat expectations and came in at $725.52 million. EPS of $0.10/share beat by 0.01/share.

Revenue grew 30% year-over-year in Q3, driven by an intensifying AI revolution that the U.S. is rapidly driving, Taylor said.

Taylor went on to note:

Our U.S. business achieved 44% year-over-year and 14% sequential revenue growth… [and our]…U.S. government business revenue growth accelerated to 40% year-over-year and 15% sequentially, while our U.S. commercial business momentum continued with 54% year-over-year and 13% sequential revenue growth. This AI revolution that is transforming industry, as well as government is also transforming markets.

Exploring the numbers beyond just what Taylor laid out during the earnings call, below are 11 stats that prove just how successful Palantir was in Q3. I think the results are telling.

Going back to the Rule of 40 that I briefly mentioned earlier and discussed more in depth in the last piece of research, Palantir put together an amazing performance in Q3. In Q3, Palantir booked a Rule of 40 score of 68%, exceeding the benchmark by a strong 28%.

CEO Alex Karp chimed in on the call about the incredible Rule of 40 results.

There’s a steel man version of this, which is given how well you’re doing, given you’ve really accelerated to 30%, given the U.S. is growing 44%, why don’t you blow up your Rule of 68, which by the way, to my knowledge is the single best in of comparable companies in the world and significantly better than many very strong companies. So an average normal way of looking at Palantir be like, great, you have a 44% growth on $2 billion base in the U.S. and you have a Rule of 68. Get that 68 down to 50 and maybe you can grow. But in fact, that way of looking at a business misunderstands the way in which Palantir builds -Q3 Call.

How The Election Impacts Palantir

While Monday’s earnings release played a big role in my heightened optimism for Palantir, the results of Tuesday night’s presidential election have me even more bullish than before on the tech firm.

To be clear, this is not a political article. The point of this analysis is to show how a change in policy at the federal government may impact the firm.

Former President Trump won the presidential election here in the US and will take office on January 20th.

This is especially important for Palantir because Trump has mentioned that he is interested in spearheading a government efficiency commission focused on reducing bureaucracy. With this, Trump hopes to make the government more efficient. A more efficient government needs software tools to increase efficiency. This is exactly where Palantir fits in.

According to the article, Trump will lean on tech billionaire Elon Musk to lead the charge. Musk (and fellow billionaire Peter Thiel) are part of the infamous ‘PayPal Mafia.’ According to research by USA Today, Thiel is expected to be a major player in shaping the lineup of the second Trump administration. Thiel is a co-founder of Palantir.

While Palantir is still subject to competitive government bidding (like all government contractors) the benefit here will be an increased priority on efficiency in the US government. This is exactly what Palantir can help with.

Valuation

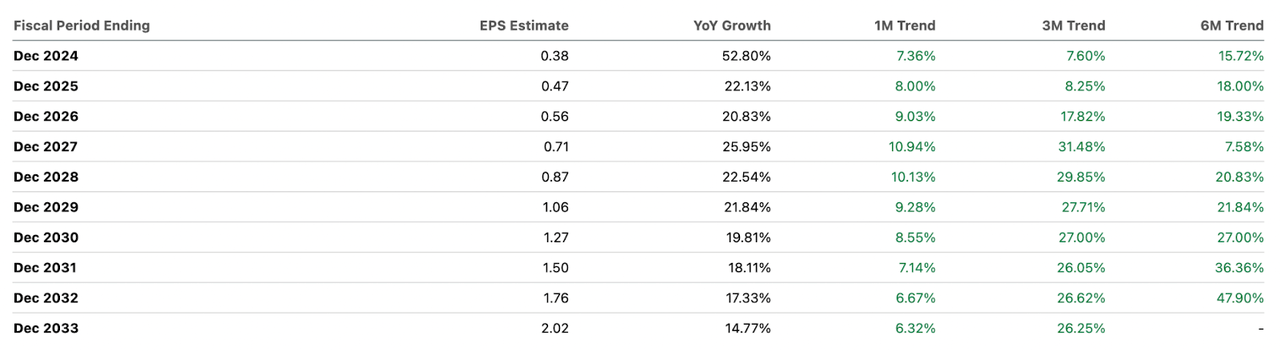

As I mentioned in my pre-earnings analysis (and now as well), the AI innovator’s traditional valuation metrics are well above the sector median. Palantir’s forward Non-GAAP P/E of 134.47 is 458.30% higher than the sector median, which is at 24.09.

This may seem very expensive, but if we look at the forward EPS growth for the company over the next 12 months, growth is expected to come in 1,210.05% higher than the sector median. EPS growth of Palantir is expected to come in at a strong 97.51% YoY whereas the sector median is expected to come in at 7.44% YoY.

I believe you have to pay for exceptional growth, and Palantir is no exception to this rule. While the following may sound like an extreme premium, I think Palantir should deserve to trade at a 500% premium to the sector median forward P/E given the huge opportunities ahead of them because of both an accelerating core business and new government opportunities. If Palantir were to trade at a 500% premium to the sector median, this would represent roughly 9% upside.

Keep in mind that earnings revision data has consistently underestimated the EPS performance of the company, and analysts have had to revise estimates higher this year. We will likely end up with a scenario in a year where Palantir trades at a smaller premium to the sector median forward P/E not because shares went down, but rather because EPS growth beat estimates.

Forward EPS Revisions (Seeking Alpha)

Risks

During the last analysis on Palantir, I honed in on how the company’s valuation was highly dependent on the future growth of the business.

With strong Q3 numbers out, I think for now the future growth of the business looks optimistic. But, as was the case before earnings, the company is really dependent on growth continuing to be strong. Particularly, further growth in AIP was needed to support the valuation from here.

With this I continue to believe the single biggest risk for us to watch out for are any signs of slowing growth for the AIP product.

To help keep growth strong (and part of why I am so bullish) I want to hone in on a cloud deal Palantir signed with Microsoft earlier this year.

I talked about this in my last piece of research, but this key cloud deal is going to allow Palantir to sell their AIP tech to the US government at a much bigger scale because this means government data is on a much more secure server system. This is a big deal as it expands AIP’s use-cases and upside.

Bottom Line

Palantir’s Q3 report was incredible, and the election now adds more to the bull thesis. The year-over-year and quarter-over-quarter growth exceeded the high end of expectations that were set on Palantir heading into the earnings call.

Now, with Palantir in a good position to offer the automation technology the next presidential administration craves, I think shares have more upside from here.

With this, shares continue to be a strong buy. The growth is really unique, and the company keeps finding new ways to scale their business. Typically revenue begins to plateau at scale, but Palantir just keeps on growing. Palantir is a rare exception.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of PLTR either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Noah Cox (main account author) is the managing partner of Noah’s Arc Capital Management. His views in this article are not necessarily reflective of the firms. Nothing contained in this note is intended as investment advice. It is solely for informational purposes. Invest at your own risk.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.