Summary:

- Palantir’s shares have surged 93% since August, driven by strong demand for its AIP platform, expanding both commercial and government customer bases.

- The AIP Bootcamp sales strategy accelerates new customer acquisition, with conversions as fast as 16 days, boosting Palantir’s growth prospects.

- Earnings outlook remains positive, with projected YoY growth in EPS and revenue, supported by Palantir’s performance on key metrics like the Rule of 40.

- While high valuation poses risks, Palantir’s partnerships, particularly in defense, reinforce its long-term potential in the AI-driven enterprise space.

- Heading into earnings shares are still a strong buy.

Tasos Katopodis/Getty Images Entertainment

Co-Authored By Noah Cox and Brock Heilig.

Investment Thesis

Palantir (NYSE:PLTR) shares have been on a tear since early August, the last time I wrote on the breakthrough AI software company. Shares are up almost 93% since the last time I covered the company in early August. Investors have clearly done well on the software giant. CEO Alex Karp’s 2 decade long vision looks to be paying off now.

As has been the case since early 2023, one of the main drivers behind this exponential growth (both in shares and in commercial revenue) has been their strong AIP (Artificial Intelligence Platform) demand, powered by their ingenious AIP Bootcamp sales strategy. These bootcamps are allowing the company to quickly demo and sign new customers to their commercial and government divisions, helping them scale quickly. This is not new. What is new is the sheer scale of bootcamps, new customer sign ups and new use cases we saw from Palantir customers this quarter. Frankly I found it to be game changing (in a positive way)

Earnings are set to come out on Monday, and with that, I want to do a deep dive into the company and discuss what I think is going to be the state of the AIP demand heading into Q4. I think AIP demand will continue to accelerate, which justifies the company’s expensive valuation.

With this, I think shares continue to be a strong buy.

Why I’m Doing Follow Up Coverage

Shares of the top secret defense tech and AI company have well outpaced the market since I last wrote on them in August. I think this is fitting, based on the strong demand and customer interest the company is receiving.

While Palantir’s product, AIP Bootcamp, is not new at this point, the accelerating pace of adoption is. AIP is driven on the AI framework called Ontology, which I wrote about in my last piece of coverage. This is a huge deal. The framework allows companies to organize the large amounts of data they have so they can place it into more readable, easy-to-use formats for AI tools (including the rest of the AIP system). This helps companies make faster business decisions. Time is money for fortune 500 firms.

While shares are up a significant amount, some investors might think they are overpriced. I disagree with this. While we definitely could see volatility in the stock in the short term, I still think shares will continue to have strong upside in the long run.

I am a long-term investor in Palantir. The purpose of this follow up coverage is to show how from a long-term perspective, shares remain undervalued.

New Customers In Action

AIP is gaining rapid traction helping Palantir pull in new customers at an accelerating rate. A major driver of this are the wide sets of use cases these new customers are providing Palantir. These use cases are exactly what the AI leader needs to push for a wider market. It’s also helping them close customers faster, with customers converting from AIP bootcamps to sales in as little as 16 days according to the Q2 call.

For those who have done enterprise sales, you’ll know this is unheard of. Most enterprise software sales take up to 18 months.

New and existing customers across the commercial and federal landscapes continue signing up for multiple aspects of the PLTR [Palantir] tech stack based on our recent checks as the company introduces new valuable use cases to customers with more organizations seeking to drive efficiencies on the back of AI –Wedbush analyst Daniel Ives.

Palantir also had more than 100 organizations and potential customers at its fifth AIPCon in September.

More than 100 organizations will be at AIPCon, including many customers who are demoing and speaking publicly about their work for the first time — including The National Geospatial-Intelligence Agency, Aramark, bp, Associated Materials, Lear, Trinity Industries, Anduril, DTN, EllisDon, Department of State, L3Harris, Owens & Minor, Selkirk Sport, and more -Press Release.

With this Palantir recently closed two $100 million deals.

Palantir has inked several large contracts with the U.S. government in the past week alone, including a pair of $100M contracts with the DEVCOM Army Research Laboratory and another related to the Maven Smart System AI tool -Seeking Alpha.

The firm is using their new technology to close leaders faster and accelerate revenue growth. It’s a whole new sales model.

Earnings Preview

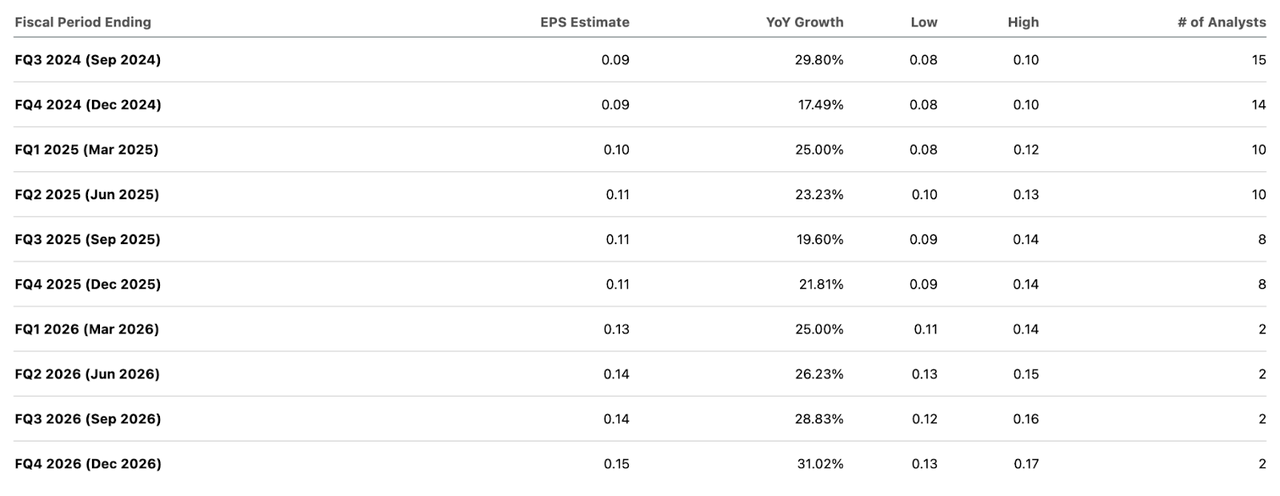

Heading into earnings Monday after the bell, Palantir is expected to see strong growth both in its EPS and revenue numbers. 15 analysts (when averaged) project Palantir’s EPS to come in at $0.09/share, which would be 29.80% YoY growth for the company.

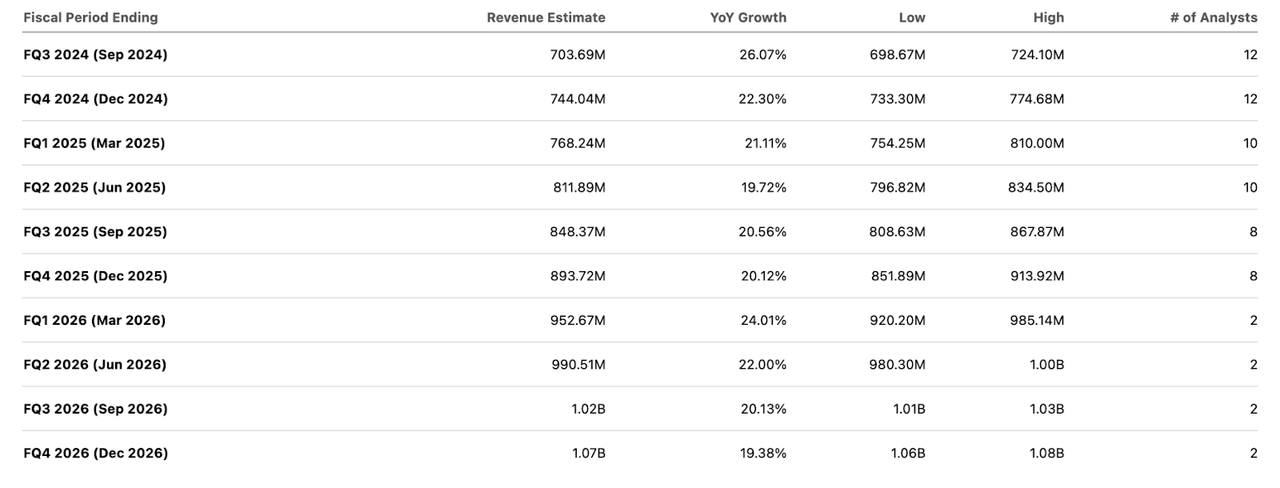

Meanwhile, if projections are accurate, Palantir is expected to see similar growth in revenue. A consensus of 12 analysts expect Palantir to haul in $703.69 million. This would be 26.07% YoY growth.

Not only do short-term earnings look promising for Palantir, but things are trending upward in the long-term as well. At no point in the next 10 quarters does the EPS decrease quarter-over-quarter, and the projected YoY growth is greater than 20% for eight of the next 10 quarters. This is incredible.

EPS Estimates (Seeking Alpha)

In terms of revenue, analysts predict that Palantir will surpass $1 billion in quarterly revenue by Q3 2026. And similar to EPS estimates, eight of the next 10 quarters project YoY growth of 20% or greater.

Revenue Estimates (Seeking Alpha)

When the earnings call is released on Monday, I will be looking closely for more evidence on how many AIP Bootcamp demos (that turned into sales) the company has done. I’ll also be looking for more data showing how AIP sales are growing inside existing customers, which would give me a ton of confidence that the product is having strong success within the companies that have purchased it. The best potential customers are the ones you already have (that you upsell to).

Valuation

When we look from a growth standpoint, there are quite a few metrics that tell me Palantir is performing well as a software company. The first is the Rule of 40.

The rule of 40 states that “a software company’s combined revenue growth rate and profit margin should equal or exceed 40%,” according to Cloud Zero.

If the number is above 40%, this means that the company is excelling and producing SAAS net income margins at a sustainable rate. For companies whose number is below 40%, the firm may experience cash flow problems.

As I previously mentioned, this quarter, Palantir’s revenue is expected to grow by more than 26% YoY. On top of this, Palantir’s net income margin on a trailing 12-month basis is 16.32%.

When you add these two numbers up, you get a sum of just over 42%, which is obviously greater than 40%. This tells us that Palantir is performing well as a software company, and that it is producing profit at a “sustainable rate”, according to Cloud Zero.

However, I think Palantir is doing much better than simply producing at a “sustainable rate.” Given these very promising numbers, I think the company should trade at roughly a 20% premium to where shares are today, because they continue to perform well according to the Rule of 40, and because EPS and revenue numbers are trending in a strong direction.

Diving into their EPS growth vs. sector median, I think we can see this value as well. EPS growth is expected to be 93.09% YoY on a forward basis according to data from Seeking Alpha. This is an 1,150% premium over the sector median growth of just 7.44%.

While Palantir’s forward non-GAAP P/E is 392.59% higher than the sector median this makes sense because EPS growth is 1,150% higher than the sector median. The sector median forward P/E currently comes in at 23.92, and Palantir sits at 117.82.

Even though the P/E ratio on a forward basis is much higher than the sector median, I think the investment is worth it. The EPS and revenue growth numbers back up my optimism in Palantir, and I think they’re set up well for success from here over the long run even if shares appear expensive on the surface.

Risks

Let’s be clear: Palantir’s high forward valuation is especially dependent on the future growth of their business, given the high forward price-to-earnings ratio. If there are any signs that growth is slowing for their innovative AI products, this would mean that the stock could have major downside because of the fact that it’s currently so expensive on traditional metrics (which I think are the wrong way to value them).

Essentially, it comes down to this: if customers are getting value from Palantir’s product and continue to pay for it and potentially even purchase more subscriptions, the company should continue to perform very well. This is the single most critical factor to the company over the long run.

So the question is: does Palantir provide great value to its customers?

I believe they do.

Recently, Palantir teamed up with Microsoft to “bring some of the most sophisticated and secure cloud, AI and analytics capabilities to the U.S. Defense and Intelligence Community.”

The company also partnered with L3Harris Technologies to combine “L3Harris’ sensors and software-defined systems and Palantir’s Artificial Intelligence Platform…to enable new levels of capability across the joint-all-domain network”

To be clear, Palantir has always been a provider of critical consulting and software solutions for the defense community. Now, more than ever, they are relying on them to help keep our military functioning and keep the US safe. I think there is no better indicator to show that their products work and customers are getting incredible value from them

They are fulfilling their most critical factor.

Bottom Line

Palantir’s long-term growth projections are strong. The EPS and revenue projections over the next 10 quarters are bullish, and the expected growth over the next few years is on pace to be game changing to bring the AI software firm to the next level of performance for both its customers and investors. I think data from this quarter shows the firm is doing what is most important: adding incredible value for its customers.

According to the Rule of 40, Palantir is in a strong position to continue on their upward trend with key metrics like this one showing the firm is currently sporting sustainable growth. Even though shares are up ~93% since the last time I wrote on them, I continue to see great long term value in the company.

There is a real chance the company’s shares experience some volatility over the next few months, but I continue to believe they are a big part of the future of enterprise AI. It’s worth a premium to pay for that. With this, I still think shares are a strong buy.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of PLTR either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Noah Cox (main account author) is the managing partner of Noah’s Arc Capital Management. His views in this article are not necessarily reflective of the firms. Nothing contained in this note is intended as investment advice. It is solely for informational purposes. Invest at your own risk.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.