Summary:

- I am upgrading Palantir’s stock to a “buy” as I had previously underestimated profitability expansion potential, despite high valuation and expected volatility.

- I believe that Palantir will likely beat its Q3 FY24 revenue and earnings target, driven by strong AIP demand and strategic government contracts keeping the trend of revenue acceleration alive.

- While Palantir’s forward revenue multiple is high compared to peers, despite similar revenue growth rates into FY26, its potential for profitability expansion could justify a price target of $61.

- However, risks include potential volatility from polarized investor sentiment and reliance on continued demand and controlled operating expenses.

Michael Vi

Introduction & investment thesis

I last wrote about Palantir (NYSE:PLTR) in September, where I discussed that the stock’s outperformance is tied to it beating its Q2 FY24 earnings target, where it demonstrated exceptional strength in its US commercial segment from unrelenting AIP (Artificial Intelligence Platform) demand, which grew at an accelerating rate of 33%YoY, along with expanding GAAP profitability driven by its GTM (go-to-market) strategy that is focused on AIP Bootcamps and AIPCon to unlock potential AI use cases for clients instead of hoarding salespeople.

I had also mentioned that the stock’s outperformance could be tied to its addition to the S&P 500 index, where newly added stocks typically see outperformance in the first three months.

However, despite its strength, I downgraded the stock to a “sell” due to concerns on tougher comps in FY25 and beyond, along with its eye-watering valuation, which I did not feel justified, where it fetched an NTM (Next 12M) forward revenue multiple of 21.2 and earnings multiple of 80 at the time of my writing.

Since then, its NTM forward revenue and earnings multiple have further expanded to 28 and 106, an increase of 32% and 32.5%, respectively. This is driven primarily by the stock price going up 28.69% to $44.86 during this period of time.

With the company set to report its Q3 FY24 earnings on November 4, I decided to take a hard look at the 3 main things that need to happen for Palantir to justify its present valuation. In all of this, I have decided to upgrade my rating to a “buy,” as I believe I was wrong in my assessment of how fast its profitability can potentially expand from its current levels. Although the stock is extended at its current levels and may be subject to significant volatility given elevated levels of investor expectation, I believe there is a path toward a price target of $61.

Before I move ahead, I would like to point out that I will not be initiating a net new position at the stock’s current levels, given my own risk appetite.

Will revenue and earnings growth continue to accelerate in Q3?

For Q3 FY24, Palantir is expected to grow its revenue between $697-$701M, which would represent a growth rate of 3% and 25.2% on a sequential and year-over-year basis, respectively. What is important to note is that, unlike most software companies that are yet to see a reacceleration in their revenue growth, especially as they have invested in their genAI efforts, Palantir has proven to be an exception.

It has seen its revenue growth accelerate after bottoming in Q2 FY23, with Q2 FY24 revenue growing 27.2% on a year-over-year basis. This is driven by persistent demand for their enterprise platform, AIP, where it has seen its US commercial customer count grow a whopping 83% YoY to 295, capturing the enterprise AI opportunity from “prototype to production” like no other company. This has in turn led the company to see a sequential acceleration in its $5M and $10M deals, with LTM (Last 12 months) revenue from Top 20 customers growing 9% YoY to $57M/customer as existing customers continue to expand usage of their solutions with deepening product-level relationships, along with robust new customer acquisition trends.

However, if Palantir just meets its revenue expectations in Q3 FY24, it would mark the first quarter of a reversal in the revenue acceleration trend. On the other hand, if it is able to produce a revenue of at least $709.9M, it would mark a beat of roughly 1.5% and would keep the revenue acceleration trend alive.

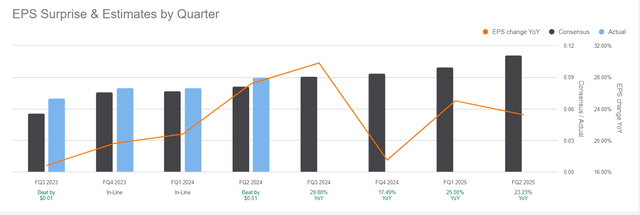

Simultaneously, the company has also projected to grow its Adjusted Operating Income by approximately 43.9% on a year-over-year basis to $235M, with a non-GAAP EPS of $0.09. While this would mark a sequential decrease in Adjusted Operating Income and margin by 340 basis points to 33.6%, I believe investor sentiment has been boosted partially by a total of 11 net upward EPS revisions over the last 90 days for Q3, with 0 downgrades during this period of time. Plus, over the last four quarters, Palantir has consistently beat earnings estimates by an average of 14.5%, as can be seen below, and therefore a beat of a similar magnitude in Q3 would align with investors’ elevated level of optimism for the company.

While I believe that it is not a far-fetched idea that Palantir will likely beat estimates on both revenue and earnings front given ongoing strength in AIP, along with winning strategic, high-value, long-term contracts with the government. At the same time, its initiatives with its “Warp Speed” platform, which is designed to enhance American manufacturing capabilities, and announcing its first developer conference, DevCon, should further accelerate its deal cycle, given the highly targeted audience of technical decision makers.

Aside from this, I believe it is the management’s commentary on the overall demand environment for FY25 and beyond that will determine how sustainable its current valuation multiples are and whether investor optimism continues to remain elevated.

Forward revenue multiple of 28 is extended. But, that’s not the full picture

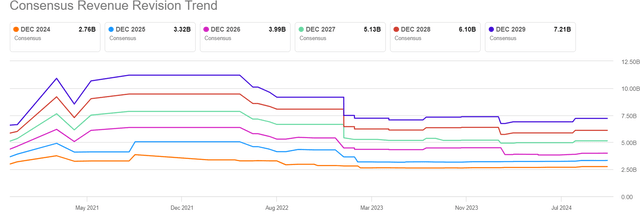

Over the last one and a half months, Palantir has seen its revenue multiple expand from 21.2 to 28, an increase of 32%. This was driven primarily by the stock price, which grew over 28%, while its revisions to revenue expectations over FY24, FY25, FY26, and FY27 grew 0.01%, 0.14%, 0.23%, and 3.43%, respectively.

SA: Trend of Revisions to future Revenue Growth

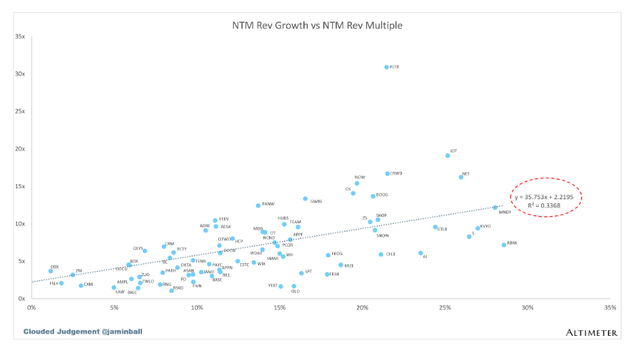

Furthermore, when we take a look at the following scatter plot, where we can see companies mapped by NTM Revenue Growth vs. NTM Revenue Multiple by Altimeter Capital, we can see that Palantir’s NTM Revenue Multiple is extremely elevated compared to its peer group in the software sector. What is most important to note is that Palantir has a similar revenue growth projection in the NTM, as do companies such as CrowdStrike (CRWD), Datadog (DDOG), ServiceNow (NOW), and more, and yet its revenue multiple is roughly double that of those companies. Meanwhile, we can also see companies such as Samsara (IOT), Cloudflare (NET), and monday.com (MNDY) that have superior projected NTM revenue growth are also significantly “cheaper” on an NTM Revenue multiple basis compared to Palantir.

Altimeter Capital: NTM Revenue Growth vs. NTM Revenue Multiple

While one may argue that the higher revenue multiple of Palantir is driven by the magnitude of upward revenue projections by analysts for the next twelve months as compared to other companies in the software sector, I don’t believe it is sufficiently high enough to justify a revenue multiple that is twice its peer group that boasts similar revenue growth projections over the NTM.

The story doesn’t become any better when we look further out into FY26 and FY27, where Palantir is projected to grow in the low twenties range, similar to its peer group. On one hand, the bull case could be shaped by projected spending on software that is expected to grow at an accelerated rate of 14% to $1.23T, driven by AI-related projects as spending shifts from the infrastructure to the application layer. In this case, we are likely going to see continued strength in Palantir, with revenue that will likely grow higher than current projections. On the other hand, there is reason for caution, with Gartner projecting that one of every three genAI projects will likely be scrapped by 2025 due to escalating costs and unclear business value.

Therefore, if we think linearly, we would think that Palantir would need to grow its revenues by twice as much as projected in order to justify its forward revenue multiples, which is double that of its peer group in the software sector. While that may be tough, I believe it is the potential expansion in its profitability that paints a path toward a continued rally in the stock price.

A drastic expansion of profitability is possible, leading to $61/share

In my previous post, I had discussed that its forward PE of 80 is pure nosebleed. Since then, its forward earnings multiple has expanded to 106, while its earnings estimate has gone up by only 0.23%. Therefore, the expansion in its multiple is primarily driven by the stock price.

However, when we look at earnings per share projections over the next 2 years into FY25 and FY26, we can see that it is estimated to grow roughly in the low to mid-twenties range, which is once again in line with companies such as ServiceNow, Datadog, and Snowflake (SNOW) and MongoDB (MDB).

But unlike the last time, where I based my “sell” rating off of valuation concerns when comparing it with earnings growth rates of other companies in the software sector and the S&P 500 index, I believe that it is important to look at it from a slightly different lens.

Let me explain.

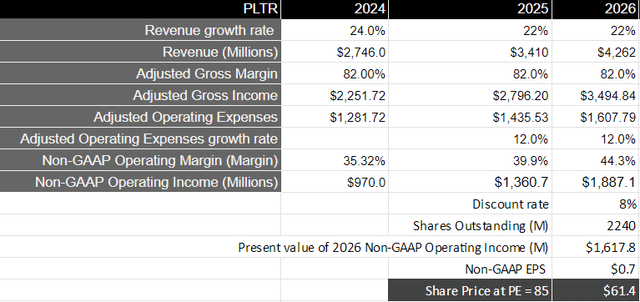

If Palantir is able to meet its FY24 Adjusted Operating Income of $970M, it would imply a margin of 35.3%, an expansion of 730 basis points over the last year. Now, during this period of time, Palantir’s Adjusted Operating Expenses are expected to grow just 3.8% if we assume an Adjusted Gross Margin of 82% on a projected 24% YoY FY24 revenue growth to $2.745B. This is creating an enormous amount of operating leverage with the company unlocking the “holy grail” in the world of SaaS with a Rule of 40 score of 56, which is the highest among its peer group of software companies.

Furthermore, if we assume that Palantir will be able to grow its Adjusted Operating Expenses in the high single digits to low double digits over the next couple of years as it invests in R&D, then its Adjusted Operating Margin should expand from a projected 35.3% in FY24 to 44.3% in FY26, with Adjusted Gross Margin at 82% and Revenue growth at par with consensus estimates.

If this scenario is to play out, then Adjusted Operating Income will grow at a compounded annual growth rate of 41% over the next 2 years, roughly twice the rate of projected revenue growth.

Therefore, in this case, taking a multiple of 5 times that of the S&P 500, where its earnings grow on average by 8% over a 10-year period, we arrive at a PE ratio of 85, with a price target of $61, which represents an upside of 36% from its current levels.

The bull thesis is not without its risks

Even though there is a path to $61 for the stock, which represents a 36% upside from current levels, I believe that the stock is likely to be subject to tremendous amounts of volatility ahead, given highly polarized investor sentiment on either end of the spectrum.

When it comes to the demand environment, we need to see continued momentum in enterprise demand for AIP across expanding AI uses, along with strength in the government sector. Meanwhile, the magnitude of revenue and earnings revisions over the last six months has also played a significant role in the stock’s rally. However, if investors expect the current momentum in upward revisions to revenue and earnings growth to continue, there might be some level of disappointment and hence the volatility in the stock price. Should we see a weakness in the demand environment from a combination of companies cutting back on low ROI (return on investment) AI projects, along with macroeconomic uncertainties, leading the management to project FY25 revenues lower than current analyst estimates, there will be significant selling pressures.

Meanwhile, in terms of the profitability landscape, a large part of my assumption is banked on Palantir being able to streamline its operating expenses as a percentage of revenue, as it sees its operating expenses grow at a slower pace than overall revenue growth given the design of its GTM strategy with AIP Bootcamps and AIPCon that helps potential and existing customers unlock AI cases and shorten deal cycles. However, should we see a combination of slower-than-projected revenue growth, along with increasing operating expenses from investments in R&D and other strategic areas, Palantir may not be able to see the magnitude of profitability expansion as I have demonstrated in my valuation model.

With the new price of $61, I will be upgrading the stock to a “buy.” However, given my risk appetite and the potential for violent swings in the stock, I will not be initiating a position at its current levels. However, I will be listening in on the earnings call to assess management’s commentary on the demand environment and the overall progress in the profitability landscape, and I will use any major price asymmetry in the stock to add a position(s) in the company, as long as its fundamentals are unchanged.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of NET either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

I am Amrita and I write primarily about growth software stocks.

I recently joined The REIT Forum and if you are looking for more investment ideas like this one, get them exclusively at The REIT Forum with access to our subscriber only portfolios.