Summary:

- Palantir Technologies Inc.’s Q3 results exceeded expectations, driven by AI-led growth, but the stock is treated as speculative, making current valuations unjustified.

- Despite strong governance and growth, Palantir’s valuation is overextended, reminiscent of the .com boom, suggesting caution for serious investors.

- Palantir’s intrinsic enterprise value is estimated at $46.06 billion, indicating a 49% negative margin of safety from its current enterprise value of $90.23 billion.

- Serious investors should wait for a significant decline before buying, as speculation surrounding Palantir stock makes it a risky investment at the present valuation.

lindsay_imagery

“…given the market’s irrational tendency to trade on momentum and sentiment – especially with strong Q3 results likely – further speculative valuation gains could compound in the near term.” – from my Q3 Earnings Preview (emphasis added).

Welcome to Palantir Technologies Inc. (NYSE:PLTR) in Q3 2024, where the company continues to perform robustly, outperforming estimates on impressive AI-led growth, but the market is treating the stock as a speculative investment. Indeed, this era-defining organization is positioned for greatness, but even the best companies can’t sustain a valuation that is significantly unjustified by traditional valuation measures. Moreover, if one is a buyer of Palantir at its current valuation, I am inclined to consider the decision more speculation than investment (despite the company’s unique market position, moat, and growth trajectory).

Q3 Earnings Review: AI Tailwinds Support the Speculative Valuation

The headline data is that Palantir achieved adjusted earnings per share of $0.10 versus the consensus estimate of $0.09. Moreover, its revenue came in at $725.52 million for the quarter, significantly above the consensus estimate of $703 million.

Then, there was guidance, where the company again exceeded investors’ expectations, with Q4 revenue of $767 million to $771 million expected by management, which is significantly higher than the consensus estimate of $746 million.

We should remember one critical element about Palantir: it is governed by some of the most astute business leaders in the world, Peter Thiel among them, and therefore, should not be underestimated operationally. Thiel co-founded the company, not only personally investing $40 million into the company early on but also facilitating support from In-Q-Tel, the CIA’s venture capital arm, helping to secure the company’s network within government sectors. Thiel has been instrumental in the company securing significant contracts with the CIA, NSA, and Department of Defense (“DoD”). While Thiel is not in a direct leadership role at this time, he is currently a member of the board. I have deep trust in his input into the governance of the company and its future operational stability.

That said, there is an overarching mystique about Palantir that attracts the kind of speculative retail investment leading to valuations that I consider it best to avoid, not least that the company is involved in AI for the DoD and CIA. Indeed, Palantir’s inclusion in the S&P 500 (SPY) recently has consolidated its position as one of the West’s most important companies, but it has also reaffirmed to certain investors that the current valuation is sustainable, but in reality, it is unlikely to be.

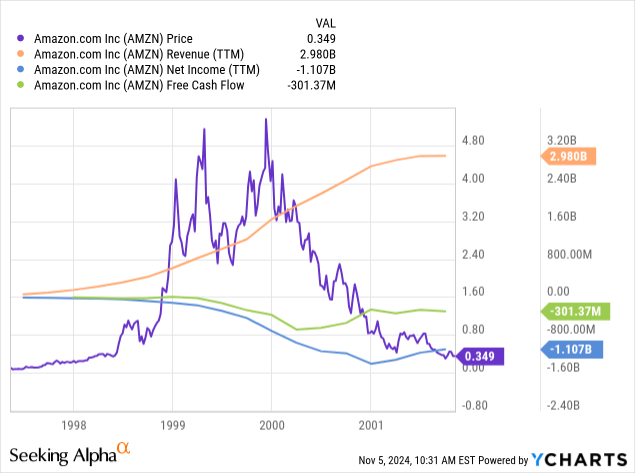

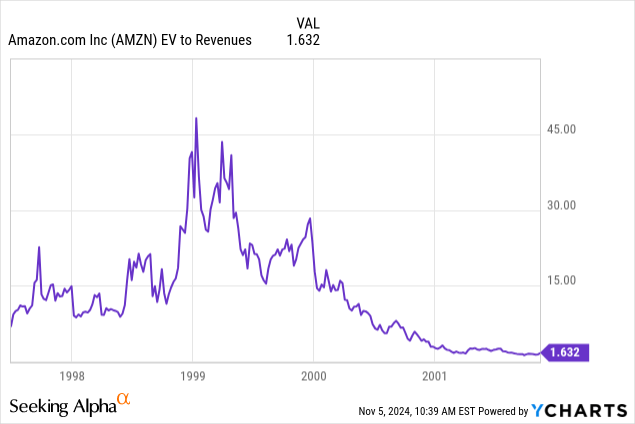

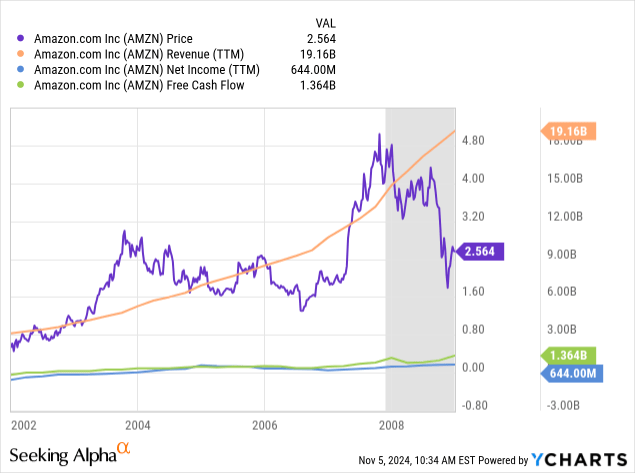

Indeed, Palantir is at the forefront of global defense and high-caliber commercial use cases for AI, indicated by the following data and broader rapid AI adoption trends, but one must remember that similar speculative stock valuations were experienced during the .com boom of the 1990s. Amazon.com, Inc. (AMZN) was one such company whose valuation collapsed when the broader market crashed (indeed, its valuation found a stable path to growth in the long term). If Palantir faces such a crash, this is when I will be buying my position, certainly not at the current valuation. The point about a potential impending recession being likely significantly destructive to the valuation of Palantir stock is also verified by the effect that the 2008 crisis had on Amazon, as outlined in the second chart below.

- U.S. revenue grew 44% year-over-year and 14% quarter-over-quarter to $499 million.

- Customer count grew 39% year-over-year and 6% quarter-over-quarter. Closed 104 deals over $1 million.

- Adjusted income from operations was $276 million, representing a 38% margin.

- Cash from operations of $420 million, representing a 58% margin and $995 million on a trailing twelve-month basis.

Palantir’s TTM EV-to-revenues ratio is 36.

We should remember that Amazon’s price crash in 2000 was largely due to the broader bursting of the dot-com bubble, rather than a traditional economic recession. In the case of Palantir, the same effects are not at play because there is much less speculation in the AI market compared to the .com boom. That said, if NVIDIA Corporation (NVDA) faces a valuation decline in the upcoming years during a macroeconomic recession, which could be impending in 2027/2028 by my analysis (based on current and forward-looking inflation and interest rate sensitivities), Palantir could be one such stock which crashes with it (given the excessive valuation multiples and likelihood of-at least-significant growth rate contractions for Palantir in the face of a protracted reduction in government and commercial demand due to a macroeconomic recession).

Palantir may very well continue to grow over the next couple of years. In fact, there is some chance that 2025 will continue to see the stock climb even higher if interest rates in the U.S. are significantly cut, but the likely price action remains speculative, as the company’s intrinsic valuation is already significantly overextended. At best, long-term Palantir stockholders should expect heavy volatility. At worst, potentially significantly protracted long-term equity value losses from the present highs if geopolitical tensions escalate over the coming years, creating a protracted bear-market condition in the U.S.

Valuation Analysis: High Risk

Palantir may be a worthy long-term holding if its valuation is reasonable, but due to the volatility in its financial positioning-with exceptional upward revisions in guidance making forward estimates intangible over long time frames, I’m focusing on a five-year discounted EBITDA model for my intrinsic value analysis.

I estimate that the company will have approximately $7 billion in annual revenue in December 2029. At a forecasted EBITDA margin of 17.5% in five years, the company will have an annual EBITDA of $1.225 billion. The company’s EV-to-EBITDA ratio is currently 277.5 on a TTM basis (which is unreasonable). As a relative gauge, Salesforce, Inc. (CRM) has a five-year average TTM EV-to-EBITDA ratio of almost 60. Palantir’s forward EV-to-EBITDA ratio is almost 90. Therefore, I will be using 75 as my terminal multiple due to Palantir being at an earlier stage of reliable profit generation than Salesforce. In addition, 75 is also the median of Salesforce’s five-year average TTM EV-to-EBITDA ratio of 60 and Palantir’s current forward EV-to-EBITDA ratio of 90.

My 2029 enterprise value for Palantir is, therefore, $91.875 billion.

For my discount rate, I will be using the company’s weighted average cost of capital (“WACC”) of 14.81%, which reflects the weighted costs of equity and debt, adjusted for a tax rate of 5.87%. With a market capitalization of $92.74 billion and a TTM quarterly average debt value of $237.44 million, the company’s cost of equity, calculated using the capital asset pricing model (“CAPM”), is 14.85%, while the cost of debt is 0.37%.

Discounting my 2029 terminal enterprise value of $91.875 billion to present-day value using the WACC as the discount rate gives me a five-year-holding-based intrinsic enterprise value of $46.06 billion. The company’s current enterprise value is $90.23 billion. Therefore, Palantir has a 49% negative margin of safety with sustained market sentiment.

However, given my terminal multiple of 75 accounts for significant goodwill related to brand, management, and moat, all heightening market sentiment. If the company were to trade at a TTM EV-to-EBITDA ratio of 60 (equal to Salesforce’s five-year average), then its 2029 enterprise value would be $73.5 billion. Discounting $73.5 billion back to present-day value using the company’s WACC of 14.81% gives an intrinsic value of $36.85 billion. That indicates that Palantir has a 59% negative margin of safety based on a more conservative outlook.

Contrarian Analysis

- Momentum investors may argue that Palantir is a company unlike any other, deserving of a “one-of-a-kind valuation,” and likely to sustain the current high sentiment over time. I agree that this argument may work well in the short term, but once a major recession hits, I find it essentially inevitable that the stock will reflect the fundamentals more appropriately.

- The West may not face a recession in 2027/2028 as I currently predict. In that case, Palantir investors may find that the stock has considerably longer to consolidate a premium valuation near current levels, especially as management will be able to continue to deliver high growth for an extended period. That said, macroeconomics is cyclical, and a recession will inevitably occur eventually, severely impacting Palantir stock if its valuation remains elevated until then.

Conclusion

Any investor who has followed Palantir and its management and founders for some time knows that this is a special company with an enduring operational position. However, astute Seeking Alpha community members often point out that a stock and a company are connected, but not the same thing. I invest in companies, not in stocks-because Palantir is selling as a speculative stock right now, I can’t invest meaningfully in the underlying company. Palantir is likely worth approximately $50 billion in enterprise value currently (and that includes goodwill for brand and management)-not the market’s value of $90.23 billion. At this valuation, wise investors will sell their stake and wait for a major decline before buying their next big position in the company.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of AMZN either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.