Summary:

- Palantir is a frontrunner in enterprise AI, with a unique process called “ontology” that sets them apart.

- Strong early adoption of Palantir’s AI platform at the enterprise level distinguishes them from other major AI players.

- High-profile contracts, such as the recent agreement with Tree Energy Solutions, showcase Palantir’s technology and growth potential.

- While AI stocks have sold off (Palantir included) I think the company is truly unique allowing them to buck the trend in the long run.

Kevork Djansezian/Getty Images News

Investment Thesis

Palantir (NYSE:PLTR) is emerging as a front-runner in the enterprise application of AI, leveraging their unique process called “ontology” by CEO Alex Karp. As Palantir defines it, Ontology acts as an operational layer for the company, sitting on top of integrated digital assets, and links them with physical assets such as equipment, plants, products, and concepts including orders placed by customers and financial transactions. It’s an operating principle that allows them to produce enterprise-grade AI that’s valuable. I think this is allowing them to stand out.

Palantir’s AI platform, AIP, has demonstrated strong early adoption at the enterprise level, setting the company apart from other major AI players who have recently faced setbacks.

Palantir’s ability to secure high-profile contracts, such as the recent multi-year agreement with Tree Energy Solutions shows that the company is building technology that customers want just at a time that Wall Street is losing patience with other AI plays.

In this case, this partnership will see Palantir’s AI used to support TES in producing electric natural gas from green hydrogen, showcasing Palantir’s role in advancing renewable energy initiatives, a market that is likely only going to grow. Palantir showing real use cases where customers are paying is the bedrock for how I think this company is going to get through what appears to be the beginning of an AI slowdown.

Heading into the earnings report on Monday after market close, expectations are high (which I think is justified). Analysts expect Palantir to report a consensus EPS of $0.08 on revenue of $652.42 million representing year-over-year growth of 22.33%. Their performance, I believe, will underscore the resilience and growth potential of their business model, which benefits from a diversified revenue stream including both government contracts and private enterprise deals. This should help them avoid much of the private sector hesitation that may be brewing to some AI applications.

Moreover, Palantir’s valuation, while rich (even in the AI space), is supported by their impressive growth metrics. The company’s forward EPS diluted growth rate is an estimated 1,146.41% above the sector median, indicating exceptional earnings performance relative to their peers. Additionally, Palantir’s forward PEG ratio stands at 89.40% above the sector median. In a market that is now starting to question the AI growth story, investors are still rewarding Palantir. I think it’s this different framework and business model that lets them stand out. I’m optimistic.

Going into the upcoming earnings call, I continue to believe Palantir is a strong buy. However, more than before, I think it is crucial to closely monitor management commentary and guidance to ensure the company continues to justify their high valuation with sustained growth. The market is far less forgiving now.

Why I’m Doing Follow-Up Coverage

Since my last coverage on Palantir in early May, the AI innovator’s shares have slightly outperformed the market, increasing by 5.37% while the market has grown by 4.37%. On the whole, the market has experienced a recent, dramatic cool down as AI stocks have sold off. Much of this market-wide sell off is due to skepticism over the ability for AI companies to monetize their AI investments. The other big driver is investor concern that the economy is slowing. Both are not good for high growth tech companies.

This article’s goal is to demonstrate that Palantir, despite these market challenges, remains well-positioned to meet and exceed expectations. Last quarter’s results were promising, and they have to continue with this trend to keep the share price up. I feel confident they will.

Earnings Expectations

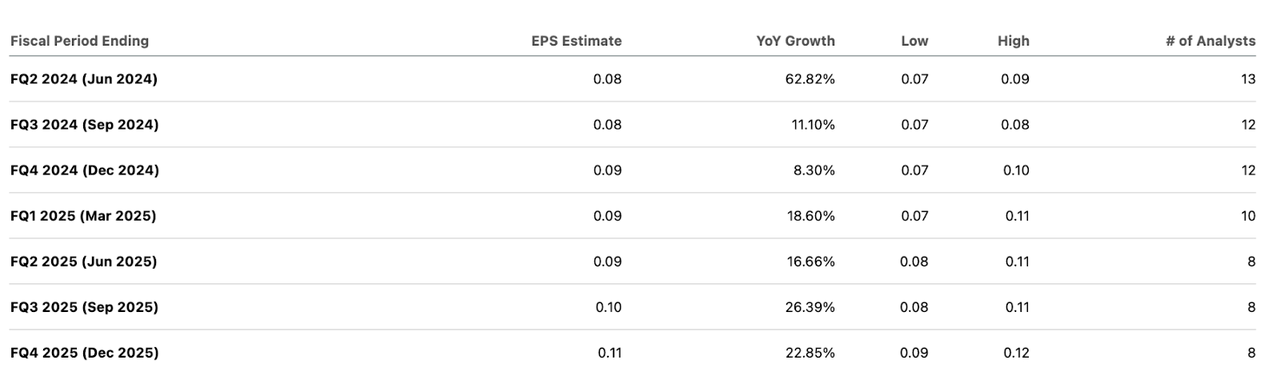

Palantir is expected to report earnings on August 5th, after the market. As I mentioned above, expectations are high. Analysts have projected a consensus EPS of $0.08/share for FQ4, representing a year-over-year growth in EPS 62.82%. Revenue estimates follow a similar trend, with a consensus of $652.42 million, reflecting a 22.33% increase compared to the same quarter last year. I think what is key about these numbers is that Palantir is finding ways to make money off of AI with impressive, exponential EPS growth. Few companies can say the same.

Guidance this quarter will be more important than ever. The market needs to know if the trends powering Palantir will continue. For now, analysts seem confident in Palantir’s ability to continue to produce exponential EPS results, as outlined in the table below:

Palantir EPS Expectations (Seeking Alpha)

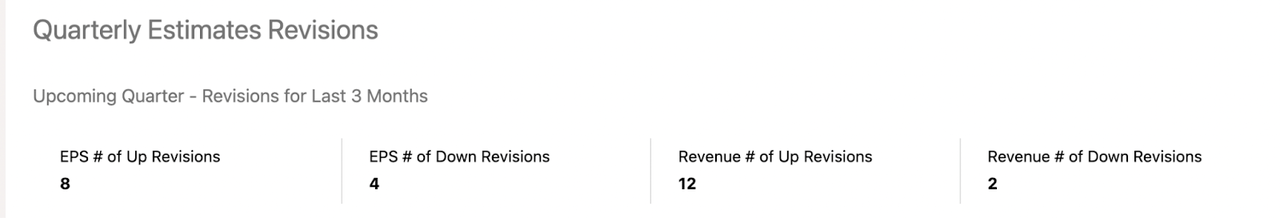

On this note, I also think it is important to point out that in the last 3 months, earnings revisions have been fairly positive (but not overwhelmingly positive which means the company still has some skepticism they can overcome). Looking at revenue, there have been 12 upward revisions, and 2 downward.

EPS is more mixed, with 8 upward revisions, and 4 downward.

Palantir Revisions (Seeking Alpha)

Qualitative commentary will be imperative. One key aspect I’ll be paying attention to is any and all data on the performance of AIP. With the recent AIP Con back in March, I really think we’re going to start to see AIP Con interest covert into paid demos and full contracts now that we are a full quarter out from the event. Dan Ives wrote on this in an investor note, stating:

Over 1,300 bootcamps have been completed including over 500 over the past three months alone, which has been a pillar in the company’s growth strategy as these bootcamps point directly to where users can implement this technology and see tangible value in real-time -Dan Ives.

Bootcamps have been key. I’m excited to see that 38.4% of all bootcamps have been completed in the last 3 months. This should really help the company convert interest into revenue.

On this note, and as I mentioned in the beginning of this piece Palantir needs to reassure investors on how key partnerships are going to show that they make AI that works. In the past quarter, Palantir has secured several significant partnerships. Notable among these is the multi-year agreement with Tree Energy Solutions, which involves using Palantir’s AI to support the production of electric natural gas from green hydrogen. Speaking on this partnership, Francois Bohuon, Commercial Leadership EMEA of Palantir stated:

Working with a green energy player as innovative as TES was the perfect fit, and we are honored to supply them with an enterprise AI system in support of their mission -Francois Bohuon.

The role of Palantir’s AIP for this project is noted in the press release:

Palantir Foundry and Palantir Artificial Intelligence Platform (AIP) will support TES in supply chain management, simulation and scenario modeling for investment optimization, site selection, asset management, carbon emissions tracking, and modeling the energy transformation pipeline -Press Release.

Wow. Not only is this impressive, but it’s a welcome use case. Being attached to such core functions in a business helps show Palantir’s customers more than use AIP, they depend on it. This should help keep software churn down.

Valuation

With AI stocks selling off (Palantir included) their valuation is far more important than before. Investors over the last year just wanted to be a part of the AI story, at whatever the price. Now it’s not a question of “how can I invest?”

It’s a question of “for what what valuation?”

Given the company’s premium metrics compared to the broader sector. The company’s P/E ratio is notably high, with the forward Non-GAAP P/E at 74.68, surpassing the sector median of 22.70 by 228.94%.

Palantir’s valuation metrics are high, no doubt. But they have real AI growth. Palantir’s forward revenue growth is 191.29% higher than the sector median, clocking in at 19.53% vs. 6.71%. Many software companies claim to be powered by AI and delivering AI growth. Palantir actually is.

On this same note, Palantir’s EPS diluted growth (forward) is an astonishing 1,146.41% above the sector median, meaning the company has an exceptional ability to build a strong value capture system. With revenue growth, they are showing they can create a ton of value for customers. With their EPS growth, they are showing they can capture a ton of value for shareholders.

To this point, while some AI plays (like Nvidia (NVDA)) have a PEG ratio below sector median showing that the market is skeptical of their future EPS growth, Palantir’s PEG ratio shows the opposite. The forward non-GAAP PEG ratio is 3.33, which is 89.40% above the sector median of 1.76. Given the current market environment, where many AI stocks are facing declining expectations, Palantir’s robust growth projections position themselves favorably. I believe that their PEG ratio could rise to 125% of the sector median as Palantir continues to outpace competitors in terms of earnings growth and stability. This would represent 39.82% growth from here.

Why I Think This Is Possible In An AI Bear Market

The biggest catalyst for share price upside will actually believe competitor losses, I believe. As competitors start to show fatigue, I think there is a subset of investors in the market that still want to play AI and the immense potential, but they are concerned the investments they are getting into may not live up to the growth.

Palantir could offer an exception to this. A strong earnings report means the company will stand out in a market that is far more pessimistic than even a few weeks ago.

Risks

Despite Palantir impressive growth and strategic positioning, I think the biggest risk is a valuation compression.

While I think this valuation is justified, it is crucial that Palantir matches it with strong growth. Personally, I think in the upcoming earnings call, we will see this occur due to their recent partnerships and improving position in the AI enterprise market. The tech sector, especially AI stocks, has been really volatile, and the market has shown an increasing tendency to punish companies that do not meet or exceed their lofty projections.

With this, some estimates show that stocks often have 90% of their movement caused by general macroeconomic movements. There is a belief that one bad earnings report from one stock in a sector can cause all stocks in the sector to fall under pressure. Palantir is not immune to this (we have seen this recently with all AI stocks selling off). While the company could beat and raise guidance Monday, there is a risk they could fall victim to this phenomenon.

However, I am a long-term investor. While this is a risk in the short run, the cure to beating this stat is consistent growth and performance. Palantir is good at this, and I expect this to be highlighted by the market the more they shine in spite of external market pressure.

Bottom Line

Despite the market’s recent volatility and skepticism around the stock’s high valuation, to me Palantir remains a strong buy. The company has consistently demonstrated their ability to drive growth through innovative AI solutions and strategic partnerships. I think their recent agreement with TES to advance low-carbon energy initiatives is a perfect example and contrasts how they are shining while other AI businesses are slowing.

While there are risks associated with the company’s rich valuation and the general macroeconomic pressure that could push shares down even if the firm itself outperforms, I think the company is going to perform well in the long run. That’s what really matters. This quarter should be no different than how the company has been performing over the last 18 months.

While I don’t blame investors who have seen gains this year trimming their positions, the company’s excellent growth story across multiple verticals suggests they are well-positioned for future success. I look forward to seeing how these developments unfold in the upcoming earnings call.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of PLTR either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Noah Cox (account author) is the managing partner of Noah’s Arc Capital Management. His views in this article are not necessarily reflective of the firms. Nothing contained in this note is intended as investment advice. It is solely for informational purposes. Invest at your own risk.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.