Summary:

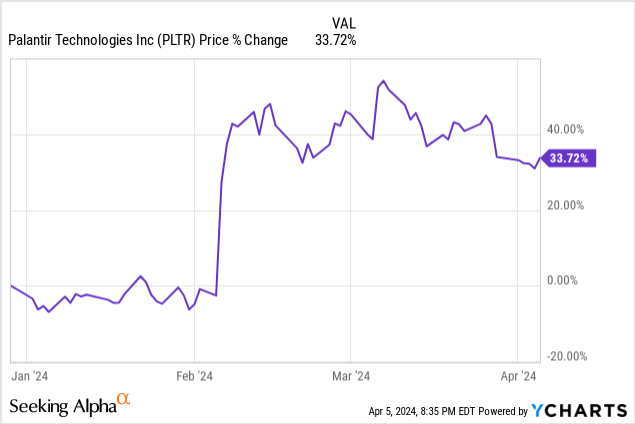

- Palantir Technologies Inc. is up 30% year-to-date — the rally was largely driven by AIP.

- The company also closed the most number of deals in a single quarter.

- The Commercial segment is still in its early innings, as AIP gains momentum.

- So is the Government segment — software only makes up 0.015% of the Army’s budget.

- Despite its rich valuation, I think there’s more upside ahead for Palantir stock.

JHVEPhoto

Introduction

Palantir Technologies Inc. (NYSE:PLTR) is a big data analytics firm that is building the foundational software of tomorrow, helping enterprises integrate and optimize data, decisions, and operations at scale.

It is one of the best-performing stocks this year, up nearly 34% as of this writing. That didn’t come as a surprise to me, since I was pretty bullish on Palantir as we entered 2024.

Despite the stock’s great start to the year, there are plenty of reasons to believe that there’s more upside for Palantir stock for the rest of 2024 and beyond.

Yes, valuation looks rich currently.

But that’s the price you have to pay for quality. After all, the best-of-breed companies seldom come cheap.

Growth

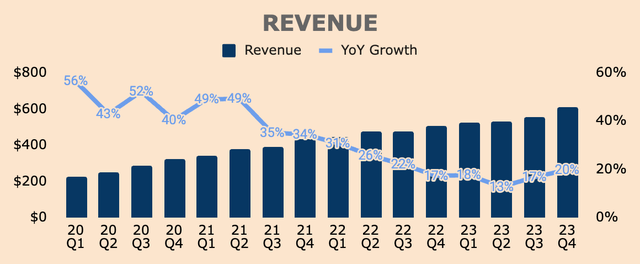

Palantir’s Q4 Revenue was $609M, up 20% YoY and 9% QoQ, beating both management’s midpoint guidance of $601M and analyst estimates of $603M.

Notice the continued acceleration in growth, showing strong demand for Palantir’s offerings.

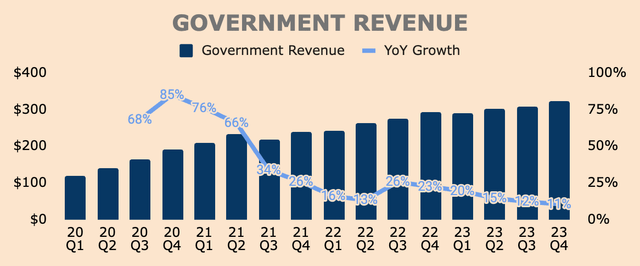

Breaking it down by segment, Q4 Government Revenue was $324M, up 11% YoY and 5% QoQ. Despite the slowdown in the segment, Government Revenue continues to make new highs, reflecting Palantir’s importance in the defense sector.

Growth was muted mainly due to the timing of larger contract awards. However, Palantir continues to see positive developments with its Government customers, which should accelerate Government Revenue in future quarters.

In our government business, we are actively engaged across all theaters of crisis and conflict. The strength of our US government business is not reflected in the fourth quarter results, which remain muted. Some of this is due to the continuing resolution and timing of large potential contract awards.

(CRO Ryan Taylor, emphasis added — Palantir FY2023 Q4 Earnings Call.)

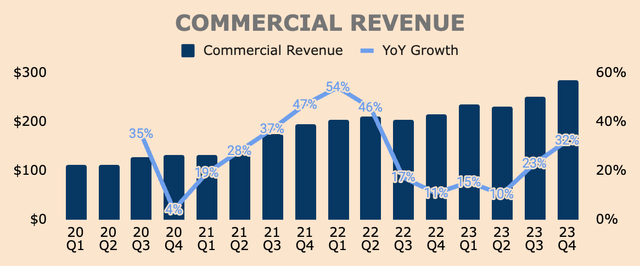

On a much more positive note, Palantir’s Commercial segment saw a surge in demand. In Q4, Commercial Revenue was $284M, up 32% YoY and 13% QoQ. As you can see, Commercial Revenue growth continued to accelerate.

As you probably know, the spike in Palantir’s commercial segment was driven by the recent launch of AIP — Palantir’s Artificial Intelligence Platform — which enables enterprises to leverage large language models (“LLMs”) and artificial intelligence (“AI”) in combination with their existing data and operations.

Palantir knew it had the best AI software product in the market — the company just needed a good strategy to distribute AIP.

Enter AIP bootcamps, “an interactive workshop where customers go from 0 to use case in 5 days.” It used to take months for enterprises to integrate new software platforms (including Palantir’s) with their existing systems. But with the bootcamps, “AIP can now be up and running in as little as a few hours.”

Enterprises are seeing concrete results without having to wait for months or invest hundreds of millions of dollars. Time and capital are precious, limited resources, and being able to save them is already a massive win for clients.

To say that the bootcamps have been successful is an understatement. In particular, the bootcamps led to:

- a 70% YoY growth in U.S. Commercial Revenue in Q4, to $131M. This is a massive acceleration from Q3’s already-strong growth of 33%.

- a 107% YoY growth in U.S. Commercial Total Contact Value, to $343M.

- a 32% YoY growth in U.S. Commercial Remaining Deal Value.

According to management, within just a few months, Palantir has completed over 560 bootcamps across 465 organizations, far surpassing its target of 500 bootcamps within a year, which was set back in October last year.

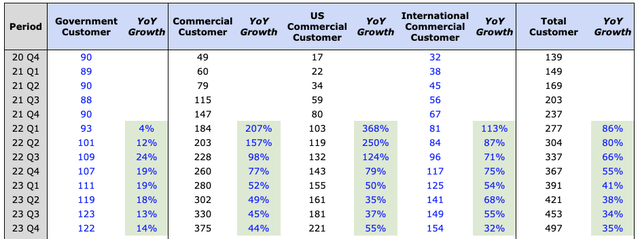

Such immense participation led to higher and faster customer conversions. In Q4, Commercial Customers grew 44% YoY to 375. As you can see below, US Commercial Customer growth accelerated in Q4, growing 55% YoY to 221.

Government Customers grew 14% YoY to 122.

As of Q4, Palantir has 497 Total Customers, up 35% YoY — in Q1, we should see customer count surpassing 500 for the first time ever.

Customer growth is probably the most important metric to track since customer count is a leading indicator of Revenue stability and growth, so to see robust customer growth means that we can expect strong Revenue growth moving forward.

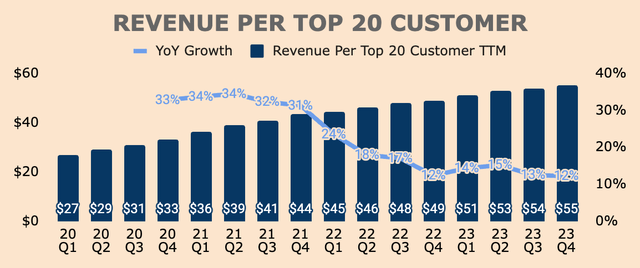

In addition, customers are growing within the Palantir platform. As of Q4, Revenue Per Top 20 Customer grew 12% YoY to $55M per customer, which is a record high for the company.

In short, Palantir is gaining back momentum, propelled by unprecedented demand for AIP. This should drive strong growth for years to come — both in terms of Revenue and Customers.

The demand for large language models from commercial institutions in the United States continues to be unrelenting. Every part of our organization is focused on the rollout of our Artificial Intelligence Platform (AIP), which has gone from a prototype to a product in months. And our momentum with AIP is now significantly contributing to new revenue and new customers.

(CEO Alex Karp — Palantir 2024 Annual Letter to Shareholders.)

Profitability

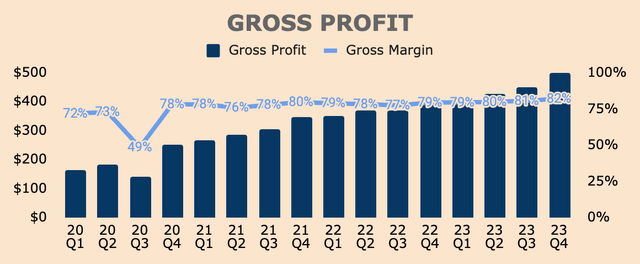

Gross Profit continues to climb higher. As of Q4, Gross Profit was $500M, representing a Gross Margin of 82%, a record-high for the company.

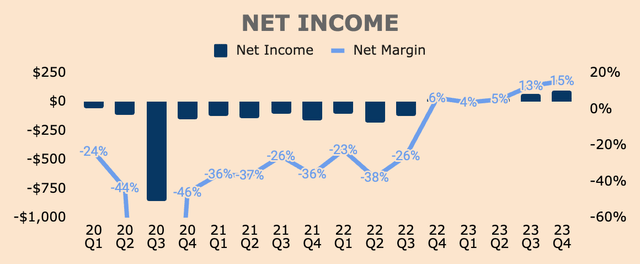

The bottom line looks better as well. Q4 Net Income was $93M with a Net Margin of 15%, a 900bps improvement YoY. This is the company’s fifth consecutive quarter of GAAP profitability, and I don’t foresee profitability swinging back to negative territories.

Without a doubt, Palantir is gaining significant operating leverage at the moment — and I expect margins to continue to expand as the company scales further.

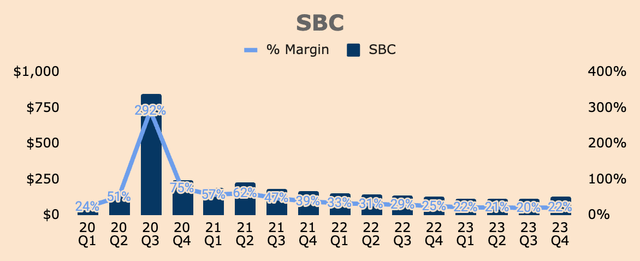

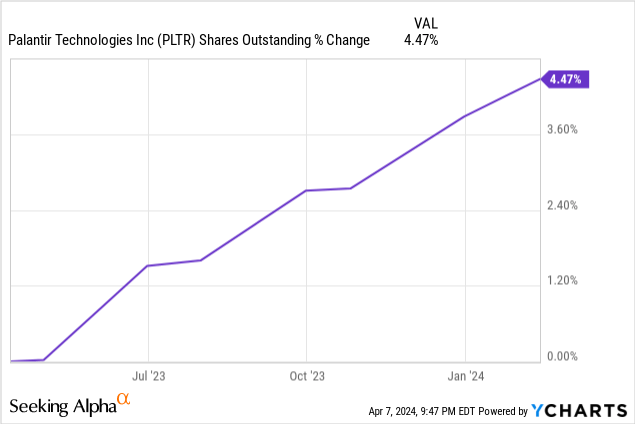

One caveat though. Share-based Compensation, or SBC, as a % of Revenue remains high at 22% in Q4, which apparently ticked up 200bps QoQ. Although the overall trend is still down, SBC Margin remains unsustainably high, which leads to shareholder dilution.

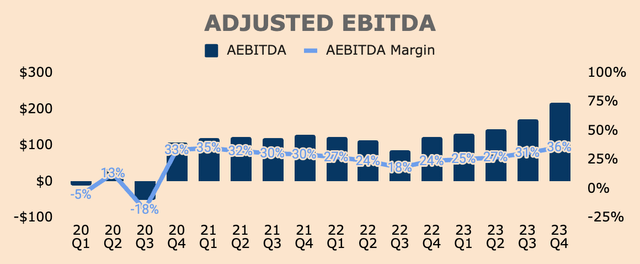

Adjusting for SBC and non-cash expenses, Adjusted EBITDA was $217M for the quarter, representing a record-high Adjusted EBITDA Margin of 36%.

As you can tell, Palantir is a profit-generating machine in the making.

While SBC remains high, the bear argument for high SBC is getting weaker with each passing quarter as Palantir continues to improve earnings on a GAAP basis.

Health

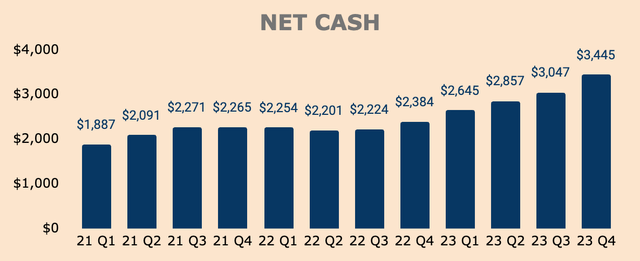

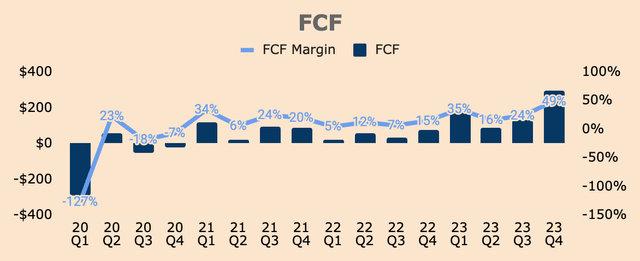

Along with improving profitability, Palantir’s balance sheet continues to expand as well. As of Q4, the company has a Net Cash position of about $3.4B, which, as you can see, has been building up over the last few quarters — expect this trend to continue as Palantir maintains robust Free Cash Flows, or FCF.

In Q4, FCF was $296M, representing a FCF Margin of 49%. While FCF Margin looks exceptionally high in Q4, keep in mind that FCF will be lumpy given the timing of Palantir’s contracts with customers.

Nevertheless, FCF nearly quadrupled in 2023, from $184M in 2022, to $697M in 2023. There’s no doubt Palantir is a cash flow machine, which should reward shareholders in the long run.

Outlook

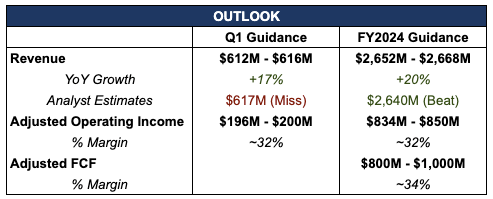

Guidance was a mixed bag.

Author’s Analysis

On one hand, Q1 Revenue guidance was weak, at just $614M at the midpoint, implying a 17% YoY growth, which is a deceleration from Q4’s growth of 20%. This also missed analyst estimates of $617M.

On the other hand, 2024 Revenue outlook was strong. Management expects Revenue of $2,660M at the midpoint, implying a 20% YoY growth rate, which is an acceleration from 2023’s growth of 17%. This also implies that growth is expected to reaccelerate after Q1. Full-year guidance also beat analyst estimates of $2,640M.

Management also expects US Commercial Revenue of at least $640M for the full year, implying a growth of at least 40% YoY.

On the profitability front, management expects Adjusted Operating Margins of 32% for both Q1 and the full year, which is an improvement from 2023’s 28% Margin.

Lastly, management also expects $900M of Adjusted FCF at the midpoint, representing an Adjusted FCF Margin of 34%, also an improvement from last year’s 31% Margin.

Put simply, expect robust growth as well as margin expansion throughout 2024, which should lead to strong earnings growth for the year.

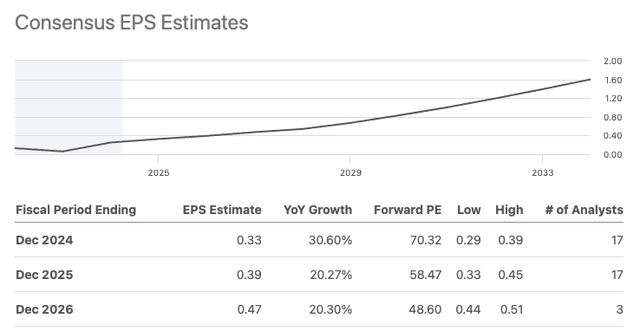

Below, you can see analyst estimates for Palantir’s Non-GAAP EPS in 2024 and beyond.

In 2024, analysts expect Non-GAAP EPS of $0.33, which represents a 31% YoY growth. I think this estimate is too low considering that Palantir posted a Non-GAAP EPS of $0.08 in Q4, which is an annual run-rate of $0.32. In my opinion, I believe a Non-GAAP EPS of $0.40 in 2024 is doable, given Palantir’s growth and profitability momentum. That said, I expect multiple upward revisions in 2024, which should rerate the stock higher from here.

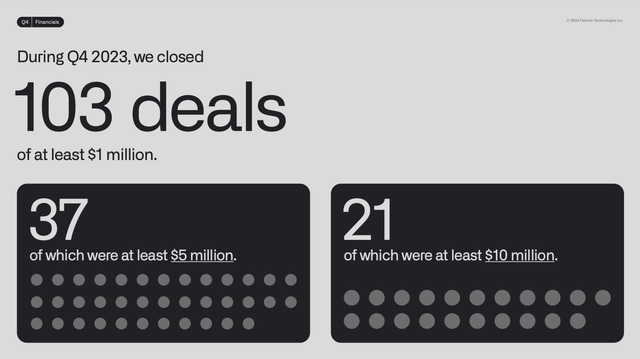

Whatever it is, we can expect the AI revolution to continue to drive Palantir’s Commercial segment forward. Palantir maintains a robust deal pipeline with 103 deals of at least $1M closed in Q4, which is the highest number of deals the company closed in a single quarter.

That is a clear testament to the company’s unique and superior software stack.

Palantir FY2023 Q4 Investor Presentation

Moreover, Palantir’s Government segment still has a long growth runway ahead, as software makes up only 0.015% of the Department of Defense’s budget in 2024:

At the same time, monetization of these efforts will take time. The principal reason is that the DoD is at the very beginning of a long-term allocation shift from hardware to software. For example, the Army is spending a mere 0.015% of its budget on command and control software in fiscal year ’24.

(CTO Shyam Sankar, emphasis added — Palantir FY2023 Q4 Earnings Call.)

Valuation

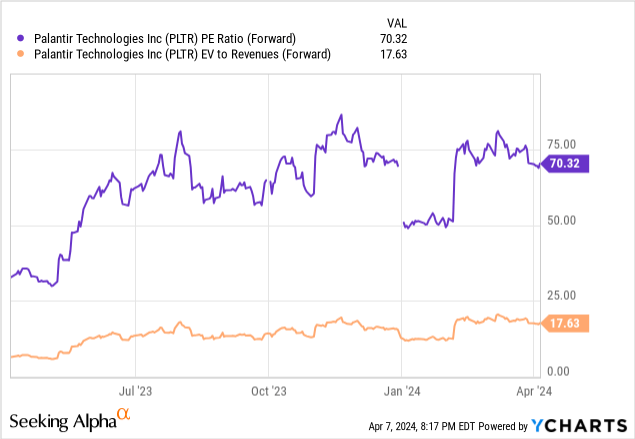

Everything looks great from a fundamental standpoint… until, of course, you factor in Palantir Technologies Inc. stock valuation.

Palantir trades at an EV to Revenue multiple of 17.6x and P/E Ratio of 70.3x, which is a hefty price to pay — and mind you, these are forward multiples, so trailing twelve-month valuations look much more expensive.

Now, if Palantir is growing at 30% or 40% plus, then its current valuation is well justified. But at the moment, Palantir is only growing at a rate of 20%, which makes its current valuation quite expensive. Perhaps, a Revenue multiple of around 12x is much more reasonable — but that’s up to the markets to decide.

With all the headlines about AI, software, and war, I think there’s a lot of optimism currently baked into the stock price, which makes it particularly difficult to rate Palantir stock a table-pounding Buy.

Then again, Palantir has a differentiated tech stack and the business has only just started to build momentum through the recent introduction of AIP and its bootcamps. In addition, Palantir is a cash flow machine and has a fortress balance sheet with virtually zero debt. These are valid reasons why Palantir stock is valued at a premium.

However, this valuation premium leaves little room for error — if Palantir does not meet investor expectations, the stock may be severely punished.

Personally, I like to invest with a large margin of safety, and based on today’s price of $23, I don’t see any margin of safety to justify buying the stock.

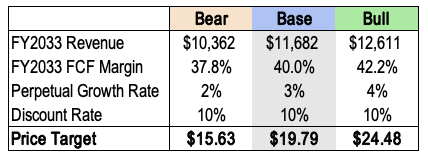

As you can see below, I have a base-case price target of $19.79 for Palantir stock, which is about a 15% downside from the current price of $23 a share.

Author’s Analysis

Yes, I agree that Palantir is overvalued, which is why I won’t be a buyer at current prices.

However, I won’t be a seller either as Palantir leads the pack in big data and AI. The company is gaining strong momentum and producing more cash than ever. At the same time, S&P500 inclusion is on the horizon, which could provide a major catalyst for the stock.

Risks

- Dilution — SBC remains high at 20%+, which is why shares outstanding are up 4.5% YoY. Shareholder dilution is a problem and this could limit Palantir’s upside potential.

- Premium Valuation — Again, investors expect highly of the company, so if Palantir falls short of expectations, we could see a violent selloff in the stock. Furthermore, Palantir needs to sustain growth of at least 20% (perhaps more) to justify its current valuation.

Thesis

Palantir displayed strong momentum heading into 2024, which is why I think Palantir is primed for a banner year in 2024. So far, the stock is up more than 30% year-to-date.

The rally was largely fueled by its strong Q4 performance. Given the surging demand for AIP, we can expect strong results to continue throughout 2024.

In addition, we might very well see Palantir get added to the S&P 500 (SP500).

Nevertheless, the valuation looks rich, so I won’t be surprised if we see a deeper correction — Palantir stock is already 15% off its recent high.

Whatever it is, Palantir trades at a premium for a reason. Not only is Palantir one of the strongest players in big data and AI, but the company also has solid fundamentals with growth reaccelerating, profits improving, and balance sheet expanding.

Perhaps, that’s the price you have to pay for quality.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of PLTR either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.