Summary:

- Palantir’s Q2 results were strong across the board, with the company’s government and US commercial businesses both areas of particular strength.

- The company’s ability to land 7-figure deals in a matter of weeks is indicative of an extremely robust demand environment.

- Despite its impressive recent financial performance, I believe Palantir’s valuation makes it overly risky, particularly given the precarious state of the economy.

- While I think that Palantir offers a poor risk/reward ratio at current prices, its valuation probably won’t matter while it can continue to beat and raise guidance.

hapabapa

Palantir Technologies Inc.’s (NYSE:PLTR) Q2 results showed an ongoing acceleration across a range of metrics. Deal volumes rebounded strongly and Palantir’s government business continues to gather pace. While Palantir’s government business has never really been in doubt, the company’s ability to drive adoption amongst commercial customers and rapidly scale this part of this business has been surprising.

I previously suggested that Palantir’s valuation made it risky, with uncertainty surrounding enterprise software demand and softer deal volumes as particular points of concern. Palantir’s Q2 results were strong across the board though and the stock is now up over 40% since my last article.

While I continue to think that Palantir offers a poor risk/reward ratio at current prices, I tend to think that valuation won’t matter in the short term. Palantir’s stock has momentum, and as long as the company can continue to beat and raise, the share price will likely continue to rise.

Palantir is clearly the right company, in the right place at the right time, but I think there are indicators that the current spending environment is unsustainable. Palantir has been landing 7-figure deals in a matter of days or weeks, which seems like a lack of due diligence on the part of customers. Consequently, I believe that current strength should not be over-extrapolated.

Market Conditions

Rapid changes in AI capabilities over the past few years have caused dramatic shifts in planned infrastructure, cloud, and AI spending. For example, revenue expectations from the AI infrastructure build-out have increased from $200 billion to $600 billion per year in under 12 months.

There is a large bottleneck between prototyping and production though, and this is where Palantir is currently benefitting. While 96% of CIOs reportedly want to increase their AI investments, only 49% believe that their IT departments have the necessary skills.

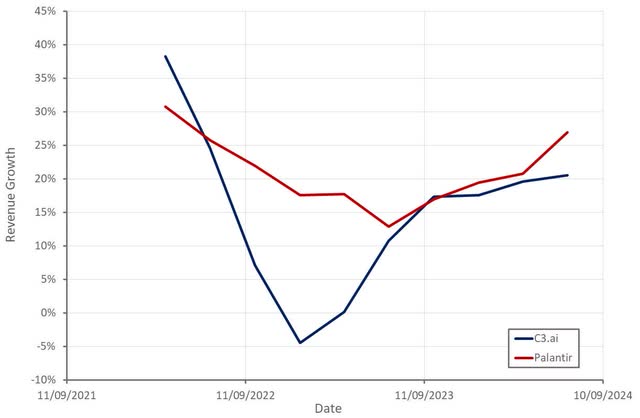

Palantir’s success also appears to be influencing how other companies in the space are positioning themselves, with C3.ai recently adopting Palantir’s terminology.

Today, we have pre-built AI applications with turnkey ontologies that address entire value chains across industry verticals. These applications don’t operate in silos. They’re designed and built to work in concert, all running on the C3 AI platform. Each new application can deploy faster than the last, thanks to the ability to reuse data integrations, ontologies, AI/ML pipelines, workflows, and user interface components. – Edward Abbo, C3.ai EVP & Chief Technology Officer

Palantir’s success also appears to be making it the subject of some jealousy.

Palantir, I don’t know that much about Palantir. I suspect it’s a pretty good company. I’m pretty impressed that the investment community doesn’t make them distinguish between services revenue and license revenue. I mean, it’s fascinating that somebody would invest in a company that is hiding the ball like that. It looks to us like a services company masquerading as a software company. But that being said they’re certainly making a lot of — making a lot of revenue. I suspect they will continue to make a lot of revenue and good for them. And they don’t have to lose for us to win. I mean, there’s a big market opportunity and we’re — I wish them all the best. – Tom Siebel, C3.ai Chairman and CEO

While I have criticized Palantir’s business for being service-heavy in the past, the Commercial side of the business appears to be scalable, suggesting the company’s platform can be readily implemented in many organizations. Palantir has stated that implementing its platform can be a complex and lengthy process though, requiring Palantir to configure its platform for customers. In any event, a dependence on service revenue doesn’t mean that Palantir has a bad business.

Figure 1: Palantir and C3.ai Revenue Growth (Source: Created by author using data from company reports)

Palantir

Palantir recently announced Warp Speed, a vertical solution built on AIP that targets the manufacturing industry. Palantir’s relationships with companies like Airbus have given it experience in manufacturing, which was leveraged to develop Warp Speed. The solution is being positioned as a manufacturing operating system that covers areas like ERP (Enterprise Resource Planning), MES (Manufacturing Execution System) and PLM (Product Lifecycle Management).

Competition is likely to be fierce in this area though, with companies like Autodesk and PTC positioning themselves to capture more value throughout the product lifecycle. These companies are embedded into areas like design workflows, giving them a strong competitive position. Palantir’s success in manufacturing will therefore likely depend on factors like scalability, security and analytic capabilities. I would not be surprised to see Palantir introduce more vertical solutions going forward, which could help to drive the adoption of its software and support growth, even if AI hype begins to falter.

Palantir’s US government business has strengthened in the last two quarters, although it is not yet clear how sustained this trend will be. Regardless, Palantir appears to be well-positioned long-term, with a number of defense initiatives seemingly including or being built around Palantir’s platform.

Palantir received several notable awards in the second quarter, including a production contract from the Department of Defense Chief Digital and Artificial Intelligence Office. The contract involves deploying and scaling an AI-enabled operating system across the DoD and has an initial order value of $153 million. Additional awards of up to $480 million can also be made over a five-year period.

The CDAO also recently announced, Open Data and Applications Government-owned Interoperable Repositories (DAGIR). Palantir’s contract for this is worth $33 million. CDAO Open DAGIR is an ecosystem that enables industry and government to integrate data platforms, development tools, services, and applications while allowing government to maintain data ownership. The ecosystem will initially be used for the data infrastructure and applications that support the Combined Joint All Domain Command and Control.

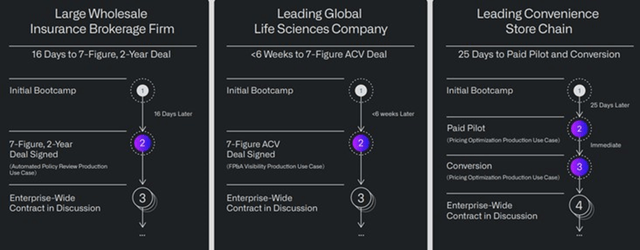

Palantir’s US commercial customer count increased 83% YoY in the second quarter, with bootcamps remaining a key driver. While bootcamps are important for prototyping and demonstrating the capabilities of AI, Palantir believes that it is its ability to rapidly move from prototype to production that is appealing to customers.

AIP Bootcamps have been completed with over 1,025 organizations since being launched in mid-2023. This is up from 915 in the previous quarter and 560 at the end of 2023. If bootcamps are a leading indicator of deal volumes, Palantir’s commercial business could reasonably be expected to decelerate going forward. Several more quarters will likely be needed to get a better understanding of this. I have always questioned how broadly Palantir’s software would appeal given the cost, though.

Palantir also continues to show an ability to rapidly convert leads into large contracts. While this may speak to the strength of Palantir’s platform and go-to-market motion, it is hard not to feel that customer spending is somewhat reckless at the moment. Signing seven-figure deals in a matter of weeks is not normal. The seven-figure deals highlighted in Q2 earnings weren’t even for enterprise-wide deployments, meaning spending could end up being much higher than the initial figure.

Palantir has stated that its normal sales cycle often lasts 6-9 months but can extend to a year or more for some customers. This is due to the fact that it involves a significant financial commitment, and customers generally evaluate the platform at multiple levels within their organizations.

Figure 2: Example US Commercial Customer Journeys (Source: Palantir)

Palantir also recently entered into a five-year collaboration with BP, which aims to introduce new AI capabilities using Palantir’s AIP software. The AIP software will enable BP to leverage LLMs to aid decision-making. This isn’t really a surprise as the two companies have been collaborating for a decade, with Palantir’s software being used to support BP’s oil and gas production operations.

Financial Analysis

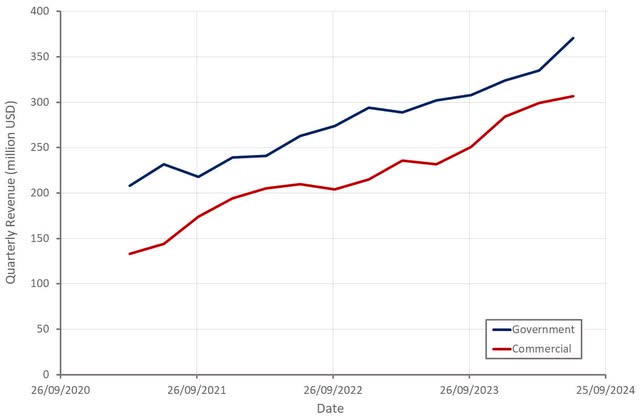

Palantir’s revenue increased 27% YoY in the second quarter to $678 million, with the US commercial and government businesses areas of particular strength. Excluding the impact of revenue from strategic commercial contracts, Q2 growth was 30%.

Some of Palantir’s apparent Q2 strength was driven by an easily comparable period in 2023. The company’s underlying growth continues to accelerate though, with third quarter guidance particularly strong. Assuming current strength continues, I can see Palantir’s growth rate accelerating into the 30-40% range over the next year.

Commercial revenue increased 33% YoY in Q2, or 40% excluding the impact of strategic commercial contracts. International commercial revenue was only up 15% YoY though and was down sequentially. Government revenue increased 23% YoY in the second quarter, with US government revenue up 24% and international government revenue increasing 21%. Second quarter strength was driven by several notable US government awards and additional funding from a partner nation related to Palantir’s ongoing efforts in Eastern Europe.

Palantir expects $697-$701 million in revenue in the third quarter, an increase of roughly 25% YoY. For the full year, Palantir is guiding to $2.746 billion in revenue at the midpoint, representing a 23% YoY growth rate. US commercial revenue is expected to be greater than $672 million, representing a growth rate of at least 47%.

Figure 3: Palantir Quarterly Revenue (Source: Created by author using data from Palantir)

Palantir’s customer count increased 41% YoY in the second quarter to 593. This was driven by Palantir’s US commercial customer count, which increased 83% YoY to 295.

Net dollar retention was 114%, an increase of 3% sequentially. Customers signing expansions was reportedly an area of strength in the quarter. Net dollar retention does not include customers acquired in the past 12 months though, meaning it does not reflect the current strength of Palantir’s US commercial business. Regardless, Palantir tends to land large, resulting in less expansion over time. Trailing 12-month revenue from Palantir’s Top 20 customers increased 9% YoY to $57 million per customer, though.

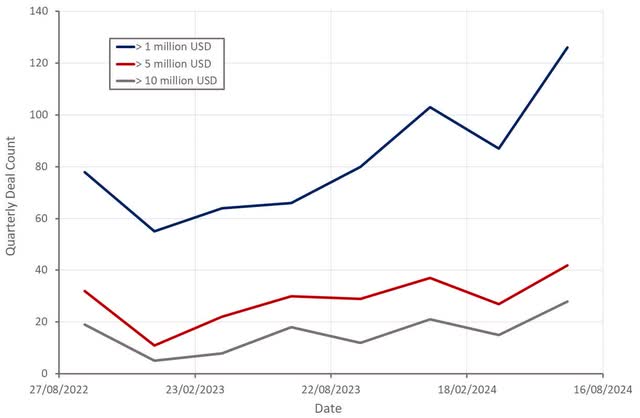

Q2 TCV booked was $946 million, up 47% YoY. Commercial TCV booked was $377 million, an increase of 31% YoY, with US commercial TCV booked up 152% to $262 million.

Palantir ended the second quarter with $4.3 billion in total remaining deal value, an increase of 26% YoY. The company also had $1.4 billion in remaining performance obligations, up 41% YoY. RPO does not take into account contracts with an initial term of less than 12 months and contractual obligations that fall beyond termination for convenience clauses though, meaning it primarily reflects the commercial business.

Figure 4: Palantir Quarterly Deal Count (Source: Created by author using data from Palantir)

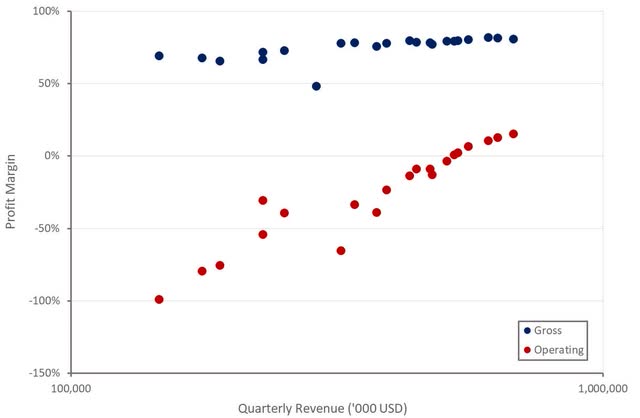

Palantir’s margins continue to move higher as the business scales. Gross margins have been fairly stable in recent quarters in the low 80% range. The cost of services primarily consists of employee costs for personnel performing professional services, cloud hosting and hardware. Of the $21.7 million YoY increase in the cost of services recorded in Q2, $14.4 million was related to cloud hosting and $10.8 million was due to subcontractors. This was somewhat offset by a $7.8 million decrease in field service representatives and hardware costs.

Palantir’s operating margins and cash flows are still moving higher though, driven by operating leverage. Much of the improvement in profitability has been driven by general and administrative expense control. The company does expect expenses to ramp in the second half of 2024 though due to investments in product development and debottlenecking the journey from prototype to production. This may reduce the pace of margin improvements in the short term.

Figure 5: Palantir Margins (Source: Created by author using data from Palantir)

Conclusion

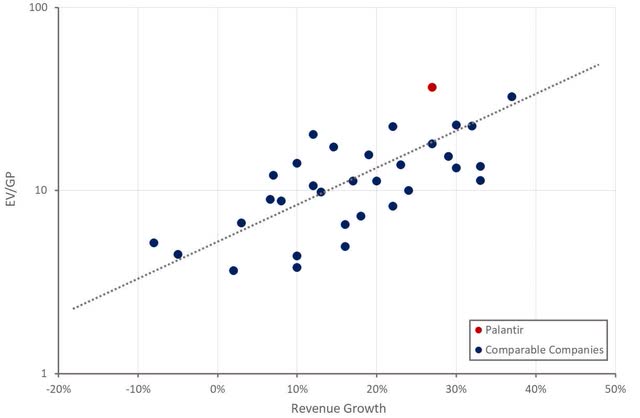

While Palantir’s recent growth has been impressive, the company’s share price has run far ahead of the fundamentals of the business. Even with a return to +40% annual growth, Palantir would still appear expensive relative to peers.

It is also worth keeping in mind that relative to many other high-profile software companies, Palantir is more dependent on large government contracts, has a relatively concentrated customer base (close to 20% of revenue from top-3 customers) and its revenue is relatively volatile and skewed towards services.

An argument can be made that Palantir’s valuation is justified by its margins and accelerating growth, but investors shouldn’t lose sight of interest rates and the precarious state of the economy. Palantir can probably still generate reasonable returns over a longer time frame from current levels, but investors need to be prepared to weather a +50% drawdown in the event of headwinds.

Figure 6: Palantir Relative Valuation (Source: Created by author using data from Seeking Alpha)

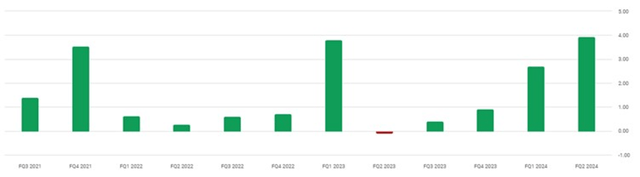

I tend to think that valuation is irrelevant to Palantir’s share price in the short term anyway. Investors want AI exposure, but there are only a handful of companies that are really benefitting, and most of those have extremely high valuations and are dependent on CapEx, which could vanish as quickly as it appeared. Palantir is a momentum stock and will likely continue to perform well while the economy remains resilient, rates are expected to decline, and the company is able to continue beating and raising guidance.

Figure 7: Palantir Quarterly Revenue Surprise (Source: Seeking Alpha)

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.