Summary:

- PLTR’s inclusion in the S&P 500 index was followed by a substantial price rally, but the benefits are now priced in.

- Substantial insider sales, particularly by Chairman Peter Thiel, signal heightened valuation risks.

- Despite robust EPS growth projections, PLTR’s forward P/E ratio remains excessively high, pointing to an unfavorable return/risk profile ahead.

Vladimir Zakharov

PLTR stock: substantial rally after S&P500 inclusion

My last article on Palantir Technologies (NYSE:PLTR) was published back in August, shortly after the release of its Q2 earnings report (“ER”). That article was titled “Palantir Q2: Another Step Toward S&P 500 Inclusion In September.” In that article, I explained why Q2 results represent another step for PLTR’s inclusion in the S&P 500 index in September, and concluded that:

All told, the stock is certainly not a good fit for every investor. The extremely high valuation ratios and large volatility are off-putting for more conservative investors. However, for more risk-prone investors, the upside potential is very attractive both in the long term given the company’s unique strategic positioning, and also in the short term with the prospects of SP500 inclusion as soon as September 2024.

Since that writing, there have been a few new developments worth updating and reexamining. The top 2 on my lists are the inclusion in the S&P index and the substantial insider sales (especially those from its Chairman Peter Thiel). In the remainder of this article, I will assess the impacts of these new developments on the return/risk profile of the stock. You will see that my conclusion is that the return/risk curve has become unfavorable and has led to a Sell rating under current conditions.

Let me start with its inclusion of the S&P 500 index. As projected in my earlier article, the stock has indeed become a member of the S&P 500 index in September. More specifically,

Investor’s Business Daily: Palantir Technologies (PLTR), Dell Technologies (DELL) and Erie Indemnity (ERIE) will join the S&P 500 index before the open on Monday, Sept. 23, 2024. S&P Dow Jones Indices announced that late Friday as part of a quarterly rebalancing of the S&P indexes.

Also as anticipated in my earlier article, the stock has indeed enjoyed a robust price rally after the inclusion as you can see from the chart below. All told, the stock has gained about 30% in September alone.

Against this background, my view is that the potential benefits (such as increased visibility, increased demand, etc.) of the S&P 500 inclusion have already been priced in by this time. Moreover, I consider the recent insider sales as an inflection of the heightened valuation risks under current conditions, as detailed next.

Seeking Alpha

PLTR stock: Insider transactions

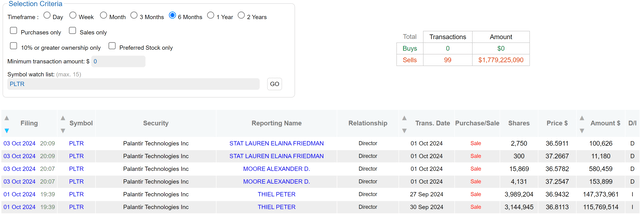

Insider transactions surrounding the stock have been completely dominated by selling activities as you can see from the chart below. More specifically, the chart shows that insider activities over the past six months are all selling. According to the data, a total of 99 sell transactions were executed, resulting in a total sales value of more than $1.77 billion. The single sales were made by Peter Thiel, a director and chairman of Palantir.

DataRoma

According to Seeking Alpha News (Sept. 27, 2024),

Thiel sold over $600M worth of the company’s stock in the week of Sept. 27, bringing his total disposals this year to over $1B. Thiel sold approximately 16.17M common shares over three days this week, according to regulatory filings with the SEC… Thiel has only sold common equity, not stocks with special voting rights, which give him and co-Founders Alex Karp and Stephen Cohen control of the board, the report added.

As you can see from the chart above, Thiel’s divestiture continued after this news. On Sept. 30, 2024, he sold another batch of more than 3.1 million shares at a price of $36.8 per share, for a total value of more than $115 million. Other insiders disclosed substantial sales too. The most recent sale was reported on Oct. 1, 2024, by Lauren Friedman, another director of Palantir, who sold 2,750 shares at a price of $36.59 per share.

Usually, I do not consider inside sales as a negative sign, as insiders can sell for various reasons unrelated to business fundamentals. However, in this case, it should be cause for concern for PLTR investors considering that A) the insider transactions are completed and dominated by sellers, and B) the sum involved in these sales is quite substantial.

For me, the top concern is the heightened valuation risk, as elaborated on below.

PLTR stock: valuation risks

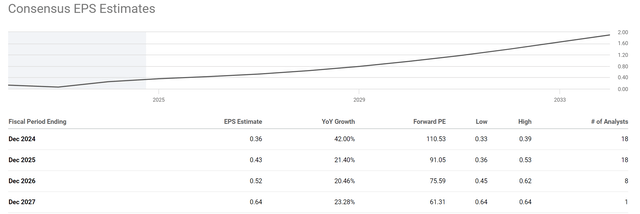

The table below shows the consensus EPS estimates for PLTR stock in the next four years. As seen, the good news is that analyst consensus points to a robust EPS growth in the next few years, from $0.36 in FY 2024 to $0.64 in FY 2027. The annual growth rates are expected to be in the range of 20% to as high as 42% during this period. Overall, I agree with the positive outlook for PLTR’s earnings growth for a range of catalysts to be detailed later.

However, the valuation risks it simply too high at this point. As seen in the table, PLTR’s forward P/E ratio currently hovers around 110 based on the FY 2024 ESP forecast. Even assuming the growth curve projected by consensus materialized perfectly, the implied FWD P/E would still be about 61.31 in 4 years, still too high both in absolute and relative terms.

Seeking Alpha

PLTR stock: Upside risks and final thoughts

In terms of upside risks, I do anticipate PLTR to continue to benefit from strong demand for its products. More specifically, I anticipate a considerable sales funnel of prospective clients, as well as the potential for PLTR to expand with new products for existing partners. Let me just provide a few examples here to illustrate the key catalysts that can enable such an expansion in my view. The company has recently demonstrated with A.I.P., the Ontology platform, and other successful tools. These tools demonstrated to me that they can help clients quickly spin out new, highly profitable products. Furthermore, generative AI (“GAI”) and Large Language Models (“LLM”) are already presenting tools that are reducing clients’ cost structures and improving productivity, and future applications of these technologies appear inevitable.

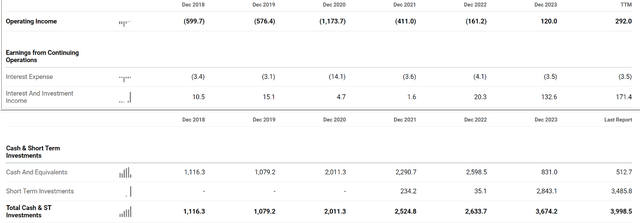

Of course, this is a space that’s subject to rapid or even unpredictable change, I think Palantir is in a strong position to weather the speed bumps. As a reflection of its strength, the company has almost $4 billion of cash on its balance sheet and no long-term debt (see the next chart below). As a result, the company collected over $171 million of interest and dividends from U.S. Treasury securities in the past 12 months as seen, a nice supplement to its operating incoming (of around $292 million as of TTM).

All told, my verdict is that, despite the positives, existing investors have set too optimistic expectations for the company’s future growth. As argued above, even if the company keeps growing at 20%-plus annual rates as consensus forecasted, its implied P/E would still be in the 60-plus range after four years. This level of FWD valuation translates into an extremely unfavorable return/risk profile in my view, and the recent insider sales serve as a reflection of such risks.

Seeking Alpha

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

As you can tell, our core style is to provide actionable and unambiguous ideas from our independent research. If your share this investment style, check out Envision Early Retirement. It provides at least 1x in-depth articles per week on such ideas.

We have helped our members not only to beat S&P 500 but also avoid heavy drawdowns despite the extreme volatilities in BOTH the equity AND bond market.

Join for a 100% Risk-Free trial and see if our proven method can help you too.